India needs to plan for a radical expansion of public support for the elderly. In this piece, Drèze and Duflo argue that near-universal social security pensions would be a good start. Elderly persons, especially widows, often struggle with poverty, ill health and loneliness, all associated with a risk of depression. Financial assistance would help them to lead an easier life. Some Indian states already have near-universal pensions, and there is a case for extending this approach across the country.

Life expectancy in India has more than doubled since Independence – from around 32 years in the late 1940s to 70 years or so today. Many countries have done even better, but this is still a historical achievement. Over the same period, the fertility rate has crashed from about six children per woman to just two; liberating women from the shackles of repeated childbearing and childcare.1 All this is good news, but it also creates a new challenge – the ageing of the population.

The share of the elderly (persons aged 60 and above) in India’s population, which was close to 9% in 2011, is growing fast and may reach 18% by 2036 according to the National Commission on Population. If India is to ensure a decent quality of life for the elderly in the near future, planning and providing for it must begin today.

How do pensions help?

Recent work on mental health among the elderly in India sheds new light on their dire predicament. Evidence on depression from a collaborative survey of J-PAL and the Government of Tamil Nadu (Banerjee et al. 2022) is particularly telling – among persons aged 60 and above, 30 to 50% (depending on gender and age group) have symptoms that make them likely to be depressed. The proportion with depression symptoms is much higher for women than men, and rises sharply with age. In most cases, depression remains undiagnosed and untreated.

As one might expect, depression is strongly correlated with poverty and poor health, but also with loneliness. Among the elderly living alone, in the Tamil Nadu sample, 74% had symptoms that would classify them as likely to be mildly depressed or worse on the short form Geriatric Depression Scale2 (McKelway et al. 2022). A large majority of elderly persons living alone are women, mainly widows.

The hardships of old age are not related to poverty alone, but some cash often helps. It can certainly help to cope with many health issues, and sometimes to avoid loneliness as well. The first step towards a dignified life for the elderly is to protect them from destitution and all the deprivations that may come with it. That is why old-age pensions are a vital part of social security systems around the world.

India has important schemes of non-contributory pensions for the elderly, widowed women, and disabled persons under the National Social Assistance Programme (NSAP). Alas, eligibility for NSAP is restricted to ‘below poverty line’ (BPL) families, based on outdated and unreliable BPL lists – some of them are twenty years old. Further, the central contribution to old-age pensions under NSAP has stagnated at a tiny Rs. 200 per month since 2006, with a slightly higher but still paltry amount (Rs. 300 per month) for widows.

Many states have enhanced the coverage and/or amount of social-security pensions beyond NSAP norms using their own funds and schemes. Some have even achieved ‘near-universal’ (say 75-80%) coverage of widows and elderly persons. That is now the norm, for instance, in all the southern states except Tamil Nadu – an odd exception, since Tamil Nadu has been a pioneer in the field of social security.

Targeting and a possible alternative

‘Targeting’ of social benefits is always difficult. Restricting them to BPL families has not worked well, as there are huge exclusion errors in the BPL lists. When it comes to old-age pensions, targeting is not a good idea in any case. For one thing, targeting tends to be based on household rather than individual indicators. A widow or elderly person, however, may experience major deprivations even in a relatively well-off household. A pension can help them to avoid extreme dependence on relatives who may or may not take good care of them, and it may even lead relatives to be more considerate.

For another, targeting tends to involve complicated formalities such as the submission of BPL certificates and other documents. That has certainly been the experience with NSAP pensions. The formalities can be particularly forbidding for elderly persons with low incomes or little education, who are in greatest need of a pension. In the Tamil Nadu sample, eligible persons who had been left out of pension schemes were found to be much poorer than the pension recipients (by more than just the pension). Moreover, even when lists of left-out, likely-eligible persons were submitted to the local administration, very few were approved for a pension, confirming that they face resilient barriers in the current scheme of things.

The problem is generally not a lack of effort or goodwill on the part of the government officials. Rather, many have absorbed the idea that their job is to save the government money by making sure that no ineligible person qualifies by mistake. In Tamil Nadu this often means, for example, that if the applicant has an able-bodied son in the city, they may be disqualified, regardless of whether they get any support from their son. In their quest to avoid inclusion errors, many officials are less concerned about exclusion errors.

A better approach is to consider all widows and elderly or disabled persons as eligible, subject to simple and transparent ‘exclusion criteria’. Eligibility can even be self-declared, with the burden of time-bound verification being placed on the local administration or gram panchayat. Some cheating may happen, but it is unlikely that many privileged households will risk trouble for the sake of a small monthly pension. It is preferable to accommodate some inclusion errors rather than perpetuate the massive exclusion errors we are seeing today in targetted pension schemes.

Widening the net

The proposed move from targetted to near-universal pensions is not particularly new. As mentioned earlier, it has already happened in several states. Of course, it requires larger pension budgets, but additional expenditure is easy to justify. India’s social assistance schemes have low budgets and make a big difference to large numbers of people (about 40 million under NSAP). They are well worth expanding.

An example may help – in Tamil Nadu, social security pensions (typically Rs. 1,000 per month) are targetted and cover about one third of all elderly persons and widowed women, at a cost of around Rs. 40 billion per year. If, instead, 20% were to be excluded and the rest eligible by default, the cost would rise to Rs. 100 billion per year. That would be a modest price to pay to ensure a modicum of economic security in old age to everyone. It would be a fraction of the Rs. 400 billion Tamil Nadu is expected to spend this year on pensions and retirement benefits for government employees – barely 1% of the population. If the transition cannot be made in one go, there is a strong case for starting with women (widowed or elderly), who often face special disadvantages. This would also be a step towards the fulfilment of the Tamil Nadu government’s promise of a ‘home grant’ of Rs. 1,000 per month for women.

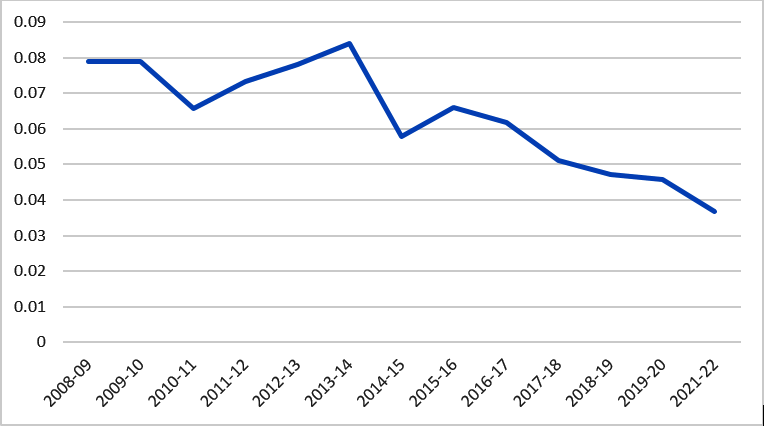

India’s southern states are relatively well-off, but even some of the poorer states (like Odisha and Rajasthan) have near-universal social security pensions. It would be much easier for all states to do the same if the central government were to revamp the NSAP. The NSAP budget this year is just Rs. 96.52 billion – more or less the same as ten years ago in money terms, and much lower in real terms. This is not even 0.05% of India’s GDP!

Figure 1. NSAP budget, as a percentage of GDP

Source: Revised estimates from Government of India’s budget documents and Handbook of Statistics on the Indian Economy (Credit: Jasmin Naur Hafiz)

Social security pensions, of course, are just the first step towards a dignified life for the elderly. They also need other support and facilities such as healthcare, disability aids, assistance with daily tasks, recreation opportunities and a good social life. This is a critical area of research, policy and action for the near future.

A version of this article previously appeared in The Hindu on 15 September, 2022.

Notes:

- For further details, see Table 1.2 of Drèze and Sen (2013), and World Development Indicators.

- The Geriatric Depression Scale (GDS) is a brief questionnaire in which participants are asked yes/no questions about how they felt over the past week. The short form GDS is more easily used by patients who have short attention spans.

Further Reading

- Banerjee, A, E Duflo, E Grela, M McKelway, F Schilbach, G Sharma and G Vaidyanathan (2022), ‘Depression and Loneliness among the Elderly Poor’, NBER Working Paper 30330.

- Drèze, JP and AK Sen (2013), An Uncertain Glory: India and Its Contradictions, Penguin, New Delhi.

- McKelway, M, A Banerjee, E Greal, F Schilbach, G Sharma, M Sequeira, G Vaidyanathan and E Duflo (2022), ‘Impacts of Cognitive Behavioral Therapy and Cash Transfers on Depression and Impairment of Elderly Living Alone: A Randomized Trial in India’, Working Paper. A version of this paper is available here.

26 September, 2022

26 September, 2022

Comments will be held for moderation. Your contact information will not be made public.