The literature shows that rigid capital-control policies adversely influence international trade, but overlooks the relationships among access to external financing, firm-level productivity, and exporting performance. Using a dataset of 11,612 Indian firms over 1988-2014, this article finds a significant effect of capital-account liberalisation through an export-oriented policy initiative, on firm productivity and hence exporting activity. The effect is stronger for financially vulnerable firms, as measured by high debt and low liquidity.

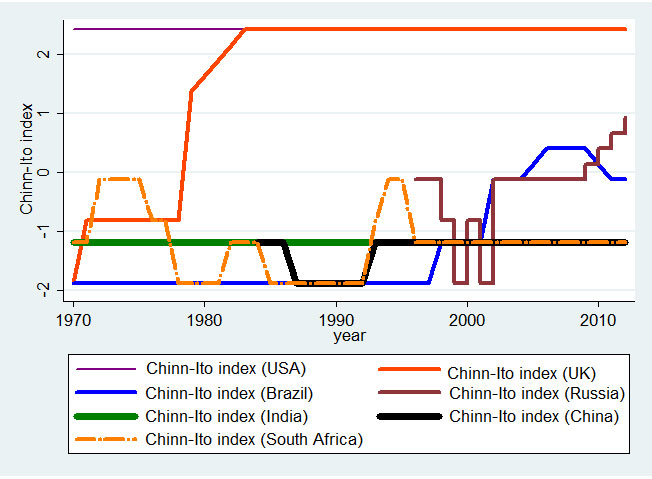

Access to financing is a well-established, critical factor in export activities. Due to limited capital flows, the lack of access to external financing became a major constraint for firms in emerging markets during the 1990s, hampering the acceleration of their exporting activities. Since then, many governments in the developing world have liberalised their capital-account regulations, especially with regard to restrictions on external borrowing, in order to allow better access to financing. However, as highlighted by the Chinn-Ito Financial Openness Index (see Figure 1), the presence of capital controls in emerging economies (namely, India and China) still points to the rigidity in financial openness compared to advanced countries, which creates external credit constraints for outward-oriented firms.

Figure 1. Chinn-Ito Financial Openness Index shows rigidity for India and China

Capital-account liberalisation

Although India is the fifth largest economy in the world in terms of nominal GDP (gross domestic product), according to the International Monetary Fund (IMF), its capital controls remain at a higher level. Dismantling these capital controls can provide greater access to overseas borrowing and help firms import capital goods, set up new foreign projects, and modernise or expand existing units. In the past four decades, India has embarked on a journey of continuous changes in trade policy, removing anti-export and pro-import substitution bias. This resulted in replacing the Foreign Exchange Regulation Act (FERA), which was in place since 1973, with the more market-friendly Foreign Exchange Management Act (FEMA) in 1999.

The FEMA reform

The key idea of FEMA was to facilitate foreign trade, and payments involving foreign exchange, consistent with full current-account convertibility, and progressive liberalisation of capital-account transactions to promote orderly maintenance of the foreign-exchange market. Under FEMA, the maximum amount of external commercial borrowing (ECB) an individual firm can raise, increased gradually since the introduction of the regulatory framework (currently US$750 million or equivalent during a financial year). The limit can mitigate any systemic risk due to currency mismatch or excessive borrowing.

Our recent research (Bose et al. 2020) shows that firms’ access to much-needed foreign-currency financing increased by six times after FEMA. The average foreign borrowing before FEMA was US$6.20 million, which significantly increased to US$40.36 million after FEMA. This suggests that FEMA helped all outward-oriented firms to significantly raise foreign-currency financing to boost performance. Using a panel dataset for 11,612 Indian firms over the period 1988-2014, and a difference-in-differences analysis1, we study how well FEMA helped firms to access overseas financing and achieve better performance during the post-policy period.

We divide firms into two groups: ‘treated’ and ‘control’. The treated group includes exporting firms with foreign financing under the ECB framework, which was introduced after the FEMA reform. The control group includes exporting firms with domestic financing only. We provide new evidence on how firm performance, in terms of productivity improvement, responds to international-transaction liberalisation, with implications for the intensive margin of trade activity. We argue that, although FEMA beneficiaries did become more productive, the effect may have been variable across firms. More specifically, we investigate how firm productivity reacted to the FEMA reform, and whether high-leverage or low-liquidity firms are more likely to benefit from the reform.

Easing access is beneficial for financially vulnerable firms

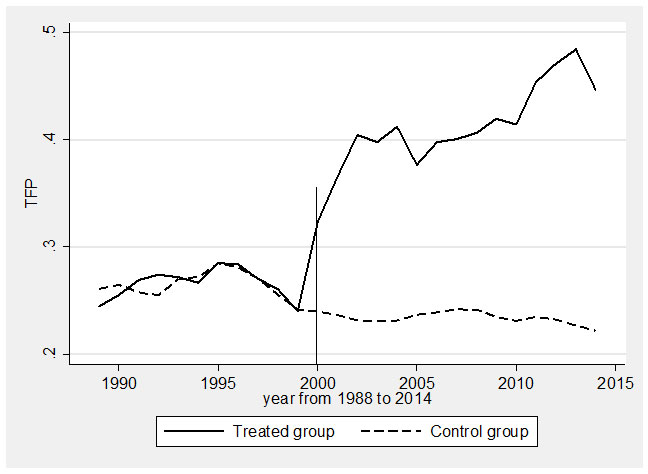

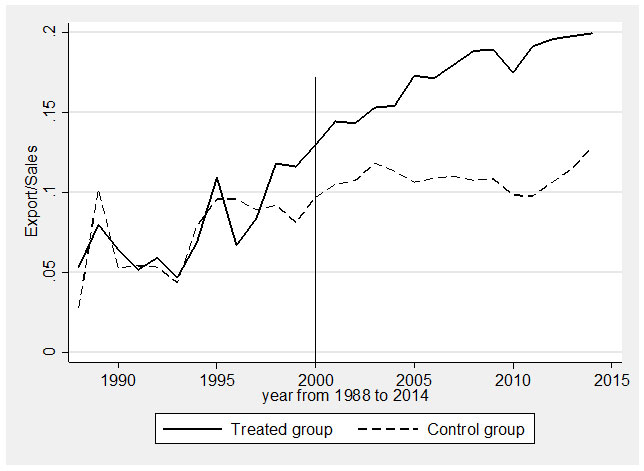

Exploiting India's foreign-exchange liberalisation, through the FEMA lens, we found that firms that benefitted from FEMA were more productive and had higher export intensity compared to firms with domestic sources of financing only (as shown in Figures 2 and 3). Moreover, we suggest that firms increased their productivity following the policy change, especially if they were financially vulnerable (as measured by the high levels of debt and low levels of liquidity). These findings thus make a case for easing capital controls to improve firm performance in countries that maintain restrictive capital accounts.

Figure 2. Total factor productivity (TFP) for treated and control groups

Figure 3. Export share for treated and control groups

In terms of identifying the mechanisms through which firms can improve their productivity after FEMA, we focused on staff training and technological sophistication. We find that firms that spend resources on staff training can enhance their productivity as employees gain knowledge and/or capabilities that improve their abilities. Additionally, firms in high-tech industries have the highest degree of sophistication, technological content, and research and development (R&D) intensity, which help achieve competitive gains in the exporting market. Following the FEMA reform, we find that, treated firms that invest in human capital, and those in high-tech industries, are more likely to improve their productivity in ways that increase their export intensity compared to their counterparts.

Given the policy relevance of this research, it can be concluded that the countries that maintain restrictive capital accounts can improve performance by gradually easing capital controls. National governments should thus prioritise diversified sources of external financing. This will help create balanced economies and conditions that could enhance companies’ competitive advantages by increasing their productivity and, ultimately, their export intensity. We suggest that the policies aimed at making foreign-currency borrowings readily available to financially vulnerable firms would improve firm performance.

Notes:

- A technique to compare the evolution of outcomes over time in similar groups that gained access to an intervention with those that did not.

Further Reading

- Bose, Udichibarna, Sushanta Mallick and Serafeim Tsoukas (2020), "Does Easing Access to Foreign Financing Matter for Firm Performance?", Journal of Corporate Finance, 64(101639), October 2020.

- Chinn, Menzie D and Hiro Ito (2006), “What Matters for Financial Development? Capital Controls, Institutions, and Interactions", Journal of Development Economics, 81(1):163-192 (October).

17 July, 2020

17 July, 2020

Comments will be held for moderation. Your contact information will not be made public.