In this 'Perspectives' piece, Prof. Himanshu argues that the crisis in Indian agriculture today is not a new one; it goes back many years. Therefore, the problems of farmers cannot be addressed by the band-aids of higher minimum support prices and cash transfers. He presents an analysis of the causes and an outline of what needs to be done.

The middle class may have woken up to the crisis in agriculture when thousands of farmers marched to the national capital on 30 November 2018, but it is a crisis that has been with us for quite some time now.

The Delhi march had been preceded by many protests across state capitals starting with the ‘Long March’ of 12 March 2018 in Mumbai. In fact, there have been numerous farmer protests – small and large – since 2016. There was the long dharna (agitation) by Tamil Nadu farmers in 2017 in Delhi. Then there was the death of five protesting farmers in police firing in June 2017 at Mandsaur, Madhya Pradesh. These have been only a few of the many agitations that have taken place across the country in recent years.

One immediate fallout of the widespread protests has been that it has forced the attention of the media and the political parties on the misery of the farmers. The debate around the plight of agriculture has been reduced unfortunately to only two issues: one, the lack of remunerative prices for which the demand is for higher Minimum Support Prices (MSPs) and, the second, the debt trap that farmers find themselves in. As a result, state and central governments and political parties are promising debt waivers and higher MSPs, and more recently income transfers to farmers. However, none of these responses reveal an understanding of the true extent of the crisis in agriculture. It is unlikely that adversity will go away even if these promises of loan waivers and higher MSPs are implemented, and the income transfers of the state and central governments are handed out.

The crisis in agriculture is deep-rooted and is a result of an accumulation of distress over the last decade or so. There are a number of reasons why the predicament agriculture now finds itself in is unprecedented compared to previous instances of distress.

First, unlike earlier episodes when acute distress was the result of a disruption in production or weather-induced factors, this time it has intensified at a time when the monsoon has been normal. Sure, the crisis was aggravated by the twin droughts of 2014 and 2015, but its genesis and its subsequent intensification have been a result of factors unrelated to monsoon failure. Apart from the impact of a sharp decline in the prices of agricultural produce since August 2014, the current episode of severe adversity is the result more of a larger neglect of the agricultural sector since 2012-13.

Second, this time it is not agriculture alone that is in distress but the entire rural economy has been affected by a severe decline in demand including in activities other than farming (what is called the ‘non-farm sector’).

Third, unlike earlier when the response of governments to some extent managed to alleviate the suffering of farmers and revive the agrarian economy, this time the government’s actions have only worsened the crisis.

Finally, unlike previous such episodes when the plight of agriculture was localised to parts of the agrarian economy, this time it is both geographically widespread with almost all major states being affected, and different segments of the agricultural sector – food crops, non-food crops, and livestock economy – are in the doldrums.

The widespread nature of the crisis also implies that any solution has to address all its dimensions. Unfortunately, the narrow approach given the impending elections has meant that the solutions offered are piecemeal and half-hearted without addressing the root causes. While these may provide temporary relief to the farming community, they are unlikely to prevent another crisis a few years from now.

Building up to a crisis: 2014-2016

Long-time observers are in some ways not surprised by the state of Indian agriculture today. In many ways, agriculture has always been in crisis, the intensity of which may have gone up or down from year to year. This time it is serious and has taken political dimensions, with almost all political parties waking up to the situation. The entire rural economy has been affected with consequences for overall economic growth.

The non-farm sector in rural India, which has lately been an equally important part of the rural economy, has been under stress with most of the rural activities witnessing lower growth than during the period 2004-05 to 2013-14. Along with farmers (cultivators) whose incomes have declined in real terms (that is, after adjusting for inflation), the wages of casual workers have been growing much more slowly than earlier. The real wages of labourers in agriculture as well as the non-farm rural sector have even stagnated in the last five years. Taken together, casual workers and cultivators account for almost two-thirds of all workers in the rural economy. So a decline in their real incomes has contributed in recent years to an extreme episode of demand deflation (that is, a decline in demand, as opposed to an increase in inflation).

The current situation in many ways mirrors the predicament faced by the agricultural sector during 1997-2003 when another National Democratic Alliance (NDA) government was in power – led by the Bharatiya Janata Party (BJP) with Atal Bihari Vajpayee as Prime Minister. The similarities are a prolonged period of demand deflation led by a collapse of agricultural prices and a sharp slowdown in agricultural wages. The former contributed to the terms of trade shifting away from agriculture and in favour of the non-agricultural sector. (The terms of trade between two sectors broadly measure the purchasing power of the income earned by one sector in order to buy the goods and services of the other sector.)

There was also a sharp increase in farmer suicides. It is this backdrop and the anger against the then government that led to the United Progressive Alliance (UPA) being elected to office in 2004. Unfortunately, the NDA-II government again led by the BJP has not learnt from its previous mistakes and has ended up in a similar situation, this time with an agricultural crisis worse than in the early 2000s.

Agriculture grew by just 1.76% every year during 1998-2004. However, the rural economy bounced back after 2004 with the growth rate of agriculture accelerating by more than double to 3.84% per annum between 2004-05 and 2012-13 (growth rates are based on the old GDP series). The revival of agriculture was led by an increase in credit availability to agriculture, a rise in farm investment and MSP policies that helped shift the terms of trade in favour of agriculture. The increase in the MSP during the first term of the UPA government (2004-09) may have partially fuelled food inflation during the second term of the UPA (2009-14), but it also led to higher incomes for farmers and a general increase in the wage rate of labour that was unprecedented since the 1980s.

At the time, the MSP of paddy was hiked from Rs. 560 per quintal in 2004-05 to Rs. 1,310 per quintal in 2013-14 while that of wheat from Rs. 640 per quintal in 2004-05 to Rs. 1,400 per quintal in 2013-14, both increasing by more than two times. The higher incomes in the hands of farmers certainly helped expand demand in the rural economy, which was reflected in a higher purchase of consumer durable goods like two-wheelers. It was also reflected in a higher demand for labour in employment in the non-farm sector of rural India, the latter being largely led by an increase in private construction.

At the same time, the non-farm sector also benefited from an increased transfer of funds from the central and state governments through various rural development and food security programmes such as the Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA) scheme and the expansion in the public distribution system (PDS). The net result was an equally sharp increase in non-farm incomes and the fastest reduction in poverty in the last three decades.

Prime Minister Narendra Modi’s NDA government has promised to double farmers’ income by 2022. That is near impossible since farmers’ incomes have declined in real terms not just during this government’s tenure but also since 2011-12.

While there are no reliable and robust estimates of farmer incomes, the background paper outlining the strategy and action plan for doubling incomes prepared by the NITI Aayog (National Institution for Transforming India), shows a trend of declining farmer incomes since 2011-12 (Chand 2017). As against a growth rate of farmer incomes at 5.52% per annum between 2004-05 and 2011-12, the incomes of all farmers actually declined at 1.36% per annum between 2011-12 and 2015-16. Extending the calculations to 2017-18 and using the methodology suggested by the NITI Aayog, it is seen that the trend of a deceleration (slowdown) in growth of farmer income has continued.1

In fact, the period after 2011-12 has been the longest such episode where farmers have seen the growth in real incomes slow down year after year.

Incidentally, this has happened at a time when, based on the new series of national accounts, the agricultural growth rate has been 2.9% per annum between 2013-14 and 2017-18,2 which although lower than the 3.5% per annum between 2004-05 and 2013-14 under the UPA government, is not bad considering the back-to-back droughts of 2014 and 2015. However, this picture of a fairly buoyant agricultural sector in terms of total output is only part of the story. A break-up of the various sub-sectors of the agricultural sector shows a story of stagnation in crop production in the last four years.

The crop sector has seen a sharp deceleration in the growth of real gross value added (GVA), a comprehensive measure of net income which has been generated in production that is used in the national accounts) during the first four years of this government, with growth in real terms at only 0.5% per annum.3 What makes it significant is the size of the crop sector which accounts for as much as two-thirds of agricultural sector GDP and is the source of livelihood for the huge number of farmers dependent on it. Within the crop sector, it was only the horticulture and allied activities, which showed a sharp recovery while there was a decline in the growth rate of all crop production.

Rising costs and falling profits

A declining growth rate of GVA in the crop sector is not just a result of weather fluctuations that affected the output in the first two years of the tenure of the Modi government, but also of cumulative neglect over the years that has intensified during the entire term of the NDA-II government.

While the agricultural sector rebounded after the crisis of 1998-2003 with a recovery in farmer incomes, this recovery was short-lived and started showing signs of stress from 2012-13. The sharp rise in real casual wages at more than 6% per annum during 2008-13 along with rising fuel and input costs had already begun to squeeze the profit margin of farmers from 2011-12 onwards.

The rise in petroleum prices had led to an increase in irrigation costs. Following the introduction of the Nutrient Based Subsidy (NBS) scheme for fertilisers in 2010, fertiliser prices had also risen. Fertiliser consumption that had increased from 16.7 million tonnes in 2000-01 to 28.1 million tonnes in 2010-11 started declining after the introduction of the NBS scheme, falling sharply to 26 million tonnes by 2016-17. It also led to a worsening of the fertiliser mix. All this together contributed to a squeeze on farmer incomes, affecting rural demand for consumer and investment goods. This is visible, for instance, in the trend in tractor and power tiller sales, where tractor sales increased from 247,000 units in 2004-05 to 697,000 in 2013-14, and then declined subsequently to 582,000 in 2016-17. Similarly, sales of power tillers that had risen from 17,481 units in 2004-05 to 56,000 in 2013-14 later declined to 45,200 in 2016-17. The squeeze on farmers’ incomes also resulted in a declining offtake of bank credit and an increase in the total debt burden.

The twin droughts of 2014 and 2015 occurred against this background of rising input costs and a squeeze on farm incomes. Adverse weather conditions then led to a decline in agricultural output. But farmers also suffered from two associated factors. The first was the decline in agricultural commodity prices following a sharp collapse of international prices coinciding with the fall in petroleum prices. The decline in crop output prices took place first in cash crops, when they witnessed a sharp collapse in domestic prices following that of international prices, and soon spread to all commodities as well.

Both these factors – adverse weather conditions and the fall in international prices – came as a shock to the agricultural sector that had already started showing signs of stress because of rising input prices. These were further aggravated by the response of the government that contributed to a build-up to a full-blown crisis. The first was the sharp cuts in agricultural expenditure with major declines in spending on agriculture-related schemes. The first full budget of the NDA government in 2015-16 saw a decline in the agriculture budget by almost one-fourth in nominal terms compared to the 2013-14 budget. Although it improved in 2016-17, it still remained lower than the allocation in the agriculture budget of 2013-14.

Second, the fall in petroleum prices was not passed on to the consumers, leaving them with an unchanged input bill. The government chose to raise taxes and was the beneficiary of a large windfall of tax revenues.

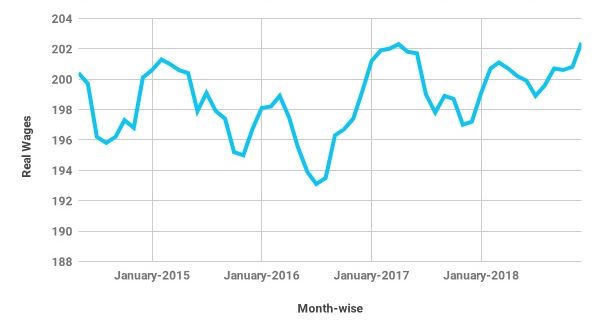

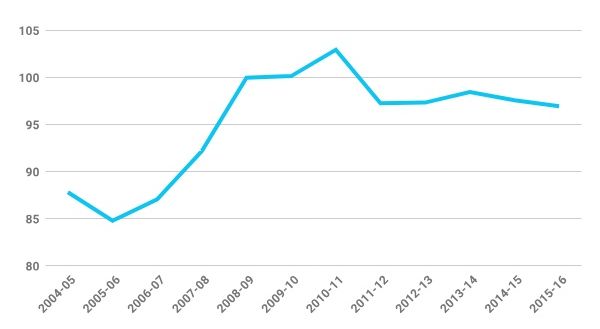

While the terms of trade had already started turning against agriculture after 2011-12, it worsened in the next two years. Figure 1 shows the terms of trade between farmers and non-farmers. The last time the index of terms of trade had moved against farmers was during 1997-2003. It had recovered after that with the index moving up from 85 in 2004-05 to 103 by 2010-11, driven by generous MSP increases and a general rise in food inflation. But it declined soon after and has remained at this level ever since (Figure 1).

Figure 1. Index of terms of trade between farmers and non-farmers

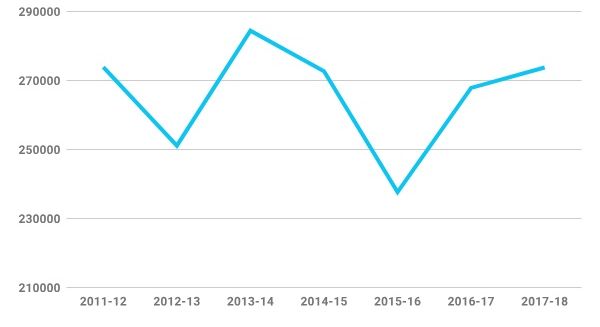

The third factor was the decline in real investment in agriculture. At a time when all indicators of the rural economy were suggesting a deterioration of the agricultural situation with a decline in farmers’ income, the response of the government was to reduce the already meagre investment in agriculture. Public investment in the agricultural sector declined sharply with real investment declining at 1% per annum during the four years of the NDA-II government for which data is available. Figure 2 presents the picture.

Figure 2. Investment in agriculture (Rs. Crore, 2011-12 prices)

The non-farm sector

While distress in the agricultural sector had been building up since 2012-13, one of the reasons why it later worsened was the slowdown in the non-farm sector. The non-farm sector has been gaining importance in the rural economy for some time now. By 2011-12, agriculture was not the dominant employer in the economy, although it remained important in the rural economy. While aggregate data may not fully capture the extent and importance of the non-farm economy in sustaining the larger rural economy, the evidence from village surveys clearly points to its increasing importance.4 The rural non-farm economy is now not just a driver of income and employment diversification, it contributed to a significant reduction in poverty between 2004-05 and 2011-12. However, the rural non-farm economy started showing signs of stress when the construction sector too started slowing down. This slowdown was reflected in the national accounts statistics, but is more starkly visible in wage data.

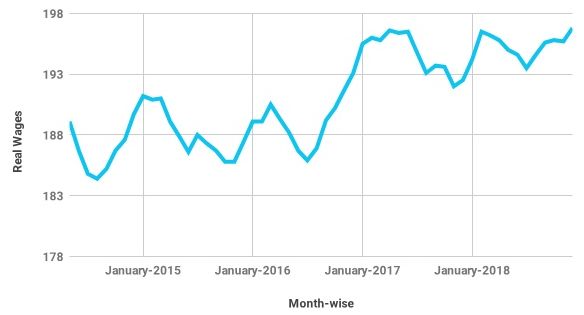

Real rural wages rose at more than 6% per annum between 2008 and 2012, but growth started slowing in November 2013. Real wages of agricultural labourers grew at 0.87% per annum between May 2014 and December 2018, whereas for non-agricultural labourers they grew by only 0.23% per annum. For construction workers, who are among the largest group of workers outside agriculture, real wages during the same period declined by 0.02% per annum.

The deceleration in real wage growth and stagnation in real wages was reversed in July 2016, which was a normal monsoon year after two years of drought. However, real wages again stagnated after May 2017, most likely as a result of demonetisation in November 2016, which disrupted agricultural activities as well as the rural non-farm sector (see Figures 3 and 4). Both these sectors are largely informal in nature and suffered immensely due to the withdrawal of cash from the system.

The decline in real wages was driven by the decline in agricultural production, as also by the slowdown in the non-farm sector, particularly in construction and manufacturing.

The construction sector grew at 7.9% per annum between 2004-05 and 2012-13. Growth then decelerated sharply to only 3.5% between 2014-15 and 2017-18, which affected the demand for non-farm labour. The slowing growth in real wages was also partly caused by the cutbacks in public spending, which had helped raise wages between 2007-08 and 2012-13. Not only did the overall expenditure on MNREGA decline after 2011-12, even the person days of work generated started falling. The NDA government’s attitude to MNREGA can be summed up by Prime Minister Modi’s speech in Parliament, where he declared that it should be seen as a symbol of failure of the UPA.

Figure 3. Real wages of non-agricultural labour (Rs. per day, 2011 prices)

Note: Real wages have been obtained by deflating nominal wages by the consumer price index, rural.

Source: Wage Rates in Rural India, Labour Bureau.

Figure 4. General agricultural real wages (Rs. per day)

Note: Real wages have been obtained by deflating nominal wages by consumer price index, rural.

Source: Wage Rates in Rural India, Labour Bureau.

The slowing growth of real wages contributed to the general decline in demand in rural areas. The cumulative impact was felt not just on agricultural demand but also on non-agricultural goods and services. Unlike the agricultural sector, where unforeseen circumstances such as weather shocks and the collapse of international prices had a role to play, the decline in the rural non-farm sector was entirely a domestic creation. Partly, it was the NDA government's attitude towards rural development interventions such as MNREGA and other such schemes. It saw such policies as a legacy of the previous UPA government and therefore not deserving attention. The wilful neglect of agrarian distress also contributed to the slowdown in the non-farm sector.

Finally, the decline in agricultural exports too contributed to the worsening situation in agriculture. The fall in international commodity prices affected the demand for Indian agricultural products in global markets where the collapse in prices along with the relatively negligible decline in domestic prices made Indian agricultural exports uncompetitive. As a result, agricultural exports, which had increased from a low of US$8.8 billion in 2004-05 to US$39.4 billion in 2014-15, declined to US$33.8 billion by 2016-17. At the same time, agricultural imports that amounted to US$3.8 billion in 2004-05 increased to US$15.03 billion in 2014-15 and further to US$16.9 billion in 2016-17.

The fall in exports and increase in imports hurt domestic producers. One of the reasons domestic prices remained high making Indian produce uncompetitive, was that unlike international trends the decline in petroleum prices did not materialise in lower energy costs for Indian farmers. The price competitiveness of Indian agricultural exports was also hurt by an ad-hoc export–import policy, which put unnecessary export restrictions, thus preventing farmers from benefiting from international markets. An unfavourable exchange policy and imports by the government also contributed to unfair competition from agricultural commodities, which were imported from the global markets where prices were lower than domestic prices.

Intensification of agrarian crisis: 2016-2018

Government policy not only neglected agriculture during the crucial period of 2014-2016, but also played an active role in deepening the crisis. Fortunately, the resilient Indian farmer was strong enough to effect a revival in 2016 when the weather turned favourable. Agricultural growth rebounded to more than 6.3% in 2016-17 and followed it up with 5% growth in 2017-18.5

Unfortunately, the recovery was short-lived. Farmers who had harvested a bumper crop in Kharif 2016 found themselves unable to sell once demonetisation was announced on 8 November 2016, which thus caused acute misery. Most of the trade in agriculture is cash based, and the absence of cash led to huge losses for most farmers. It also affected the non-farm sector, which was showing signs of revival following the normal monsoon of 2016. The net result was a continuation of the profit-realisation crisis of farmers alongside job losses. Real wages, which had started showing signs of faster growth, also started showing a slower growth from May 2017. By October 2018, the last month for which the Labour Bureau has released data, real wage rates were lower than February 2017 for agricultural as well as non-agricultural labourers.

While demonetisation adversely affected the agricultural sector and the non-agricultural sector, the hasty introduction of the Goods and Services Tax (GST) added to the woes of the informal non-farm sector. The combined impact of demonetisation and GST was a further slowdown in the rural non-farm sector.

While the crop economy was under severe distress, matters were made worse by the problems in the livestock economy. The cattle economy is an integral part of the agrarian economy, particularly for small and marginal farmers. The political mobilisation against cattle trade affected the agrarian economy. Several incidents of lynching of cattle traders and tightening of regulation for cattle trade by state governments led to a sharp reduction in the volume of trade. The downturn in the livestock economy, which used to provide emergency cash and in some cases was also a necessary diversification in the rural economy, now also contributed to the decline in rural incomes. The increase in stray cattle, abandoned by farmers after the cows are no longer lactating, added to the cost of farming as labourers had to be engaged to protect the fields from stray cattle. The net impact of these developments was a sharp reduction in income opportunities that were available to farmers along with an increase in the cost of cultivation. The non-crop economy not only added to income but also acted as insurance against losses in crop cultivation.

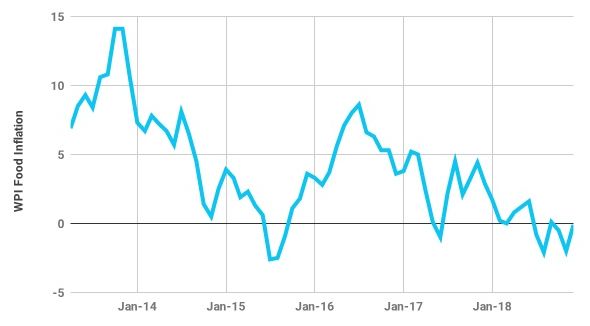

The cumulative impact of all these factors resulted in one of the sharpest declines in rural demand. Reduced domestic demand and external opportunities led to a collapse of prices in the domestic market. The fact that agricultural markets were fragmented also did not help the farmer realise the price for his produce. The collusion and cartelisation of agricultural markets only led to farmers being squeezed out from the demand that was coming from urban areas. However, it was the demand deflation in the domestic economy that has ended up in a situation where food price inflation has turned negative. Since August 2017, the food price index from the wholesale price index (WPI) has not seen any growth (Figure 5).

Figure 5. Wholesale price index food inflation (%)

Clearly, the crisis in agriculture this time is not driven by the collapse of agricultural output. Its genesis lies in the broader policies that the Indian economy has followed in the last three decades since the economic reforms of 1991. It is embedded in the larger political economy architecture following structural adjustment policies, which make low inflation the objective of fiscal and monetary policies. Since food and agricultural commodities constitute a significant part of the consumption basket, the objective of low inflation also implies keeping food inflation low.

The second component of the structural adjustment policies that seek to keep the fiscal deficit under control also emphasises a reduction in subsidies and revenue expenditure on agriculture and rural development. A failure to adhere to the principle of low inflation invites censure from the rating agencies, which seek to keep the real value of foreign investments intact. Inflation erodes the real value of these investments. While there is no substantial evidence either against undertaking expansionary fiscal policies when there is surplus capacity and demand deflation, or that overall inflation is driven largely by food inflation, successive governments have continued to maintain inflation targeting and fiscal fundamentalism as non-negotiable policy.

The implication of the deflationary policies has been felt largely by the farmers and rural population in order to keep the middle classes and the foreign investors happy. Despite the acute crisis in the countryside, governments have avoided using the available fiscal space to increase demand in rural areas.

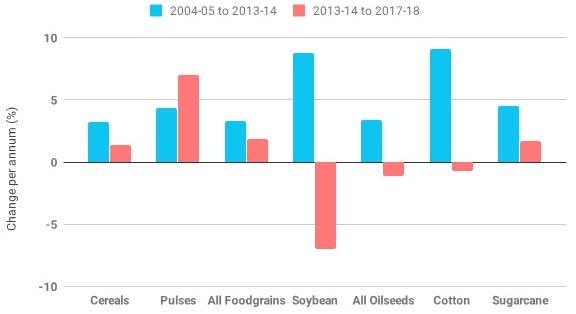

Not only is the aggregate growth rate of crop agriculture lower now than during the UPA years, the increase in agricultural output is nowhere close to the increase in production observed during the period 2004-05 to 2013-14, except in the case of pulses. Figure 6 gives the growth rate of major crops and crop groups for the periods 2004-05 to 2013-14 and 2013-14 to 2017-18.

Figure 6. Growth rate of output of different crops

Note:Growth rates are compound annual growth rates. Figures for 2017-18 are based on 4th Advance Estimates.

Source: Ministry of Agriculture and Farmers’ Welfare.

Except for pulses, which have seen output grow faster between 2013-14 and 2017-18, all other crops and crop groups have seen a sharp deceleration in output growth.

In the case of pulses, untimely imports resulted in a price collapse. But commercial crops such as soybean and cotton that have seen an output decline have also seen a fall in prices. The current spell of low and declining prices is therefore certainly not due to overproduction as has been claimed by the government and some sections of the media, and nor does it follow international prices that have not shown any sharp decline, after falling between 2014 and 2016.

The response

One way to gauge the response of the government and its commitment to agriculture is by examining the budget allocations for agriculture. While the budget of the ministry of agriculture increased almost 10 times from Rs. 21.67 billion in 2003-04 to Rs. 216.09 billion in 2013-14 during the UPA years, the allocation in the first full budget of the NDA government declined by one-fourth to Rs. 166.46 billion in 2015-16. It increased to Rs. 204 billion in 2016-17, which remained lower than the budgeted allocation for 2013-14. In normal course, governments would increase budgeted expenditure on agriculture, particularly in drought years, but the two budgets after the droughts clearly showed the present government’s lack of concern for agriculture.

While the budget allocations did show a jump in 2017-18 and 2018-19, much of this was due to smart accounting where the amount spent on interest subsidy, which was earlier reflected in the budget of the finance ministry was brought into the budget of the agriculture ministry. Excluding the interest subsidy component, the overall budget for agriculture increased by 26% per annum during the UPA years but by only 8.7% per annum under the NDA-II government. It is also important to note that except in 2016-17, in none of the years has the actual expenditure been close to the budget allocation. The marginal increase in the agricultural budget in recent years has largely been on subsidy on interest and on insurance premium. But this increase has come at the cost of a decline in investment in agriculture. Real investment in agriculture declined by one percentage point per annum during the first four years of the Modi government.6

While the government continued to reduce public investment in agriculture alongside the marginal increases in overall agricultural budgets, the cut in some of the vital schemes such as Rashtriya Krishi Vikas Yojana (RKVY)7 also had adverse effects on the farm sector.

In the context of the increased protests by the farmers and resulting politicisation of the farmers’ crisis, the response has largely been of three kinds: loan waivers, MSP increases, and some form of direct income transfers, which have now found favour with political parties and have also been implemented in several states. The total amount of loan waiver announced so far is almost Rs. 1.9 trillion with promises of more after the Lok Sabha8 elections.

While there is some justification for providing relief to farmers unable to pay their debt due to unforeseen circumstances such as a failure of the monsoon or a collapse in prices, loan waivers have now become the dominant way of addressing the agrarian crisis. The last big loan waiver was in 2008 when the UPA government announced a national loan waiver with loans worth Rs. 700 billion being waived. Given the extent of indebtedness and the crisis in agriculture following the drought and price collapse after 2014, there was some justification for these interventions.

The latest data on the extent of indebtedness among farmers is available from the Situation Assessment Survey (SAS) of 2012-13. According to the SAS, 52% of all farmers in the country had on an average unpaid debt of Rs. 47,000. However, there is a large regional variation with a higher incidence in southern states, with 93% of farmers being indebted in Andhra Pradesh and 83% in Tamil Nadu. At the all-India level, 60% of these loans were from institutional sources with the remaining from local moneylenders and other informal sources. The data also shows that the extent of dependence on non-institutional sources was much higher among small and marginal farmers with more than 50% of the loans for these groups coming from non-institutional sources.

While loan waivers are desirable in some cases and necessary in the case of extreme indebtedness, they come with their own set of problems. There is the issue of moral hazard,9 which penalises the sincere and rule-abiding farmer. It gives rise to a tendency to default on loans, especially if the loan waivers are not a one-time solution but keep recurring every decade, which is the case this time with multiple loan waivers. It also has an impact on the banks, which are already stressed with large non-performing assets. However, the real problem with loan waivers is that they contribute little to providing a solution to the problem of declining farm prices which are seen as the primary reason for worsening of the crisis.

Even the attempts to increase the MSPs are unlikely to help raise market prices of crops in rural areas. The idea of providing a fixed mark-up over the cost of cultivation has been quite dominant for some time now. It was also among many recommendations of the National Commission on Farmers chaired by M.S. Swaminathan. An MSP at 50% over costs was also promised by political parties including the BJP which took advantage of the agrarian unrest during the run up to the 2014 election. But the BJP’s actions once it assumed power were contrary to its promises. The government raised MSPs only notionally, and it used administrative measures to reduce procurement. The bonus that was given by the state governments was also discontinued. But the government finally had to respond to the pressure to raise MSPs by announcing increases in the 2018-19 budget. The MSP for paddy was increased by Rs. 200 from Rs. 1,550 to Rs. 1,750 for Kharif 2018, a 13% increase over the previous year. The MSP increase for other crops varied between 3.7% for moong bean to 45% for Niger seed. The MSP makes a significant difference for paddy and wheat for which there is a proper procurement and distribution mechanism in the form of the Public Distribution System (PDS) but not as much for other crops where there is almost negligible procurement. Even for paddy and wheat, the impact has been muted since the market prices were higher than the announced MSP.

The third kind of response to the agricultural crisis has been the more recent one of making direct benefit transfers to farmers. Such income transfers have so far been implemented fully only in Telangana. Similar schemes, with some variation, have been proposed in Odisha and Jharkhand which are going for legislative assembly elections this year.

The direct income support scheme in Telangana was seen as a political success with the Telangana Rashtra Samiti (TRS) retaining power in the state with a thumping majority in the assembly elections of December 2018. The Rythu Bandhu scheme of the Telangana government provides Rs. 4,000 per acre for every season to all the farmers of the state, with an annual budget of Rs. 120 billion. The scheme in Jharkhand is similar to the Rythu Bandhu scheme with an enhanced pay out of Rs. 5,000 per acre to 2.28 million farmers at the cost of Rs. 22.5 billion to the state government. The third scheme is the Krushak Assistance for Livelihood and Income Augmentation (KALIA) that has been started by the Odisha government. Unlike in Telangana and Jharkhand, KALIA does not provide any income transfer on the basis of the land holding but for the household as a unit. The pay out at Rs. 10,000 per family per year also extends to sharecroppers and landless agricultural labourers.

The central government also announced an income transfer scheme with retrospective effect as part of the interim budget for 2019-20, called the PM-KISAN (Pradhan Mantri Kisan Samman Nidhi). The central government will provide an annual transfer of Rs. 6,000 to be paid in three equal instalments to roughly 125 million small and marginal farmers. The first instalment of the scheme will be delivered before the elections. However, the national scheme does not cover sharecroppers and wage labourers.

Concluding remarks

The current crisis in agriculture is a serious one. The precarious situation is basically a result of neglect of the agrarian economy by successive governments. The roots of the crisis, however, are in the broader political economy paradigm that India has followed since the early 1990s. It has resulted in an increased frequency of such extreme episodes, and has also seen the intensity increase over the years. Unfortunately, the solutions being offered are not only inadequate to prevent the recurrence of such crises, but may in the long run actually aggravate the problems.

The latest fad of cash transfers is also a part of this broader political economy architecture that sees them as a panacea for all the problems in agriculture. Propagated by a group of influential economists, these are now part of mainstream discourse not just as a resolution of the agrarian crisis but also as solutions for corruption, malnutrition, and jobless growth that the economy has seen in the last two decades.

The biggest appeal of the cash transfer scheme is its supposed simplicity. It is certainly popular and politically rewarding, but it is unlikely that it will solve the deep-rooted problems of Indian agriculture.

If there is one message from the analysis here, it is that the genesis of the current crisis lies in the faulty and ad-hoc export–import policy, lack of infrastructure, low investment, and cartelisation and collusion in agricultural markets, which have prevented farmers from realising market prices for their produce. It is the combination of these factors along with the twin droughts of 2014 and 2015 which created the current crisis in the first place.

It is also true that the situation worsened due to the sudden shocks of demonetisation and the hasty implementation of GST, which affected the rural economy adversely. Cash transfers are not a solution to any of these developments and are definitely no guarantee of protection against unforeseen events, whether natural or policy-induced. They are certainly not a substitute for the structural reforms needed in agriculture. The current crisis may have worsened due to the sharp fall in agricultural crop prices but it is ultimately a result of multiple failures of policy. Further, it is a crisis which is as much agricultural as it is caused by the failure of the non-farm sector in creating enough jobs as is evident from the deceleration in real wages in rural areas.

Some of these income transfer schemes, such as the Telangana model, are also regressive with the amount of transfer proportional to the land owned. In case of the national scheme, which targets the small and marginal farmers, the real problem will be of identifying the beneficiaries. Given that the current problems are a result of demand deflation in the rural areas, the transfers may revive rural demand in the short- and medium run. But they are certainly not free and costless. They come at a cost: a decline in investment as well as a decline in other rural development expenditure. With most state governments already committed to loan waivers, an income transfer scheme does have an impact on the states’ ability to invest in agriculture. The transfer scheme will therefore further erode the fiscal capacity of states.

While proponents of a cash transfer scheme may argue that it is non-distortionary and therefore more efficient, it does nothing to correct the imbalance that has arisen due to a movement of terms of trade against agriculture or against price transmissions from international markets. With agriculture becoming more diverse with growth in horticulture and crops with a large trade exposure, increased monetisation and mechanisation of agriculture, a rise in input costs has also been seen.

What are needed are larger investments in improving access to better technology, extension programmes to enable farmers to take advantage of new technology, market infrastructure, storage and warehousing infrastructure, and easy and assured supply of credit. Cash transfers absolve the government from all such obligations. Rather, by taking away precious fiscal resources, they makes the farmer more vulnerable to both market- as well as non-market induced risks by reducing investments in basic infrastructure and other support measures necessary to support agriculture. Cash transfers and loan waivers may not be the solution to the agrarian crisis, but will surely create an agriculture which is far more vulnerable and crisis-prone than even what it is currently.

This piece first appeared in The India Forum: https://www.theindiaforum.in/article/farm-crisis-runs-deep-higher-msps-and-cash-handouts-are-not-enough

Notes:

- Since there have been frequent revisions to the estimates of GDP including the one released by the Central Statistical Office (CSO) on 31 January 2019, it is difficult to get conclusive trends. The trends mentioned here are based on estimates from the annual publication of national accounts. While these will show some increase given that estimates of growth in agricultural gross value added (GVA) has been revised upwards, these are unlikely to match the growth rate of income during the UPA years.

- The 2018-19 figures are based on advance estimates released by the CSO in end January.

- Note, it was actually declining for the first three years of the NDA government (2014-15 to 2016-17).

- For an overview of changes in the rural economy and the role of the non-farm economy, see Himanshu, Jha, and Rodgers (2016), and Himanshu, Lanjouw, and Stern (2018).

- A revival of wage growth was also witnessed where growth in wage rate in both agricultural and non-agricultural sector which had plummeted to -1.1% and -3.0% in July 2016, respectively, accelerated sharply to reach a high of 5% in agriculture and 4% in non-agriculture in May-June 2017.

- If we take into account the latest GDP statistics that have been put out. In terms of the old series, it was 2.3%.

- Rashtriya Krishi Vikas Yojana (RKVY) is a state plan scheme which seeks to incentivise the states that increase their investment in agriculture and allied sectors. It makes preparation of district and state agriculture plans mandatory.

- Lok Sabha is the lower house of the Parliament of India.

- Moral hazard here refers to the tendency among borrowers to take more loans and default knowing that they are protected against default.

Further Reading

- Chand, R (2017), ‘Doubling Farmer’s Income: Rationale, Strategy, Prospects and Action Plan’, NITI Policy Paper No. 1/ 2017, NITI Aayog.

- Himanshu, P Jha and G Rodgers (eds.) (2016), The Changing Village in India: Insights from Longitudinal Research, Oxford University Press, New Delhi.

- Himanshu, P Lanjouw and N Stern (2018), How Lives Change: Palanpur, India, and Development Economics, Oxford University Press, Oxford.

12 April, 2019

12 April, 2019

By: panchayati raj system in india 29 August, 2022

Wonderful Information In THis Blog Thanks For Sharing This https://ruralmarketing.in/stories/everything-you-need-to-know-about-panchayati-raj-system/