It is argued that by keeping India open to imports of cheap British manufactures, the imperial power made it excessively difficult for Indian industry to emerge in the early 20th century. This article examines this by studying the impact of World War I-related drop in net imports from Britain during 1913-1917 on Indian industrialisation. It finds that the protection offered by this trade shock had a positive effect on Indian industry, and that 24% of industrial employment growth in this period can be attributed to it.

Towards the end of the 19th century, the technologies of the British industrial revolution began to spread to countries outside Europe and the US. While colonial India was no exception, its industrial performance in this period was unimpressive, particularly if compared to European offshoots such as Australia and Canada, but also if compared to a Japanese colony such as Korea (Kohli 2004). A long-standing argument made both by nationalist politicians and prominent economic historians (Nehru 1947, Bairoch 1989) blames this modest performance on British trade policy. By keeping India open to imports of cheap British manufactures, they argued, the imperial power made it excessively difficult for Indian industry to emerge. This argument is supported by the observation that Australia and Canada, by then substantially independent colonies, decided to protect their nascent industry behind a high tariff wall. Indeed, economists have found that countries with higher industrial tariffs industrialised faster in this period (Lehman and O’Rourke 2012).

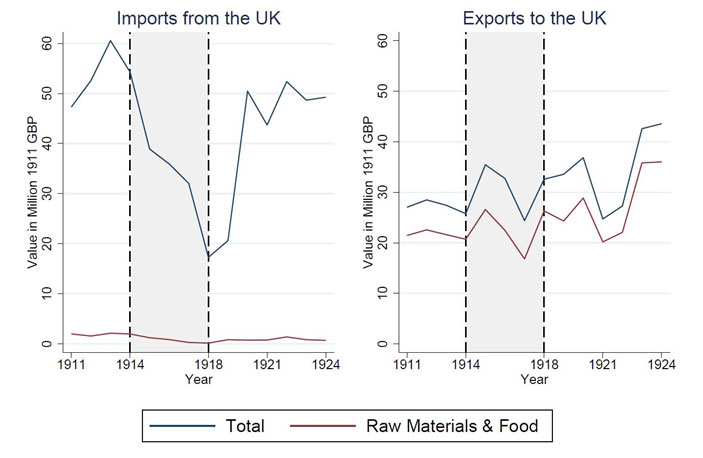

Figure 1. Effect of World War I on India’s trade with the UK

Note: The difference between the blue and red line denotes Indian imports (exports) of manufactures from (to) the UK.

Estimating the effects of a trade shock on industrialisation in colonial India

Despite its popularity, the argument outlined above is by no means accepted by all. The problem is that social scientists can never observe the counterfactual scenario: what exactly would have happened to Indian industry, had Britain chosen to protect it from foreign competition, remains anyone’s guess.

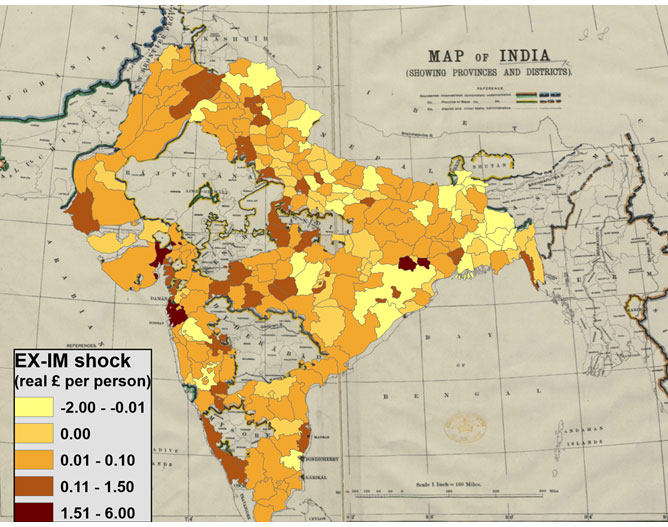

In ongoing research, we shed new light on what that counterfactual might have looked like. We do so by exploiting a historical experiment: World War I. During the war, Indian imports of British manufactures declined dramatically (see Figure 1), affording Indian industrialists a period of protection from British competition. Crucially, this collapse in trade did not affect all Indian districts in the same way due to differences in initial industrial composition. Taking advantage of this, we construct a district-level measure of exposure to the World War I trade shock, combining information from the Census of India and the Statement of Trade of the UK. This measure is presented in Figure 2, where a darker colour indicates a more exposed district. By comparing industrial performance across districts with different exposures, we can estimate the impact of temporary protection on Indian industry. This allows us to make an educated guess as to what the performance of Indian industry would have been had Britain chosen to provide it with protection from foreign competition.

Figure 2. Exposure to World War I trade shock across colonial India

Note: The map shows exposure to the World War I trade shock (1913-1917) in British pounds, per person, across British Indian districts. The area covered includes the main provinces accounting for 78% of the population of British India. Map shows British India in 1915, and not independent India.

Research findings

Our results clearly suggest that protection had a positive effect on Indian industry. Districts more exposed to the World War I trade shock witnessed a more rapid increase in the share of population working in industry between 1911 and 1921, as compared to less-exposed districts. The effect is quantitatively important: we estimate that 24% of the industrial employment growth that occurred in India in this period can be attributed to the World War I trade shock. Protection also made Indian industry more Indian, in the sense that it increased the share of owners and administrators of Indian origin (as opposed to European).

We next study whether the positive effect of protection waned shortly after the war (as trade resumed), or rather persisted over time. We find that districts that experienced more protection during World War I were still more industrialised in 1926 than they would have been without the war, and so they were in 1936 and 1951. Remarkably, they are still more industrialised nowadays (2011). Our estimates suggest that 3.5% of the growth in the industrial employment share between 1913 and 2011 can be attributed to temporary protection during World War I.

These long-run estimates must be taken with more caution as many events that occurred till World War I may have influenced our estimate. Nevertheless, the fact that the effect of temporary protection was persistent is significant: it suggests that parts of Indian industry had the capacity to learn, during the war years, how to stand on their feet even after the return of foreign competition.

In the second part of the research, we investigate a second hypothesis about the role of free trade in the political economy of colonial India. In earlier work, Bonfatti (2017) constructed a theory according to which the more a colony specialises in the production of raw materials and food, as opposed to manufactures, the less attractive the rebellion against colonial rule becomes. Intuitively, colonial producers of raw materials are a group in favour of empire, since the empire makes it easier for them to sell their products. In contrast, manufacturers are a force against empire, since they face increased competition due to manufactures produced in the mother country. If this theory is true, then we should observe that Indian districts that industrialised more due to World War I, should later provide greater support to the Indian National Congress (INC), India’s main pro-independence party. We test this hypothesis with our data. To measure a district’s support for the INC, we adopt two alternative approaches. First, we use an internal survey that the INC conducted in 1922. Prominent party members from all over India were asked how much in favour they were of immediate civil disobedience, and of a boycott of British products. Second, we use local-level results in the 1937 election (the first Indian election with a large franchise) to measure the degree of support that each district gave to the INC.

Our findings are supportive of the theory that specialisation in primary products tied colonies to their empires. In Indian districts that industrialised more due to World War I, INC members became more likely to support civil disobedience and a boycott of British goods by 1922. These same districts also became more likely to vote for the INC in 1937, to the tune of a 5% higher probability of the INC winning a local seat per each £1 decline in imports per capita during World War I.

Discussion

These results improve our understanding of the ways in which colonial trade – and the international specialisation that it implied – likely benefited the imperial powers. In addition to lowering the price of imported raw materials and increasing the price of exported manufactures, colonial trade also made it less attractive for colonies to rebel. Presumably, this gave the imperial powers a freer hand in setting extractive colonial policies. Taking one step back, this also improves our understanding of the reasons why Britain kept colonial India open to free trade, while at the same time providing very little policy support to its industrialisation (Kohli 2004). Not only would a policy of supporting Indian industrialisation have hurt British manufacturers, it would have also undermined the very foundations of Britain’s colonial rule.

In summary, our study supports the notion that free trade made it harder for colonial India to industrialise in the early 20th century. The fact that even a short interruption to trade had a persistent effect suggests that some sectors of Indian industry had the potential to be competitive in the global economy, and would have benefited from more protection in order to learn how to do so. Our results also suggest that colonial trade made it harder for India to negotiate its political relationship with Britain, with possible knock-on effects on the way in which India was treated more generally.

Three caveats are in order. First, our results are not rich enough to determine whether or not free trade made colonial India worse-off on the whole: while it seems to have hindered industry, it certainly benefited Indian producers of primary products and consumers of manufactures. More research is required before we can consider all these effects together and get a final estimate on the overall impact of free trade. Second, the notion that free trade was bad for industrial growth does not imply that any protectionist regime would have been better. Protectionist regimes can very easily get out of hand, and the experience of many developing countries (including India) in the second half of the 20th century clearly illustrates that excessive protection is bad for long-term growth. Finally, while many Asian and African colonies were forced to accept, like India, a liberal trade policy in the early 20th century, it is hard to know whether our results would generalise to those other colonies. Unlike those colonies, India had a pre-colonial past as a global centre of artisanal manufacturing. This makes it possible that we would find stronger results for India than for most other colonies.

Further Reading

- Bairoch, P (1989), ‘European trade policies, 1815–1914’, in P Mathias and S Pollard (Eds.), The Cambridge economic history of Europe Vol. 8, Cambridge University Press.

- Bonfatti, Roberto (2017), “The sustainability of empire in a global perspective: the role of international trade patterns”, Journal of International Economics, 108:137-156.

- Kohli, A (2004), State-Directed Development, Cambridge University Press.

- Lehmann, Sibylle and Kevin H O’ Rourke (2011), “The structure of protection and growth in the late nineteenth century”, Review of Economics and Statistics, 93:606-616.

- Nehru, J (1947), The Discovery of India, Meridian Books, London.

18 May, 2020

18 May, 2020

By: Bjoern 24 September, 2020

The preliminary version of the full paper can be found here now: https://www.cesifo.org/DocDL/cesifo1_wp8461.pdf Roberto Bonfatti & Bjoern Brey (2020), "Trade Disruption, Industriali-sation, and the Setting Sun of British Colonial Rule in India", Cesifo Working Paper 8461