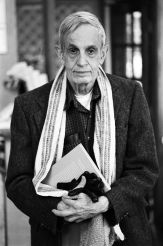

In a tribute to John Nash, Parikshit Ghosh, Associate Professor at Delhi School of Economics, outlines the revolutionary contributions of the late Nobel laureate to economic thought.

John Nash died the way he lived. He was killed in a car crash on his way back home after accepting the prestigious Abel prize in mathematics. More than half a century ago, just when Nash had launched a brilliant academic career, it was similarly cut short by mental illness. This roller coaster of a life lasted more than eight decades but its creative period barely extended beyond one. In that short span of time, perhaps more than anyone since Adam Smith, Nash revolutionised economic thought.

He wrote about half a dozen papers in economics, apart from making some deep contributions to pure mathematics. The economics papers were so influential that people soon stopped citing them. The ideas had become part of the DNA of the discipline. More than three decades after being struck with schizophrenia, Nash experienced a remission and won a string of awards in recognition of his earlier work, starting with the Nobel Prize in economics in 1994. The story of his remarkable life is narrated in Sylvia Nasar’s aptly named biography, A Beautiful Mind. The Hollywood film based on the book, though responsible for making Nash a household name, lacks its psychological complexity, sophisticated empathy and actual interest in his ideas.

The Nash bargaining theorem

One of Nash’s earliest contributions to economics can be found in his 1950 Econometrica paper on the Nash bargaining solution. For novelty, simplicity and sheer beauty of its argument, Ariel Rubinstein picks this as his favourite Nash paper. Me too! Nash’s proof of the theorem eschews dense formalism and uses mostly words and diagrams. It has the kind of lyrical quality G.H. Hardy rhapsodised about in his book, A Mathematician’s Apology (Hardy’s examples of mathematical beauty draw upon elementary proofs devised by the ancient Greeks). Theoretical papers today often couch even trite points in a highly technical cloak, failing to take inspiration from Nash’s elegant and minimalist approach to both modelling and reasoning.

Before Nash, economists had developed sophisticated models of market exchange under conditions of competition (when each buyer or seller can choose from many trading partners) as well as one-sided monopoly. Situations of bilateral monopoly, where two agents have no alternative but to make some kind of deal with each other, remained largely beyond the discipline’s analytical reach. It was thought that the outcome cannot be theoretically pinned down. For example, Edgeworth’s analysis of exchange economies identified a set of outcomes (the contract curve) as possibilities.

The first contribution of the bargaining paper lies in the marvelously succinct modelling. Nash abstracted away from all contextual detail and associated each possible outcome or deal with the utilities it gives to the players. He then made some eminently reasonable assumptions regarding what kind of deal the players may make. The second contribution of the paper is its striking theorem. Nash proved that in any bargaining problem, there is only one deal among the many possible ones, which satisfies all the assumptions he made. It is the one where the product of net utilities of the players is the highest. Without breaking a sweat, the theory yields a sharp prediction that can be easily computed by solving a simple optimisation problem.

Interestingly, 20 years before Nash, Zeuthen arrived at the same solution to the bargaining problem but starting from a rather ad hoc specification of how the players must adjust their demands (see Friedman). Nash’s approach is far more transparent and compelling. It shows the importance of theoretical foundations.

Nash equilibrium

The bargaining problem, as formulated by Nash, is an example of what he called a cooperative game. What players can do and when, what they know, etc. are not explicitly modelled. The implicit assumption is that players can make binding agreements as to how they will play the game and the focus is on what agreement they may come up with. The other approach to understanding strategic interaction is to build a model laying out all the details and then apply a ‘solution concept’ or a theory about how rational players will make their individual choices. Nash termed this non-cooperative game theory and it is in this branch that he made his most well-known contribution.

The framework for non-cooperative game theory had been laid out some years ago in John von Neumann and Oscar Morgenstern’s 1944 magnum opus, Theory of Games and Economic Behavior. Von Neumann and Morgenstern’s attempt to build a predictive theory of how rational players might play a game culminated in the minimax theorem. However, its applicability was limited to zero sum games, where one player’s gain always comes at the expense of an equivalent loss to other players. In his Ph.D. dissertation, Nash proposed his alternative solution concept (in zero sum games, it coincides with minimax) and proved that it exists in all finite games. In one fell swoop, game theory was generalised.

The problem of thinking about strategic interaction is that each player’s best course of action depends on what other players will do. When a player tries to guess the choices of others, he must realise that their choice, in turn, depends on their guess about what he himself will do. This quickly leads to an infinite loop of double guessing and triple guessing which is well illustrated in this scene from The Princess Bride. To escape this vortex (that demands what the hero in the clip calls a ‘dizzying intellect’), Nash introduced a bold assumption into his definition of equilibrium – each player will correctly guess his opponents’ strategies and react accordingly! The equilibrium concept then boils down to a vector of strategies that are best responses to each other.

The precursors and followers of Nash

It is interesting to reflect on what exactly is Nash’s contribution to non-cooperative game theory. He did not uncover any empirical facts to motivate or support the theory. He did not help build the general framework either. Much of the credit for that goes to John von Neumann, Harold Kuhn and John Harsanyi. Mathematicians are often bemused that Nash achieved so much fame for his (mathematically) trivial work on game theory rather than his deeper contributions to pure mathematics such as the isometric embedding theorem. Nash’s Ph.D. dissertation was only 27 pages (Kuhn quipped that it was 18 pages too long) and when he showed his game theoretic work to von Neumann, the brilliant Hungarian retorted, “But that’s just another fixed point theorem!” Indeed, it is a straightforward application of a result by Shizuo Kakutani.

The immense value of Nash’s work derives not from ingenious modelling, deep analytical insight or discoveries based on data. The gem to be found there is a mere definition – that of his equilibrium concept. It is utterly lacking in mathematical heft but pregnant with a million possibilities when applied to social science (Nash’s illustrious contemporary, mathematician John Milnor, acknowledges this graciously). It is an idea that is simultaneously most surprising (it eluded the great von Neumann) and most natural (it was almost immediately adopted by all game theorists). Many of Nash’s contemporaries must have felt like Thomas Huxley who, upon hearing about Darwin’s theory, is said to have remarked, “Why didn’t I think of that?”

Actually, some people had thought of that long before Nash. Cournot, in his analysis of oligopolistic markets and Hotelling, in his study of spatial competition, constructed game theoretic models and used what we recognise today as Nash equilibrium to solve them. It seems, on the face of it, that Nash cannot even lay claim to originality!

Yet, note the observations of Jorge Louis Borges in his mischievous sketch “Kafka and His Precursors”:

[I]f Kafka had never written a line, we would not perceive this quality (in earlier writers)…The fact is that every writer creates his own precursors. His work modifies our conception of the past, as it will modify the future.”

Roger Myerson, in his very insightful essay on Nash, makes essentially the same point. Cournot and Hotelling had stumbled upon the concept of equilibrium while trying to solve their specific problem but they failed to understand the universality and power of the idea. Having called upon its services once, they paid it no more attention and moved on. Nash, a man perpetually on an intellectual gold-rush looking for difficult unsolved problems, recognised that in a simple concept lay the key to unlock the mysteries of strategic interaction of all kinds.

The impact of Nash’s idea has been great and economic theorists have devoted a lot of energy to refining and applying his concept. Although Nash spent only a short time studying game theory, it is remarkable how much of the subsequent developments he anticipated. I will give three examples.

First, Nash seems to have had a glimpse of the application of his ideas to the study of evolutionary dynamics or learning processes. The standard interpretation that a Nash equilibrium is the product of hyper-rational thought processes makes it empirically suspect. There has been much research subsequently on whether cognitively limited players can ‘learn’ to play Nash equilibrium by adjusting their strategies using sensible rules of thumb, or whether natural selection can yield a population distribution of strategies that resembles a (mixed strategy) Nash equilibrium (the answer is a qualified yes). The “mass action interpretation” of his equilibrium concept that Nash provides in his dissertation (p. 21-22) foreshadows this line of enquiry.

Another pre-occupation of the game theory literature has been the task of ‘refining’ the concept of Nash equilibrium to eliminate outcomes that seem implausible especially in dynamic games. One technique for achieving this is to introduce small perturbations like mistakes or payoff shocks into the game. In his 1953 Econometrica paper where he sought to give a non-cooperative foundation to his cooperative bargaining solution (which is part of the enterprise known as the Nash program), Nash first used a perturbation argument to narrow down the set of equilibria.

Finally, a popular trend in recent years has been the use of laboratory experiments to illuminate the empirical scope of game theory or provide feedback on how the theory should be developed. Here too, Nash is a pioneer. His 1953 paper with John Milnor and others is probably the first instance of a laboratory experiment in game theory.

Nash is a true original, marking a turning point in the history of social science. He created his precursors as well as his followers.

Impact factor

The development of non-cooperative game theory has left two lasting impacts on the discipline of economics. First, it has led to what is sometimes called the imperialism of economics – its tendency to coopt topics traditionally studied by sociologists, political scientists or psychologists. The theoretical paradigm economists used before the arrival of game theory was price theory, whose scope is limited to the production, distribution and consumption of material goods. Game theory not only made it possible to analyse market structures like oligopoly, it opened up the possibility of exploring topics like voting behaviour, intra-household conflicts, social norms and problems of self control or motivation. Economists of course bring their own methodological and philosophical predilections to the study of these subjects, sometimes to the annoyance of other social scientists. Nash must share a big part of the credit or blame for this development. This point is also stressed by Myerson.

The second big impact of game theory is that it made the discipline of economics politically less conservative by providing the tools to understand the limitations of markets. The apotheosis of price theory is the fundamental welfare theorems, which reflect Adam Smith’s idea of the invisible hand – markets will allocate resources efficiently. Even externalities like pollution, once thought to be the source of inefficiency, could theoretically be overcome through negotiations and contracts among individuals, without any intervention by the State (the Coase theorem).

Game theory quickly made economists realise that markets could shut down if there is asymmetric information between buyers and sellers (see George Akerlof’s paper on lemons markets), there could be wasteful use of resources in signalling activity (like advertising or conspicuous consumption) or rent-seeking behaviour (such as political lobbying), and predatory actions by firms could lead to monopolisation. The simple game called prisoners’ dilemma illustrates in a compelling way how rational individual behaviour may not lead to an optimal outcome for society. This is a strong antidote to the powerful metaphor of the invisible hand. Game theoretic analysis also helps us understand many reasons for government failure, so the general political stance it inspires is one of agnosticism. Whether to rely on markets or government appears to be a judgment that must be made on a case-by-case basis. The field of macroeconomics has not incorporated game theoretic lessons very enthusiastically, which is why it still remains more instinctively pro-market.

Behavioral economics: A challenge to game theory?

Two emerging fields within economics seem to have posed a challenge to game theory in some people’s eyes. These are experimental and behavioural economics. Starting with the important work of Daniel Kahneman and Amos Tversky, research has found that when ordinary people are asked to play even simple games in the laboratory, their behaviour is often quite different from what a simple-minded game theoretic analysis would predict. The phrase ‘simple-minded’ must be emphasised.

Let me get a common defense coming from game theorists (one that has some merit) quickly out of the way. Laboratory experiments are usually conducted with very small monetary stakes on inexperienced subjects (most often undergraduates in Western universities), while serious applications of game theory address interactions among experienced players playing for high stakes (example, business managers battling over market share). This might make a difference. A good illustration of this is the following. In simple zero sum games played in the lab, actual play can stray quite far from a mixed strategy Nash equilibrium (see Ochs). Yet, in high-level professional sports like soccer and tennis, Nash’s solution concept does a remarkably good job of predicting behaviour (see Walker and Wooders and Chiappori, Levitt and Groseclose).

The more important point is that game theory, in itself, is devoid of empirical content unless it is combined with auxiliary assumptions about the specific game environment and the motive of the players. Experimental results caution us on two fronts: one is related to players’ preferences and the other to their cognitive abilities. In experiments on dictator games, for example, subjects given full power to allocate a pot of money often leave a considerable fraction to an anonymous partner rather than taking everything themselves. This suggests people may not be purely selfish and money-minded – a statement about their preferences. Other experiments have found that subjects sometimes suffer from the framing effect (answers depend on how a question is phrased) or confirmation bias (people filter out data that does not support their prior beliefs) – a statement about their cognitive abilities.

The general framework of game theory places some restrictions on preferences (such as the expected utility property) but the axiom that people are preoccupied with their own wealth is not part of that framework. It is an auxiliary assumption made in many applications but it is also increasingly common to encounter models that introduce some form of altruism or non-monetary motives like image or anxiety avoidance. At any rate, it is an assumption that can be dropped easily. Cognitive limitations, such as the inability to calculate probabilities correctly, pose a much greater challenge. The core of Nash equilibrium – the hypothesis of fulfilled strategic expectation – will not withstand players’ lack of sophistication.

Behavioural economics loosely refers to a new modelling approach that supposedly takes the experimental data seriously. It is interesting that many of the well-known papers introduce innovations in preferences but otherwise embrace the logic of Nash equilibrium ever more tightly. Two examples are Laibson’s model of time-inconsistent preferences (that explains phenomena like procrastination) and Rabin’s model of fairness (that explains why people sometimes reject bargains even at a cost to themselves). The model of time inconsistency actually turns decision theory into game theory – the analysis proceeds as if the decision-maker is playing games against her own future self and employs refined Nash equilibria to understand that interaction. Rabin makes payoffs depend directly on strategic anticipation (I feel generous towards you if I think you will be generous towards me) but does not abandon the assumption that anticipations turn out to be correct.

Perhaps the true essence of the social world is that of mutually incompatible beliefs and expectations. Maybe we live on disconnected cognitive islands. A fruitful analytical framework for a world like this is yet to be found. More than half a century after Nash published his two-page note in Proceedings of the National Academy of Sciences, its main idea remains the only game in town.

Conclusion

The ironies of John Nash’s life and work are difficult to miss. A man who found social interaction difficult in personal life developed our canonical model of social interactions. A man who influenced so many minds across the world lost his own. The opening chapter in Nasar’s biography recounts a visit from one of Nash’s colleagues to his psychiatric ward. After a long silence, the colleague confronts Nash with the question how he, the great theorist of rationality, could arrive at such delusional thoughts. Nash’s reply is memorable: “The same way I arrived at my theorems.” In his autobiographical note prepared after winning the Nobel prize, Nash says that his recovery is “not entirely a matter of joy” since it “imposes a limit on a person’s concept of his relation to the cosmos.”

Perhaps those whom the gods want to bless they first drive mad.

Photo courtesy: Peter Badge / Typos1 (OTRS submission by way of Jimmy Wales) [CC BY-SA 3.0 (http://creativecommons.org/licenses/by-sa/3.0)],

via Wikimedia Commons.

04 June, 2015

04 June, 2015

Comments will be held for moderation. Your contact information will not be made public.