Kisan Credit Card programme - a key reform in agricultural lending in India - has been operational for almost 20 years now. However, there is little empirical evidence of its impact on intended beneficiaries. This column finds that the programme has had significant positive impact on agricultural production and technology adoption. It is likely that the channel is enhanced borrowing ability of the already unconstrained, rather than expanded access to credit.

The Kisan Credit Card (KCC) programme was introduced in India in 1998 and continues amidst much fanfare even today. Policymakers over the last decade and a half seem to have taken a liking to this programme, and it has been widely recognised as a massive reform in agricultural lending in the country. However, there is little empirical evidence on the success of the programme and its effects on intended beneficiaries, that is, farmers and rural households.

In this column, I discuss findings from my empirical evaluation of the KCC programme (Chatterjee 2016). The study provides the first micro-evidence from the KCC programme that uses data from both before and after the programme1, and complements a large literature, as summarised by Karlan and Morduch (2009), on the impacts of providing credit access in the developing world.

Kisan Credit Cards: Background

The programme was first announced in the budget speech of the then Finance Minister of India in 1998, and took as a result of the combined endeavours of the government, Reserve Bank of India (RBI), and National Bank for Agriculture and Rural Development (NABARD). Within a year of inception, close to four million KCCs were issued. A couple of years into the programme, KCCs constituted around 71% of the total production credit, and around Rs. 50 billion worth of loans had been disbursed (Planning Commission of India, 2002).

The programme has undergone several changes and the current structure is completely different from that in its debut year. Initially, it was just meant to be a credit line with a bank where farmers had to visit a bank branch to withdraw cash and use it at their discretion; hence, the term ‘credit card’ was a misnomer in some sense. Eventually, it graduated into a full-fledged credit card with features such as ATM withdrawal and the ability to swipe at the point-of-sale. The idea was to give out these cards to farmers all over the country with the objectives of providing easier access to credit via simpler eligibility norms, more flexible credit via looser monitoring criteria, and cheaper credit via lower interest rates. Apparently, the policy aimed to ease credit constraints for poor farmers as well as expand credit resources for the already unconstrained. In a NABARD report, Samantara (2010) points out how prior to KCC, the multi-agency approach of borrowing and lending in agriculture led to farmers getting caught up in the rungs of bureaucracy. In the only other evaluation of KCC that I know of, Areendam Chandain his 2012 International Growth Centre (IGC) working paper, analyses post-1998 data and finds no evidence of any impact of this policy on state- or district-level agricultural productivity.

The key thing to note is that KCCs are formal bank loans, as is the nature of any credit card debt. Banks can exercise discretion vis-à-vis the variety of KCC product they offer. We should therefore regard KCC loans as a differentiated product (see Chatterjee 2016 for details). Usually, as long as farmers have title to about an acre of irrigated land, they are eligible for loans up to Rs. 50,000 without collateral; the credit lines can be much higher with collaterals. The cards are usually valid for three years with the possibility of renewal upon successful repayment of loans. Repayment cycles usually align with crop cycles (one year for most crops; 18 months for sugarcane). Being essentially a credit card, this new form of crop loan for farmers do not have a formal monitoring procedure and banks are happy to renew the cards as long as there is no default. So, while these cards were possibly intended to relax constraints on borrowing for poor farmers to enable them to enhance agricultural productivity by making requisite investments, in practice, they may alter their consumption expenditures only. In line with these apprehensions, recent media reports suggest high rates of default on KCCs, and the fact that these are becoming a major source of non-performing assets (NPAs) for banks.

Impact on production and technology adoption in agriculture

I exploit certain institutional features of the implementation of the programme to estimate the effects of potential exposure to KCC on a host of outcomes, including rice production and technology adoption (Chatterjee 2016). I compare average outcomes before and after the implementation of the programme; in districts with a high concentration of bank branches as of 1998 (cumulative up to the policy year) to the ones with low concentration of bank branches; and in states that were politically aligned2 at the time versus those that were not. The idea is that the interaction of these three factors captures the intensity of exposure to the programme.

Using district level data3 from 1986-2011, I find that rice production increased by almost 88,000 tonnes more (close to 33% of average production in the economy) in areas with potentially high exposure to KCC relative to those with low exposure. It is possible that some of the inputs that accelerate production were not being used due to credit constraints, and KCC relaxed those constraints. As supportive evidence for this, I find that area cropped under high-yielding variety (HYV) of seeds increased substantially more in areas exposed to the programme.

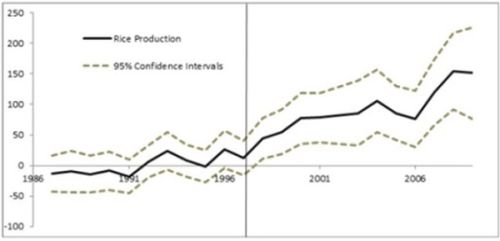

Figure 1. Estimated year-specific difference-in-differences in rice production

One concern that may arise is that the effects picked up by the interaction of the three variables described above are not necessarily that of KCC but represent already existing differences across the districts. Figure 1 plots these interactions using the first year of the data span, 1986, as a reference year. I find that prior to the policy year represented by the vertical line, these differences are statistically not differentiable from zero but become positive and significant from 1998 onwards. This provides confidence in the analysis, suggesting that the interactions are picking up KCC effects and not something else.

Impact on borrowing patterns

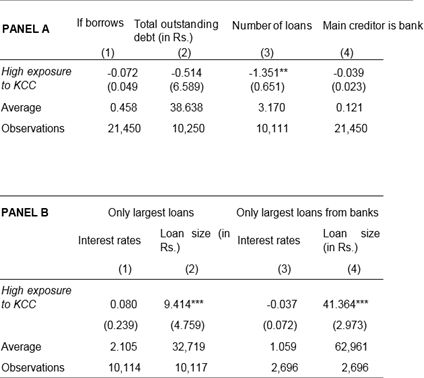

I supplement the above findings by using data from the India Human Development Survey (IHDS)-I (2004-05) to analyse how the KCC affected borrowing patterns4. I find that households in high-exposure areas are not any different from those in low-exposure areas in terms of their likelihood to borrow, total amount of borrowing, or choice of creditor (banks/others). This suggests that KCCs did not lead to new access to credit. I also find that the number of loans decreased by over one loan per household in the last five years (Table 1, Panel A).

Combining the results above with those presented in Panel B of Table 1, shows that households exposed to KCCs get fewer but larger loans. This suggests that while it is unlikely that KCC led to relaxation of credit constraints, it is plausible that already unconstrained households having access to credit now substitute other sources of borrowing with this cheaper alternative; they borrow in bulk with total number of loans reducing and loan sizes increasing.

Table 1. Effects on borrowing patterns

Data source: IHDS-I database, 2004-05.

Data source: IHDS-I database, 2004-05.

Notes: (i) All data in the table pertains to the five years prior to the survey. (ii) ‘Main creditor is bank’ indicates if the largest loan of a borrower comes from a bank, and takes the value zero for borrowers from other sources as well as non-borrowers. (iii) Additional demographic controls include household size, number of children in a household, number of married men and married women, and age and education levels of men and women. (iv) * denotes statistical significance at 10% level; ** denotes statistical significance at 5% level; *** denotes statistical significance at 1% level.

Concluding thoughts

I find that increased exposure to KCCs seems to have led to large increases in agricultural production and technology adoption. To investigate this further, I use household data to check if borrowing patterns changed in response to KCC exposure. I find that with exposure to KCCs, households are not more likely to borrow, they do not have higher outstanding debts, and neither are they more likely to have banks as their preferred creditor.

This indicates that the large effects seen in agriculture may not be driven by the relaxation of credit constraints and expanded access to credit due to KCC, but through some other channel. One such channel could be an expansion of credit. Along these lines, I also find that the above effects are magnified for households already having access to credit from banks, providing further evidence in favor of ‘expansion’ of credit and against ‘access’ to credit.

The welfare implications of this policy remain ambiguous and depend on whether ‘access’ to credit should be prioritised over ‘expansion’ of credit. Irrespective of the channel, the programme led to large increases in agricultural production, and hence overall improvement in the economy of the sector. This leads us to speculate about another possible channel - an increase in risk tolerance of the farmers. If farmers view KCCs as insurance against income shocks, they may increase investments and as a result, have higher output, even though this increase in investment does not show up as an increase in the likelihood of borrowing. It is just that farmers are now less compelled to save up for shocks as KCCs can help smooth out consumption, if required5.

Notes:

- Even though there are detailed studies on the implementation of the programme, most of these are commissioned reports that look at the success or failure of the programme from an administrative point of view (Planning Commission, 2002, Samantara 2010).

- A state is considered politically aligned if the ruling party/coalition in the state is part of the ruling coalition at the Centre. The idea is that KCC being a Central government programme would get implemented sooner in states ruled by the same coalition as opposed to states ruled by an opposition party.

- Data source: ICRISAT-VDSA (International Crops Research Institute for the Semi-arid Tropics-Village Dynamics in South Asia).

- For this part of the analysis, exposure is determined by bank branch concentration and political alignment only.

- I thank I4I Editor Parikshit Ghosh for comments and helpful insights about explaining these findings.

Further Reading

- Chanda, A (2012), ‘Evaluating the Kisan Credit Card Scheme: Some Results for Bihar and India’, International Growth Centre Working Paper.

- Chatterjee, S (2016), ‘Effects of Agricultural Credit Reforms on Farming Outcomes: Evidence from the Kisan Credit Card Programme in India’, Working Paper.

- Karlan, D and J Morduch (2009), ‘Access to Finance’, in D Rodrik and M Rosenzweig (eds.), Handbook of Development Economics, Vol. 5. Available here.

- Planning Commission of India (2002), ‘Support from the Banking System: A Case Study of Kisan Credit Card’.

- Samantara, S (2010), ‘Kisan Credit Card - A Study’, NABARD Occasional Paper 52.

03 November, 2016

03 November, 2016

Comments will be held for moderation. Your contact information will not be made public.