Social Health Insurance seeks to protect the poor from high health spending, and encourage healthcare utilisation. Analysing 2004-05 and 2011-12 Indian Human Development Survey data, this article finds that Rashtriya Swasthya Bima Yojana increased the likelihood of hospitalisation for long-term illness, and of doctor visits for short-term illness. While out-of-pocket health expenditure rose, there was a decline in the number of days lost due to illness.

A large section of the population in developing countries are not covered by health insurance (Banerjee et al. 2004), which has led them to incur huge out-of-pocket (OOP) health expenditures. Given this backdrop, Social Health Insurances (SHIs), which are particularly targetted towards the lower income strata of the society, have recently received a lot of attention in low- and middle-income countries.

While most studies have found a significant positive impact of SHI schemes on the utilisation of health services, the impact on healthcare spending is mixed. Examining an SHI scheme in Peru, Neelsen and O’Donnell (2017) show that it improved ambulatory care and medication but has no effect on in-patient care and OOP health spending. However, in case of Thailand, Gruber et al. (2014) and Limwattananon et al. (2015) find that a health insurance programme for the poor led to a reduction in OOP health spending along with a positive impact on healthcare utilisation. Wagstaff et al. (2009) find that after a highly subsidised health insurance scheme was implemented in China, there was an increase in both in-patient and out-patient utilisation of services, with no change in OOP spending. In Colombia, Miller et al. (2013) find a lower distribution for in-patient expenditure related to preventive care with no impact on the distribution of out-patient spending. There are other studies conducted in China (Wagstaff and Lindelow 2008) and Peru (Bernal et al. 2017) that analyse how health insurance coverage increases the chances of incurring health expenditures by individuals.

India’s RSBY

Introduced in 2008, Rashtriya Swasthya Bima Yojana (RSBY) was Government of India’s first health insurance scheme that was implemented at the national level1. RSBY aimed to protect poor households from financial distress due to health shocks that required hospitalisation. The enrolment was at the household level, and it provided annual coverage of Rs. 30,000 per household. This covered most of the diseases that required hospitalisation. Beneficiaries could avail healthcare at empanelled private and public hospitals. The scheme was also innovative as it provided cashless facility by issuing smart cards to households.

Only a few studies have focussed on understanding the impact of this large-scale intervention. Using two rounds (61st and 66th) of National Sample Survey (NSS) data (2004-2005 and 2009-2010), Johnson and Krishnaswamy (2012) find an increase in the number of households with a case of hospitalisation, and a small decrease in household out-patient expenditure. On the other hand, Karan et al. (2017) find no significant impact on OOP expenditure using three waves (1999-2000, 2004-2005, and 2011-2012) of the household-level Consumer Expenditure Surveys (CES) conducted by the NSSO (National Sample Survey Organisation). Using the India Human Development Survey (IHDS) dataset, Azam (2018) studies the impact of RSBY on rural and urban households separately and shows a positive and significant impact on utilisation of healthcare services, with no impact on OOP health spending.

Our study

In a recent study (Dutta and Sarkar 2021), we evaluate the impact of RSBY on the utilisation of health services and household per-capita OOP health spending, using data from the IHDS2 (2004-05 and 2011-12). We contribute to the literature by examining the causal impacts of RSBY on healthcare utilisation and health expenditure by including different fixed effects3 and showing that the results are similar. Further, we look at the distributional impact of RSBY by implementing the quantile difference-in difference4 approach. We also provide a conceptual framework to form our hypothesis which we test empirically5.

Our results show that RSBY beneficiary households were 1.3 percentage points (16%) more likely to report hospitalisation for a long-term illness (LTI)6. We also find that RSBY encouraged a greater proportion of members within a household to be hospitalised for LTI.

With regard to short-term illness (STI)7, RSBY households were 3.2 percentage points (7.6%) more likely to report treatment from a doctor. We also find that RSBY encouraged a greater proportion of members within a household to seek treatment from a doctor for STI.

Next, we estimate the impact of health insurance on OOP health expenditure. We find that monthly per-capita OOP expenditure on health due to any illness increases by Rs. 46.3 (37%), monthly per-capita OOP expenditure due to STI increases by Rs. 28.9 (41%), and monthly per-capita OOP due to LTI increases by Rs. 17.4 (32%). The increase in OOP expenditure is primarily dominated by STI, which suggests that RSBY motivated households to opt for treatment for STI despite knowing that in most cases these expenses will not be covered by insurance since they do not require hospitalisation.

The rise in OOP expenditure on healthcare, as a result of the implementation of RSBY, can be viewed critically especially when the primary objective of the programme was to reduce the financial burden arising out of health shocks. On the one hand, this increase in expenditure can be seen as a burden on the poor households in rural India. On the other hand, households in rural areas do not receive proper treatment especially for STIs because of financial constraints, low awareness of their healthcare needs, and limited availability of facilities. Instead, poor households in rural India often go to a nearby pharmacy to obtain over-the-counter medication, or consult traditional healers because they are generally cheap and easily accessible. The increase in the likelihood of hospitalisation and greater proportion of members in the household getting hospitalised because of RSBY, indicates an increase in their awareness about formal healthcare facilities through more patient-doctor contact. This encourages households to get themselves treated from a doctor for STIs despite of knowing that it would not be covered under RSBY.

Moreover, a positive impact of increased hospitalisation and receiving treatment from doctor is reflected through the fact that the number of days lost8 due to illness decreased. Lost days decreased by 4.36 (20.8%) on account of RSBY and this was primarily driven by a decrease in lost days of 4.96 (27.5%) due to LTI.

Thus, access to RSBY improved utilisation of health services, including an increased likelihood of seeking a doctor’s advice for STIs. While this comes with an increased spending on health, the fall in lost days due to illness suggests that our findings could be less worrying than they may first seem.

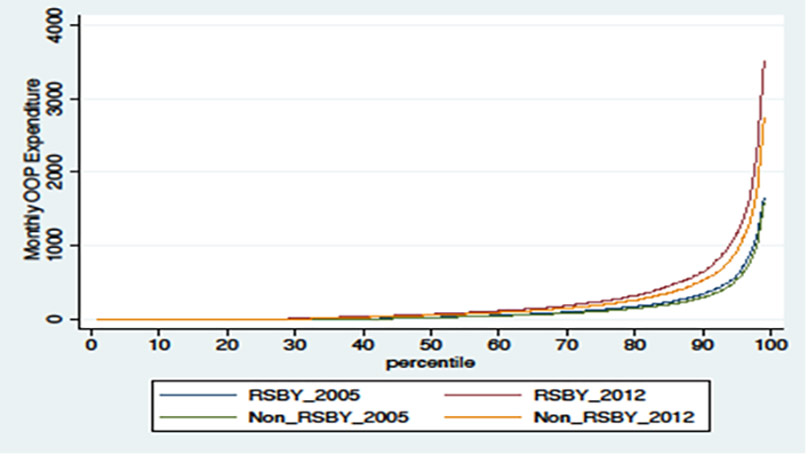

Further, we plot the different quantiles of the distribution9 of monthly per capita OOP health expenditure for households with and without RSBY, pre- and post-intervention in Figure 1. In the figure, we observe that total OOP expenditure has a skewed distribution. We find that RSBY led to an increase in total OOP expenditure for all the quantiles from the 65th quantile, but it led to highest increases in expenditure at the top quantiles.

Figure 1. Monthly OOP expenditure for households with and without RSBY

Concluding remarks

As India and other countries push for universal health coverage, increasing the effectiveness of SHIs is important for providing eligible households with quality healthcare without increasing their OOP health spending. Certain steps could be taken in this regard. First, the coverage limits of such schemes could be extended10, and more services included in their ambit. Second, households or individuals eligible for such schemes could be automatically enrolled so that enrolment rates improve. Third, investments by the government to strengthen public healthcare facilities and their coverage in rural areas, improving the infrastructure and expanding the network of empanelled hospitals, may also help the beneficiary households in reducing their OOP health spending. Finally, random audits by the government or appointed third parties could help ensure that empanelled hospitals provide the covered services free-of-charge to the eligible households seeking care. These steps could further provide households with improved access to affordable healthcare and protect them against high health spending.

I4I is on Telegram. Please click here (@Ideas4India) to subscribe to our channel for quick updates on our content

Notes:

- In September 2018, the scheme was subsumed under the more comprehensive health insurance scheme known as Pradhan Mantri Jan Arogya Yojana (PM-JAY).

- IHDS is a nationally representative panel survey of about 40,000 households across 1,503 villages and 971 urban neighborhoods.

- Fixed effects control for time-invariant unobserved characteristics. We have different specifications controlling for district and village fixed effects.

- Quantile difference-in-differences is a technique to compare the changes in outcomes at different quantiles (rather than at average) over time between two groups, one that gained access to an intervention with another that did not.

- We also perform a variety of robustness checks to ensure that the impact is indeed due to RSBY.

- LTI includes diseases like cataract, tuberculosis, high blood pressure, heart diseases, etc., which in most cases would require hospitalisation and therefore would be covered under the scheme.

- STI includes diseases like fever, cough, and diarrhoea.

- Lost days are measured as the number of days an individual loses out on usual activities in work, school/college or domestic work.

- We look into the distributional impacts of the scheme on health expenditure because of the presence of excess zeros in health spending.

- The recently launched PM-JAY scheme provides annual coverage of Rs. 5 lakh per household for secondary and tertiary diseases which requires hospitalisation.

Further Reading

- Azam, Mehtabul (2018), “Does social health insurance reduce financial burden? Panel data evidence from India”, World Development, 102: 1-17.

- Banerjee, Abhijit, Angus Deaton and Esther Duflo (2004), “Wealth, health, and health services in rural Rajasthan”, American Economic Review, 94(2): 326-330. Available here.

- Bernal, Noelia, Miguel A Carpio and Tobias J Klein (2017), “The effects of access to health insurance: Evidence from a regression discontinuity design in Peru”, Journal of Public Economics, 154: 122-136. Available here.

- Dutta, S and S Sarkar (2021), ‘Impact of Social Health Insurance on Health Care: Utilization and Spending: Evidence from India’, Working paper.

- Gruber, Jonathan, Nathaniel Hendren and Robert M Townsend (2014), “The great equalizer: Health care access and infant mortality in Thailand”, American Economic Journal: Applied Economics, 6(1): 91-107. Available here.

- Johnson, D and K Krishnaswamy (2012), ‘The impact of RSBY on hospital utilization and out-of-pocket health expenditure’, Working Paper, World Bank.

- Karan, Anup, Winnie Yip and Ajay Mahal (2017), “Extending health insurance to the poor in India: An impact evaluation of Rashtriya Swasthya Bima Yojana on out of pocket spending for healthcare”, Social Science & Medicine, 181: 83-92.

- Limwattananon, Supon, Sven Neelsen, Owen O’Donnell, Phusit Prakongsai, Viroj Tangcharoensathien, Eddy Van Doorslaer and Vuthiphan Vongmongkol (2015), “Universal coverage with supply-side reform: The impact on medical expenditure risk and utilization in Thailand”, Journal of Public Economics, 121: 79-94.

- Miller, Grant, Diana Pinto and Marcos Vera-Hernandez (2013), “Risk protection, service use, and health

outcomes under Colombia’s health insurance program for the poor”, American Economic Journal: Applied Economics, 5(4): 61-91. - Neelsen, Sven and Owen O’Donnell (2017), “Progressive universalism? The impact of targeted coverage on health care access and expenditures in Peru”, Health Economics, 26(12): 179-203.

- Wagstaff, Adam and Magnus Lindelow (2008), “Can insurance increase financial risk?: The curious case of health insurance in China”, Journal of Health Economics, 27(4): 990-1005.

- Wagstaff, Adam, Magnus Lindelow, Gao Jun, Xu Ling and Qian Juncheng (2009), “Extending health insurance to the rural population: An impact evaluation of China’s new cooperative medical scheme”, Journal of Health Economics, 28(1): 1-19.

31 March, 2022

31 March, 2022

Comments will be held for moderation. Your contact information will not be made public.