In the year 2000, three new states – Jharkhand, Chhattisgarh and Uttarakhand – were carved out of the large states of Bihar, Madhya Pradesh and Uttar Pradesh respectively. This column analyses the performance of the new entities before and after

Is small beautiful? Since the breakup of the three large states of Bihar, Madhya Pradesh (MP) and Uttar Pradesh (UP) in 2000, and the most recent breakup of Andhra Pradesh in 2014, there has been much debate on whether the new, smaller states have done better in terms of both governance and economic performance. For instance, the particular success of Bihar relative to the past has been attributed to the zeal of the Chief Minister, Nitish Kumar, while the weak performance of the breakaway state Jharkhand compared to its rump (remnant of the old state

New vs. rump states

We began this project with some scepticism about ascribing change entirely to the zeal of a particular leader. The starting point of our analysis was investigating the average performance of each of the new entities before and after

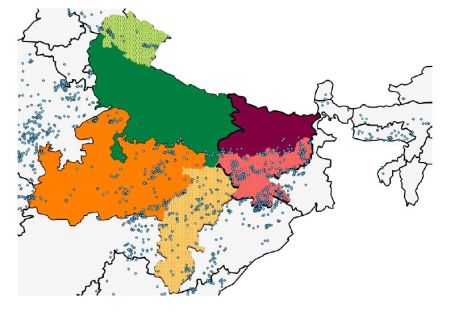

In order to identify the effect of state breakup on both economic activity and inequality, we rely on geographic discontinuity at the boundary of each state pre-breakup, to estimate the causal effect of secession on growth and inequality outcomes. Figure 1 shows the states before and after

Figure 1. The old and new states in India

Our first result is that while all six states experience an increase in luminosity, it is clear that, on average, new states did better than the rump states: the increase in luminosity post-breakup for new states was 35% more than that for rump states. Moreover, the effects vary across pairs of new states and rumps; the average positive effect is driven by Uttarakhand while Jharkhand fares substantially worse than Bihar and Chhattisgarh does about the same as MP.

Natural resources

This led us to explore reasons for the variation across pairs of states and an obvious candidate to focus on seemed to be the variation in the distribution of natural resources. The change in

Figure 2. The distribution of mineral deposits across states, 2002

The main change due to breakup is the creation of a new political entity and the consequent changes in

Role of institutional arrangements

We tie these results to

It is instructive to compare the results here with a recent study by Loazya et al. (2013) examining the impact of a sharp increase in revenues from mining across districts in Peru. They find that while economic outcomes improved in mining districts, inequality increased both within and across all districts. They attribute the better outcomes in mining districts to the legal requirement that revenues are distributed back to mineral-producing districts, while the increase in inequality within mineral-producing districts is attributed to capture by local agents. Viewed from the prism of our theoretical framework, this result can be explained by the predominantly higher effect of increased local revenues, as opposed to the case of India where redistribution happens at the state level and not at the local level. The increase in local inequality in mineral-producing districts, on the other hand, resonates with our findings. The different institutional structures in India imply that political power resides at the state level rather than the local

The previous government at the Centre had proposed a draft Mines and Mineral Development and Regulation Bill, 2011, which provided for a 26% share in mining profits for local communities, which would have been a substantial change in policy. The current government has instead proposed an amendment to the original Bill of 1957, which in turn has a rather convoluted provision for sharing of benefits with local communities. It proposes the establishment of District Mineral Foundations (DMFs) in areas affected by mining-related operations. The objective of this foundation would be to work for the "interests and benefits of persons and areas affected by

These new institutional arrangements might well be the key to the improved performance of areas with high concentration of resources that might succumb to a local natural resource curse otherwise. However, the incentives for

Notes:

- This is attributed to the historian Thomas Carlyle (1840) who wrote, "The history of the world is but the biography of great men."

- This refers to the fact that countries endowed with natural resources such as minerals and oil have tended to grow more slowly than countries without these resources (see Frankel (2012) for a survey).

- Here, the comparison is between the region that later broke away and the remaining part of the state.

- Luminosity refers to measures of night-time lights visible from space that are increasingly used as a proxy for economic activity/output, particularly in contexts where reliable data on these indicators are sparse (see Henderson et al. 2011, Chen and Nordhaus 2011). The night-time image data is from the Defense Meteorological Satellite Program Operational Linescan System (DMSP-OLS).

- We exclude forest resources from our analysis since ascribing rents from them to specific areas is difficult, unlike in the case of minerals. Data on the location, type and size of mineral deposits are from the Mineral Atlas of India (Geological Survey of India, 2001). We are grateful to Sam Asher for sharing his version of the data with us.

- In the sense that the fraction of ACs with substantial potential for rent grabbing increases.

Further Reading

- Carlyle, T (1840), ‘On Heroes, Hero-Worship, and the Heroic in History’, Lectures, Yale University Press, Re-published in 2013.

- Chen, X and WD Nordhaus (2011), “Using luminosity data as a proxy for economic statistics”, Proceedings of the National Academy of Sciences, 108, 8589–8594.

- Dhillon, A, P Krishnan, M Patnam and C Perroni (2015), ‘The Natural Resource Curse Re-visited: The Case of New States in India’, Working Paper.

- Frankel, JF (2012), ‘’, In Commodity Price Volatility and Inclusive Growth in Low - Income Countries, Arezki, R, C Pattillo, M Quintyn and M Zhu (eds.), International Monetary Fund.

- Henderson, JV, A Storeygard and DN Weil (2011), “A bright idea for measuring economic growth”, The American Economic Review, 101, 194.

- Kale, S and L Bhandari (2010),

“ ” , Analytique, VI(4). - Loayza, NV, A Mier Y Teran and J Rigolini (2013), ‘Poverty, Inequality and the Local Natural Resource curse’, IZA Discussion Paper No. 7226.

- Mehlum, H, K Moene and R Torvick (2006), "Institutions and the resource curse", The Economic Journal, Vol. 116 (508), 1-20.

- Narain, S (2015), ‘’, The Business Standard, 19 July 2015.

- Robinson, JA, R Torvik and T Verdier (2006), “Political Foundations of the Resource Curse”, Journal of Development Economics, 79 (2): 447–468.

02 March, 2016

02 March, 2016

Comments will be held for moderation. Your contact information will not be made public.