India’s dependence on fossil fuel is widely regarded as unsustainable. This column highlights that this unsustainability is not just environmental in character, but is emerging as a macroeconomic one as well, leading to challenges for India on multiple fronts – discovering new sources of hydrocarbon deposits, developing new renewables and strengthening the macroeconomic fundamentals by making India a more attractive destination for FDI.

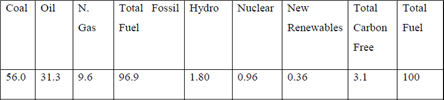

India’s current energy use is unsustainable. This consists of fossil fuels, hydro and nuclear resources on the one hand, and combustible biomass and wastes on the other, the latter being largely non-traded resources having a share of almost one quarter in the total primary energy supply. New renewable resources currently have a negligible share (0.36%) in the total commercial (i.e. traded) energy balance. Table 1 shows the composition of India’s primary energy supply as of 2009 where the total supply is the energy equivalent of 366 million tonnes of oil.

Table 1. Composition of Primary Commercial Energy of India in % share (2009)

Author´s calculation based on IEA data on Energy balances of Non-OECD Countries for 2009 published by OECD Paris.

The high dependence of India’s energy system on fossil fuel is unsustainable not only because of the high share of carbon footprint in the total ecological footprint and the various other adverse environmental effects, but also because of the economic (or ‘macroeconomic’) unsustainability of such dependence due to heavy financial requirement for imports arising from the growing scarcity of the fossil fuel resources. The factors underlying the financial unsustainability of such an energy supply are outlined in this column.

Issues with coal

Among the fossil fuels, coal, being a relatively cheap and perceived to be an ‘abundant’ energy resource as compared to hydrocarbons in India, has remained the focus of attention for energy planners ever since the oil shock of the early 1970s to meet the ever-increasing energy demand in the country. The total estimated reserve of coal in India as of 31 March 2010 was around 277 billion tonnes, according to the Energy Statistics of India in 2012. However, the minability and extractability of Indian coal are significantly affected by the geological, technical and other surface constraints such as township, riverbed, high environmental fragility due to the location of deposits underneath deep pristine forests and so on resulting in high economic cost for at least some part of the resource which cannot be as a result categorised as economically viable reserves. Some errors in measurement due to methodological reasons have further compounded the problem of estimation of reserves for energy planning. The high ash quality problem of Indian coal also tends to offset part of the apparent benefit of the low-cost of coal from the geo-technically friendly coal fields and basins. All these factors have resulted in the growing import of both coking and non-coking coal over time due to demand exceeding domestic supply and also of washing both coking and also non-coking coal. The share of import of coal in total apparent consumption has in fact grown from 2.2% in 1989-1990 to 11.1% in 2010-2011. The unit prices of imports of coal by India also rose during the period 1989-1990 to 2010-2011 in both nominal dollars and rupees, particularly since 2000, at the respective annual rates of 10.8% and 11.4%. The rise in the import price of coal in its turn eroded the relative cost benefit of imports of such coal.

Issues with oil and natural gas

India is highly dependent on the import of crude oil to meet its energy demand and oil import has been steadily rising over the years. Although India has set up some refinery capacity under a private initiative which is used only to produce for export of petroleum products, the net imports of total oil (that is, aggregate of all imports of crude and petroleum products less all exports of petroleum products) have increased from around 25 million tonnes during 1989-1990 to around 120 million tonnes in 2010-2011 – a growth rate of over 7% each year over the past two decades. While the average price of India’s net import of oil has gone up in both nominal rupees by around 14% each year and nominal dollars by around 6% each year, the share of import in the total apparent consumption of oil (that is, crude oil production plus net petroleum import) has grown from 43% in 1989-1990 to a high of 76% in 2010-2011.

The natural gas market, on the other hand, is only an emerging market in India. The International Energy Agency (IEA) estimates the Indian market of natural gas to be one of the fastest growing in the world over the next 20 years and projects the growth to be around 5.4% per year over 2007-2030 (IEA, 2009). It is being preferred mainly due to its inherent environmentally benign nature, greater efficiency and cost-effectiveness as a fuel. The production of natural gas has picked up very recently in 2009 with the start of the Krishna-Godavari KG-D6 hydrocarbons bearing field after remaining stagnant for almost a decade. The enactment of the New Exploration Licensing Policy (NELP) by the government has played a key role in ensuring greater participation of private and foreign companies in natural gas discovery and extraction. India has already started importing natural gas in spite of such growth in production the share of import reaching 19% of apparent consumption in 2010-2011. The unit price of natural gas in nominal dollar has also been growing at an annual average rate of 3.85% per year since 2004-2005.

Aggregate fossil fuel energy

As now India is importing all kinds of fossil fuels, the percentage share of total import in the total apparent consumption of such fuels (in units of oil equivalent tonne) had been increasing throughout the past two decades and touched 35% in 2010-2011. Meanwhile, the unit price of total fossil fuel (in oil equivalent units) has increased in nominal rupees and dollar terms at the rates of 10% per year and 6% per year respectively. As a result of the price rise and the growing imports of all the fossil fuels as indicated above, India’s total bill of net import of energy has grown at an alarming rate of close to 20% per year, leading to an increase of almost 55 times over the past two decades. As a consequence, the share of total energy import bill as a percentage of India’s total export earnings has also been growing over time, and has now reached almost 38% in 2010-2011 which is a source of concern for macro-economic sustainability of such pattern of growth of energy use in India. In view of the sharp decline in the rate of growth of IT related service export earnings to 10% per year, the slowing down of inflow of foreign direct investment (FDI) into India and the footloose erratic character of inflow of foreign portfolio investment, the current pattern of fossil fuel use is likely to create macro-economic stress on the front of the balance of payments and the stability of India’s currency value. Thus, replacement of fossil fuel by renewables is not only important for the environmental sustainability or greenness of our development process, but also in the interest of the macroeconomic sustainability of our growth process.

Hydro and Nuclear: What is the way out?

As the major part of India’s coal import is for the power and steel sector, coal has been substituted by two carbon free non-fossil fuel energy resources from among the conventional ones – namely nuclear and Hydro in large storage – for power generation. The prospect of nuclear route of energy development depends on India’s success at the stage of breeder reactor and that in developing thorium-uranium cycle so that it can use its huge stock of thorium reserve. It is now too early to assess the situation, but India needs to engage in trade in uranium and light water reactor market so that it is in a position to successfully experiment with uranium-thorium reactor. So far as large hydro-electric projects are concerned this option is fraught with too many socio-political and political economic problems arising from the environmental effects due to too much disturbance in the local and regional ecosystems of the river basin and river valley as well as human ecological conditions due to the destabilisation of human settlements. Besides, the high capital cost of storage of water as power energy resource and high gestation lag of projects when added to the environmental costs would often tend to offset the benefit of zero fuel cost of hydro-electric power.

Concluding remarks

It is obvious that India will have to depend on new renewable energy resources to meet the challenge of the growing eco-scarcity of fossil fuel resources and to combine macroeconomic sustainability with the environmental one. However, as power, steel and transport are responsible for most of the imports of coal and oil which have limited substitutability by other fuels in these sectors, the development and deployment of the technologies of new renewable resources of wind, solar, biomass and wastes for conversion into power and of bio-liquids to substitute petroleum as blending fuel into diesel and petrol have become vital for sustainable or green energy development.

This issue of energy security and macroeconomic sustainability of growth also further requires greater flow of hydrocarbons from domestic sources and intensification of hydrocarbon discovery activities. For attracting finance and modern technology for such purpose in this area, it is important to encourage foreign investors to take greater interest in such investment – which depends on the terms of production-sharing and profit-sharing contracts and prices of the products in this sector. While the price of oil, which is quite liquid in trade, is globally determined, the market for gas is mostly localised and region specific. The government is expected to announce its gas pricing and gas utilisation policy and fix it for a period of time. This is particularly important to create a competitive environment in such investments in view of the oligopolistic nature of this global industry. The Indian government is at the moment engaged in such task of restructuring the production-sharing contract and formulating its gas pricing policy.

Finally, India will have to live with net dependence on the import of some fossil fuel energy, however reduced, for supporting the growth of its economy. The current-account deficit in balance of payments as caused by energy import would warrant the creation of a business environment in India which would be conducive for attracting FDI and thereby ensure no deficit in the overall balance of payments. There should also be policies regarding the direction of inflow of foreign investments into the area of renewables and biofuels for the transfer of the required technology and mobilisation of the required financial resources for the purpose.

Further reading

- Sengupta, R (2012a), ‘Macroeconomic Sustainability of Use of Fossil Fuel and Coal based Power Development of India’, Report of a Study for the World Institute of Sustainable Energy, Pune, India, August.

- Sengupta, R (2012b), ‘Green Economic Development and India’s Energy Policy Questions’, Report of a Study for the Climate Finance Unit of the Department of Economic Affairs, Ministry of Finance, Government of India, December.

17 April, 2013

17 April, 2013

Comments will be held for moderation. Your contact information will not be made public.