Financial liberalisation has been controversial as it is not clear whom the expanded credit allocation actually benefits. Using variation across time and states in India, this column finds strong evidence that financial deepening reduces rural poverty, especially among the self-employed. Financial deepening is also found to be associated with an inter-state migration trend from rural areas into the tertiary sector in urban areas.

For better or worse, the 2008 financial crisis has put the financial sector again at the centre of public debate. Several commentators have suggested that financial liberalisation contributed both to the financial crisis and to growing income inequality (for example, Krugman 2009 and Moss 2009). On a more general level, financial liberalisation has been controversial among academics and policymakers, as it is not clear whom the benefits of expanded credit allocation accrue to.

Evidence across countries has linked financial development both to lower levels of and faster reductions in income inequality and poverty rates (Beck et al. 2007, Clarke et al. 2006). But does this relationship also hold for individual countries?

Financial development and poverty

We use annual household survey data across 15 Indian states over the period 1983 to 2005 to assess the effect of financial sector development on changes in rural and urban poverty (Ayyagari et al. 2013). Specifically, we exploit variation across states and over time in both financial depth and financial inclusion to explore: (i) The relationship between financial development and poverty levels, (ii) The relative importance of financial depth and financial inclusion in this relationship; and, (iii) The channels and mechanisms through which financial development alleviates poverty. While financial depth refers to the overall volume of financial transactions, especially credit, in the economy, financial inclusion relates to the share of population with access to financial services.

India is suitable for such an analysis given not only the large variation across states in socio-economic and institutional development, but also significant policy changes the country has experienced over the time period being studied (Besley et al. 2007).

Data and methodology

To assess the relationship between financial sector development and poverty levels and disentangle the mechanisms and channels through which this relationship works, we use household surveys from the National Sample Survey Organisation (NSSO) from 15 Indian states over the period 1983 to 2005. We measure poverty using headcount (share of population living below the national poverty line) and poverty gap (average distance separating the population from the poverty line as a proportion of poverty line). We measure financial depth by commercial bank credit to state domestic product (SDP) and financial inclusion by bank branch penetration per capita.

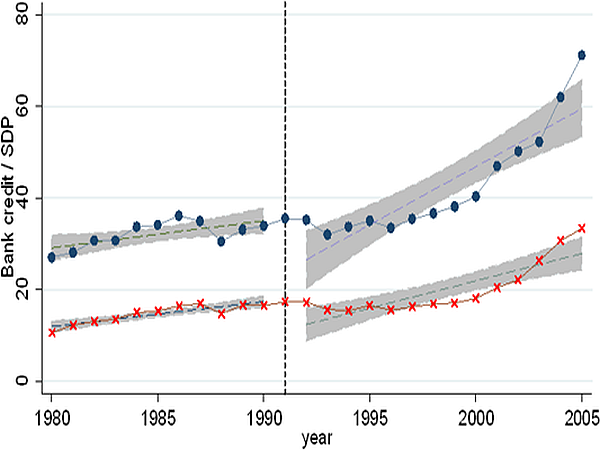

In our analysis we control for other factors that might influence poverty levels and for trends in poverty levels over time.1 As reductions in poverty levels might increase demand for financial services, we focus on the part of financial depth and financial inclusion that cannot be explained by poverty levels. Specifically, Figure 1 shows that financial depth increased much more rapidly after financial liberalisation in 1991 in states with a more vibrant and widely-read newspaper industry. A more informed public is better able to compare different financial services, resulting in more transparency and a higher degree of competition leading to greater financial sector development.

Figure 1. Bank credit and English newspaper circulation

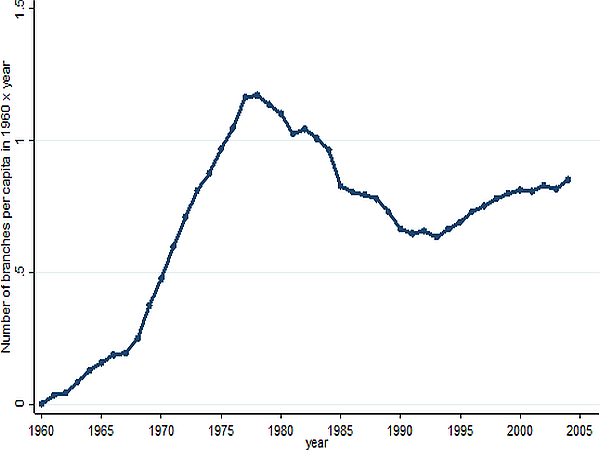

In addition, we follow Burgess and Pande (2005) and exploit the policy-driven nature of rural bank branch expansion across Indian states as an explanatory variable for branch penetration and thus financial inclusion. According to the Reserve Bank of India’s (RBI) 1:4 licensing policy instituted between 1977 and 1990, commercial banks in India had to open four branches in rural unbanked locations for every branch opening in an already banked location. Thus between 1977 and 1990, rural bank branch expansion was higher in financially less developed states while after 1990, the reverse was true (financially developed states offered more profitable locations and so attracted more branches outside of the programme), as illustrated in Figure 2.2

Figure 2. Bank-branch penetration as function of initial financial development

Main findings

Relating annual state-level variation in poverty to variation in financial development, we find:

- Financial depth has a negative and significant impact on rural poverty in India over the period 1983-2005. On the other hand, we find no effect of financial depth on urban poverty rates.

- The effect of financial depth on rural poverty reduction is also economically meaningful. Variation in credit to SDP can explain up to a third of variation in rural poverty.

- We also find that over the time period 1983-2005, financial depth has a more significant impact on poverty reduction than financial outreach. Our measure of financial breadth, rural branches per capita, has a negative but insignificant effect on rural poverty over this period, though a strong and negative effect over the longer period of 1965 to 2005, which includes the complete period of the social banking policy.

The channels

The household data also allow us to dig deeper into the channels through which financial deepening affected poverty rates across rural India:

- We find evidence for the entrepreneurship channel, as the poverty-reducing impact of financial deepening falls primarily on self-employed in rural areas. On the other hand, we find no evidence that financial deepening has contributed to human capital accumulation.

- We also identify migration from rural to urban areas as an important channel through which financial depth reduces rural poverty. In particular, we find that financial sector development is associated with inter-state migration of workers towards financially more developed states. The migration induced by financial deepening is motivated by search for employment, suggesting that poorer population segments in rural areas migrated to urban areas.

- The rural primary and tertiary urban sectors benefitted most from this migration, consistent with evidence showing that the Indian growth experience has been led by the services sector rather than labour intensive manufacturing (Bosworth et al. 2007).

- This last finding is also consistent with the finding that it is specifically the increase in bank credit to the tertiary sector that accounts for financial deepening post-1991 and its poverty-reducing effect.

Conclusion

Our findings suggest that financial deepening can have important structural effects, including through structural reallocation and migration, with consequences for poverty reduction. Our findings have important policy repercussions. The pro-poor effects of financial deepening do not necessarily come just through more inclusive financial systems, but can also come through more efficient and deeper financial systems. Critical, the poorest of the poor not only benefit from financial deepening by directly accessing financial services, but also through indirect structural effects of financial deepening. 3

A version of this column has appeared on VoxEU (www.voxeu.org).

Notes:

- We use difference-in-differences regression set-up, controlling for state-fixed and year-fixed effects and controlling for time-variant state-level factors, such as the share of literate population, state domestic product per capita and state government expenditures to state domestic product.

- In technical terms, we use an instrumental variable specification, where English newspaper penetration in 1991 interacted with a post-1991 time trend and the initial level of financial development with post-1977 and post-1991 dummies are used as instrumental variables for financial depth and financial inclusion.

- This is consistent with evidence from Thailand (Gine and Townsend 2004) and for the US (Beck et al. 2010) who document important labour-market and migration effects of financial liberalisation and deepening.

Further Reading

- Ayyagari M, T Beck and M Hoseini (2013), “Finance and Poverty: Evidence from India”, CEPR Discussion Paper 9497.

- Beck T, A Demirgüç-Kunt and R Levine, (2007), “Finance, Inequality and the Poor”, Journal of Economic Growth 12(1), 27-49.

- Beck T, R Levine and A Levkov (2010), “Big Bad Banks? The Winners and Losers from Bank Deregulation in the US”, Journal of Finance 65(5), pages 1637-1667.

- Besley, T and R Burgess, (2002) “The Political Economy Of Government Responsiveness: Theory And Evidence From India”, Quarterly Journal of Economics 117(4), pages 1415-1451.

- Besley T, R Burgess, and B Esteve-Volart (2007), ‘The Policy Origins of Poverty and Growth in India’, Chapter 3 in Besley, T. and Louise J. Cord (eds.), Delivering on the Promise of Pro-Poor Growth: Insights and Lessons from Country Experiences, Palgrave MacMillan for the World Bank.

- Bosworth, B, S Collins and A Virmani (2007), “Sources of Growth in the Indian Economy”, in Bery S, B Bosworth and A Panagariya (eds.), India Policy Forum, 2006-07, Washington, DC: Brookings Institution Press.

- Burgess, R and R Pande (2005), “Do Rural Banks Matter? Evidence from the Indian Social Banking Experiment”, The American Economic Review, vol. 95(3), pages 780-795.

- Clarke G, L C Xu and H Zhou, (2006) “Finance and Income Inequality: What Do the Data Tell Us?”, Southern Economic Journal 72(3), pages 578-596.

- Gine, X and R Townsend (2004) “Evaluation of financial liberalization: a general equilibrium model with constrained occupation choice”, Journal of Development Economics 74, 269-307.

- Krugman, P (2009), "The financial factor", The New York Times blog, 7 April.

- Moss, D A (2009), "An ounce of prevention: Financial regulation, moral hazard, and the end of ´too big to fail´", Harvard Magazine September-October, 25-29.

13 September, 2013

13 September, 2013

Comments will be held for moderation. Your contact information will not be made public.