For countries like India where large numbers of small- and medium-sized firms cannot access formal credit and face widespread bureaucratic corruption, long-run survival and consequent distributional implications are important. Based on firm-level micro-data, this article shows that obstacles, as perceived by firms in the form of corruption and access to finance, jointly reduce their probability to innovate.

While the implications of actual obstacles like corruption have been studied extensively in view of the negative influence on a firm's prospect and growth, a recent literature is exploring if perceptions about obstacles are equally damaging for important aspects of business. Indeed, one such aspect receiving attention is about how perception of obstacles influence innovation activities for firms (for example, Pellegrino and Savona 2017, Mancusi and Vezzuli 2014, Iammarino et al. 2009, Tiwari et al. 2008).

For a country like India where the scope of formal businesses is still limited by bureaucratic red-tape and rent-seeking by regulators (Kar et al. 2020), prevailing perceptions regarding obstacles could be treated as important signals. It is reasonable to assume that firms will perceive obstacles to accessing credit since even in recent times as low as 10% of the population has access to formal credit (World Bank, 2017). With a tightly controlled and risk-averse banking practice1 (see Bhaumik and Piesse 2005), shallow stock markets2, and negligible presence of corporate debt market (Guha-Khasnobis and Kar 2008) firms in India, particularly medium to small firms, are usually credit-constrained. A survey by American Express finds that 42% of small and medium enterprises (SMEs) consider access to finance to be a vexing problem. Coupled with this, corruption in India is a major issue with a long history widely documented in the literature (Heston and Kumar 2008, Krueger 1974). Transparency International (2018) ranks India at 78 along with countries like Kuwait, Turkey, Ghana, Burkina Faso, etc. Thus, firms are likely to perceive corruption as an obstacle as well. Naturally, the real barriers are considerably different from perceived barriers and here we focus on how the behavioural responses to information flows influence tangible outcomes – in this case, the likelihood of innovation among firms in India.

In theory, perception of a particular obstacle on its own may both deter and enhance the innovation efforts of firms. Prevalence of high corruption can dissuade firms from innovation, since corruption in general hurts growth and lowers the returns from innovation for entrepreneurs (for example, Dutta and Sobel 2016, Anokhin and Schulze 2009, Glaeser and Saks 2006). However, Holmstrom (1989) had already shown that innovative firms might be the ones that are more willing to bribe their way ahead of other firms. Later, Ayyagari, Demigurc-Kunt, and Maksimovic (2014) also offer similar findings. Therefore, perceptions of higher corruption3 (as compared to the difficulty associated with getting finance) might make a firm innovate more, or at least, not dampen the probability significantly. But what happens when firms perceive both obstacles? Do they continue to innovate? There is no prior about whether the situation worsens when both (negative) perceptions get stronger, and lead to decay of firms. This warrants empirical testing. The many possible outcomes associated with subsequent production reorganisation, as well as, employment and returns to capital and land constitute the overall impact for the economy.

Data

Our data source for this study is the World Bank Enterprise Survey Database. The specific dataset used from the said database is the 2014 Enterprise Survey data for India. The firm-level data was collected between June 2013 and December 2014. The data set consists of 9,281 firms from 23 major states of India. Firms, as represented in the sample, belong to 26 different industries like food, textiles, garments, leather, wood, paper, chemicals, etc. Among service industries, major services like hotels and restaurants are included. Our main dependent variable is based on the question: ‘In the last three years, has this establishment introduced new products or services?’ The variable takes the value 1 if the answer is ‘yes’ and 0 otherwise. Of the 9,281 surveyed firms, about 44% say ‘yes’. It is seen that some of the most innovative industries are electronics (57%), leather (56%), hotels and restaurants (54%), and garments (52%).

One of the key factors expected to influence the response to the above question is the perceived difficulties in accessing finance for firms. The variable is constructed on the basis of the following question: ‘How much of an obstacle is access to finance?’ As stated in the Survey, difficulty in accessing finance by firms includes availability as well as cost, interest rates, fees, and collateral requirements. The Survey categorises difficulty in accessing finance under five heads: no obstacle, minor obstacle, moderate obstacle, major obstacle, and very severe obstacle. The variable generates a hierarchical order ranging from 0 to 4 with higher numbers indicating greater difficulty in accessing finance. The average response for the variable is about 1.2. Almost 60% of the firms in the sample have 'access to finance' scores of 0 or 1 suggesting that they perceive relatively low difficulty in accessing finance.

As introduced above, the other variable of interest is the perception about corruption among firm-owners. The specific question asked is: ‘how much of an obstacle is corruption?’ For the firms, corruption typically pertains to issues around licensing, adherence to rules and regulations, maintenance of proper accounts, and so on, and these – individually or in combinations – leading to harassment by regulators, tax officials, auditors, and rent-seekers in general. The average response for the sample of firms is around 3.2. The response of a large majority of firms (approximately 46%) was 2 or 3, suggesting that they perceive corruption as a moderate to major obstacle.4

Perceived obstacles jointly decrease a firm’s likelihood to innovate

The main results show that neither of the perceived obstacles – access to finance or corruption – affects the probability to innovate on its own and, in fact, can actually facilitate if the other factor rises (better perception regarding credit) or falls (better perception about corruption) at a given level of one factor.5 However, the highlight of our contribution is the finding that perceived obstacles jointly decrease a firm’s likelihood to innovate. With worse perceptions about corruption, a firm is less likely to innovate when it also senses a higher obstacle to accessing finance and vice versa, albeit the effect of corruption perception is generally stronger of the two.

To augment the policy debate, we do find that the results are robust when we control for SMEs, holding large firms as the baseline. Further, since export-oriented firms are more likely to innovate, we also test for the percentage of sales constituting export by the firm. Our results remain valid. Are more experienced firms and those from large cities and premium locations equally susceptible to this perception-driven problem? We find that these tend to become less innovative as well when perceptions regarding access to finance worsen and as the sense of corruption all around gets bleaker. However, if these perceptions turn into actual incidences, do we still have a relation? To verify, we replace the data on perception with actual incidences of obstacles and find a direct match.

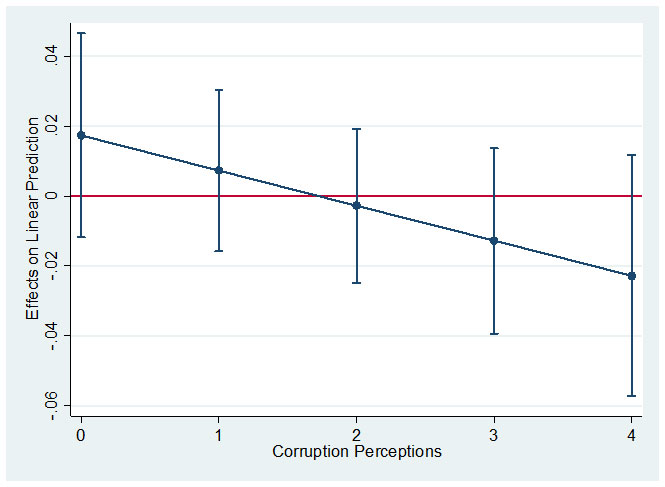

To understand the results better, we compute marginal effects. What this means is that we estimate how a firm’s probability to innovate is affected by a unit rise in its perception about difficulty in accessing finance, for weak and strong corruption perceptions. We find that when firms perceive weak corruption levels, its probability to innovate is not affected even if it perceives marginal rise in difficulties in accessing finance. It is only when corruption perceptions become strong that the firm is likely to innovate less as it senses greater difficulties in accessing finance. (Figure 1)

Figure 1. Marginal effect of perceived difficulties in accessing finance on probability of innovation, by perceived corruption levels

In terms of policy, our study offers some directions for possible intervention which must begin with reassurance, mainly via information flow, from the public authorities regarding their willingness to curb corruption among officials. In addition, bank and non-bank financial institutions should also take into cognisance that by relaxing credit constraints – for now the perception of it – facing SMEs should be win-win for all the stakeholders in this game. It is well-known that financial institutions shy away from financing smaller businesses and at the same time complain about lack of businesses. The businesses resort to high-cost private sources of finance owing to what we observed as the perceived hurdles. Therefore, a Pareto-improving reallocation is perfectly feasible under the circumstances, perhaps with an initial public intervention, to be sustained on its own thereafter.

Notes:

- India’s banking practice has overwhelmingly nationalised public sector undertakings.

- Bombay Stock Exchange and National Stock Exchange together have less than a fifth of the domestic market capitalisation of NYSE (New York Stock Exchange); World Federation of Exchanges, 2018.

- Analogously, perceptions about credit unavailability could, in theory, dissuade firms from approaching financial institutions and deter drives towards innovation if it requires large investments, or push them for more if innovation is mainly about production reorganis

- Analogous to the other variable, that is, difficulty in accessing finance, the survey categorises corruption as an obstacle in five levels: no obstacle, minor obstacle, moderate obstacle, major obstacle, and very severe obstacle.

- The empirical model (probit fixed effect model) takes into account factors specific to industries or states (‘fixed effects’) that can affect the probability to innovate. Additionally, we consider different estimation methodologies to ensure that causation runs from perceived obstacles to probability to innovate and not the other way round (method of causal ‘identification’).

Further Reading

- Anokhin, Sergey and William S Schulze (2009), “Entrepreneurship, innovation, and corruption”, Journal of Business Venturing, 24(5):465-476.

- Ayyagari, Meghana, Asli Demirguc-Kunt and Vajislov Maksimovic (2014), “Who creates jobs in developing countries?”, Small Business Economics, 43:75-99.

- Bhaumik, S and J Piesse (2005), ‘The Risk Aversion of Banks in Emerging Credit markets: Evidence from India’, William Davidson Institute Working Papers Series WP774, William Davidson Institute at the University of Michigan.

- Dutta, Nabamita and Russel Sobel (2016), “Does corruption ever help entrepreneurship?”, Small Business Economics, 47(1):179-199.

- Glaeser, Edward and Raven Saks (2006), “Corruption in America”, Journal of Public Economics, 90:1053-1072.

- Guha-Khasnobis, B and S Kar (2008), ‘The Corporate Debt Market – A Firm-Level Panel Study for India’, in B Guha-Khasnobis and G Mavrotas (Eds.), Financial Sector Development for Growth and Poverty Reduction, 190-211, Palgrave, New York.

- Heston, Alan and Vijay Kumar (2008), “Institutional Flaws and Corruption Incentives in India”, The Journal of Development Studies, 44(9):1243-1261.

- Homstrom, Bengt (1989), “Agency costs and innovation”, Journal of Economic Behavior and Organization, 12(3):305-327.

- Iammarino, Simona, Francesca Sanna-Randaccio and Maria Savona (2009), “The perception of obstacles to innovation, foreign multinationals and domestic firms in Italy”, Revued’économieindustriell, 125(1):75-104.

- Kar, Saibal, Biswajit Mandal, Sugata Marjit and Vivekananda Mukherjee (2020), “Seeking Rent in the Informal Sector”, Annals of Public and Cooperative Economics, 91(1):151-164.

- Krueger, Anne O (1974), “The Political Economy of the Rent-Seeking Society”, American Economic Review, 64(3):291-303.

- Mancusi, Maria Luisa and Andrea Vezzulli (2014), “R&D and credit rationing in SMEs”, Economic Inquiry, 52(3):1153-1172.

- Pellegrino, Gabriele and Maria Savona (2017), “No money, no honey? Financial versus knowledge and demand constraints on innovation”, Research Policy, 46:510-521.

- Treisman, Daniel (2000), “The causes of corruption: A cross-national study”, Journal of Public Economics, 79(3):399-457.

- Tiwari, A, P Mohnen, F Palm, S Schim van der Loeff (2008), ‘Financial constraint and R&D investment: evidence from CIS’, in C van Beers, A Kleinknecht, R Ortt and R Verburg (Eds.), Determinants of Innovative Behaviours: A Firm’s Internal Practice and Its External Environments, Palgrave Macmillan, 217-242.nnovation is mainly about production reorganisation.

10 June, 2020

10 June, 2020

Comments will be held for moderation. Your contact information will not be made public.