An RBI-appointed Expert Committee has recommended targeting a 4% inflation rate, but allowing it to vary between 2% and 6%. This column takes a different position on the target and leeway. It argues that achieving truly low and stable inflation alongside macroeconomic stability is not as difficult as is usually made out to be, if the right policies are in place.

Last week, an Expert Committee appointed by the Reserve Bank of India (RBI) released their report on revising and strengthening the Monetary Policy framework of India1. The main recommendation of the Report is that RBI should shift from multiple indicator approach2 to inflation targeting; it should target 4% Consumer Price Index (CPI)-Combined based headline inflation rate3, and should have a leeway of 2 percentage points around the target.

Inflation targeting begun in developed countries such as New Zealand, Canada and United Kingdom in the 1990s. Their choice was close to a 2% target with leeway of 1 percentage point around the target. Several emerging countries followed suit, but both their target and leeway were higher. In the aftermath of the financial crisis, there is some rethinking, even in developed countries, to move to a higher inflation target and more leeway (Blanchard et al. 2010).

In recent years, India’s inflation has been high at around 8-10%. In view of all this, the recommendation of the Report appears reasonable. An inflation target of 4% and a leeway of 2% around the target are more appealing than say, an inflation target of 2% and leeway of 1 percentage point. However, I take a different position with regard to (a) the target and leeway, and (b) the need and the scope for other policies as an accompaniment to inflation targeting.

The fact that inflation-targeting central banks in emerging and developing countries have opted for relatively high inflation targets and more leeway than their counterparts in developed countries is not a good reason for India to adopt a relatively high inflation target. By this yardstick, it could have been argued in 1947 that India should not adopt democracy (which other developing country was a democracy then?). But India did precisely that and there have been no regrets. So the issue is not always what other developing countries are doing.

India has had inflation rates at around 8-10% for a while now. However, if we take a long-term view, this is unusual for the country. So we should not let recent events influence us too much in setting a future inflation target for the long-term. This is not to say that policymakers can ignore the prevailing high inflation when they plan a path of policy changes, till the desired low inflation can be achieved.

In what follows, I will present simplified and stylised arguments to demonstrate what can be done by public authorities in India (and more generally, in other countries) to achieve an inflation target of say 2%, and a small leeway around the target.

Output and employment

The Report recommends that the RBI should reduce interest rate if actual output is less than the potential output of the economy. The reasoning is that a lower interest rate can help increase demand, which in turn can increase output and employment in the economy. Let us look at this closely.

When the RBI reduces interest rate, it obviously does so for both investing entities and saving entities in the economy - it is as if there is a subsidy for investment as the interest rate charged is low, and a tax on savings as the interest rate received is low. Hence, there is an implicit tax-subsidy scheme at work. Since the implicit subsidy is equal to implicit tax, there is no fiscal burden. However, this results in redistribution from savers to investors, which is an issue4). Is there an alternative?

In times of recession, the Government of India (GoI) can provide an explicit subsidy to investing entities on their cost of funds. This is effectively a reduction in interest rate, which can raise investment demand. This increase in demand can raise output and employment (possibly with multiplier effect). The GoI can finance this subsidy by issuing bonds in the market. It can later redeem the bonds by imposing a tax on investing entities in non-recession years. So, there is no net fiscal burden across the years. Note that saving entities are not involved in this scheme at all and hence, there is no redistribution from savers to investors. Moreover, this explicit tax-subsidy scheme is more transparent than the tax-subsidy scheme implicit in monetary policy changes such as a reduction in interest rates.

This sort of explicit tax-subsidy scheme can be used to vary the effective interest rate, which in turn can help to manage aggregate demand in the economy. This paves the way for the RBI to focus on truly low and stable inflation5

Cost-push inflation6

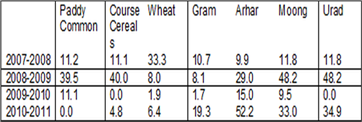

Before we come to what the GoI can and should do, let us first say, as the Report has indicated, what the GOI should not do. The GoI had raised Minimum Support Prices (MSP) substantially in the years around 2008-2009. See Table 1 below.

Table 1. Minimum Support Price for food grains, according to Crop Year

Notes: (i) The figures in the Table reflect Year-on-Year growth in percentage terms. (ii) Source: RBI 2014.

Notes: (i) The figures in the Table reflect Year-on-Year growth in percentage terms. (ii) Source: RBI 2014.

These price hikes have played an important role in the high and somewhat persistent inflation in the last few years. The GoI needs to avoid such large and sudden changes in the future.

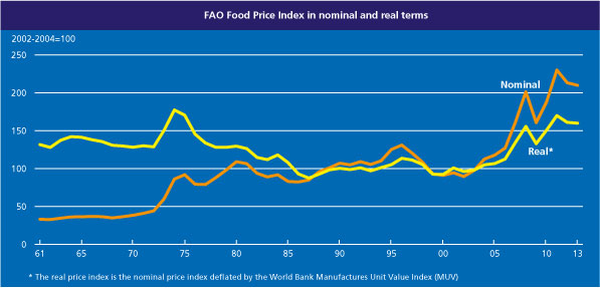

Figure 1 below shows that there are phases of price falls in international food prices. It is in this context that the GoI needs to intervene at home. It can impose a tax on food prices when they are low, build a corpus of funds and use this corpus to subsidise food prices when they are high. Besides the tax-subsidy scheme, the GoI can use reserves of food grains, and options7 in a meaningful way. It is possible that options may not be available in the international food market, the way they are in the stock market. However, such options may be available after some search and negotiation.

Figure 1. Trends in international food prices (1961-2013)8

An optimal mix of the tax-subsidy scheme, reserves, and options can avoid cost-push inflation due to, what will otherwise be, jumps in food prices. A similar argument holds in the case of cost-push inflation due to jumps in oil prices. With jumps in food prices and oil prices reduced, if not avoided completely, the RBI can focus on truly low and stable inflation.

Exchange rates

In the long run, inflation and depreciation of currency can be two sides of the same coin. In the short run, the inflation rate can get pushed up due to a pass-through9 from unusual depreciation of the local currency. Hence, it is important to have a somewhat stable path of exchange rates. On this, the Report has indicated the role that fiscal policy can play - the GoI can impose taxes on large and sudden capital flows10. The GoI can go a step further by providing subsidies on capital inflows if they are low during some periods. Such a tax-subsidy scheme can help stabilise exchange rates11.

The Report also discusses the role of foreign exchange reserves and swap arrangements for macroeconomic stability. However, the Report does not consider one-way credit lines that are available from the International Monetary Fund (IMF). These can play an important role in ensuring exchange rate stability (Singh 2013)12.

In ensuring exchange rate stability, we have come a long way from what was witnessed in 1997-1998 or even around 2008. If foreign exchange reserves, credit lines and a tax-subsidy scheme are in place, exchange rate instability can be taken care of. This paves the way for the RBI to focus on truly low and stable inflation.

Fiscal side

In the alternative set of policies proposed here, the government spends in some years but it also collects taxes in other years – hence, there is no inter-temporal fiscal burden. However, it may help to create a separate account to earmark funds for macroeconomic stability.

Further, it would help to have an amendment in the Fiscal Responsibility and Budget Management Act, 2003 for more inter-temporal flexibility without compromising on the average targeted fiscal deficit to Gross Domestic Product (GDP) ratio or on the targeted public debt to GDP ratio. This is consistent with Keynes’ insight that led to advocacy of cyclical movement of fiscal deficits. This is where more leeway around the average fiscal targets can help. This can pave the way for the RBI to focus on truly low and stable inflation.

Notes:

- http://rbi.org.in/scripts/PublicationReportDetails.aspx?UrlPage=&ID=743

- Under this approach, “a number of quantity variables such as money, credit, output, trade, capital flows and fiscal position as well as rate variables such as rates of return in different markets, inflation rate and exchange rate are analyzed for drawing monetary policy perspectives.” (RBI 2014)

- “The new all India CPI Combined provides for the first time since 2011 a nationwide retail price index in India that captures the inflation faced by households, i.e., cost of living inflation” (RBI 2014)

- This is bothering the public in developed countries where interest rates have been reduced considerably.

- This argument applies not only to the RBI but to any central bank, including those of developed countries. This is notwithstanding the fact that they have faced a financial crisis, a serious recession, and a zero lower bound (ZLB) on nominal interest rate. The ZLB implies that nominal interest rate can be reduced up to zero but not beyond zero. The ZLB will hardly be a problem if the explicit tax-subsidy scheme described here is used to lower the effective interest rate (for further details, please see Singh (forthcoming) and the references therein).

- Cost-push inflation is a type of inflation caused by substantial increases in the cost of important goods or services where no suitable alternative is available.

- The GoI can buy an ‘option’ to purchase food in the international market at a pre-determined price in the future. There is a price to be paid for such an option. However, the benefit is that this can be used to increase food supply at a reasonable price, in case food prices in the international market increase, and thus reduce food price inflation within the country.

- Source: http://www.fao.org/worldfoodsituation/foodpricesindex/en/

- If the local currency depreciates, then imports become more expensive in terms of the local currency. This can raise prices more generally in the economy. This is the process of ‘pass-through’ from deprecation to inflation.

- In practice, countries like Brazil have used such a tax in 2009. In theory, it has been explained at length in Jeanne and Korinek (2010).

- A similar tax-subsidy scheme may be used to take care of credit boom-bust cycles.

- For more on credit lines, see http://ideasforindia.in/article.aspx?article_id=125.

Further Reading

- Blanchard, Olivier, Giovanni Delláriccia, and Paolo Mauro (2010), “Rethinking macroeconomic policy”, Journal of Money, Credit and Banking, 42(1), 119-215.

- Jeanne, Olivier, and Anton Korinek (2010), “Excessive volatility in capital flows: A Pigouvian taxation approach”, American Economic Review: Papers & Proceedings, 100(2), 403-407.

- Reserve Bank of India (2014), ‘Report of the Expert Committee to Revise and Strengthen the Monetary Policy Framework’, RBI, Mumbai.

- Singh, Gurbachan, “Overcoming zero lower bound on interest rate without any inflation or inflationary expectations”, South Asian Journal of Macroeconomics and Public Finance, Forthcoming.

- Singh, Gurbachan (2013), ‘Why India should not further delay a credit line from the IMF’, Ideas for India, 3 April 2013.

31 January, 2014

31 January, 2014

Comments will be held for moderation. Your contact information will not be made public.