The 2020 farm laws have been opposed by several farmers due to their possible use for corporate takeover of agriculture, removal of APMC mandis, and dilution of minimum support price and public procurement. This article examines the impact of repealing the Agricultural Produce Marketing Committee Act in Bihar in 2006 on the state’s agricultural indicators – as a test case for the potential impact of the Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act.

The agitation over the 2020 farm laws has continued even during the second wave of Covid-19, mostly about the Farmers’ Produce Trade and Commerce (Promotion and Facilitation) (FPTC) Act. This Act allows farm produce to be bought and sold at any place – within APMC (Agricultural Produce Marketing Committee) mandis (markets) or outside. The opposition to the FPTC Act rests on the view that it is no less than a trojan horse for corporate takeover of agriculture, an excuse for removal of APMC mandis, and dilution of MSP (minimum support price), and public procurement1.

Among the diverse views on FPTC, one fact stands out: lack of a robust empirical analysis backing the arguments in favour or against. Before the FPTC Act, several states have attempted legislations like it, particularly in enabling transactions outside of APMC mandis (Table 1). There are important lessons to learn from these experiments. Assuming power in Bihar in 2005, one of the first acts of Nitish Kumar government was to repeal the APMC, making Bihar the first state to do so.

Table 1. Progress of market reforms at the state level

|

Reform |

Adoption by states |

|

Model Agricultural Produce and Livestock Marketing (Promotion and Facilitation) (APLM) Act, 2017 (13 states have adopted fully, and three states have adopted partially) |

|

|

Bihar has repealed APMC Act, whereas Kerala, Manipur, Daman and Diu, Dadra and Nagar Haveli, Lakshadweep, and Andaman & Nicobar, have no APMC Act, 2003. |

|

|

Though model APLM Act is not adopted by any state except Arunachal Pradesh, many reforms suggested in it have been adopted by states to varying degrees either by partial adoption of model APMC Act, 2003, or by amendment in own Act. |

|

What have the impacts of this radical policy reform been? Which groups have benefitted or suffered? We explore these questions in our research (Saroj et al. 2021). A major concern is that Bihar may have chosen to repeal the APMC Act because the state had not sufficiently invested in it in the first place (Intodia 2011, World Bank, 2005)2 . As the choice to repeal the APMC Act may not be ‘random’, we turn to non-experimental methods to assess its impacts.

Measuring the impact of repealing the APMC Act

We seek to assess the causal impacts of repealing the APMC Act on the agricultural market, and subsequently farmer-level outcomes in Bihar. We face several challenges in this estimation. Repealing the APMC Act is a policy change that is specific to Bihar. With just a single state executing this policy, an accurate inference from statistical analysis is difficult, and perhaps impossible (Abadie et al. 2010, Autor et al. 2008, Buchmueller et al. 2011). We, therefore, adopt a quantitative case-study approach and use the synthetic control method (SCM)3, devised precisely to address such situations (Abadie et al. 2010).

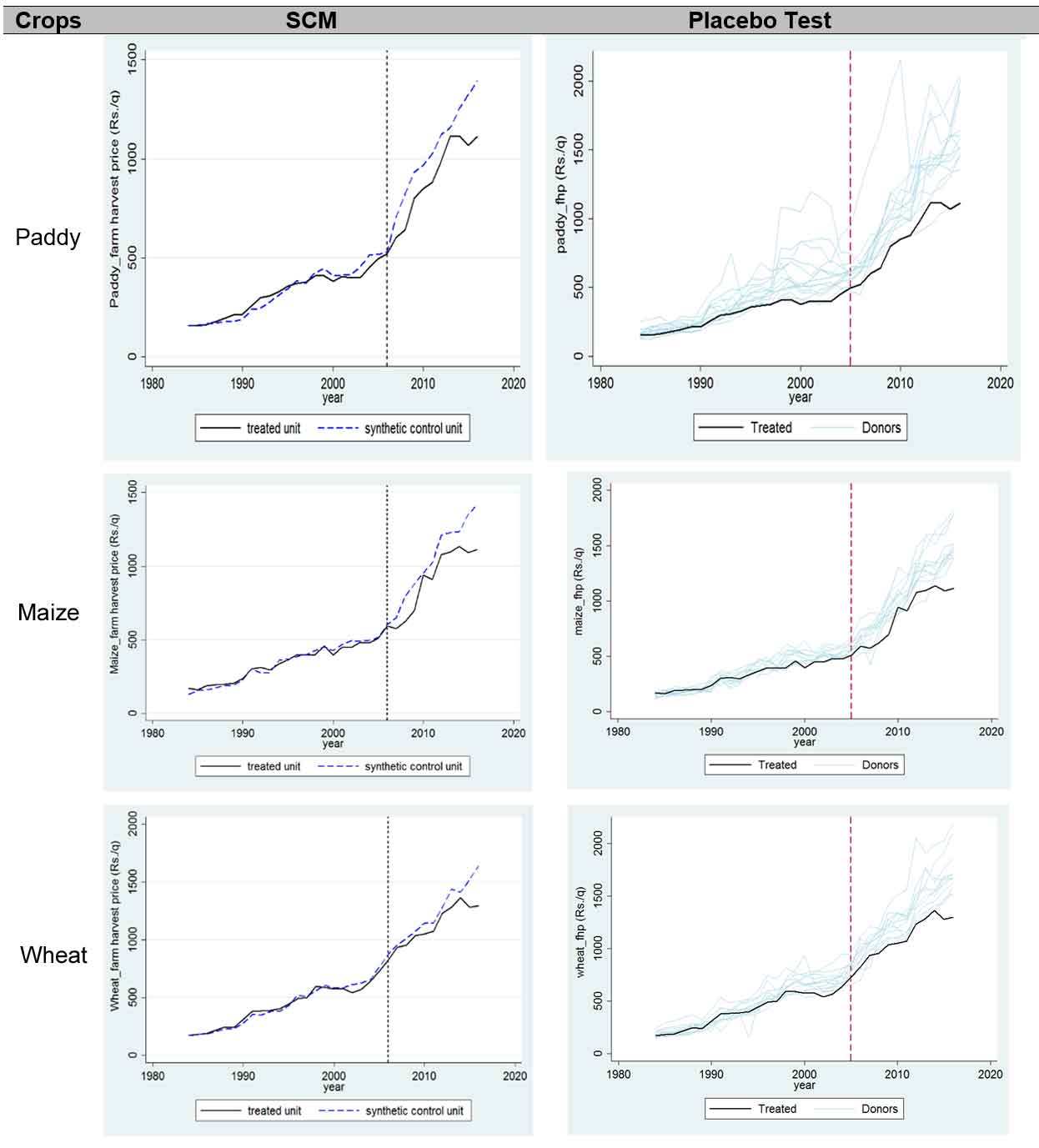

Figure 1 below shows the causal impacts on farm harvest prices (FHP)4 for select commodities, by comparing the actual case of Bihar and ‘synthetic’ Bihar. We find that the repeal did not bring about any measurable change in market-level outcomes of paddy, wheat, and maize. There are no market-level effects for pulses or perishables either. We also analyse wedges between retail-wholesale, retail-farm harvest, wholesale-farm harvest, and MSP-farm harvest prices to assess market efficiency (in cereals, maize, pulses, and vegetables). The estimates show that none of these are impacted by the APMC repeal in a significant way.

Figure 1. Price impacts of repealing APMC Act on paddy, wheat, and maize

Note: The right panel presents ‘placebo tests’ where artificial interventions are applied to control states (those not subjected to the intervention in reality), and outcomes of Bihar are compared to the placebo run. Bihar does not stand out from other states, implying insignificant effects.

In the period after the APMC repeal, other confounding changes also occurred in Bihar. First, there was a change is the system of decentralised partial procurement of cereals, particularly rice. In Bihar, even though procurement took place, it was mostly below MSP. Hence, relative to states where price was closer to MSP, in relative terms the price accruing to Bihar farmers was subpar on a trend basis. Second, there was ‘dumping’ (in a trade sense) of rice, after the National Food Security Act (NFSA), 2013, where a significant amount of rice was brought in from the Central Pool at prices much below marginal cost. Third, strong technological improvement in maize occurred in this period. As Bihar increasingly exported maize to other states, it necessitated import parity to hold (maize prices in Bihar would need to be comparatively low for exports to occur) (Figure 3). Notably, maize is the only crop where Bihar’s productivity was higher than national average in this period.

Outcomes at the farmer level

At the farmer level, by employing panel data5 from Commission on Agriculture Costs and Prices (CACP) and using difference-in-difference6 methods, we find impacts on FHP that varies by crop7.

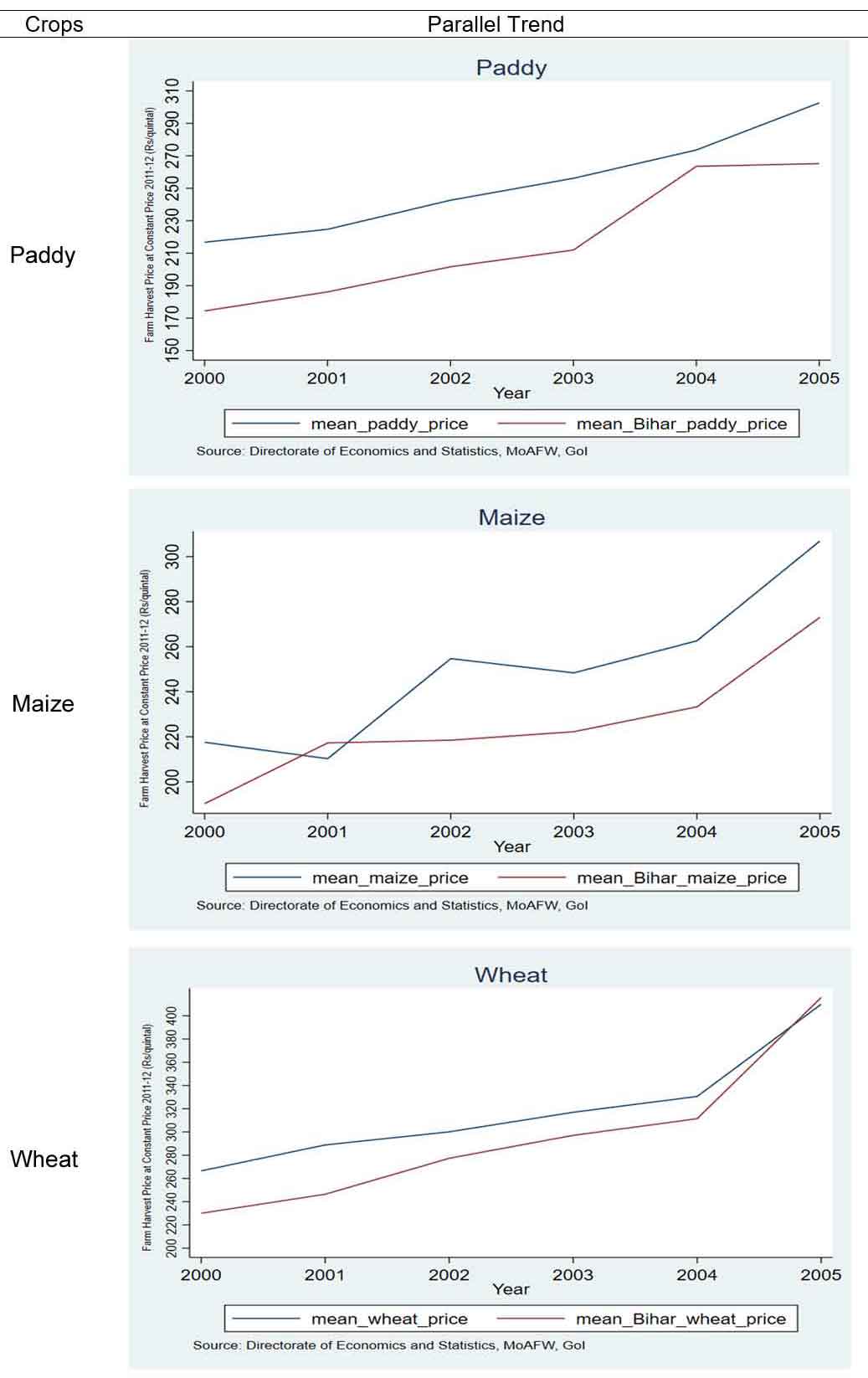

Figure 2 shows that barring wheat, prices of paddy and maize behaved in a similar fashion in Bihar as in other states. With such parallel trends, the difference in unit values post-2006 may be attributed to the reform, depending on other time-varying factors such as technology, policy, or extent of markets remaining constant.

Figure 2. Behaviour of unit values in paddy, wheat, and maize

Table 2 shows that the period following the APMC repeal is associated with lower FHP, and revenues/profits of paddy farmers in Bihar relative to comparable farmers in other states. On the other hand, for maize, the repeal led to the entry of new private investors in the state and brought more competition that would help farmers realise better prices and higher value, owing to improved market efficiency8. Table 2 shows that post-repeal, maize farmers’ revenue/profits go up differentially and there is increased use of hybrid seeds, machinery, fertilisers, and even casual workers.

Table 2. Estimates of impacts on farmer-level outcomes of paddy and maize

|

Outcome at constant price 2011-12 (in Rs. per hectare) |

Crops |

Coefficient |

|

Revenue |

Paddy |

-8,346.2*** |

|

Maize |

9,443.2*** |

|

|

Profit (revenue minus cost A2) |

Paddy |

-3,252.7*** |

|

Maize |

9,687.9*** |

|

|

Casual workers |

Paddy |

-1,673.2*** |

|

Maize |

652.4*** |

|

|

Hired machine |

Paddy |

-194.9*** |

|

Maize |

82.7 |

|

|

Owned machine |

Paddy |

-87.1*** |

|

Maize |

-90.3 |

|

|

Seeds |

Paddy |

-168.8*** |

|

Maize |

641.4*** |

|

|

Fertilisers |

Paddy |

-378.9*** |

|

Maize |

544.5*** |

|

|

Hired irrigation |

Paddy |

431.8*** |

|

Maize |

1,121.0*** |

Notes: (i) p-value is the probability of getting results at least as extreme as the results observed, given the assumption that the null hypothesis is true. A p-value lower than a mentioned significance level would be considered statistically significant (if p < 0.01, it is statistically significant at the 1% level). (ii) *, **, and *** indicate statistical significance at the p < 0.10, p < 0.05, and p < 0.01 levels, respectively. (iii) A2 refers to the costs that the farmer pays for buying various inputs such as seeds, fertilisers, pesticides, hired workers, hired machinery, and leased-in land.

Understanding the case of Bihar and drawing lessons

Even after foundational reform in agricultural markets, Bihar continued to lack adequate marketing infrastructure. Prior to the reform, the World Bank (2005) ranked Bihar third-last amongst states in marketing infrastructure and fourth-last in farmers’ satisfaction with existing market conditions.

There are lessons from differences in outcomes across commodities. Paddy is cultivated mostly for self-consumption in Bihar with limited procurement by public agencies. Bihar had emerged as a maize hub even before 2006. In 2012-13, Bihar’s maize exports crossed 1 million tonnes. In 2012, when world corn prices peaked, Bihar maize was US$ 10-15 cheaper than the running price in Southeast Asia, due to a location advantage (two-month time for South American shipments). The export boom benefitted Bihar’s farmers and market reforms contributed to this.

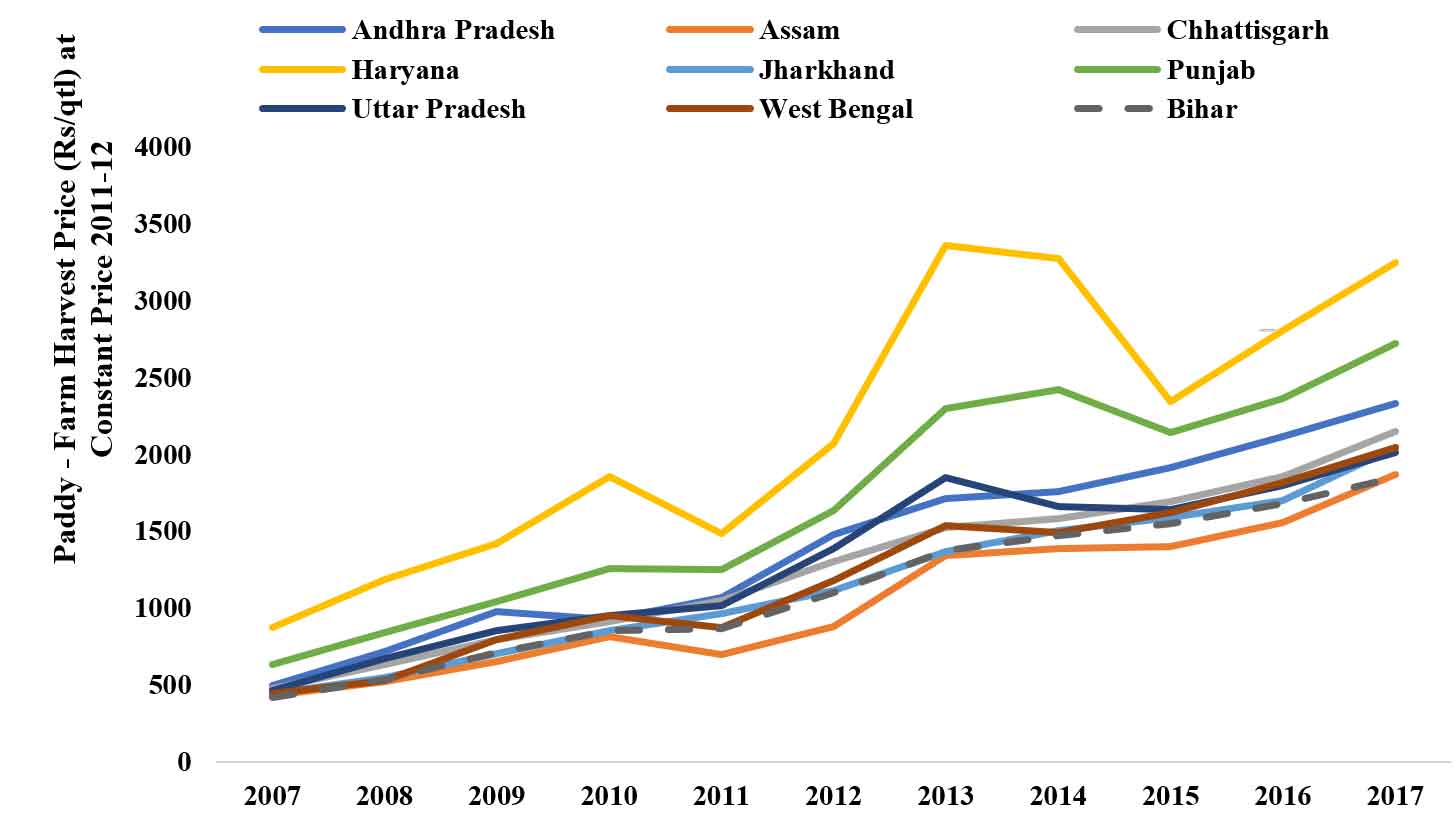

The outcomes in paddy tell a far more nuanced story. Post the repeal in 2006, in real terms, paddy FHP has been going up secularly in Bihar but also in other states (Figure 3). However, in relative terms, Bihar’s paddy FHP has turned out to be lower. The impact estimates based on changes in Bihar relative to control states show negative effects. This difference is due to better procurement systems and tighter anchoring of FHP to MSP in control states vis-à-vis Bihar (time-varying unobserved factors that are unaccounted in the difference-in-difference analysis)9. Procurement in Bihar remains a small fraction of marketable surplus, and sales are overwhelmingly between farmers and traders at farm gate outside of the APMC mandis. In 2019, only 5.5% of Bihar farmers sold to government agencies – a characteristic that has remained unchanged with reforms (Chatterjee et al. 2020)10.

Figure 3. Farm harvest prices of paddy after 2006 across states

Farm price compression from augmented supply

One other pathway for the effect on FHP can be thought of as general-equilibrium effects11 of the NFSA. In paddy, Bihar is self-sufficient and only one million tonnes are procured. More than three million tonnes of rice are pushed into Bihar from the Central Pool. This large increase in supply is expected to bring down prices. To assess this external effect, we repeat the difference-in-difference estimation for NFSA intervention in 2013. Table 3 shows the effect on paddy FHP after NFSA. Due to dumping, FHP is found to be lower by about Rs. 111 per quintal.

Table 3. NFSA impact on cereal FHP in Bihar

|

Impact of NFSA (post 2013) in Bihar |

||

|

Outcome Indicators |

Crops |

Coefficient |

|

Farm harvest price (INR per quintal) |

Paddy |

-111.602*** |

|

Wheat |

5.497 |

|

|

Net profit (INR per hectare) |

Paddy |

-5,350.576*** |

|

Wheat |

-4,250.217*** |

|

|

Production (quintal) |

Paddy |

-0.203 |

|

Wheat |

1.646 |

|

|

Area (hectare) |

Paddy |

-0.037** |

|

Wheat |

0.006 |

|

|

Net profit (INR per quintal) |

Paddy |

41.775*** |

|

Wheat |

34.020** |

|

Concluding remarks

The aim of repealing the APMC Act in Bihar was to create new markets and attract private investment in agricultural markets and improve infrastructure. However, we find that private markets did not emerge. Estimates show that market-level outcomes including measures of market efficiency were not causally impacted. In terms of farmer-level outcomes, we see contrasting impacts for maize and cereals. In the case of maize – where entry of private sector has been significant and there is market pull from livestock sector in other states – the repeal reduced transaction costs, brought in disintermediation, and improved farmer outcomes.

In states such as Punjab and Haryana, where MSP-based procurement takes place, most transactions occur inside an APMC mandi, while in Bihar, majority of the transactions are conducted either at the farm gate or in informal local markets. Other effects could possibly come from lower quality of marketing infrastructure as the finance mechanisms such as mandi taxes and fees cease to exist in Bihar.

A priori, it is very hard to tell whether the repeal of APMC Act in Bihar, is favourable for the farmer or not. In terms of lessons for other states, several states resemble Bihar in some ways like dominant crops and average land sizes. Yet there are important differences in terms of farmer, market, and location characteristics. For paddy, Bihar has comparatively low yields, and the local market is thin. With low productivity, it is harder to access farther markets. The outcomes for maize show the importance of reforms and the role of demand from commercial production in other states. Given trading costs, it is possible to access distant market only when there is high productivity – as recent innovations in trade literature have demonstrated.

I4I is now on Telegram. Please click here (@Ideas4India) to subscribe to our channel for quick updates on our content.

Notes:

- Open-ended procurement refers to the process whereby foodgrains are offered by farmers within a stipulated procurement period, and in accordance with quality specifications of Government of India; this is purchased at MSP by government agencies including Food Corporation of India for the Central Pool.

- In Bihar, an area of 400 square sq. kms is served by one wholesale market as against 156 sq. km. in Punjab and 318 sq. km. in West Bengal.

- Synthetic control is a statistical method used to evaluate the effect of an intervention in comparative case studies. It creates a ‘synthetic’ version of the units that received the intervention by weighting variables and observations in the group that did not.

- For farm harvest price, we have taken the period from 1984 to 2016. Data source is Directorate of Economics and Statistics, Ministry of Agriculture and Farmers Welfare, Government of India.

- Panel data measure the same set of observations (individuals in this case) repeatedly across time.

- A technique to compare the evolution of outcomes over time in similar groups that gained access to an intervention with those that did not.

- FHP from CACP gives unit values based on locality-based reference prices and not prices at which actual market exchange occurs.

- Gulabbagh mandi in Purnea, a hub of maize, has its contract listed on NCDEX (National Commodity & Derivatives Exchange). It attracts MNCs (multinational corporations) like Skylark, Cargill, Roquette, and Louis Dreyfus (Chatterjee et al. 2020) who manage their own supply chains, and have invested in warehousing, research, and input markets. Increasingly, smaller traders from different states visit Gulabbagh and set up offices there. Such changes were likely possible only because of the APMC repeal.

- The negative effect is expectedly smaller after dropping Punjab, Haryana, and western UP from the control group.

- Kapur and Krishnamurthy (2014), based on fieldwork in Ara and Bhiya, reveal that most farmers were not even aware of the APMC repeal.

- General-equilibrium effects are the indirect impacts of an intervention/policy due to the reaction of prices to the intervention/policy based on interactions in multiple markets.

Further Reading

- Abadie, Alberto, Alexis Diamond and Jens Hainmueller (2010), “Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California’s Tobacco Control Program”, Journal of the American Statistical Association, 105 (490): 493-505. Available here.

- Autor, David H, Lawrence F Katz and Melissa S Kearney (2008), “Trends in U.S. Wage Inequality: Revising the Revisionists”, The Review of Economics and Statistics, 90(2): 300-323. Available here.

- Buchmueller, Thomas C, John DiNardo and Robert Valletta (2011), “The Effect of an Employer Health Insurance Mandate on Health Insurance Coverage and the Demand for Labor: Evidence from Hawaii”, American Economic Journal: Economic Policy, 3(4): 25-51.

- Chatterjee S, M Krishnamurthy, D Kapur and M Bouton (2020), ‘A Study of the Agricultural Markets of Bihar, Odisha and Punjab’, Center for the Advanced Study of India, Final Report.

- Intodia, V (2011), ‘Investment in Agricultural Marketing and Market Infrastructure – A Case Study of Bihar’, National Institute of Agricultural Marketing (NIAM), National Report. Available here.

- Kapur, D and M Krishnamurthy (2014), ‘Understanding Mandis: Market Towns and The Dynamics of India’s Rural and Urban Transformations’, CASI Working Paper Series: 14-02, International Growth Centre (IGC).

- World Bank (2005), ‘Bihar-Towards a Development Strategy’, World Bank Report.

11 June, 2021

11 June, 2021

By: Ecotonic Solar Pvt Ltd 12 June, 2021

Thank You For The Info https://ecotonic.co.in/