Persistently high inflation is a key challenge facing India today. This column analyses long-term trends in Indian inflation and causal factors. It also discusses the current thinking of the RBI on revising and strengthening India’s monetary policy framework.

After the crisis of 2008 and worldwide negative macroeconomic consequences, there has been renewed focus on policies aimed at greater financial system stability. It is widely agreed that economic and financial stability are important objectives which need to be factored into central bank and government thinking, rather than focusing excessively on inflation.

Developed economies such as US, UK and EU have been experiencing inflation lower than their central bank targets and hence, their central banks have been engaging in printing money by buying large volumes of government- and mortgage-backed securities. Since these economies have been liberal with inflation by favouring stimulation of demand to reduce unemployment, there have been spillover effects in emerging economies owing to global integration.

Indian inflation has averaged 6.7% per year in the last six decades, according to the Wholesale Price Index (WPI). This is not particularly high compared to rates experienced by economies such as Venezuela, Iran and Argentina. However, since 2010, inflation has hovered in the double digits mainly on account of high food inflation. Due to continuous high inflation, the Reserve Bank of India (RBI) has not been able to ease lending rates and hence, loans by commercial banks remain costly. High inflation has resulted in relatively low real interest rates that have depressed savings and eroded external competitiveness. Increased demand for gold, which is perceived as a hedge against inflation, has contributed to the deterioration in India’s current account and greater vulnerability to external shocks. Persistent inflation impacts allocation of resources negatively, impedes growth and worsens income distribution. Given the high costs of sustained inflation, it is one of the serious challenges facing India today.

Measuring inflation in India: Overview of price indices

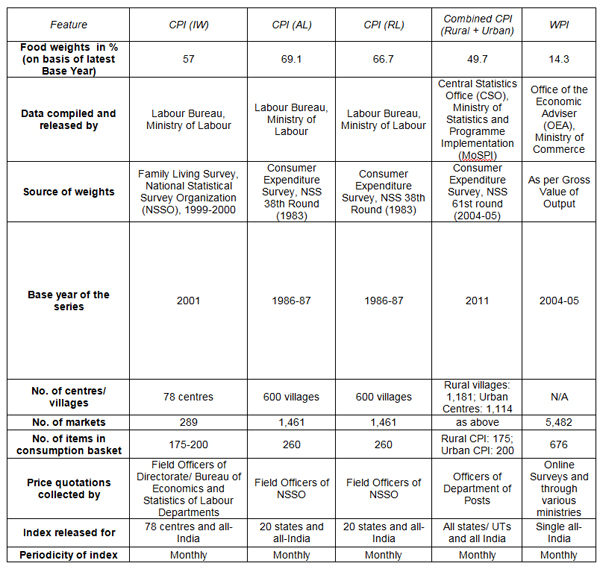

Inflation is measured using several price indices in India. Price changes of goods at wholesale levels are gauged by WPI whereas at retail levels by the Consumer Price Index (CPI).

Currently, four CPIs are estimated, corresponding to different segments of the population: (i) CPI for Industrial Labourers/ Workers (IW) (ii) CPI for Agricultural Labourers (AL) (iii) CPI for Rural Labourers (RL), and (iv) CPI for all-India (or combined CPI) which encompasses all groupings of the population.

Table 1. Price indices used to measure inflation in India

Long-term trends in Indian inflation

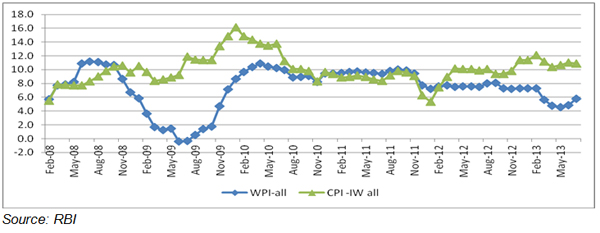

In the past four decades, WPI and CPI have risen steadily. CPI inflation in 2012-13 was 10.4% compared to 3.2% in 1971-72, and WPI inflation rose to 7.4% from 5.6% over the same period. While inflation oscillated through several highs and lows, the divergence between WPI and CPI-IW has been prominent since 2008 (Figure 1). WPI inflation registered a sharp decline (from 8% to 3.8%) while CPI-IW inflation rose sharply (from 9.1% to 12.2%) during 2009-10. Surprisingly, wholesale food prices jumped 26% while overall wholesale prices dropped by 89% in 2009. This rise in food prices was not captured by WPI as the weight for food articles is just 14.3% as compared to 65% for manufactured products (Figure 3). On the other hand, the weight for food is 57% in CPI-IW, which captures the impact of food prices better. Moreover, when just the changes in food prices for WPI and CPI-IW are plotted (Figure 2), the two curves move in tandem. This suggests that inflation is dominated by food inflation.

Figure 1. Long-term trends in annual inflation (WPI and CPI-IW)

.jpg)

Source: RBI

Figure 2. Long-term trends in food inflation (WPI and CPI-IW)

.jpg) Source: RBI

Source: RBI

Figure 3. Monthly inflation (2008-2013; WPI and CPI-IW)

Causal factors for inflation in India

Extensive studies (Gulati and Saini 2013, Patra, Khundrakpam and George 2013, Nair and Eapen 2012) across countries list factors such as fiscal deficits, oil imports, surging domestic demand, low buffer stocks of food grains, changes in global and domestic consumption patterns, supply-side constraints and higher than anticipated growth in money supply, as causal factors for inflation. Determinants for inflation in India have been recognised as high fiscal deficit, rising farm wages, domestic supply-side constraints, unexpected weather patterns, rise in international oil prices, rupee depreciation, increased demand, pass-through of global prices for input commodities such as coal, iron ore and aluminium, volatile capital flows and expansionary monetary policy.

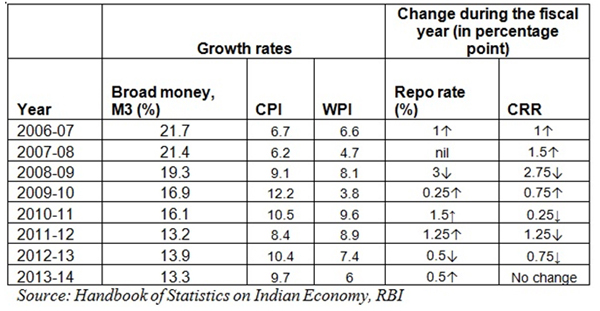

Analysing the demand side, the average annual growth in broad money supply, M31 grew by 14.7% during 2010-2014 as compared to 19.1% during 2005-2009. Moreover, inflation has been persistent even when growth in M3 has declined (CPI inflation has increased steadily during 2010-11 to 2011-12; Table 2). Similarly, WPI inflation has gone up except for a few years. Hikes in repo rate2 and Cash Reserve Ratio (CRR)3 in 2009-10 did not soften CPI inflation although WPI inflation was moderated. Hence, it appears that reduced money supply may not reduce Indian inflation and this suggests a greater role for non-monetary explanatory factors.

Table 2. Monetary indicators

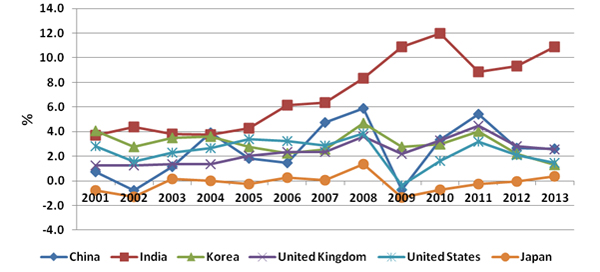

Further, despite rise in oil prices starting early 2009, the increase does not seem to have been significant enough post 2011 to list India’s dependency on oil imports as the major reason for persistent inflation (Figure 4). Also, Figure 5 shows that emerging as well as developed countries experienced a lowering of inflation post 2008 until early 2009, suggesting that movements in oil prices is reflected in CPIs of major oil-importing countries. However, this trend is not exhibited by India’s CPI. One implication is that there are inefficiencies on the supply side which have pushed up domestic inflation. Supply-side bottlenecks include administered (non-market driven) pricing of agricultural inputs such as fuel, fertilisers, electricity, production and distribution of agricultural commodities via announcement of Minimum Support Prices (MSPs) for certain crops, buffering of food grain stocks, etc. While these interventions seek to protect the interest of producers and consumers, they distort prices and make price discovery inefficient 4.

Figure 4. Global oil prices

.jpg) Source: US Energy Information Administration

Source: US Energy Information Administration

Figure 5. CPI across countries, 2001-2013

Source: International Monetary Fund (IMF)

Source: International Monetary Fund (IMF)

Lastly, it is difficult for central banks of developing countries such as India to influence expectations pertaining to inflation to the same extent as developed countries as information dissemination coverage is not the same.

Revising and strengthening India’s monetary policy framework

In recent years, RBI’s key concerns have included persistent high inflation and sluggish growth. To have better insight into India’s monetary policy framework, an expert committee was constituted under the chairmanship of Dr Urjit Patel, Deputy Governor, RBI; the committee submitted its report in January 2014. The report recommends the use of Combined CPI instead of WPI to measure inflation and guide monetary policy. This is very much justified since burgeoning food prices that are driving inflation in India are better accounted for by CPI as compared to WPI. The committee has proposed an inflation target of 4% with a band of +/- 2% around it. Further, the report emphasises targeting inflation only, and not adopting a multiple-indicator approach that involves targeting other indicators such as growth, employment and stable exchange rate as well.

The report points out that the biggest constraint on inflation targeting is lack of control over credit given to the central government by the RBI. This is due to the fact that RBI has been periodically engaging in indirect monetisation (printing of currency) of fiscal deficit by conducting open market operations5 , which undermines the credibility of discretionary liquidity management operations of the central bank. In addition, exchange rate volatility makes inflation management much more complex and a stable exchange rate is needed for better monetary transmission6 7. The report also highlights the challenges to effective liquidity management due to large fluctuations in the central government’s balances (revenue minus expenses), and foreign exchange (FX) market interventions among others. It is pointed out that standing sector-specific refinance facilities8 interfere with monetary policy transmission because of assurance of liquidity at fixed rates. To strengthen liquidity management capability, longer-term repos have been proposed9. However, use of these to mop up liquidity, particularly that resulting from FX reserves intervention, may lead to segmentation of the already shallow domestic sovereign bond market10. This could raise the issue of conflicting objectives: preference for longer-term paper to reduce the need to roll it over and inclination towards short-term instruments for day-to-day liquidity operations. This may lead to undesirable consequences for monetary transmission mechanisms. The impact on inflation due to changes in repo rates is over the medium term and reliance on longer maturity may delay the impact further (Riskbank 2011).

Discussion of FX reserves becomes imperative since the monetary policies of RBI directly impact FX reserves. FX reserves (as a percentage of Gross Domestic Product (GDP)) have declined over the last five years. This trend is also apparent in the decline in import cover11 and rise in short-term debt as a percentage of FX reserves over the period 2003-2013. This presents an unfavourable picture about the adequacy of India’s FX reserves. Evaluation of India’s FX reserves is important in the context of inflation targeting by RBI. Since the effectiveness of monetary policy is impeded due to various issues which have been outlined, the adverse effect on FX reserves due to an inflation-targeting regime can deteriorate the import cover which will further constrain the monetary policy aimed at containing inflation.

The report also analyses other impediments to the efficacy of monetary policies in containing inflation. It has been observed that the interest rate route only has a positive impact on housing costs in the short-term12. Further, monetary policy has a mild effect on price inflation and no direct impact on rural wage inflation while adversely affecting growth to a larger extent. In contrast, fiscal measures have had more consequences for rural wages.

The report recognises the need to improve the efficacy of monetary policy transmission mechanisms and suggests increase in the frequency of resets for the Small Savings Schemes13; however, in view of the corpus of these assets, frequency of resets might not be enough and dissolution of administered rates must be undertaken to empower RBI to effectively alter financial savings behaviour and consumption by changing short-term rates.

Conclusions

- Recommendation to use CPI for monetary policy decision making is timely.

- Responsibility to compile and release price indices should be housed in one government body as done in US, UK and Germany.

- Government interventions via subsidies, tariffs and MSPs distort price discovery mechanism and limit the impact of monetary policies on headline inflation. Thus, such distortions should be eliminated. Transparent and sustained trade policies are required for farm products for a competitive and buoyant agricultural sector, before targeting any inflation number.

- Due to transmission impediments and second-order effects of policies targeting consumption patterns, monetary policies may impact exchange rates more immediately than inflation. Hence, monetary policy may be more effective in influencing exchange rates rather than targeting inflation.

- Identification of policies to be adopted when objectives are in conflict, such as building up FX reserves, can adversely affect objective of containing inflation.

- Since food and fuel prices are volatile and can be better addressed by correcting supply-side constraints, a multipronged approach is needed for price stability.

- Administered rates on savings such as Government Provident Fund, Employees’ Provident Fund, Public Provident Fund and postal savings schemes need to be dropped to bolster monetary policy effectiveness. Well-explained statements communicated by RBI and inclusion of projected fiscal developments (in coordination with government) will lower inflation expectations.

Notes:

- M3 is a measure of money supply in India. It is the sum of currency with the public, and demand deposits and time deposits with the banking system.

- Repo rate is the rate at which RBI lends short-term money to banks against securities.

- CRR is the minimum ratio of cash deposits (against total deposits) that banks are required to maintain, as stipulated by RBI.

- The government provides MSPs to farmers and hence, some of the supply gets absorbed at MSPs. This reduces the supply that reaches the market and market price is determined by equating this supply and market demand. The market supply becomes fairly inelastic (not very responsive to changes in market prices) and this makes the transmission mechanism of monetary policy’s impact on consumer prices relatively ineffective – the impact of a change in monetary policy on headline inflation is less than expected.

- RBI conducts monetary policy through open market operations (OMO) - purchase (or sale) securities to infuse (or absorb) liquidity. OMO though essentially a monetary tool, has to factor in the large market borrowing at times to maintain orderly financial conditions. However, it is not easy make a distinction between what portion of the RBI’s purchases of government securities stands for the purpose of the conduct of monetary policy and what proportion is for financing of central government’s borrowings.

- Monetary policy transmission suggests how effectively policy rates (repo rates) of a central bank are translated into lending rates of commercial banks.

- Volatility in exchange rate mainly occurs as a result of sudden capital inflows and/ or outflows, which has repercussions for monetary policy. For instance, in the recent episode, the sharp depreciation of Indian rupee against US dollar forced RBI to intervene in the FX market in order to stabilise the domestic exchange rate. The RBI sold US dollars in the FX market and therefore domestic money supply was contracted and ultimately policy rate (interest rate) got a hike in already tight liquidity conditions.

- Due to sector-specific financing by the government, monetary policies do not impact all sectors equally; some sectors suffer at the expense of others when interest rates are increased.

- Since monetary transmission through adjustment of short-term rates by the RBI has been weak, longer-term repos have been proposed. These will allow the RBI to intervene effectively at longer maturities on the yield curve. When RBI intervenes by changing the short-term interest rates, the interest rates for longer maturity also gets impacted but to a lesser extent as the long-term projections for the economy may not have changed. However, when RBI will have the arsenal to intervene at longer maturities, the impact of changing short-term interest rates will be further reduced as expectation would be of usage of longer-term repo to impact long-term interest rates.

- Segmentation here refers to preference for securities of certain maturity, leading to illiquid market for securities with different maturities. This is an adverse outcome from the point of view of developing deep bond markets.

- Import cover is the number of months of import that can be sustained with currently available FX reserves, other things remaining the same.

- In India, it has been observed that an increase in interest rates has a depressing impact on housing costs only in the short-term. In the longer term, higher interest rates have a marginal impact on housing costs due to rising middle-class income and burgeoning of overall demand (Mahalik and Mallick 2011).

- Reset refers to marking to market (using the fair values from market prices) the interest rates being offered on the products termed as Small Savings Schemes such as post-office deposits, Employee Provident Fund and so on, to better align with changing market conditions.

Further Reading

- Gulati, A and S Saini (2013), ‘Taming Food Inflation in India’ Commission for Agricultural Costs and Prices, Discussion Paper No. 3, ICRIER, April 2013.

- Gupta, K and F Siddiqui (2014), ‘Salient Features of Measuring, Interpreting and Addressing Indian Inflation’, ICRIER, Working Paper No. 279, July 2014.

- Mahalik, M K and H Mallick (2011), ‘What Causes Asset Price Bubble in an Emerging Economy? Some Empirical Evidence in the Housing Sector of India’, IIT Madras.

- Nair, S and L Eapen (2012), ‘Food Price Inflation in India (2008 to 2010): A Commodity-wise Analysis of the Causal Factors’, Indian Institute of Management, Kozhikode.

- Patra, M, D Khundrakpam, J Kumar and A George (2013), ‘Post-Global Crisis Inflation Dynamics in India: What has changed?’, India Policy Forum, NCAER and The Brookings Institution.

- Riskbank (2011), ‘How changes in the repo rate affect inflation’.

10 October, 2014

10 October, 2014

Comments will be held for moderation. Your contact information will not be made public.