In the past, infrastructure projects in India have suffered from long delays, massive cost overruns, and poor quality of assets. A widely held belief is that public private partnerships (PPPs) can solve these problems. To examine this claim, this article compares the performance of PPPs with traditionally procured highway projects. It finds that project delivery is faster but construction costs are significantly higher for PPPs than for non-PPP roads. Moreover, quality of road surface is better for the former compared to the latter.

During the last two decades, successive governments at the Centre have used public private partnerships (PPPs) to fund their infrastructure development programmes in roads, railways, ports, and airports sectors. According to official sources, between December 2005 and September 2017, the Centre approved 312 projects worth Rs. 3.67 trillion. Moreover, PPPs have also become a mainstay of plans of the state governments for infrastructure development.

In the past, infrastructure projects in India have suffered from long delays, massive cost overruns, and poor quality of assets (Singh 2011). A widely held belief is that PPPs can solve these problems. As part of an International Growth Centre (IGC) project, I examine the claim that PPPs can deliver superior quality infrastructure at a faster rate and lower costs (Singh 2018a). The study is based on 313 national highway projects and compares performance of the PPPs with the traditionally procured highway projects. The empirical analysis shows that the project delivery is faster for PPP projects. However, construction costs are significantly higher for PPPs than for the non-PPP roads. The available data and evidence indicates towards a better quality of roads under PPP compared to the traditional roads.

PPPs versus traditional contracts

To build a road project the government concerned signs a contract with a private construction firm. In a typical PPP contract for a road project, the government undertakes responsibility for providing land and getting regulatory clearances needed for the road. The private partners take responsibility to build the project assets, that is, the road segment. The private partners are required to fund the project upfront, but the government retains the ownership of the project assets. Moreover, the private partners are responsible for the upkeep of the road during operation and maintenance phase of the project. In any case, in a PPP the control and managements rights over the road assets are assigned to the private partner for the duration of the contract. Many a times the private partners are also granted ‘concessions’ (rights) to charge user fees. All these rights are returned back to the government at the end of the contract period.

Contracts for national highway projects are executed by the National Highways Authority of India (NHAI). The NHAI has been using PPPs as well as the ‘traditional’ contracts to build the highways. Specifically, three types of PPP contracts are used: BOT (build–operate–transfer) Toll, BOT-Annuity, and the Special Purpose Vehicles (SPVs). These PPP contracts differ in terms of the duration and the commercial risks borne by the contractor. While a BOT Toll contract grants the contractor a right to charge toll from road users, the BOT-Annuity and SPV contracts do not give such a right. Under BOT-Annuity contracts, the contractor receives biannual payment contractually agreed with the government. Under the SPVs, the contractor also happens to be the main user of the road. For example, a port trust in partnership with the state government concerned can form SPV to build road aimed at improving connectivity with the mainland.

The three types of PPP contracts have the following common features: The tasks of road-building and its maintenance are performed by one and the same entity, the contractor firm (or the consortium of construction firms); construction and maintenance related risks are mostly borne by the contractor firm; and, the tasks of designing, building, financing of road, its operation and maintenance are responsibilities of the private partner.

The traditional contracts are popularly called the ‘item-rate’ (IR) contracts. Under an IR contract, the contractor is responsible only for building of the road; maintenance is not his responsibility. Moreover, under IR contract, the contractor shares construction costs related risks with the government, especially those arising due to variations in quantities of work items.

In other words, under a PPP contract, construction and maintenance tasks are bundled and assigned to the contractor firm. Thus, a PPP contract creates incentive for the firm to factor in the life-cycle cost of the road. While poor quality road means high maintenance costs, a good quality of road implies lower maintenance expenses. So, a PPP contractor does not have incentive to dilute construction quality. In contrast, under a traditional contract, the contractor who is not responsible for the maintenance of the road built by him does not have incentive to build good quality roads. He wants to build roads with minimum acceptable quality, regardless of the consequences of poor quality during the O&M (operations and maintenance) phase. Since quality comes at the expense of construction costs, the construction cost is expected to be higher for PPP roads than for non-PPP roads.

There is one more important difference between the PPPs and the traditional contracts. Under a PPP, the time period of construction is included in the concession/contract period itself. An earlier completion of road enables the concessionaire to start his revenue stream by charging the toll or the annuity payment as the case may be. However, under traditional contract there is no such provision. Due to these differences, one would expect that under PPP a contractor has stronger incentive to complete the project sooner and avoid time overrun.

Project costs and delivery time comparisons

We use the following ratio to compare construction costs for PPP roads relative to non-PPP roads:

Cost overrun (CO) = Actual cost/ Expected cost

Assessment of construction cost of the project is done by private firms hired by NHAI through competitive bidding. The hired firm prepares feasibility report of the project, listing major works. The assessed amount is called the expected construction cost. The expected construction time is also assessed by these firms. With the estimates of project time and costs, the NHAI takes the project to investors. If the project attracts private investment, it becomes a PPP.

It is worth emphasising that the expected construction cost is assessed before the choice of contract is made, that is, before the PPP/ non-PPP status of the road gets known. Therefore, it does not depend on the type of the contract used. In contrast, the actual construction costs become known ex-post to the choice of contract and when the construction gets completed.

However, both the expected construction cost and the actual construction are about one and the same project. Plausibly, the expected construction cost factors in main elements that have a bearing on the construction costs, such as the material used in road construction, the number of over- and underpasses, service-lanes, etc. If so, the differences in the cost ratio for PPP- versus non-PPP roads can plausibly be attributed to the contract type, at least to an extent. In this context, it seems plausible to compare the CO for PPP roads with non-PPP roads. Using this ratio, we define cost overrun as CO times 100.

For similar reasons, we choose to compare the relative project delivery time (i.e., relative delays) for the two types of contracts using the following ratio:

Time overrun ( TO) = Actual time/ Expected time

where, the actual time (in months) is the time taken by project construction and expected time is the initially expected construction time for the project.

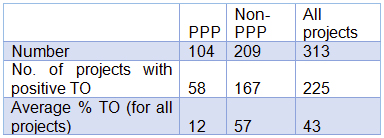

Table 1. Delays – PPPs versus non-PPPs

Our dataset consists of a total of 313 national highway projects started and completed under the aegis of NHAI between December 1997 and August 2015. All the calculations presented here are based on the data sourced from the NHAI.

Table 1 shows the delays experienced by PPP versus non-PPP roads. As predicted, a smaller fraction of PPP roads have experienced delays and the project delivery time is faster for PPPs. The average delay for all projects is 43%, that is, the average actual road construction duration is 43% longer than the estimated duration. While PPP projects have taken only 12% extra time, non-PPP roads have taken 57% additional time.

Before comparing the construction cost ratios, an explanation is in order. The data on expected costs is derived from the official figures on ‘total project cost’ (TPC). For PPP projects, the official data on TPC also includes 25% of the estimated construction costs as the cost of ‘interest during construction’ borne by the contractor.1 That is, for PPPs,

TPC = Expected costruction cost + (25% of expected costruction cost)

For non-PPPs, the funding is provided by the government. Hence, the issue of interest does not arise. So, for non-PPPs the official figures on TPC are simply the expected construction costs. For PPPs, to retrieve the figures for expected costs, one needs to discount the official data on TPC by 20%. In Figure 1 and Table 2, the figures with 20% discounting are derived by following this rule. Numbers with 10% and 15% discounting correspond to a lower level of discounting, and hence are an underestimate of cost ratio for PPPs. Calculations for CO for PPPs without any discounting at all are also reported here.

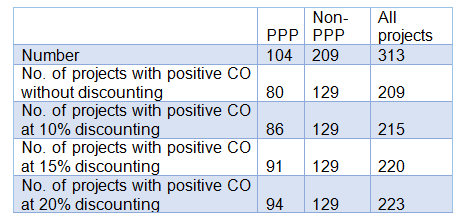

Table 2. Number of projects with cost overruns – PPPs versus non-PPPs

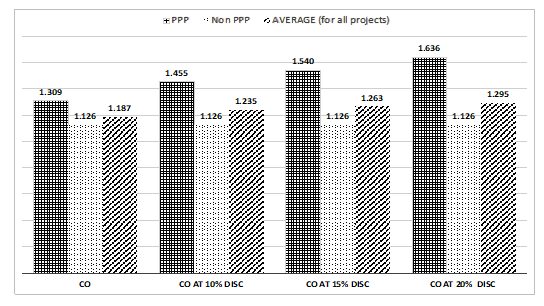

As is clear from Table 2, a much larger proportion of PPPs have experienced cost overruns. Figure 1 shows that compared to non-PPP roads, the ratio of actual to the estimated construction costs is significantly higher for PPP roads. It is higher by a margin of 17-51% depending on the discounting used.

In other words, the difference between the actual construction costs and the expected costs is much larger for PPP projects than for the non-PPP roads. Within PPP roads, the BOT Toll contract based projects have experienced significantly higher cost ratio than the BOT Annuity projects. However, as far as the project delivery time is concerned, there are no significant differences between the two types of PPPs.

Figure 1. Construction cost ratios (cost overruns): PPPs versus non-PPPs

Do higher costs for PPPs mean better quality roads?

The empirical analysis shows that controlling for the project characteristics and several other relevant factors, the construction cost ratio is 34% higher for PPPs than for non-PPPs. The difference is large and statistically significant. The cost ratio for PPPs is significantly higher even if we adopt a rather conservative approach on the interest costs. More recent projects and those with large local population also exhibit high cost ratio. The differences in the cost ratios do not seem to be caused by any of the following: Purposeful underestimation of estimated costs for PPPs; ex-post changes in project works; and purposeful escalation of actual costs by the contractors. For details, see Singh (2018 b).

It seems at least a part of the higher cost ratio for PPPs is attributable to the bundling under PPPs. As discussed above, it gives incentive to the contractor to maintain quality of construction. This inference is further corroborated by exploiting the key differences between the toll- and annuity PPPs. In case of toll roads the quality can further help the contractors to attract more traffic thereby raising their profits. Besides, the contract duration is longer for toll contracts than the annuity contracts. On this count as well the toll contractors should care more for the road quality. In view of these arguments we can expect the following: the difference between cost ratios for toll-roads versus non-toll roads should be higher than the corresponding difference between the annuity roads versus the non-PPPs. Empirical analysis shows that this indeed is the case.

For the above approach toward examining the differences in construction costs, the scope of the problem of endogeneity seems limited. Nonetheless, it is important to point out that the above line of reasoning can lead to biased estimates since the contract assignment to projects – PPP versus non-PPP – is not random.

Therefore, it will be useful to check if the above inferences are corroborated by direct comparison of quality of roads. For this purpose, data was collected on road roughness to compare the International Roughness Index (IRI) for PPP roads with non-PPP roads. This is an internationally accepted engineering measure of quality of road surface. The empirical strategy essentially focused on the comparison of the quality of roads at the intersection of the PPP- and non-PPP roads. So, the data collection was done at the intersection of roads built using different contracts. Given the paucity of funds, the exercise could be carried out only for 79 projects. The PPP contract has negative and highly significant effect on the roughness index imply that road quality is significantly higher for PPPs, controlling for the design capacity and the age of the road. See Singh (2018 a).

To sum up, the PPP roads are better than the traditional highways on the following counts: One, the project delivery is faster for PPPs. Two, the available data and evidence indicates towards a better quality of roads under PPP compared to the traditional roads. However, there is need to collect more data in order to make claim about the overall quality of road services.

Notes:

- For details see Singh (2018 a and b).

Further Reading

- Singh, R (2018 a), ‘Does choice of procurement contract matter for cost and quality of infrastructure?’, International Growth Centre Working Paper S-89209-INC-1.

- Singh, R (2018 b), ‘Public Private Partnerships Vs. Traditional: Roads Project Delivery Time, Costs and Quality’, Centre for Development Economics Working Paper No.290.

- Singh, Ram (2011), “Determinants of Cost Overruns in Public Procurement of Infrastructure: Roads and Railways”, India Policy Forum, vol. 7, pp. 97-158.

05 November, 2018

05 November, 2018

By: construction contractor in Delhi 21 November, 2019

I love this informative content. Thanks.