Despite improvements to energy supply over the years, many Indian states still face frequent power shortages. Meanwhile, neighbouring countries such as Nepal and Bhutan have large reserves of untapped hydropower with the potential to meet

The benefits of interconnection between any two power systems – be it cross-border or national – is well known. At the simplest level, an interconnection allows cheaper surplus generation from one system to supplant more expensive generation in the other. The two systems require less overall capacity since they can now ‘rely on each other’ supply. Depending on (carbon and other) emissions intensity – interconnections may also reduce overall emissions. Despite the potential, these principles have not yet been widely applied.

A regional power market has however been envisioned by the South Asian Association for Regional Cooperation (SAARC). Nepal and Bhutan have over 100

Following the Regional Energy Trade Study (SRETS) published by SAARC in 2010, the Asian Development Bank (ADB) undertook one of the first rigorous techno-economic analyses to examine the benefits of cross-border power interconnections in South Asia. The study quantifies economic and reliability gains associated with six of the near-term cross-border interconnection candidates

Benefit-to-cost ratios, even for the most expensive interconnections, are promisingly high

The (gross) benefits of the six interconnections calculated for 2016-17 are extremely promising, as illustrated by Table 1 below.

Table 1. Cost-benefit values of interconnections

Note: Case 2 for India-Nepal considers two scenarios: (a) Nepal builds all planned projects (2,000

Note: Case 2 for India-Nepal considers two scenarios: (a) Nepal builds all planned projects (2,000 Even expensive interconnections such as the one between Sri Lanka and India, which requires a submarine cable, still produce a benefit-to-cost ratio of 3.71. Most of the other interconnections being explored require comparatively lower investments due to shorter distances and the use of overhead transmission lines, as such, their benefit-to-cost ratios are also relatively higher. The India-Bhutan interconnection

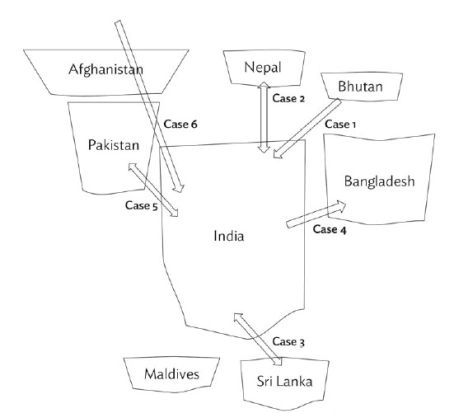

Figure 2. Cross-border power trading

Notes: (i) The arrows indicate the potential flow and direction of power between countries once the interconnection is in operation; (ii) Interconnections between India and Bhutan, Nepal and Bangladesh (Cases 1, 2 and 4) are anticipated to be operational in the next five years, while interconnections between India and Sri Lanka, Pakistan, and Central Asia (Cases 3, 5 and 6) are expected to be longer-term (5-10 years).

Interconnections can improve reliability of regional power systems

Although the energy supply situation in India has vastly improved over the last decade, several of the states continue to face both capacity and energy shortages. If we consider the case of the India-Bhutan interconnection, power sharing has the potential to sharply reduce the amount of electricity demand that currently goes unmet (primarily on the Indian side). Valued at US$555 per megawatt-hour (MWh)2, another US$1.5 billion would be added in annual benefits from approximately 3,000 GWh, or 20% of the electricity transfers that could be used to meet unserved energy demand.

India also faces a shortage of coal and gas; more importantly, there is a yawning gap between demand and supply of these resources which is expected to emerge over the coming years. Interconnections with regional neighbours would form a formidable part of the solution to further improve the Indian power system, particularly with respect to reliability. Importing hydropower from Bhutan and Nepal would tremendously help India preserve its coal/gas reserves.

Economic savings potential also exists for power trading among predominantly thermal systems like India–Bangladesh and India-Pakistan. Primary energy resources and power generation capacity and efficiency are much more limited in Bangladesh and Pakistan, which forces these systems to rely significantly on expensive oil-based power

Regional power-sharing may contribute to significant reductions in carbon emissions

In addition to economic gains and improved energy reliability, interconnections would also help reduce carbon dioxide (CO2) emissions. For India in particular, older, less efficient coal plants have an average emission intensity of 1,350

Conclusions

In summary, there are some compelling arguments in favour of establishing regional power-sharing interconnections for South Asia. The growing volume of trade between India and Bhutan and between India and Bangladesh has already started putting the value of these interconnectors on a firmer footing. The set of six near-term interconnection possibilities discussed in this column represents a small fraction of the interconnection possibilities that exist not only with the region but also between South Asia and other neighbouring regions such as Central and West Asia. It is important that policymakers, planning bodies, system operators, investors and donor agencies collaborate to identify and prioritise further investment opportunities to make the SRETS vision a reality.

Notes:

- Benefit-to-cost ratio of 3.7 is based on US$186 million in expected benefit and US$50 million in expected cost.

- The expected CO2 reduction in India alone due to Bhutan-India interconnections is around 0.1% (2016-17) of the emission in 2010 (power sector) and it can grow to 0.4% by 2020-21 (Imperial College and University College London (UCL) Energy Institute, 2013).

Further Reading

- Rahman, SH, P Wijayatunga, H Gunatilake and PN Fernando (2010), ‘Energy Trade in South Asia: Opportunities and Challenges’, Asian Development Bank, Manila.

- Imperial College London and University College London (UCL) Energy Institute (2013), ‘India’s CO2 emissions pathways to 2050’, Grantham Institute for Climate Change, Report GR5, January.

- SAARC Secretariat (2010), ‘SAARC Regional Energy Trade Study (SRETS)’, Kathmandu, Nepal, March.

- SAARC Secretariat (2013), ‘Study on a South Asia regional Power Exchange (SARPES)’, Kathmandu, Nepal, June.

- Shahi, RV (2014), ‘Foreign investment in Bangladesh: Special session on power sector’, March.

- Wijayatunga, P and PN Fernando (2013), ‘An Overview of Energy Cooperation in South Asia’, Asian Development Bank, South Asia Working Paper No. 19, May.

- Wijayatunga, P, D Chattopadhyay and PN Fernando (2015), ‘

Cross Border Power Trading in South Asia: ATechno Economic Rationale’, Asian Development Bank, South Asia Working Paper No. 38, August.

07 March, 2016

07 March, 2016

Comments will be held for moderation. Your contact information will not be made public.