When women’s participation in agriculture increases relative to men, does the intra-household distribution of consumption become more gender-equitable? Is there a positive impact on children’s access to consumption resources within households? This article analyses 2011 Consumption Survey Data and finds that regions where geographical conditions favour greater participation of women in agriculture, have significantly higher shares of consumption resources among both women and children within the household.

Greater involvement of women, relative to men, in agriculture has positive gendered effects – research has found that it improves child-sex ratios in favour of female children (Rosenzweig and Schultz 1982, Qian 2008, Carranza 2014), and reduces the prevalence of female seclusion (Miller 1982). However, whether women's increased relative participation in agriculture also raises their bargaining power within the household and reduces the gender gap in intra-household resource allocation for consumption, has remained largely unexplored. Further, it is not known whether children’s access to consumption resources would improve in this context. In our recent study (Bandyopadhyay and Maity 2023), we attempt to answer these questions. Understanding this is relevant as female empowerment is a complex phenomenon and better outcomes for women in one dimension may not necessarily translate to favourable outcomes in others (Anderson 2023).

Soil texture and women’s involvement in agriculture

Historically, women have been more likely to work in agriculture where clayey soil is the dominant soil texture. This is because such soils are not amenable to extensive ploughing – a task mainly carried out by male workers – as compared to loamy soil types (Carranza 2014). Alesina et al. (2013) provide evidence about the influence of plough agriculture on gender norms that are biased against women.

In our analysis of the impact of women’s relative participation in agriculture on intra-household resource allocation, we use soil texture as an indicator of the demand for female workers in agriculture in a region. This is because if we directly look at women’s relative participation in agriculture and how it affects intra-household resource allocation, there may be several factors that influence both of these and we will not be able to establish a causal relationship. For example, existence of pro-female attitudes can lead to more work participation among women as well as more equitable intra-household distribution of consumption resources. On the other hand, variation in soil texture is considered to be ‘exogenously’ determined through millennia of geological metamorphism and remains unaffected through land use (Carranza 2014).

We classify districts into ‘clayey’ and ‘loamy’ soils in the following way: If the percentage of the district's land area under cultivation is at least as large as the median of the distribution of the percentage of area under clayey soil at the district level, then the district is considered to be a ‘clayey soil’ district. Accordingly, all other districts are categorised as ‘loamy soil’ districts.

Estimating intra-household consumption distribution

Now, a key problem in estimating an individual’s share in household consumption is the lack of consumption data at the individual level, as consumption expenditure surveys almost always report consumption at the household level. Further, using per capita expenditure is also problematic as it assumes equal sharing of consumption resources within the household. To overcome this problem, we use the framework of the collective household model and apply a very recent structural estimation methodology proposed by Lechene, Pendakur and Wolf (2022) to estimate the share of household consumption expenditure allocated to each individual household member (henceforth, resource share) that explicitly takes into account potential differences in preferences1 and bargaining power among individual household members.2 Assuming that there is no inequality among individuals of any type (that is, there is no inequality among women in the household and analogously for men and children), we examine the per person resource share of each type of individual to measure within-household differences in resource shares using the National Sample Survey (NSS) Consumption Expenditure data (2011).

Findings

Across regions with varying soil textures, and hence varying potential involvement of women in agriculture relative to men, perfect equality in intra-household resource allocation is ruled out – men have the highest per person resource share and children have the lowest. This indicates that conventional per capita consumption expenditure that is used by policymakers to understand poverty prevalence masks important inequalities that prevail within households. Yet, there are important differences by soil textures. In comparison to loamy soil districts, the average per woman resource share is found to be higher in clayey soil districts by about 14%; while the average per man resource share is lower by 5% in households when children are present (MWC households). The average resource share per child also appears to be about 12% greater in clayey soil districts than in loamy soil districts. When concentrating on households without children (MW households), we find that the average resource share per man is 2% higher in clayey soil districts than in loamy soil districts, while the average resource share per woman is roughly 9% higher in these districts.4

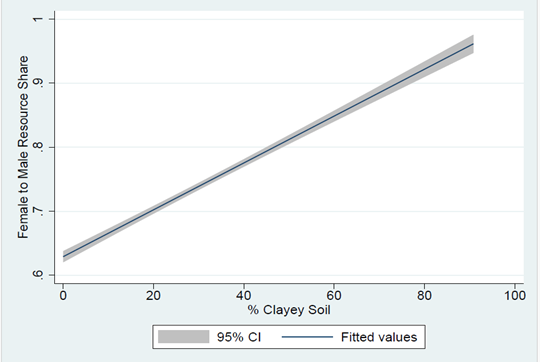

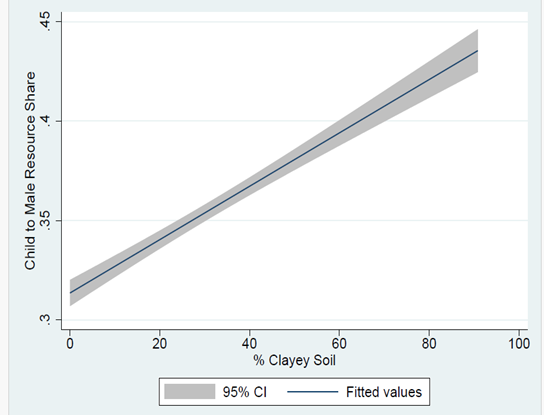

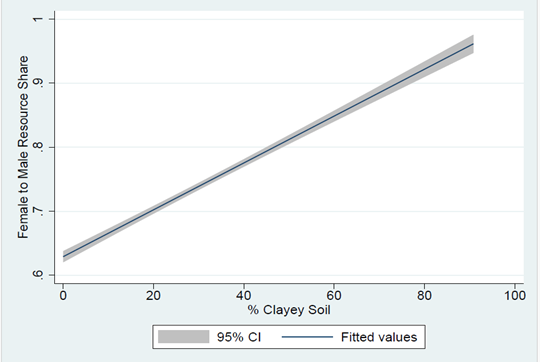

For ease of exposition, we use the ratio of per woman to man and per child to man resource shares as alternative measures of within-household relative bargaining powers of women to men and that of children to men respectively, following Calvi (2020). We examine how the relative bargaining powers of women and children to men vary with the overall percentage of clayey soil in the district’s area.

Figure 1. Percentage of clayey soil in district and relative bargaining power

a) Women's to men's bargaining power in MWC households

b) Children's to men's bargaining power in MWC households

c) Women's to men's bargaining power in MW households

Notes: (i) Relative bargaining power (of women or alternatively children) is measured as per person resource share relative to men. (ii) A 95% confidence interval (CI) is a way of expressing uncertainty about estimated effects. Specifically, it means that if you were to repeat the experiment over and over with new samples, 95% of the time the calculated confidence interval would contain the true effect.

Source: National Sample Survey (NSS) Consumption Expenditure Data, 2011.

Our results show that women and children benefit more from clayey soil texture concentration than men do. Higher resource shares for children in clayey soil districts reflects the potentially beneficial impacts that women’s involvement in economic activities has on children (Qian 2008, Carranza 2014, Maity 2020). We also find a statistically significant positive correlation between clayey soil percentage and the bargaining power of women and children (relative to men).

Gender gaps in poverty

We calculate per-capita expenditure for men, women, and children using the model-predicted resource shares. We compare these results to benchmarks of US$3.10 per day for average poverty and US$1.90 per day for extreme poverty. We observe that, in contrast to the scenario of equitable distribution of household resources, the percentage of households with ‘poor’ women is higher and the percentage of households with ‘poor’ males is lower across all soil textures. Yet, when we move from loamy to clayey soil textures, the percentage of households with poor males rises and that of households with poor women falls. However, no noticeable difference in child poverty4 is found across soil textures.

For instance, when we focus only on households with children (MWC households) and take the average poverty line as our point of reference, the percentage of households in clayey soil districts with poor men and women is 25% and 50%, respectively. In regions with loamy soil, however, 55% of households have poor women and only 19% have poor men. As we move from clayey to loamy soil textures, we also find evidence of diminishing male poverty and rising female poverty, even with the extreme poverty line as the benchmark. In households without children, clayey soil types also result in a decrease in the gender gap in intra-household poverty.

Rural versus urban

Though it is more evident in rural areas where agriculture is the primary occupation, favourable soil texture also has a significant effect on the intra-household distribution of consumption resources in urban areas. In comparison to loamy soil types, women's relative bargaining power is found to improve even in urban areas within clayey soil texture regions (as indicated by the ratio of resource shares commanded by each woman to each man). These results highlight the impact of advantageous gender norms for women that extend beyond rural communities and agriculture, stemming from favourable soil textures (Giuliano 2017).

Policy implications

Our findings have important implications for the design of anti-poverty transfer programmes by indicating which households, and importantly which members within the household, would need to be targeted by such policies. Our results show the importance of gender norms arising from greater women’s participation in economic activities in governing within household consumption resource allocation. Policymakers may want to focus on encouraging women’s labour market participation, as it can serve as an important tool for addressing within-household poverty and inequality.

I4I is now on Substack. Please click here (@Ideas for India) to subscribe to our channel for quick updates on our content

Notes:

- As it explicitly takes into consideration the differences in preferences between household members, the model accounts for the various needs of various types of individuals.

- This new methodology builds upon previous work by Browning, Chiappori and Lewbel (2013) as well as Dunbar, Lewbel and Pendakur (2013).

- These differences hold even for districts within the same state and are not limited to the specific definition we use to classify districts by soil texture.

- Child poverty line is typically considered at 60% of the standard poverty line.

Further Reading

- Alesina, Alberto, Paolo Giuliano and Nathan Nunn (2013), “On the origins of gender roles: Women and the plough”, Quarterly Journal of Economics, 128(2): 469–530.

- Anderson, S (2023), ‘The complexity of female empowerment interventions’, Ideas for India, 30 March.

- Bandyopadhyay, S and B Maity (2023), ‘Soil Endowments and Intra-Household Distribution of Consumption in India: A Structural Approach’, Working Paper.

- Browning, Martin, Pierre André Chiappori and Arthur Lewbel (2013), “Estimating consumption economies of scale, adult equivalence scales, and household bargaining power", Review of Economic Studies, 80(4): 1267-1303.

- Calvi, R (2016), ‘Why are older women missing in India? The age profile of bargaining power and poverty’, Ideas for India, 19 September.

- Carranza, Eliana (2014), “Soil endowments, female labor force participation, and the demographic deficit of women in India”, American Economic Journal: Applied Economics, 6(4): 197–225.

- Dunbar, Geoffrey R, Arthur Lewbel, and Krishna Pendakur (2013), “Children's resources in collective households: identification, estimation, and an application to child poverty in Malawi”, American Economic Review, 103(1): 438-471.

- Giuliano, P (2017), ‘Gender: An historical perspective’, National Bureau of Economic Research, Working Paper No. 23635, July.

- Lechene, Valerié, Krishna Pendakur and Alex Wolf (2022), “Ordinary Least Squares Estimation of the Intrahousehold Distribution of Expenditure”, Journal of Political Economy, 130(3): 681–731.

- Maity, Bipasha (2020), “Consumption and Time-Use Effects of India’s Employment Guarantee and Women’s Participation,” Economic Development and Cultural Change, 68(4): 1185-1231.

- Miller, Barbara D (1982), “Female labor participation and female seclusion in rural India: a regional view”, Economic Development and Cultural Change, 30(4): 777–794.

- Qian, Nancy (2008), “Missing women and the price of tea in China: The effect of sex-specific earnings on sex imbalance”, Quarterly Journal of Economics, 123(3): 1251-1285.

- Rosenzweig, Mark R and T Paul Schultz (1982), “Market opportunities, genetic endowments, and intrafamily resource distribution: Child survival in rural India”, American Economic Review, 72(4): 803–815

26 April, 2024

26 April, 2024

Comments will be held for moderation. Your contact information will not be made public.