Commenting on the discussion of the universal basic income in India's Economic Survey 2016-17, Justin Sandefur contends that a modest version of UBI could potentially save money and shift expenditure in a progressive, pro-poor direction.

Tweet using #basicincome

The New York Times (NYT) Magazine recently published a feature story by Annie Lowrey looking at GiveDirectly's universal basic income (UBI) experiment in Kenya. Reporting from a Kenyan village where eating in public is considered an ostentatious display of wealth, Lowrey does a good job of conveying just how radical this experiment is. While aid projects have come and gone, suddenly every man, woman, and child will start receiving a monthly transfer of about US$22 per month - roughly equivalent to the median Kenyan household's per capita income - for the next 12 years, no strings attached.

The NYT piece has given rise to some sensible concerns (see for example, Chris Blattman's sceptical take):

1. Can Kenya, or any poor country, really afford to provide a UBI?

2. Why not target the poor, instead of giving everyone money?

As fascinating as it is, the GiveDirectly pilot can elide some of these questions. After all, it's a relatively small-scale, privately-funded research experiment. Silicon Valley philanthropists can throw money at a few dozen Kenyan villages that might not be sustainable at a larger level.

That's why I think the truly exciting action on this topic is in India, where (as my colleague Todd Moss explained in an earlier post) the Ministry of Finance is seriously weighing the idea of a UBI that could transform the idea of the welfare State in a country of over 1.2 billion people, home to over a third of the global poor. So how does India's Chief Economic Adviser, Arvind Subramanian (a CGD (Center for Global Development) colleague, currently on leave) deal with these looming questions of affordability and targeting?

Can poor countries afford a UBI?

The short answer from Subramanian and team for India is that realistic magnitudes of cash can't wipe out poverty, but a move to universal cash programmes might actually be cheaper - per unit of poverty reduction - than current social programmes.

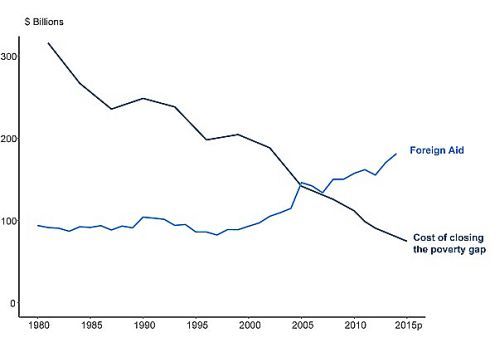

It's easy to oversell this point. As Berk Ozler notes in the World Bank's Development Impact blog, the NYT Kenya piece cites a simple back-of-the-envelope calculation by Christine Zhang, Laurence Chandy and Lorena Noe at Brookings, who estimate that the size of the global poverty gap - that is, how much extra money poor people would need to bring them up to the World Bank's US$1.90-per-day absolute poverty line - is about half of what rich nations spend each year on foreign aid. In other words, more or less, if you gave half of the foreign aid budget directly to poor people as cash, presto: no more poverty in the world.

Figure 1. Annual cost of closing the poverty gap vs. official foreign aid

Note: This Figure is reproduced from Zhang, Chandy and Noe (2016).

This viral Brookings graph is a fascinating framing of the cash-transfer debate, but sadly, it's not a remotely practical policy proposal. My colleague Maya Forstater (with a helpful pointer from Chandy) calls this the wishful thinking of redistribution in the developing world. Ozler's post explains the arithmetic of global poverty and cash transfers in detail. He notes that governments and aid donors have a very imperfect idea of who is and isn't poor. So any attempt to end poverty through transfers would end up benefitting lots of non-poor people, driving up the costs. Furthermore, most real-world transfers in poor countries are a flat amount, as it's impossible to know exactly how far below the poverty line a given household is.

The combined result is that eradicating poverty through cash transfers would be much, much more expensive than the Brookings calculation suggests.

In contrast, the India proposal from Arvind Subramanian is designed not only to be universal, but to be budget neutral - meaning it would only roll out as other social programmes were rolled back. The cost of universality is that the magnitude of any feasible transfer would likely be a small fraction of the US$22 per month from the Kenyan experiment. They estimate a quite small transfer of roughly US$4 per person per month would reduce poverty relative to India's national line from about 22% down to about 7%, at a cost of just over 2% of GDP (gross domestic product) - roughly equal to the total cost of current fertiliser, fuel, and food subsidies1.

Some of those gains are illusory. Poverty is typically defined as failing to meet a certain consumption level, measured in monetary value. Food subsidies allow you to eat more even if you 'consume' less in monetary terms, whereas cash boosts monetary consumption directly.

As Jean Dreze notes, other recent UBI proposals for India have been considerably more generous than the Ministry of Finance's trial balloon, with Pranab Bardhan proposing a UBI that would add up to 10% of GDP, and Vijay Joshi proposing an alternative at 3.5% of GDP.

By displacing other government programmes, UBI would trigger powerful political opposition. Dreze's piece worries about UBI being in tension with universal education or work guarantees. Those concerns are echoed (or pre-empted) by the report itself, which notes "while a UBI may certainly be the shortest path to eliminating poverty, it should not become the Trojan horse that usurps the fiscal space for a well-functioning state" 2.

Why not target the poor?

The bold claim buried within Subramanian's proposal, is that a universal income would actually be more pro-poor than existing, targeted anti-poverty programmes. The idea is that current 'targeted' programmes are so leaky and misallocated that they're not targeted at all, and a well-run UBI would be better than the status quo.

The solution to this apparent paradox is disintermediation. By leveraging India's combination of an advanced electronic payments infrastructure and the Aadhaar3 biometric identification programme with over 1.1 billion enlistees, UBI could allow the Indian central government to tackle poverty directly, cutting out layers of bureaucracy and political intermediaries who siphon off budgets or allocate programmes to their cronies and favoured constituents.

The obstacles to accurate targeting mentioned above in the World Bank research are mostly technical issues, preventing altruistic philosopher kings from achieving perfect poverty reduction. Real governments aren't so perfect. Misallocation doesn't happen just by accident. Politicians steer programmes to their districts, poor or not; district officials siphon off money for pet projects or election campaigns; and local officials ask for kickbacks from beneficiaries.

The result is that targeting using politicised, inefficient, and oftentimes corrupt government systems could, in theory, be worse than not targeting at all.

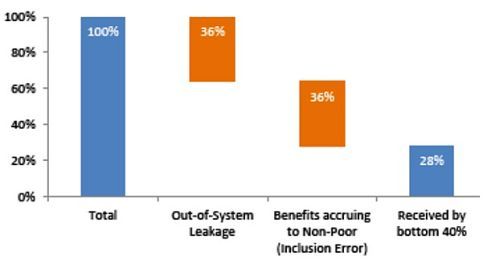

Consider the actual counterfactual to UBI: the Indian government's current massive, Public Distribution System (PDS) of subsidised food for poor households. This would be a likely target for countervailing cuts if UBI ever materialised. Subramanian and team calculate that 36% of the PDS subsidy never makes it to any household, and (coincidentally) another 36% accrues to non-poor households. What's left is just 28% of the subsidy value for the poorest 40% of Indians. In short, the PDS which allegedly targets the poor is less well targeted than a (theoretical) universal programme.

Figure 2. Targeting of India's Public Distribution System

Note: This figure is reproduced from India Economic Survey, chapter 9, Figure A5.

This is very similar to an argument made by Martin Ravallion in a CGD blog post a couple years ago. Ravallion noted that his own research with World Bank colleagues in Bihar found that "once one accounts for all the costs involved in India's National Rural Employment Guarantee Scheme [MNREGA], including the forgone earnings of participants, a [basic income guarantee] with the same budgetary cost would have greater impact on poverty than the labor earnings from the existing scheme."

Could an electronic UBI really do better? There's some evidence it could. In a large-scale randomised controlled trial (RCT) in Andhra Pradesh, economists Karthik Muralidharan, Paul Niehaus, and Sandip Sukhtankar show that shifting MNREGA (Mahatma Gandhi National Rural Employment Guarantee Act) implementation to biometrically-authenticated "smartcards" led to a significant reduction in leakage from the programme.

Curiously, though, technology hasn't solved the targeting problem: even with a biometric database of a billion people, the State still doesn't know who's poor. Poor people don't have bank accounts or pay stubs. For now, targeting the poor means allowing discretion by local politicians and bureaucrats, posing a trade-off between targeting and leakage.

Redistribution without (much of) the State

UBI embodies two radical departures from most existing anti-poverty programmes. The one we usually talk about is anti-paternalism. Cash gives beneficiaries choices. Since technocrats often distrust the choices poor people make, economists have spent much of their research effort on cash transfers to showing that poor people won't choose to drink away their money4 or stop working.

But in many developing countries, the second distinguishing feature of cash transfer programmes - disintermediation - may prove more radical in the end. By relying on electronic payment mechanisms and ubiquitous mobile phones, programmes like GiveDirectly in Kenya can 'zap' money straight from offices in Nairobi or even North America, directly to beneficiaries in Busia. In theory, the Indian central government could do the same across several hundred districts.

So yes, the new UBI pilot in western Kenya may be unsustainably expensive. And the rhetoric about the 'end of work' and the age of robots is probably overwrought in places like India or Kenya. But as the Indian government has discovered, a modest version of UBI could potentially save money and shift expenditure in a progressive, pro-poor direction.

Reprinted from CGD blog: https://www.cgdev.org/blog/disintermediating-state-would-universal-basic-income-reduce-poverty-more-targeted-programs.

Notes:

- Figure 10 (p. 188) and Table 2 (p. 190) of Economic Survey 2016-17, chapter 9.

- Page 189 of Economic Survey 2016-17, chapter 9.

- Aadhaar or Unique Identification number (UID) is a 12-digit individual identification number issued by the Unique Identification Authority of India (UIDAI) on behalf of the Government of India. It captures the biometric identity – 10 fingerprints, iris and photograph – of every resident, and serves as a proof of identity and address anywhere in India.

- Evans and Popova 2016.

Further Reading

- Blattman, C (2017), 'Why I'm a Universal Basic Income skeptic, especially for poor countries', Chrisblattman.com, 27 February 2017.

- Dreze, J (2017), 'Universal Basic Income For India Suddenly Trendy. Look Out', NDTV, 16 January 2017.

- Evans, David K and Anna Popova (2016), "Cash Transfers and Temptation Goods", Economic Development and Cultural Change, 65(2).

- Forstater, M (2017), 'On Inequality, Redistribution, and Wishful Thinking', CGD Blog, 2 March 2017.

- Ministry of Finance (2017), 'Economic Survey 2016-17', Government of India, New Delhi.

- Moss, T (2017), 'Universal Basic Income: What Would Mahatma Gandhi Do?', CGD Blog, 10 February 2017.

- Muralidharan, Karthik, Paul Niehaus and Sandip Sukhtankar (2016), "Building State Capacity: Evidence from Biometric Smartcards in India", American Economic Review, 106(10):2895-2929.

- Ravallion, M (2014), 'Time for the BIG Idea in the Developing World', CGD Blog, 12 December 2014.

- Zhang, C, L Chandy and L Noe (2016), 'The global poverty gap is falling. Billionaires could help close it.', Brookings, 20 January 2016.

31 March, 2017

31 March, 2017

Comments will be held for moderation. Your contact information will not be made public.