There are still a lot of unknowns in the fight against the Covid-19 pandemic, but two robust lessons are clear: we need to pull out all stops to strengthen our healthcare capacity and reinforce social-safety nets on a massive scale. In this post, Parikshit Ghosh argues that if the fight against the virus is given the metaphor of war, we need a Marshall Plan while we fight that war, not after it is over.

The Coronavirus pandemic or Covid-19 has landed us between a rock and a hard place. It is vitally important to recognise that we are walking a tight rope between not one but two crises – a medical and an economic one. Epidemiological projections warn of a public health crisis. The economic crisis, especially in India, is not so much the impending GDP (gross domestic product) contraction, but the fact that the pain will not be equally shared – far from it. As the country goes into lockdowns and other forms of disease suppression, there will be catastrophic livelihood loss for daily earners and the self-employed, while the salaried class will hardly take a hit.

A twin crisis calls for a two-pronged strategy. The epidemiological crisis challenges us to massively reinforce our healthcare capacity, and the economic crisis compels us to immensely strengthen our social safety net, both at lightning speed. If the fight against the virus is given the metaphor of war, we need a Marshall Plan while we fight that war, not after it is over.

Most epidemiological projections share a dire overall message. The much quoted Imperial College study predicts that in the UK, at the height of an uncontrolled epidemic, the need for critical care beds may outstrip availability by 30 to 1. Hospitals in places like Wuhan, Lombardy, and New York have already experienced acute stress, so it is not entirely phantasmagoric. The suggested strategy of flattening the curve through suppression and/or mitigation has worked for now in a few Asian countries, though the economic and social costs are only just emerging (for early Indian case count projections under various hypothetical interventions, see the report of the Michigan Covid-19 study group).

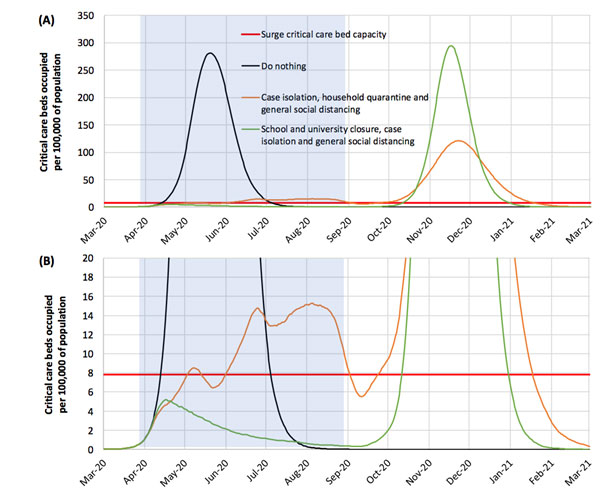

The most important point about things like lockdowns is that even if humanely and efficiently implemented, they only postpone the surge. Once restrictions are relaxed, the epidemic will spread again, feeding off the remaining infections and newly imported cases (see Figure 1, which is reproduced from the Imperial College study). It is not a magic pill. It will only buy us time in which to ramp up healthcare defenses, isolate carriers, find treatments and vaccines, and generally think things through. Policymakers must recognise this!

Figure 1. Suppression strategy scenarios for Great Britain showing ICU bed requirements

So, what should be our long-term strategy beyond the next two weeks? The only option seems to be the path taken by South Korea or Singapore – widespread testing, contact tracing, isolation of the infected, and practical but long-term steps at physical distancing, all to slow down the spread of the disease. As the World Health Organization (WHO) said, “test, test, test.”

Economic incentives for “test, test, test”: Quarantine allowance

In a country like India with poor State capacity, an intensive testing regime will require immense cooperation from the general population, which is impossible without the right incentives. This seems to have gathered surprisingly little attention.

If testing positive means being quarantined away from home and family, and losing livelihood for weeks, there is strong reason for the poor to evade quarantine and even testing in the first place. This is not because of ignorance or selfishness but the sheer necessity of making a living for 85% of the workforce who are in the informal sector (bear in mind that for a majority of the infected, the symptoms are mild).

First and foremost, testing should be easy and free, along with treatment. Second, the government should announce a generous quarantine allowance for the sick (payable in cash at release) to cover for lost earnings during the period of isolation. Lastly, it is critical to create isolation wards with decent living conditions and proper hygiene, not hell holes from which people want to escape. At a time when many premises are shut, this should be possible with a little administrative effort and ingenuity.

The importance of livelihood support cannot be over emphasised. The advantage of spending heavily on the infected is that as long as the case count does not explode, the overall fiscal burden on the government is low, but the social dividends are enormous. For a ballpark sense, consider this. If the government spends Rs. 100,000 each on 100,000 infected people for testing, allowance, treatment, food, and accommodation, the total bill still comes to Rs. 10 billion. That is a drop in the bucket even in our modest rescue package of Rs. 1.7 trillion. One of the few countries which have kept a lid on the outbreak without severe economic disruption – Singapore – pays Singapore-$100 per day (about Rs. 5,300) in quarantine order allowance. The only Indian example I know of is Odisha’s Rs. 15,000 incentive pay for a two-week quarantine.

Social distancing requires social security

Even after the lockdown ends on 15 April, continuing social distancing and altered consumer behaviour will profoundly impact businesses and livelihoods for months to come. One can imagine barbers and restaurant waiters having a tough time in the Covid economy, but grocers and vegetable vendors not so much. Yet, it is impossible to quantify these losses and target compensation.

The consequence of variable impact can be enormous. Amartya Sen identified a massive shock to the income distribution as a major factor in the Bengal famine of 1943. For example, at the height of the famine, the price of fish, eggs, and haircuts (in terms of rice) sank to a quarter of their level in the previous year, so that fishermen and barbers died disproportionately compared to the peasantry. The only hope for restoring the income distribution to some semblance of pre-Covid normalcy is a universal basic income (UBI), paid out over the next six months or so.

The financial package announced by the Finance Minister (NDTV estimates only Rs. 1 trillion is extra budget spending) relies heavily on in-kind transfers instead of cash. It doubles the PDS (Public Distribution System) grain entitlement from 5 kg to 10 kg (which is roughly the per-capita consumption according to NSS (National Sample Survey) data) and infuses only modest amounts of cash through a slew of welfare schemes. Releasing grains from FCI’s (Food Corporation of India) stock is sensible during a lockdown when supply chains are disrupted. Beyond that, there is no alternative to putting money in the pockets of everyone (except the easily identifiable creamy layer).

First, households with disappearing incomes will not only need to eat rice but also pay for vegetables, cooking oil, clothes, medicine, fuel, and rent. Second, FCI’s stocks will not last forever and should not be depleted too much – there should be some buffer against possible weather shocks in the future. Third, and perhaps most importantly, flooding the market with doubled PDS off-take for too long will depress food prices and aggravate farmer distress.

Unfortunately, a uniform helicopter drop of money on every household requires a delivery mechanism, so that nobody misses out and nobody gets a double helping either. This is what is lacking in India. Unlike developed countries, we cannot use our tax machinery to hand out money – only about 7% of Indian adults pay or file income tax. The US$2.2 trillion aid package passed by the US Congress includes cash payments to nearly 85% of households. A family of four with two working adults will receive nearly half the median household income.

If only we had the capacity to do something like that, let alone the willingness!

It does not make sense to put small sums into many little tranches, each with narrow coverage and unknown overlap of beneficiaries. Creating an aid lottery is no answer to an income lottery. The government should pick the programme that caters to the highest number of uniquely identified households and use it to channel cash into people’s pockets using the DBT (direct benefit transfer) architecture. This is a time when household needs are large and the usual cash-vs-kind debate that swirls around the food subsidy programme is quite irrelevant.

Table 1. Number of beneficiaries associated with different schemes

|

Scheme |

Number of beneficiaries |

|

230 million cards, 813 million persons |

|

|

128 million active workers |

|

|

383 million accounts |

|

|

84.6 million farmers |

|

|

6.43 million groups, 88% have <5 members="" --5--=""> |

The natural candidate is the PDS network, which reaches two-thirds of Indian households. MNREGA (Mahatma Gandhi National Rural Employment Guarantee Act) has less coverage and will largely bypass the urban poor, MSME (micro, small and medium enterprises) workers, and the self-employed. 380 million Jan Dhan accounts sounds like an impressive number, but some households may have multiple accounts and some none. PM-KISAN (Pradhan Mantri Kisan Samman Nidhi) misses out landless labourers altogether. And so on.

A group of economists at Ashoka University have also suggested cash transfers through the PDS network, but only in the time and place where lockdowns come into effect. My view is that the economic effects of the pandemic will be much more pervasive and enduring, so social safety nets need to be longer lasting, which of course increases fiscal burden. Economic protection and disease protection are complementary efforts – this was amply illustrated when jobless migrants crowded into roads and buses after the lockdown was announced.

Fiscal space

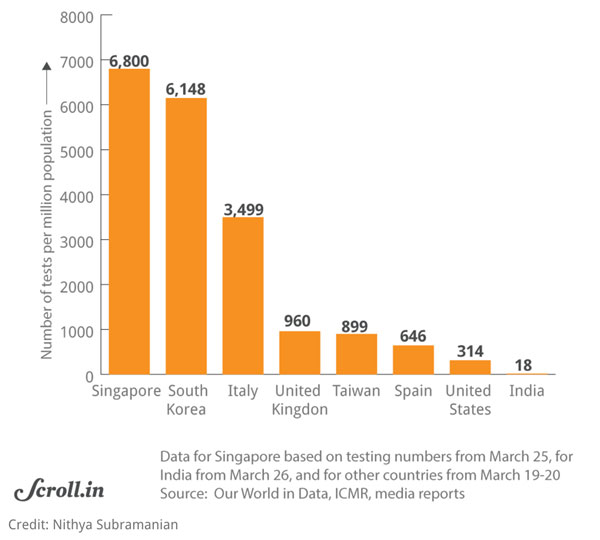

The two graphs below illustrate how much we are lagging by international standards in the fight against the pandemic. Figure 2 below shows India is still an outlier in terms of testing, even adjusting for population size.

Figure 2. Tests performed per million population in different countries

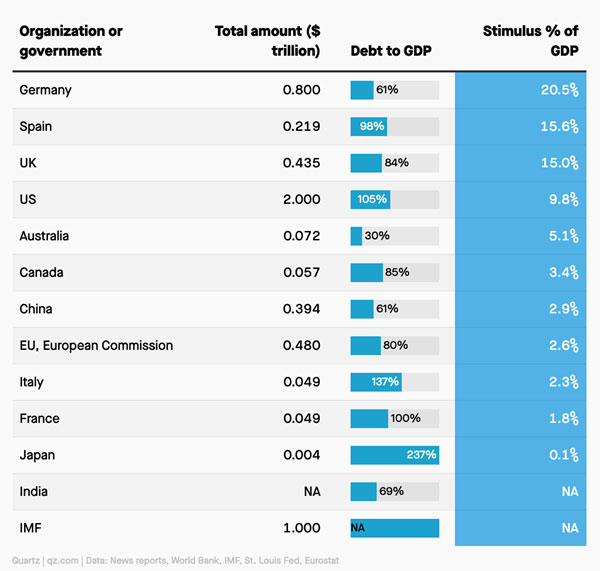

Figure 3 shows that the commitment of resources by the government in the fight against Covid-19 pandemic , even adjusted for GDP, lags behind other countries by a long distance.

Figure 3. Country-wise aid/GDP ratios

How much will a reasonable UBI cost and where will the money come from? Our per-capita GDP is currently Rs. 11,250 per month. A little back-of-the-envelope calculation shows that a Rs. 1,000 monthly grant per member to each PDS household (Rs. 5,000 for a family of five), continued for 6 months, should cost about 3% of GDP, or Rs. 5.7 trillion (scale it up if you wish). For a crisis of the century, spending this much to secure the basic needs of our fellow citizens seems like a no-brainer.

It is worth recalling that after the Global Financial Crisis of 2008, the government unpacked fiscal stimulus valued in trillions and allowed the fiscal deficit to nearly double from 3% to 6%. As a result, growth was restored – we enjoyed high single-digit growth rates for two more years while the world slowed down. The deficit also came down as growth was restored and the tax base expanded, so ultimately it mostly paid for itself.

Financial crises and ordinary recessions are better understood – from historical experience, we have a rough idea how to tackle them and usually respond promptly. The economic disruption caused by a novel Coronavirus is so novel that it is easy to become deer in the headlight. Though we do not know all details of how this will play out and what should be done, the failure to significantly shore up social security early on will probably carry a high cost.

Financing this additional expenditure through borrowing should not pose a problem. Private investment has been weak for a long time and in the current climate of uncertainty, it is bound to suffer another blow. It is a safe bet that new government debt is not going to create a lot of crowding-out, and money in people’s pockets will also act as a much-needed fiscal stimulus. There are other substantial reserves of revenue to be tapped into – the opportunity thrown up by rock bottom crude prices and the Rs. 2.1 trillion planned disinvestment.

The real economy

Trying to reverse the shocks to the income distribution will do nothing to mitigate the other fundamental problem – this is also a massive production shock. Eventually, we will have to tackle the problem of a shrinking pie. If the economy is grounded for a year, the effect will be devastating in the aggregate and no social safety net will be able to repair that.

Some, like David Katz, are of the opinion that the mortality rate is being overestimated due to selection bias (infected people with mild or no symptoms go undetected, lowering the denominator), causing undue panic. The proposal is to do more selective social distancing to protect high-risk groups but otherwise return to business-as-usual right away. This seems too risky to me. Strong initial suppression has an ‘option value’ – we can take a more decisive path once some of these uncertainties are resolved, through serological tests on random samples, for example.

Another approach that has been suggested is a staggered one. Paul Romer and Alan Garber as well as Dewatripont, Goldman, Muraille, and Platteau argue for widespread testing to identify people who have been infected and acquired immunity, and let them back into the workforce. Debraj Ray and S. Subramanian propose that younger age groups (for example, 20-40 year olds) who have a low mortality risk should be allowed to work immediately and distancing should be practised voluntarily within households rather than coercively by the state. Some epidemiologists suggest a strategy of periodic lockdowns, using the pressure on ICU beds as an on/off trigger.

I have no idea which of these approaches does a better job of balancing economic hardship and disease risk. I do not think anyone knows for sure at this point. One advantage of a period of suppression is that it gives us time to have better estimates of the parameters of the disease, evaluate alternative mitigation strategies that have been tried out even within nations, see if there is a temperature effect, design better monitoring tools, etc.

Other than reviving production, a related challenge is to prevent businesses from going into bankruptcy or closure due to dried-up cash flow. This is a pretty serious problem in India due to the large MSME sector, which does not have deep pockets. Staying afloat may be difficult even in the more organised airline or hospitality industry. Emmanuel Saez and Gabriel Zucman suggest that, during social distancing and lockdowns, the government should create virtual demand to compensate for lost revenues. A GST (goods and services tax) credit based on reported lost sales would be a solution along these lines.

Conclusion

In the fight against the pandemic, there are a lot of unknowns yet. Nevertheless, two robust lessons are clear: we need to pull out all stops to strengthen our healthcare capacity, and reinforce social-safety nets on a massive scale.

As for the latter, two broad measures deserve serious consideration. First, provide a minimum living income in cash to the majority of the population to shield them against massive shifts in the income distribution that are imminent. Second, provide a quarantine allowance and other benefits to those who test positive in order to get people’s cooperation with surgical strikes against the disease. Economic protections are needed not only to guarantee social justice, but also to make suppression and mitigation policies effective.

A hungry and insecure population is no army with which to fight a pandemic.

Author’s Note: I have benefitted from discussions with Bhramar Mukherjee and Ashwini Kulkarni. Any errors are my own.

08 April, 2020

08 April, 2020

By: Tajuddin Ahmed 18 May, 2020

How can we achieve physical distancing in India