While repayment flexibility in microfinance helps mitigate the impact of negative income shocks on MSMEs, it might increase default due to borrowers’ time-inconsistent or excessively risky behaviour. Based on an experiment in Uttar Pradesh, this article shows that, when clients are able to choose between a standard, rigid contract and a more expensive flexible contract, they have similar repayment rates but better business outcomes, than when they are only offered the standard contract.

Debt moratoria are key financial tools to mitigate the negative income shocks that MSMEs (micro, small, and medium enterprises) are often exposed to (Fafchamps 2013). The provision of repayment flexibility has been shown to improve business outcomes (Field et al. 2013, Battaglia et al. 2018). However, allowing borrowers to skip repayments can also increase default rates (Field et al. 2013, Czura 2015). One potential explanation for higher defaults when a flexible repayment schedule is provided lies in borrowers’ time-inconsistency1 or excessive risk-taking attitudes (Barboni 2017). These traits may falsely enhance borrowers’ confidence in their ability to repay their flexible loan. It follows that in contexts where it is costly for lenders to ascertain borrowers’ characteristics – as is often the case in developing countries – if more impatient or highly risk-loving customers end up benefitting from a debt moratorium, they may also be more likely to default on debt repayment.

In order to limit the extent of loan delinquencies and financial losses, lending institutions should ensure that flexible loans are taken up by the ‘right’ borrowers – financially disciplined as well as more entrepreneurial ones – who value the benefits of repayment flexibility, and are sophisticated enough to be able to manage their debt even in absence of regular repayments. But how to identify these customers?

Experimenting with a pricey, flexible contract

In a study conducted in collaboration with an Indian microfinance institution (MFI), Sonata Microfinance Ltd., we try to find out whether the contract price can be used as an effective screening mechanism when MFIs intend to introduce flexible repayment contracts (Barboni and Agarwal 2018). Over a period of three years, we have studied the impact and the financial viability of providing microfinance borrowers with a menu of contracts that vary in price and flexibility, with the flexible loan being more expensive than the standard one – thus using price to screen borrowers and assign them to the right repayment schedule. Economic theory predicts that implementing a contract-price differentiation should discourage unsuitable (time-inconsistent, financially undisciplined, and less entrepreneurial, among others) borrowers from taking up the flexible contract. This is under the assumption that borrowers have knowledge about themselves and their repayment capacity.

To test this theory, we set up a randomised controlled trial (RCT) in Uttar Pradesh. In the experiment, 28 branches of Sonata were randomly assigned to either the ‘treatment’ or the ‘control’ group – in treatment branches, clients were offered the option to choose between a more expensive (26% interest rate), flexible loan, and a cheaper, standard loan (24% interest rate). In control branches, clients were only offered the cheaper, standard loan (24% interest rate). While the standard loan entails monthly repayments starting from loan disbursal, the flexible loan gave customers two three-month holiday periods they could exercise over 24 months – the typical loan maturity of Sonata loans. This flexible option can be thought of as a line of credit: it provides borrowers with additional liquidity that can be used to ‘reshuffle’ their cash flows throughout the year and to smooth out business irregularities.

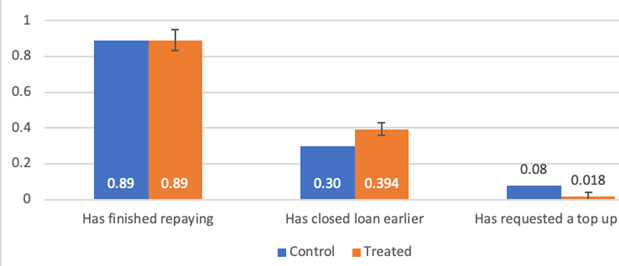

The RCT was designed to allow us to study two complementary aspects of repayment flexibility: (i) the impact of providing a more expensive flexible loan vis-à-visa cheaper, rigid one; and (ii) borrower’s selection into the flexible versus the rigid loan. The experiment began in May 2016 with loan disbursal to a sample of approximately 800 borrowers across treatment and control branches. After an extensive data collection exercise carried out in 2016 to capture the socioeconomic characteristics of the subjects, we visited them again twice – in 2017, for the midline, and in 2019, for the final/endline data collection. Combining primary data with administrative data from Sonata, we report three main sets of results: First, offering a menu of contracts that differ in price and flexibility does not increase default rates. The first two columns in Figure 1 below show that about 90% of borrowers in the control group repaid their loan on time, this percentage not being statistically different for the treatment group. In line with our hypothesis that the flexible contract was meant to provide Sonata’s borrowers with additional liquidity, we also find that treated borrowers are 30% significantly more likely to repay their loan before the due date. Additionally, we observe that borrowers in treated branches are almost 80% significantly less likely to request Sonata as well as any other formal lending source a loan top-up2.

Figure 1. Effects of repayment flexibility on repayment rates and liquidity needs

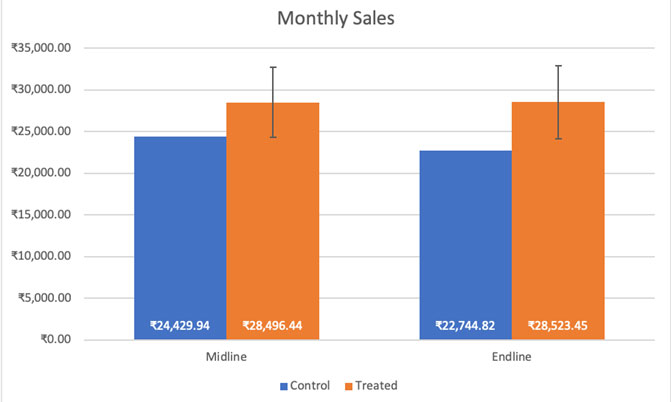

We also find that business outcomes are higher in treatment than in the control group –both at midline and endline – confirming our prediction that more entrepreneurial borrowers should opt for the flexible repayment schedule. Figure 2 below shows treatment effects on business sales at midline and endline. We observe monthly sales to be 17% and 25% significantly higher in treatment than in control, at midline and endline, respectively (column 1 and 2, and 5 and 6).

Figure 2. Treatment effects of repayment flexibility on business outcomes

All in all, observed treatment effects provide strong support to our hypothesis that offering borrowers a menu of contracts works as an effective screening mechanism. But what are the characteristics of borrowers opting for repayment flexibility? We dig deeper into borrowers’ selection. We focus on treatment branches, where 31% of borrowers chose the flexible contract over the standard, rigid one. We use the extensive data collected at baseline to understand which traits predict borrowers’ choices for the flexible contract vis-a-vis the standard rigid contract. We observe financially sophisticated borrowers – time consistent borrowers, those who reported giving financial advice to others, but also to be more worried about expenses – to be more likely to take up the flexible contract vis-à-vis the standard contract. We also find that borrowers’ behavioural and psychological traits, such as time and risk preferences, have a larger predictive power than their business characteristics, which lenders typically use to make screening decisions.

A case for more tailored financial products

Taken together, results from our study indicate that offering both repayment schedules simultaneously, and including a pricey flexibility option, selects ‘high-quality’ entrepreneurs into the flexible contract. This positive selection translates into higher business returns and good repayment rates, making this menu of contracts sustainable for microfinance lenders. From a policy perspective, our experiment leads to two sets of recommendations: First, it can be beneficial for MFIs to move from the standard rigid contract towards more sophisticated contracts that allow borrowers to select their preferred repayment schedule. Second, behavioural characteristics significantly matter for contract choice. Therefore, for microfinance borrowers’ business activities to grow beyond the subsistence level, and for them to continue to have access to microcredit, MFIs should offer more tailored financial products whose design leverage borrowers’ behavioural traits.

Finally, in the current Covid-19 context, our results can also inform MFIs on borrowers’ expected repayment performance. While MFIs have no choice in terms of who can take up the debt moratorium, under the Reserve Bank of India’s (RBI) current debt relief measure, they can nevertheless leverage the information they have about their customers to assess who is better equipped to deal with repayment flexibility. This, on the one hand, can provide MFIs (and policymakers) with an understanding of customers’ performance in the short and medium term (for instance, how many of these loans will be actually repaid). On the other hand, MFIs can use this information to help borrowers who are more likely to have repayment difficulties, meet their repayment obligations with improved wealth management and monitoring.

Notes:

- When the preferences of the decision-maker change over time in such a way that a preference may become inconsistent at another point in time, it is referred to as 'time-inconsistency'.

- Loan top-ups are a common product offered by MFIs, and typically consist of a one-shot extra credit, at the same interest rate of the current loan (24% at Sonata). The size of the loan top-up is quite arbitrary: It depends on the borrower’s request, the size of the loan previously borrowed, and on the borrower’s repayment performance.

Further Reading

- Barboni, Giorgia (2017), “Repayment Flexibility in Microfinance Contracts: Theory and Experimental Evidence on Take-Up and Selection”, Journal of Economic Behavior & Organization, 142:425-450.

- Barboni, G and P Agarwal (2018), ‘Knowing what’s good for you: Can a repayment flexibility option in microfinance contracts improve repayment rates and business outcomes?’, Working Paper.

- Battaglia, M, S Gulesci and A Madestam (2018), ‘Contractual Flexibility and Selection into Borrowing: Experimental Evidence from Bangladesh’, Mimeo.

- Czura, K (2015), ‘Do flexible repayment schedules improve the impact of microcredit? Evidence from a randomized evaluation in rural India’, Munich Discussion Paper No. 2015-20, University of Munich (LMU).

- Fafchamps, Marcel (2013), “Credit constraints, collateral, and lending to the poor”, Revue d’economie du developpement, 21(2):79-100. Available here.

- Field, Erica, Rohini Pande, John Papp and Natalia Rigol (2013), “Does the classic microfinance model discourage entrepreneurship among the poor? Experimental evidence from India”, American Economic Review, 103(6):2196-2226. Available here.

27 August, 2020

27 August, 2020

Comments will be held for moderation. Your contact information will not be made public.