To examine the response of debt holders to the Mandatory Corporate Social Responsibility, this study by Jitendra Aswani looks at debt pricing for firms impacted by the Indian Companies Act 2013 and its CSR rule. It finds that mandatory CSR counteracted the benefits accrued by other provisions of the Act. CSR negatively impacts cash flow thereby increasing the yield and yield spread for the bonds issued by those firms. However, firms are rewarded for reducing information asymmetry about their CSR expenditure.

In academic discussions of Corporate Social Responsibility (CSR), it is commonly acknowledged that markets are not always capable of efficiently pricing and providing public goods. However, it is emphasized that firms cannot and should not be expected to voluntarily act in socially or environmentally responsible ways and should focus on profit maximization. Managing externalities and providing public goods is the role of governments, who hold their position due to public preferences and democratic empowerment. This separation of corporate and government responsibility toward society is commonly referred as the classical dichotomy (Friedman 1970).

Recently research has shifted from debating the existence of CSR to examining its impact on the economy, shareholder value, and stakeholder welfare. Research in this area concentrated on understanding the motive of CSR – whether value creation (a win-win scenario), delegated philanthropy (Benabou and Tirole 2010), or manifestation of agency problems. However, in all these studies, CSR is voluntary, and therefore it is hard to disentangle the motivation that drives the results. To address this limitation, in a recent paper (Aswani 2023) I examine the influence of CSR on debt markets in India, where the government has imposed a mandatory CSR spending requirement for profitable firms. This unique setting allows me to investigate how mandatory CSR affects the pricing of debt securities.

Empirical strategy

As per the mandatory CSR rule outlined under the Indian Companies Act 2013, if during any fiscal year a firm either has (i) a net worth of Rs. 5,000 million (about US$ 83 million) or more; (ii) sales of Rs. 10,000 million (about US$ 167 million) or more; or (iii) a net profit of Rs. 50 million (about US$ 830,000) or more, it is required to spend 2% of its average net profits of the last three years on CSR related activities.

Using the bond issuances from three years before the enactment date (29 August 2013) to three years post, I used difference-in-differences and multi-dimensional regression discontinuity design (RDD) techniques1 to investigate the impact of mandatory CSR on the yield, yield spread, and the amount issued. The analysis excluded preferred stock issues and bonds with features such as step-up and convertible bonds to ensure the focus remained on standard bond issuances. The firm characteristics were collected from the Centre for Monitoring Indian Economy's ProwessDx database. Due to the absence of the main identifier (the International Securities Identification Number, or ISIN) for many Indian firms in the Securities Data Company database, a merging process was conducted by utilizing fuzzy matching techniques based on firm names, followed by manual verification of the matches. This meticulous process resulted in a final sample size of 183 firms and a total of 2,413 bond issues analysed over a six-year period spanning from 2010 to 2016. In the sample there are 2,352 bonds by firms affected by the mandatory CSR rule and 61 bonds by unaffected firms2.

Findings

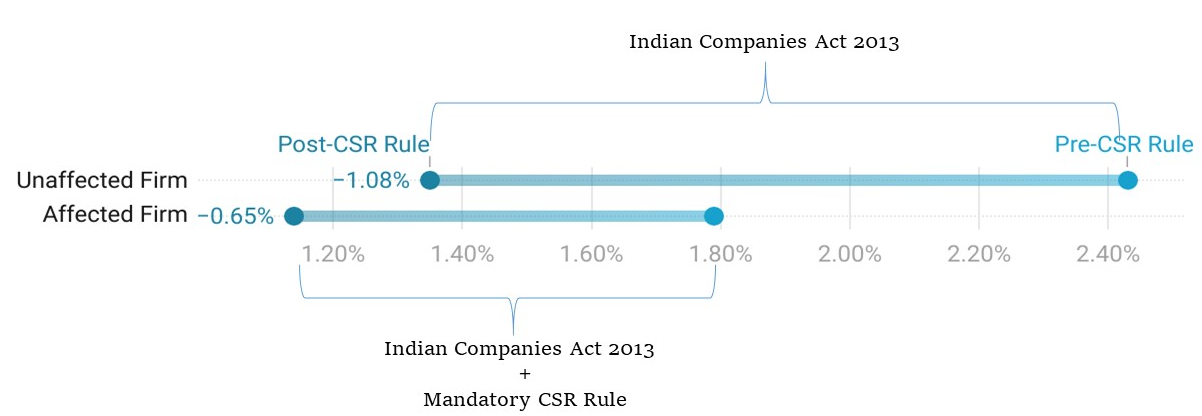

Empirical analysis shows that the mandatory CSR rule increases the yield spread by 43 basis points3 for the affected firms compared to others (see Figure 1), forcing these companies to pay a greater interest rate to entice investors. Debundling the impact of other requirements of the Act from mandatory CSR rule reveals that while the Act helped reduce the yield spread, the mandatory CSR rule counteracted those benefits for the affected companies. Adjusting for bond characteristics, firm characteristics, and industry-fixed effects using difference-in-differences specification, the yield spread of bonds issued by affected firms increased by 103 basis points compared to bonds issued by unaffected firms.

Figure 1. Debundling the mandatory CSR rule from the Indian Companies Act 2013

To ensure the accuracy of these results, I conducted a multi-dimension regression discontinuity design to identify the varying effects of the rule on firms that just met the CSR cutoff compared to those that narrowly missed the cutoff. This allowed for a more precise examination of the effects of the CSR rule on these specific sets of firms. The results indicated that the yield and yield spreads for bonds issued by firms that just met the criteria were higher than the yield and yield spreads for bonds that just missed meeting the CSR criteria. The mandatory CSR had a significant impact on pushing yield spreads upwards.

To further investigate, I analysed the impact of each of the three criteria used to determine whether a firm is subject to the CSR mandate and found that bonds issued by firms that were subject to mandatory CSR spending based on any one of the individual criteria4 also had higher yields and yield spreads. Further analysis reveals that the mandatory CSR rule impacted the yield and yield spread through the future free cash flow (FCF). Implementing CSR activities using 2% of the profits resulted in a decrease in FCF, which led to an increase in yield and yield spread.

There appears to be a discrepancy in the cost of debt of companies affected by the CSR rule, which I believe is due to a lack of transparency in CSR spending. To investigate this issue, I gathered data from the National Stock Exchange Infobase on CSR expenditure, which provides information on firm-level spending, the categories of CSR projects, the amount allocated and spent, and the geographic location of these projects. While the data doesn't provide information on the amount spent on individual projects, it does reveal that 80-90% of affected firms spent less than required under the CSR rule due to its ‘Comply and Explain’ basis,5 and that 40-50% of CSR projects and 60-65% of CSR spending is focussed on poverty, healthcare, education, and rural development.

To test whether reducing information asymmetry on CSR expenditure disbursement is rewarded by the debt market, I analyzed the details on CSR expenditure and found that affected firms which disburse an amount close to prescribed and disclose the name of the agencies used for CSR expenditure are penalized less by the debt market. This supports the argument that firms are rewarded by the capital markets for reducing information asymmetry regarding CSR amount disbursement. It's important for firms to be transparent about their CSR spending, as this can have an impact on their cost of debt.

Conclusion

Overall, the research exhibits that firms affected by mandatory CSR rule in India experienced an increase in their cost of debt compared to other firms. While other requirements of the Companies Act helped reduce the cost of debt, the mandatory CSR rule counteracted those benefits for the affected companies. A structural framework reveals that an increase in the cost of debt is driven by the negative impact of mandatory CSR on expected cash flow. This effect is more pronounced with repeat issuances but marginally reduces for firms that maintain transparency about CSR disbursement. These findings illuminate debt market dynamics in relation to CSR provisions.

Notes:

- A difference-in-differences strategy is used to compare the evolution of outcomes over time in similar groups, where one was impacted by an event or policy, while the other was not. Regression discontinuity design is used to estimate the effect of an intervention when the potential beneficiaries can be ordered along a cut-off point. The beneficiaries just above the cut-off point are very similar to those just below the cut-off. The outcomes are then compared for units just above and below the cut-off to estimate the causal effect of the intervention.

- As there is a big variation in number of bonds between affected and unaffected firms, to ensure robustness, results include conducting a propensity score matching (PSM). PSM is a statistical technique to construct an artificial control group by matching each treated unit with a non-treated unit of similar characteristics. It can help estimate the impact of a program or event for which it is not feasible to randomise.

- One basis point is 1/100th of a percent and is commonly used to measure movements in interest rates.

- If a firm meets any of the three thresholds in the Companies Act, a firm is counted as affected by mandatory CSR. However, additionally, the analysis is also extended to firms which only crossed one threshold and not the other two. For instance, there will be firms which crossed the ‘profit’ threshold and not the ‘net worth’ and the ‘sale’. Same for ‘net worth’ and ‘sale’. In all the three subsets, the yield and yield spread increased. However, results are more significant for firms that meet the ‘profit’ threshold.

- ‘Comply or Explain’ principle provides that a company is to comply with a code's provision. If it does not do so, then it is to state that it does not, and should explain why it does not.

Further Reading

- Aswani, J (2023), ‘Debt Markets Retort to Mandatory Corporate Social Responsibility’, Working Paper.

- Bénabou, Roland and Jean Tirole (2010), "Individual and Corporate Social Responsibility”, Economica, 77(305): 1-19.

- Friedman, M (1970), ‘A Friedman doctrine-- The Social Responsibility of Business Is to Increase Its Profits’, The New York Times, 13 September.

23 August, 2023

23 August, 2023

Comments will be held for moderation. Your contact information will not be made public.