Potato farmers in West Bengal sell to local middlemen because they lack direct access to wholesale markets. Middleman margins are large and there is negligible pass-through from wholesale to farm-gate prices. Farmers are uninformed about downstream wholesale and retail prices. This column finds that providing farmers with wholesale price information has negligible average effects on farm-gate sales and revenues, but increases pass-through from wholesale to farm-gate prices.

In developing countries, small farmers often cannot access organised markets directly. Instead, they sell to middlemen who resell their output to distant buyers. These middlemen appear to earn large margins, and they appropriate most of the gains from rising consumer prices. Results from African agricultural commodity markets indicate that when export prices rise by 1%, the prices that farmers receive tend to rise by less than 0.5% (McMillan et al. 2002, Fafchamps and Hill 2008).

Do middlemen earn large margins because they have more market power than farmers, or because they take advantage of the fact that farmers do not know downstream prices? Alternatively, are the large margins of middlemen compensation for services such as insurance against price risk, or transportation and storage? Might the low pass-through of changes in consumer prices to the farm gate be explained by an increase in the cost of providing these services, or by a decrease in quality in high-export-price regimes? Answers to these questions can help us understand how the benefits of globalisation trickle down to primary producers, and so design policies that can help boost growth and alleviate poverty.

Our research project examined contracting arrangements and market structure in the supply chain for potatoes in the eastern Indian state of West Bengal (Mitra et al. 2017). To do this, we randomly selected 72 villages in two potato-growing districts. We focused on potatoes because they generate the highest value-added per acre of any cash crop in West Bengal; hence, increased earnings from potato cultivation could provide an effective pathway out of poverty for small farmers in this region. Most farmers in the state own small plots, with average landholding just above one acre. Almost no farmers are able to contract directly with wholesale buyers. They sell instead to intermediary traders. These traders are located either in the village or near wholesale markets.

The data we collected through detailed farmer surveys suggested that middlemen margins were between 28% and 38% of the wholesale price. This suggests that farmers could earn 65-83% more if they could sell directly in wholesale markets. We also found that there was negligible pass-through from retail to farm-gate prices. For a one rupee increase in the price that end-consumers paid, middlemen received 80 paise more, but farmers received a mere 2 paise more – an increase so small that it is statistically indistinguishable from zero. Judging by standard models of pass-through in imperfectly competitive environments (Weyl and Fabinger 2014, Atkin and Donaldson 2016) this suggests that the trader-farmer link in West Bengal’s supply chain has extraordinarily large imperfections.

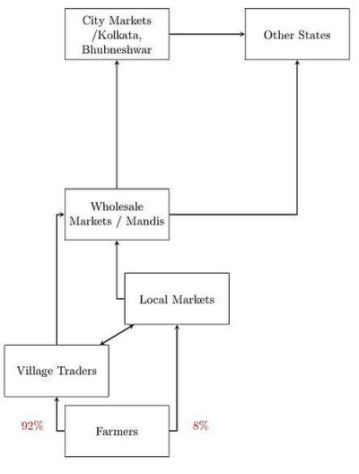

The supply chain for potatoes in West Bengal

The potato crop is harvested between January and March. During the rest of the year, farmers receive daily price offers from village traders. Farmers’ outside options are either to sell to intermediaries located outside the village, or to store their crop and sell it later in the year. More than 90% of the potato crop is sold to village traders. Figure 1 shows this supply chain.

Figure 1. The supply chain for potatoes in West Bengal

While the market within the village appears competitive by conventional concentration indices (about 10 traders buy from 150-250 farmers in each village), village traders openly discuss and coordinate price offers, suggesting that they collude. Farmers also do not know the price at which middlemen resell potatoes to wholesale buyers. Survey responses indicated there were no explicit or implicit contracts between the middlemen and farmers. Instead, the market appeared to be characterised by ex-post bargaining between village traders and farmers, in which the farmers had limited outside options.

To better understand trading mechanisms and the role of asymmetric price information, we conducted an experiment in which farmers in 48 randomly selected villages received information about the daily price at which middlemen resold potatoes in neighbouring wholesale markets. In 24 of these treatment villages, the information was provided privately to a random sub-sample of farmers using restricted cell phones. In the other 24 treatment villages, the prices were displayed on a public notice board. A third set of 24 villages received no information, and served as the control group. We conducted fortnightly farmer surveys throughout 2008, and collected data on each transaction. This allowed us to find out the quantity and quality of potatoes sold, the revenue received, the identity of the buyer, and the transport, handling, and storage costs incurred by the farmer. These data allowed us to compute the net price that the farmer received for each transaction, and to track how that price varied with neighbouring wholesale market prices.

We found that, as a group, farmers did not gain from being better informed. On average, informed farmers sold the same quantity as uninformed farmers and received the same price. Providing information, however, did increase pass-through, which rose from 2% to between 10% and 20%. Farmers’ earnings fell as a result of better information in low-price markets and rose in high-price markets, resulting in no net average effect (Figure 2).

Figure 2. Farm prices compared to market prices

Farmers’ problem was lack of competition, not lack of information

We argue that these empirical results are consistent with a model in which farmers and traders bargain at the time of sale, and village traders collude among themselves, but compete with market traders outside the village. This allows village traders to make price offers that drive farmers to their outside option of selling to market traders. Our theoretical model explains why traders find it profitable to coordinate on a price offer strategy which does not reveal their private information about the wholesale price. In this situation, when farmers receive price information, they update their beliefs about the wholesale price and village traders respond accordingly. If farmers learn that the wholesale price is higher than they expected, they also expect to receive a higher price if they took their crop out of the village to sell to a market trader, and so village traders raise their offer. If instead farmers learn that the wholesale price is lower than they expected, village traders can lower their price offer. This can explain why the volatility of farmers' earnings increased in our study, while average earnings remained unchanged.

These findings allow us to rule out alternative theories about how farmers and traders contract with each other. For example, if traders provided farmers with insurance against price risk, the information intervention would have increased the quantity that farmers sold to traders in low-price markets. Instead, we found the opposite. If middlemen margins were the result of the high costs for farmers of searching for buyers, the intervention should have lowered price dispersion within and across villages. We found no such effect.

Instead, our results point to different imperfections. Farmers have limited access to wholesale buyers, and middlemen can collude to squeeze their returns. Although the spread of information technology has made it relatively inexpensive to relay price information, our research indicates that, in this context, information interventions are unlikely to benefit farmers. Instead, measures that increase competition among buyers are more likely to be effective. Such measures could include improving the ability of farmers to transact directly with wholesale buyers, or encouraging external competition with local traders. A host of agricultural marketing regulations in West Bengal currently limit this competition, and it is not surprising that traders and their political lobbies have resisted any efforts at reform.

This column first appeared on VoxDev: http://voxdev.org/topic/firms-trade/middleman-margins-and-market-structure-west-bengal-potato-supply-chains.

Further Reading

- Atkin, D and D Donaldson (2016), ‘Who's Getting Globalized? The Size and Implications of Intranational Trade Costs’, Yale University and MIT Department of Economics Working Paper.

- Fafchamps, Marcel and Ruth Vargas Hill (2008), "Price Transmission and Trader Entry in Domestic Commodity Markets", Economic Development and Cultural Change, 56:724-766.

- McMillan, M, D Rodrik and K Welch (2002), 'When Economic Reform Goes Wrong: Cashews in Mozambique', NBER (National Bureau of Economic Research) Working Paper Number 9117.

- Mitra S, D Mookherjee, M Torero and S Visaria (2017), ‘Asymmetric Information and Middleman Margins: An Experiment with Indian Potato Farmers’, CEPR (Centre for Economic Policy Research) Discussion Paper 11548 (forthcoming, Review of Economics and Statistics).

- Weyl, E Glen and Michal Fabinger (2013), "Pass-through as an Economic Tool: Principles of Incidence under Imperfect Competition", The Journal of Political Economy, 121(3):528-585.

22 September, 2017

22 September, 2017

Comments will be held for moderation. Your contact information will not be made public.