The process of seeding Aadhaar with bank accounts in order to link welfare schemes and cash transfers with Aadhaar payment systems, created chaos on the ground. In this note, Niklas Wagner and Sakina Dhorajiwala discuss findings from their field study in rural Jharkhand, which reveal that bank employees are unable to cope with the many changes directed from above – much to the chagrin of the most vulnerable sections of people.

“Aadhaar is not mandatory, but compulsory” exclaimed a banker of a regional rural bank in Ranchi district of Jharkhand1. This exclamation summarises the story of the use of Aadhaar in welfare programmes in India. You may choose not to have it, but effectively, you choose not to access any of your welfare rights. The process of seeding the Aadhaar number with bank accounts began in 2013. This seeding between the Aadhaar and bank account made it possible to 'identify' the bank account holder and more importantly to shift customers onto the Aadhaar Payments Bridge System (APBS). This was introduced as an important part of the Jan Dhan–Aadhaar–Mobile (JAM) trinity, a pet project of the Government of India2. Although, Direct Benefit Transfers (DBT) existed even before Aadhaar was introduced, the government has fiercely pushed for linking welfare schemes and cash transfers through Aadhaar-enabled systems, thus making DBT synonymous with Aadhaar-enabled payment systems. The DBT framework involves several agencies such as government departments that implement welfare programmes, the Finance Ministry, banks, the National Payments Corporation of India (NPCI)3, the Unique Identification Authority of India (UIDAI), and the Reserve Bank of India (RBI).

Several of the welfare schemes make cash transfers through the APBS. APBS uses the Aadhaar number as a financial address to transfer welfare benefits into the customers’ bank accounts.

The process involves three steps for a successful transfer of payment:

- Correct seeding of Aadhaar in the government database (for example, linking a worker's labour card to the Aadhaar),

- Correct seeding of the Aadhaar with the person's bank account,

- Correct mapping of the Aadhaar number and bank on the mapper created by the NPCI.

Effectively, there are multiple places where the information must be correctly entered for the transfer of payment to be successful. The experience in Jharkhand reveals that this seeding process was undertaken coercively, in a haphazard manner without any consideration of the immense hardships it will cause to some of the most marginalised populations of the society. Consent norms were frequently flouted, which caused immense confusion among the account holders as to where their Aadhaar was mapped and where the benefits were being transferred. The desultory nature of the exercise was both a result and a consequence of the lack of a robust technical infrastructure. Finally, the lack of any grievance redressal system and feedback mechanism, exacerbated issues for beneficiaries, and further diluted the already weak accountability norms.

In this note, we begin by explaining the different purposes for which banks in Jharkhand have been using Aadhaar. Subsequently, we share the findings of a study undertaken in rural areas of Ranchi district to examine the extent of the irregularities in the Aadhaar seeding process. We finally conclude with some points for further policy discussion.

The usage of Aadhaar in banks in Jharkhand

In Jharkhand, banks collect a copy of Aadhaar card for the following purposes:

- Officially valid document (OVD): For opening a bank account, an identity proof and proof of address are required. The Aadhaar card serves both purposes.

- Seeding the bank account: The process of seeding Aadhaar to the bank account seeds the customer’s UID to their customer ID in the bank’s database. This is sometimes used interchangeably with the term ‘linking’. For consistency, we have used the term ‘seeding’ throughout this note.

- Mapping the UID in the NPCI Mapper: According to the NPCI, mapping is a “process of associating a Bank with Aadhaar number which is facilitated by NPCI for Direct Benefit Transfer (DBT) to the respective Bank who have linked the Aadhaar Number to a specific Bank account for receiving Direct Benefits to which customer has given the consent”.

In other words, the Aadhaar number is used as a financial address of the customer. Therefore, a citizen can provide their Aadhaar number instead of their bank account, and the money would be transferred to the account which was mapped most recently to their Aadhaar number. This process is implemented through the APBS4.

According to the NPCI, banks ought to take two different forms of informed consent: (a) seeding – at the bank’s end, and (b) mapping – to enter the details onto the NPCI mapper to enable cash transfers through ABPS into the seeded bank account.

Relevance and description of the study

While the processes to be followed by banks were briefly outlined in some circulars issued by NPCI and UIDAI, the ground reality paints a very different picture. In order to meet ‘DBT targets’, seeding and mapping happened en masse, in haste, and without proper verification. As a result, payments intended for one beneficiary went into a completely different person's bank account. Such goof-ups from different parts of the country have made news regularly – whether it is the case of community health workers in Chhattisgarh or old-age pensioners in Jharkhand. In Ranchi District, a study found that 16% of the respondents did not receive pensions due to Aadhaar-related issues. Similarly, several people have been victims of rejected wage payments in the Mahatma Gandhi National Employment Guarantee Act (MNREGA)5 and cash transfers in the Public Distribution System (PDS)6.

While these reports are a testimony to some of the problems caused by Aadhaar in welfare delivery, we have tried to understand the implementation of the Aadhaar payments system from the perspective of rural bankers. In particular, their grasp of official rules and regulations, and how these are executed on the ground, were of interest for the study.

The study was conducted in the Ranchi district of Jharkhand, India during December 2018-January 2019. We conducted semi-structured interviews with 31 bank officials and one business correspondent (BC) across 13 blocks of the district. The officials of the 10 different banks7 ranked from bank manager to the operations personnel and a zonal officer. In most cases, the questions were redirected to the staff member who dealt with the Aadhaar seeding and mapping processes within the branch.

The interview questions were aimed at gauging the bankers' knowledge of processes related to Aadhaar such as seeding and mapping, and about the Supreme Court judgement (September 2018) wherein Aadhaar was not considered to be mandatory for opening a bank account, and Section 57 of the Aadhaar Act that allowed biometric authentication for identification by private entities, was struck down.

The preliminary findings presented below, paint a worrying picture and corroborate the news reports mentioned above.

Ground reality

Rural banks in Jharkhand are severely overcrowded. Regardless of the bank location, one observes hundreds of people queuing up for basic services such as cash withdrawal; multiple visits to update one’s passbook is a common occurrence. Banks are acutely short-staffed, and owing to a mix of formal and informal pressure from the central government, banks have had to meet stiff targets for seeding Aadhaar numbers.

Therefore, it is an arduous task for the overworked staff to take informed consent from every customer with targets looming over their heads. Bankers and government officials alike have said that the shift to APBS happened in a targeted manner across Jharkhand. For instance, the MNREGA officials in the block collected the job card numbers, Aadhaar numbers, and bank account numbers of individuals. These lists were then sent as soft copies to the district’s Lead District Manager (LDM), in charge of liaising between the government and banks. The LDM then forwarded these lists to different banks to complete the process of mapping. A senior bank official told us that excel sheets were used commonly for seeding and mapping, leading to significantly high error rates meaning that Aadhaar numbers were seeded with wrong accounts and mapped with the wrong banks. Human errors such as typing the wrong digit or account number beside the Aadhaar number for a particular individual, has led to several cases of misdirection of payments.

As mentioned earlier, Aadhaar seeding and mapping are two different processes and require separately obtained, informed consent by the customer. When the banks made it mandatory to link Aadhaar, multiple accounts of individuals were all linked with Aadhaar without understanding the implications. Banks mapped the customers by default, and the money was transferred to the last Aadhaar mapped bank. Let alone the citizens, 70% of the bankers (19 of the 27 banking staff who answered the question) were unable to tell the difference between 'seeding' and 'mapping with NPCI'. It is instructive to note that the emphasis of the question was not on the words 'seeding' and 'NPCI mapping' but the understanding of the distinction between the two processes. It is obvious then, that if the bank manager is unable to understand the process and norms, the rural citizenry that is largely unlettered, is not going to understand what they are giving consent to, even if asked.

However, taking proper informed consent with an acknowledgement receipt would be a minimal measure to ensure the correct Aadhaar number is seeded and mapped with the correct bank account number (where the beneficiary intends to receive the cash transfer). The lack of this has meant that customers have to go from one place to another to find out where the cash transfer has been made.

This lack of seriousness and clarity about consent rules was demonstrated by the fact that nine out of ten banks did not have the consent form, as prescribed by the NPCI. Some bank officials seemed to know about the obligatory nature of taking consent, however, when asked about the paper form, it was met with a response that, “it is not available right now”, or it was obtained through a search on their system and printed on the spot. It was common practice to collect a photocopy of the Aadhaar card with the signature as 'consent' to seeding and consider that as a de facto consent for mapping as well.

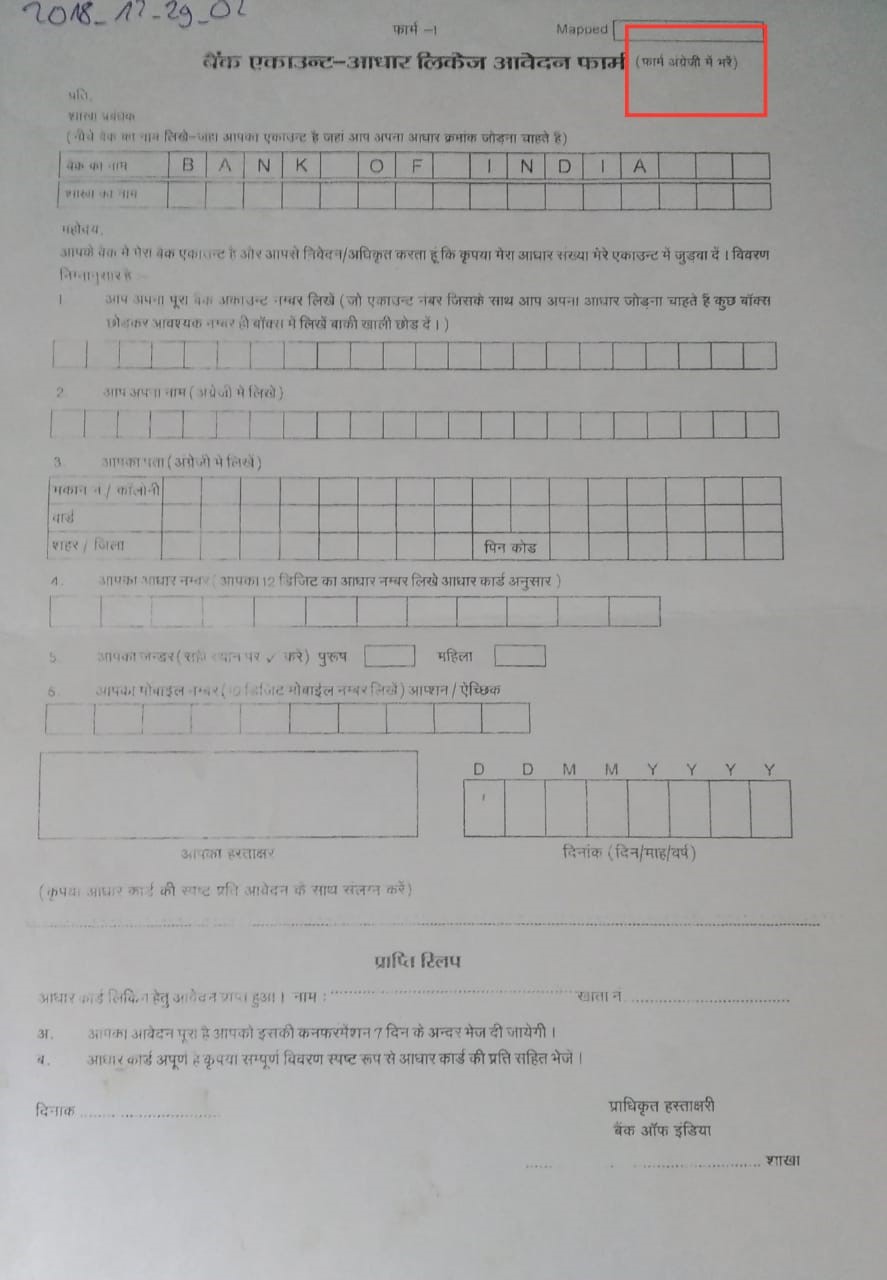

Bankers told us that “it is common practice to map the bank account without the mandate”. The IT system required bankers to change the default option from “no mandate received” to "mandate received” in order to map the bank account with the NPCI. At one of the banks, we saw that in the software used for mapping with NPCI, the field for whether consent was received or not, was not mandatory to fill. Consent, as far as rural citizens are concerned, is a farce. An illustration of this is the Hindi form obtained from one of the banks (see image below). While the form is in Hindi, the customer is instructed to fill it up in English.

During the course of the interviews we asked the bankers, what they thought was the reason for so much confusion about seeding and mapping on the ground. Bankers reported that they received lists with account numbers and associated Aadhaar numbers for seeding, from the government, with targets. To use the words of one of the bankers, “the government created a huge mess by introducing an untested system coercively".

In most cases, there was no time to obtain the consent of customers for seeding or mapping their accounts. Neither was there time to develop an appropriate IT system to ensure that human errors are minimised. Bankers are now grappling with ways to clean up these lists, often manually going through the entire data to check for errors. In part, the electronic Know Your Customer (e-KYC) process was introduced to clean up these errors. e-KYC was a biometric authentication-enabled system, which would at least ensure that the correct Aadhaar number was seeded to the correct account. However, the constant change in the norms around the usage of e-KYC, added to the woes of the bankers and citizens alike.

A study conducted by the Indian School of Business estimates the misdirection of MNREGA payments was as high as 38% between April 2014 and March 2018, wherein one person's wage was deposited in another person's bank account. This had devastating consequences for customers in at least two ways: firstly, they have no way to find out which account has been linked to their Aadhaar, and secondly, in case of wrong linking they often do not receive the benefits for the months until when the correct seeding and mapping happens.

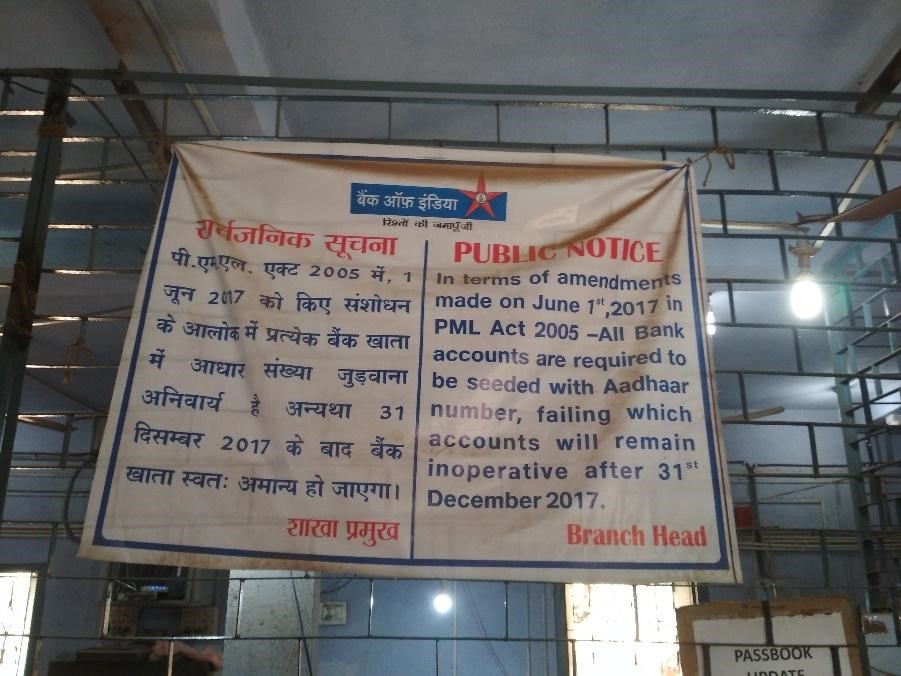

Another contributor to this confusion is the number of changes in the legal requirements without adequate notice. The Supreme Court’s Order that Aadhaar would not be mandatory for opening bank accounts is one such example. In about one-third of the banks interviewed, the ruling seemed to make no difference at all, although many were aware of the verdict of September 2018. One of the bankers told us that the news about Aadhaar not being mandatory anymore was “fake news”. Other bankers repeated several times during the interview that they regard Aadhaar as mandatory in their bank branch. While the staff of Bank of India told us that Aadhaar would not be required anymore, signs on the walls (see image above) indicated the mandatory nature of Aadhaar seeding to the customers. When legal requirements are not understood properly and technology fails, the rights of account holders are at risk.

Another problem frequently mentioned by the bankers was that their customer base consisted of largely unlettered individuals. This not only made understanding instructions printed on forms difficult but gave rise to basic challenges of mismatch of names, wherein, the spelling printed on the Aadhaar card was different from that on the bank account. This meant that the customer would have to go to the Aadhaar enrolment centre, get the spelling rectified on the Aadhaar card, and only then open a new bank account or complete the KYC formalities again. One can only imagine that this would cause immense difficulty for rural citizens, given that bank branches are sometimes up to 30 km away from the village. Someone who is already deprived of their governmental benefit must, therefore, pay the monetary cost of getting to the bank as well as the opportunity cost of not being able to work during this time.

It is important to acknowledge that the presence of local BCs in the village, benefits customers who only want information about their account balance and transact small amounts. Bankers acknowledged this benefit for customers. In 78% of cases they are of the opinion that the benefits outweigh the costs as Aadhaar-enabled banking made life easier for customers. This rate of approval is not surprising given that banks are hopelessly crowded (see image below) and the presence of BCs reduces the footfall at the banks. However, there is not much reason to be optimistic here because in Jharkhand, there have been reports of the BCs routinely overcharging the customers. It is important to note, that BC networks have worked without the use of Aadhaar-based biometrics as well and is certainly worth exploring. Bankers mentioned that electricity and network shortages are especially problematic.

Further discussion

In the light of our study and engagement with payments for welfare programmes in Jharkhand, we would like to conclude with a few points of caution and discussion.

The systematic overhaul making welfare payments through Aadhaar is like a large-scale experiment conducted on the lives of people, who are otherwise heavily dependent on social security programmes for their survival. The entire JAM project has never had the woes of the marginalised in its vocabulary. It has instead been focused on "Maximum Governance and Minimum Government". The aspiration for efficiency has trumped the most basic rights of individuals.

Even in the ‘efficiency’ department, the government's performance has been questionable. Systems were rolled out without supporting infrastructure and a weak understanding of the context. The repercussions of this chaos continue till date. Although the rural bankers also bear the brunt of the immense pressure created by the government, they end up transferring the resentment onto the account holders. The citizens are blamed for not being ‘aware’, when actually, the onus lies on the government and the banks to ensure that the rights of individuals are not violated.

The banking system as a whole considers the welfare account holders as a liability. Services provided to them are not going to yield profit for the bank, and is provided on the behest of the government – is an extremely popular narrative among bankers.

Financial inclusion and service provision to rural areas is an important mandate of the RBI. It is incumbent on the central bank of the country to sensitise the bankers and the government alike on the woes of the rural folk who avail banking services. To that end, the RBI must not only be the nominal regulator of banks, but guarantee the implementation of proactive measures to educate the citizens of their banking rights. It must also ensure that bankers follow norms (for example, taking informed consent), have robust grievance redressal mechanisms, and make it easy for customers to track their payments (for example, which bank account is mapped to Aadhaar for receiving DBT). Welfare systems (including payment systems) must be designed with the citizens and their rights at the centre. The government claims to have saved millions of rupees due to Aadhaar, which begs the question: Why is it that the savings made at the cost of the rural poor have not been reinvested in making better services available to them, and who is benefitting after all from Aadhaar-bank linkage?

The authors would like to thank Jean Drèze for his comments and continued guidance and Rajendran Narayanan for his comments on the draft.

Notes:

- Aadhaar or Unique Identification number (UID) is a 12-digit individual identification number issued by the Unique Identification Authority of India (UIDAI) on behalf of the Government of India. It captures the biometric identity – 10 fingerprints, iris and photograph – of every resident, and is meant to serve as a proof of identity and address anywhere in India.

- Pradhan Mantri Jan Dhan Yojana (PMJDY) is the Indian government’s flagship financial inclusion scheme. It envisages universal access to banking facilities with at least one basic banking account for every household, financial literacy, access to credit insurance, and pension facility.

- The National Payments Corporation India (NPCI) is a non-profit company with the purpose of providing infrastructure to the entire banking system in India for physical as well as electronic payment and settlement systems. It was set up by 10 of the largest Indian banks under the guidance of the RBI.

- For obstacles within the ABPS system, refer to ‘A bridge to nowhere’ by the authors together with Jean Drèze.

- MNREGA guarantees 100 days of wage-employment in a year to a rural household whose adult members are willing to do unskilled manual work at state-level statutory minimum wages.

- Under the National Food Security Act, a large number of poor people in the country receive food grains at affordable prices through the PDS.

- The banks consisted of State Bank of India, Bank of India, Canara Bank, Overseas Bank, Allahabad bank, Jharkhand Gramin Bank, Union Bank, Corporation Bank, Jharkhand State Cooperative Bank, and the Ranchi-Khunti Central Cooperative Bank.

23 August, 2019

23 August, 2019

By: Sahil Ahuja 19 July, 2022

I think govt is talking great step to make digital revolution in India.