From the outside looking in, it may seem that India’s central bank is making up its own rules, making it difficult to predict the next movements in the interest rate. This column argues that the central bank is in fact following a rule, you just have to look hard enough.

When it comes to monetary policy conduct in India, things are far from clear. Is India’s central bank setting the interest rate in a predictable way, one that is heavily influenced by a target rate of inflation? Or is it making up its own rules? How has the gradual process of financial liberalisation in India affected its monetary policy? There are more questions than there are answers.

The Reserve Bank of India (RBI) describes its own policy actions as flexible and states that a multitude of factors are taken into consideration when deciding the course of monetary policy. Moreover, the authorities typically argue that discretion is paramount in their policy decisions. For instance, a former Deputy Governor of the RBI has described their approach as follows, "… the overall objective has had to be approached in a flexible and time variant manner with a continuous rebalancing of priority between growth and price stability, depending on underlying macroeconomic and financial conditions" (Mohan 2006).

Revealing preferences

Given that India’s monetary policy is so opaque, what can we as economists do to make things clearer? One way is to look at previous policy decisions on the base rate and ask what they tell us about the preferences of policymakers. This is something economists call ‘revealed preferences’: the policymakers might not tell us what their preferences are, but their past decisions might reveal what they are anyway.

Looking back over the last few decades we find that, irrespective of what the authorities may claim, it is possible to find a pattern to the RBI’s behaviour.

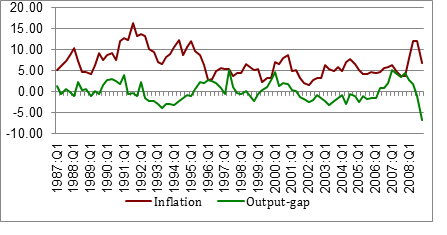

A simple graphical illustration of the data reveals that between 1987 and 2008 the correlation between output and inflation in India has been rather weak (Figure 1), or in other words, the ‘output-inflation trade-off’ is not clearly visible. But, as pointed out by many others, the relationship may be masked by a variety of real and financial disturbances to the Indian economy as well as by financial market imperfections (see also Mishra and Montiel 2012 and Lahiri 2012 in earlier posts on this site).

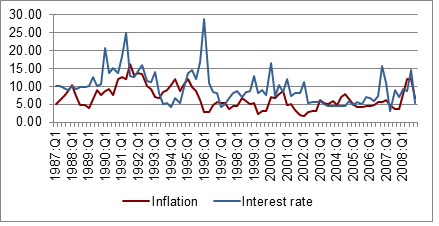

Moreover, lower and more stable inflation over the last couple of decades has been associated with lower and more stable interest rates (Figure 2), further suggesting that money market interest rate in India moved sluggishly in response to swings in the inflation rate. This implies that the RBI, in setting interest rates, has generally been slow to respond to inflation movements.

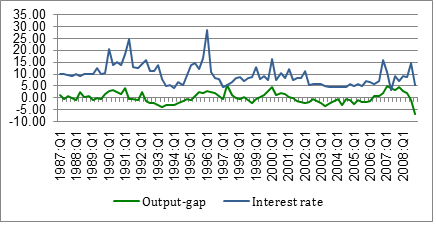

Finally, we find that swings in the output gap1 are followed by similar changes in the interest rate – that is, when actual output fell below the potential, interest rates declined and vice versa (Figure 3). This is another way of saying that the RBI has been following a counter-cyclical monetary policy, which something the ‘Taylor rule’ would predict.

Figure 1: Output Gap and Inflation (WPI)

Figure 2: Interest Rate and Inflation (WPI)

Figure 3: Interest Rate and the Output Gap

The Taylor rule in monetary policy

In his seminal work, the American economist John Taylor (1993) outlined a policy rule by which the US Federal Reserve was assumed to adjust the base interest rate in response to past inflation and the output gap (the difference between actual output and the potential output). It became known as the ‘Taylor rule’. In one of our previous papers (Hutchison et al. 2010) we investigated whether the seemingly discretionary and flexible approach of the RBI is effectively following the Taylor rule, but with a bigger role played by the exchange rate. But what we found was that over the last couple of decades neither inflation nor the exchange rates were key determinants of the RBI’s monetary policy, which instead seemed to be mostly dominated by concerns about growth.

An inherent problem with this kind of an approach, however, is that it assumes the RBI’s policy preferences remained constant over the period under consideration, which is highly unlikely. It is quite possible that shifts in preferences may have taken place over the business cycle or at other times, not necessarily representing an institutional change, but simply reflecting a complex policy rule that changes over time, shifting in response to an evolving economic environment.

Doves and Hawks

To this end, in our recent paper (Hutchison et al. 2012), we allow for shifts in RBI’s monetary policy preferences over the last two decades. We allow the RBI to operate in either of two regimes, which we term ‘Hawk’ and ‘Dove’, and switch from one regime to another, multiple times in response to changes in the macro-economic conditions (e.g. inflation rate, output, and the exchange rate). The regime switches in turn shift the central bank operating policy rule. For example, at times the RBI may be primarily concerned with inflation in a ‘Hawk’ regime, perhaps because inflation is viewed as the primary threat to macro stability, while at other times its focus may be shifted to stimulating output (‘Dove’ regime).

We find that in the first of these two regimes, the central bank reveals a greater relative (though not absolute) weight on stabilising inflation vis-à-vis promoting output growth. The central bank however was found to be in the ‘Dove’ regime about half of our sample period, focusing more on the output gap and exchange rate targets to stimulate exports, rather than on moderating inflation.

Moreover, while our previous research based on a single regime model that does not account for shifts in RBI’s policy preferences found no significant role of exchange rate in determining monetary policy (Hutchison et al. 2010), using a regime-switching model we uncover strong evidence that external considerations, such as fluctuations in the nominal exchange rate, have systemically influenced RBI policy. Their policy seems to have taken the standard form of responding to exchange rate appreciation (depreciation) by lowering (raising) the interest rate.

Reading between the lines

The essence of our argument is that despite the RBI describing its own monetary policy conduct as discretionary or ad-hoc, we find evidence that there is indeed a revealed pattern of policy that can be extracted from historical data and it becomes more evident once we allow for regime switching in RBI’s policy preferences.

In the context of worldwide attention to inflation targeting approaches by central banks, no evidence of an exclusive concentration by the RBI on inflation was found in our analysis of Indian data over the last couple of decades. This however seems to have changed over the last couple of years, as highlighted by Arvind Panagariya in his recent Economic Times article (November 28, 2012). He points out that since 2010, the RBI seems to have abandoned its growth objective and instead has been focusing almost obsessively on inflation, prompting a series of 13 consecutive interest rate hikes between March 2010 and October 2011.

This implies that perhaps a shift in RBI’s revealed preference has switched its monetary policy conduct from a ‘Dove’ to a 'Hawk' regime wherein the RBI is now primarily concerned about an inflation stabilisation objective. In other words, irrespective of whether RBI’s approach is discretionary or not, it can very well be captured by a regime-switching revealed preference model based on simple monetary policy rules.

The output gap is the difference between actual output/GDP and an estimated potential output/GDP.

Further reading

- Hutchison, M, R Sengupta, and N Singh (2010), ‘Estimating a Monetary Policy Rule for India’, Economic & Political Weekly, xlv, 38.

- Hutchison, M, R Sengupta, and N Singh (2012), ‘Dove or Hawk? Characterizing Monetary Policy Regime Switches in India’, SCIIE Working Paper.

- Lahiri, A (2012), ‘Searching for the soul of Monetary Policy in India’, Ideas for India Policy Portal.

- Mishra, P, and P Montiel (2012), “Monetary policy in India and other developing countries”, Ideas for India Policy Portal.

- Mohan, R (2006), “Evolution of Central Banking in India”, based on lecture delivered at a seminar organized by the London School of Economics and the National Institute of Bank Management at Mumbai, India, on 24 January, 2006.

- Shah, A (2008), “New issues in Indian macro policy”, in TN Ninan (ed.), Business Standard India, Business Standard Books.

- Taylor, JB (1993), “Discretion versus Policy Rules in Practice”, Carnegie-Rochester Conference Series on Public Policy, 39:195-214.

- Woodford, M (2001), “The Taylor Rule and Optimal Monetary Policy”, American Economic Review, 91(2):232-237.

21 December, 2012

21 December, 2012

Comments will be held for moderation. Your contact information will not be made public.