In the first article in the Ideas@IPF2023 series, Barnwal and Ryan describe the completion of household electrification in India as a fiscal feat, notwithstanding the persistent losses recorded by electricity distribution companies. They outline the extent of government investments in and bailouts of discoms, losses of revenue and electricity subsidies over the last decades, and propose Direct Benefit Transfers for Electricity as a policy solution based on the preliminary results of a pilot study carried out for the agricultural sector in Rajasthan and Punjab.

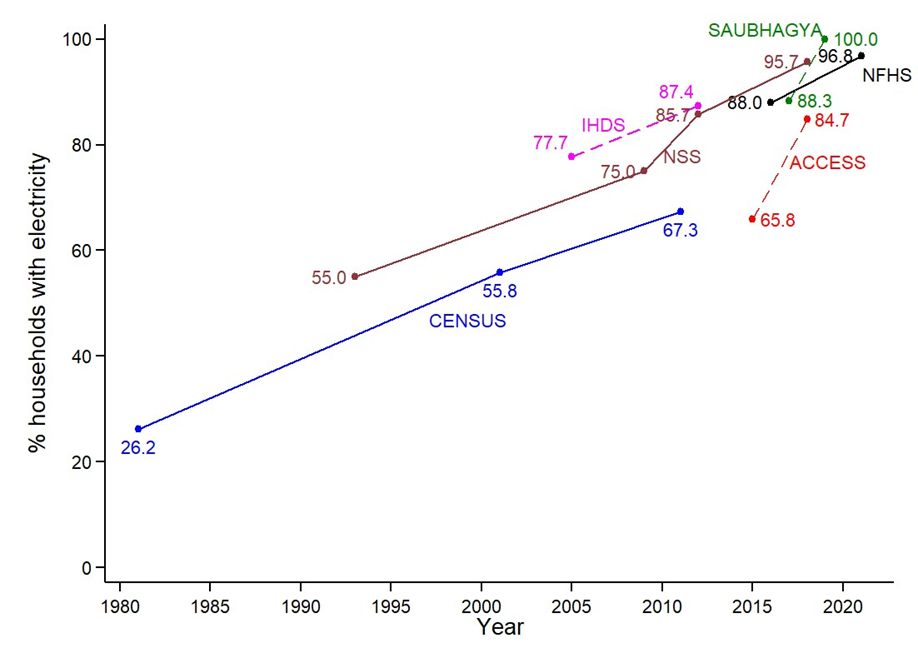

Electrification has been a milestone of economic development for more than a century and electricity continues to find new uses today. In 2019, after decades of effort and investment, the Government of India declared household electrification to be complete (Lakshamanan 2020). The historic completion of household electrification in India has been achieved through large central investments and transfers (see Figure 1). The state distribution companies (discoms) that actually supply electricity to households and businesses continue to run large losses and could not have completed electrification on their own.

Figure 1. Household electrification in India, 1990 – 2021

Sources: i) The data for years 1981, 2001 and 2011 are sourced from CENSUS, and covers all the states. ii) The data for years 2015 and 2018 includes ~9000 households that were covered in the ACCESS survey in Bihar, Jharkhand, Madhya Pradesh, Odisha, Uttar Pradesh and West Bengal. iii) Data for 1993, 2009, 2012 and 2018 is from NSS survey (Drinking Water, Sanitation, Hygiene and Housing Condition in India) and indicates the share of electricity used by households for domestic use. iv) Data from 2016 and 2021 was covered under the National Family Health Survey (NFHS) and indicates the share of population living in households with electricity. v) Data from 2017 and 2019 data captured under SAUBHAGYA indicates the share of houses that were electrified under the scheme, from the total unelectrified households identified under the scheme at the time of implementation. vi) India Human Development Survey (IHDS) provides the data for 2005 and 2012, based on a survey across ~42000 households.

The main risk in the electricity sector in India is that universal electrification and electricity supply for all households and businesses still rests on the unsteady foundation of discom finances. Discoms have little incentive to improve efficiency or reduce losses when they rely so heavily on external support. Gains in electrification and increases in power supply may strain discom finances and lead to increased, rather than reduced, dependence on the Centre and state government transfers.

We study the nature of this dependence and why improving the efficiency of discoms has been an elusive policy goal. Our paper looks at the extent to which recent improvements in discom finances are due to state governments bringing subsidy support for discoms onto their books, rather than to operational improvements in the discoms themselves. The size of state subsidies to discoms has grown rapidly and discom losses remain high when considered before subsidy transfers. The formalisation of subsidies is a positive sign for transparency in the sector but, in and of itself, will not reduce losses or improve efficiency.

In the final section, we recommend the adoption of Direct Benefit Transfers for Electricity (DBT-E) for subsidised consumers in the domestic and agricultural sectors. India has had enormous policy success with DBT programmes for LPG (DBT-L) and with unconditional income support to farmers (PM-Kisan). Ongoing investments in metering and the formalisation of subsidies now make it possible to replicate this success for the far larger subsidies in the power sector. Routing subsidies to consumers is not just a technocratic change, but a structural one, since it would impose fiscal discipline on the discoms and, in turn, urge reductions in costs and losses.

How fiscal federalism impacts electrification

The basic structural problem in the electricity sector is that the dependence of state distribution companies on external support fosters inefficiency and waste. Distribution companies do not bill for a substantial part of the power they supply but have weak incentives to improve, since they expect losses to be subsidised by the states. States, in turn, expect to be bailed out by the Centre. Since 2000-01, there have been at least four large-scale central fiscal bailouts of the power sector, each on the scale of 1 to 1.5% of gross state domestic product (GSDP), amounting to Rs. 35 trillion of expenditure in 2022 rupees.

Central intervention in the distribution sector has expanded electrification but, despite many reform campaigns has never succeeded in imparting a commercial orientation to the discoms (Bhattacharya and Patel 2008, Wolak 2008). Large central investments have fostered large improvements in real outcomes, including electrification rates and power supply. Yet, they have not solved, and may have prolonged, the basic structural dependence of state discoms on the state governments and the central government. State discoms continue to run high operating losses and to perform badly on many measures of efficiency.

Fiscal standing of India’s distribution companies

The main improvement in discom finances over the last decade has been a formalisation of state subsidies. Instead of distribution companies accumulating losses, to be bailed out by the states, they are now increasingly supported by formal subsidies on the state budget.

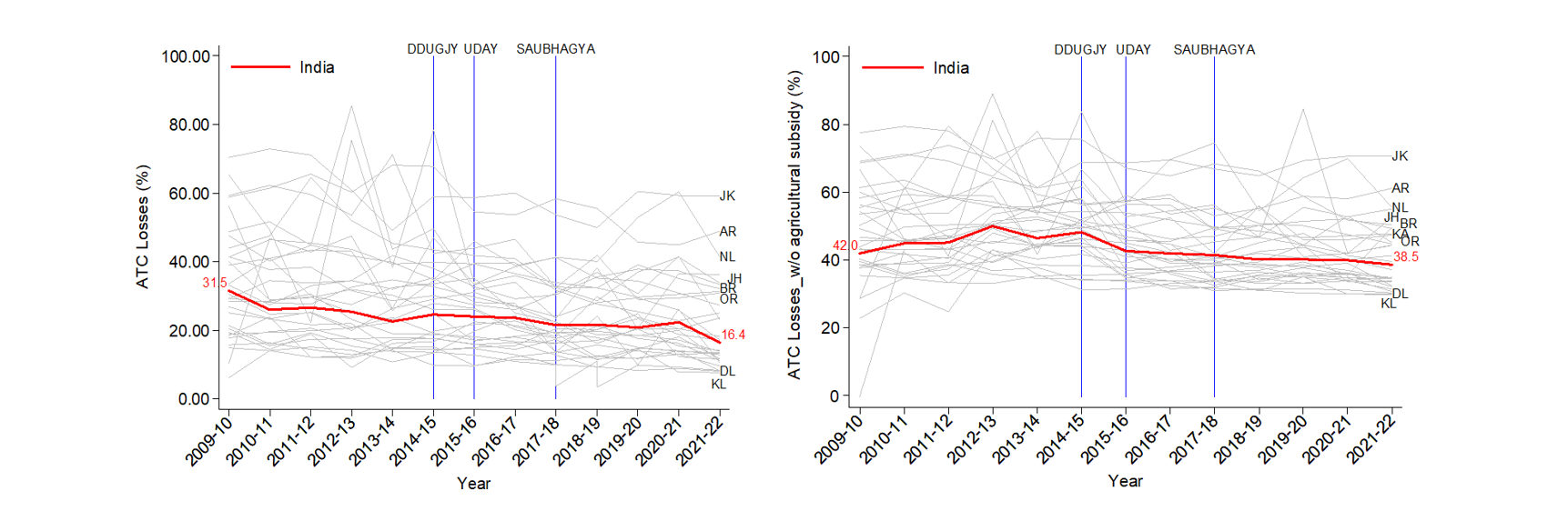

Considered before subsidy payments discoms are still losing a large amount of money. In FY2021-22, excluding subsidy support from the state and central governments, India’s state discoms lost Rs. 1.79 trillion, about 22% of discom expenditures on power or roughly 1% of India’s Gross Domestic Product. This is down slightly from 27.5% of discom expenditures in FY2011-22 but a rough tripling of the loss in absolute terms since power supply has greatly expanded. If we take out subsidies to agriculture, the average Indian discom has aggregate technical and commercial (AT&C) losses – a measure for the power that is supplied, but not accounted or paid for – of 39% in FY2021-22, far above the official 16% figure, which counts subsidies as discom revenue (see Figure 2).

Figure 2. Aggregate technical and commercial losses, including (left) and excluding (right) subsidies from revenue, FY2009-10 to FY2021-22

Notes: i) The AT&C Loss for India is an average of the AT&C losses across states every year. ii) The data from FY2020-21 has been carried forward to FY2021-22 for three discoms which have not yet submitted their data – JKPDD, Torrent Power Ahmedabad, and Torrent Power Surat.

Source: PFC Reports on the Performance of Power Utilities

Subsidising energy access for poor consumers is a worthy policy goal and may raise social welfare – that is for the government to judge. A subsidy is a transfer, and not a loss in itself. Nonetheless, one reason to look at losses before subsidy payments is that subsidies can conceal operational inefficiency and thereby sustain waste. Losses inclusive of subsidies are hard to judge, since it is possible that discoms overbook subsidies to agriculture– particularly, in order to paper over technical losses or unbilled power.

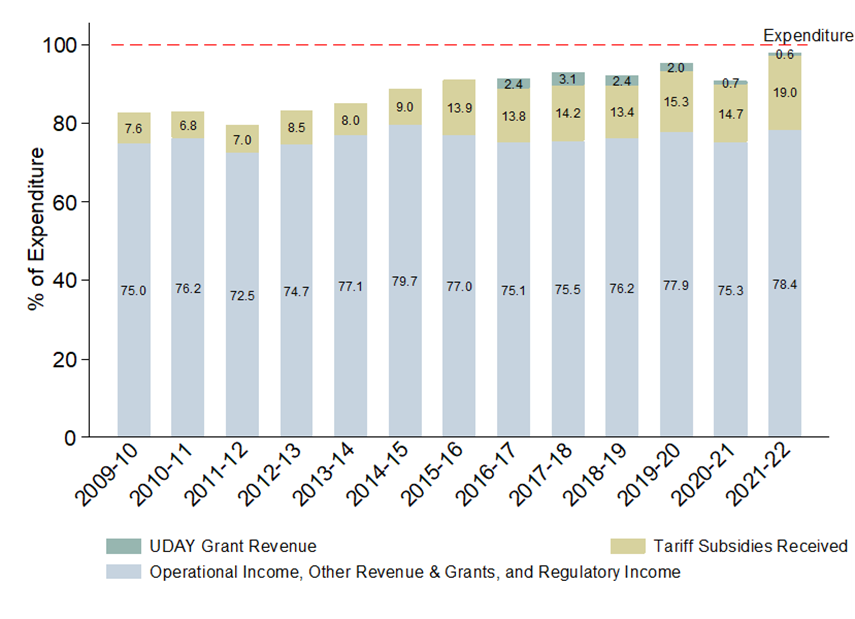

The main improvement over the last decade has been a formalisation of discom losses as explicit state subsidies. Traditionally most losses were accumulated on discom books and only occasionally recognised by states, at the time of bailouts, through debt restructuring with central government supervision and aid. This belated recognition arguably encourages inefficiency and waste since, with the expectation of state and central relief, it has been cheaper for states to finance subsidies through discom debt than to do so directly. While losses before subsidies have been almost constant, rising 27.5% of power expenditures in FY2011-12 to 29.2% in FY2021-22, losses net of subsidies have declined sharply from 20.5% to 2.4% (see Figure 3).

Figure 3. State distribution company revenue as a percentage of expenditure, by revenue category, FY2009-10 to FY2021-22

Note: Other revenues include regulatory income and grant revenues other than under UDAY.

Source: Calculated using PFC Report on Performance of Power Utilities.

What caused this sharp decline? One candidate is the Ujjwal Discom Assurance Yojana (UDAY) debt restructuring scheme, launched in 2015. Under UDAY, states were compelled not only to assume past discom debts but also to take on debts that discoms may incur in the future. We find that this incentive, in combination with other factors, may be working. State governments in most states are bringing discom losses on to their books with ex ante budget allocations for subsidies. However, we find that the UDAY scheme is not associated with improvements in operational performance. States that issued UDAY bonds did not reduce AT&C losses, or the gap between supply costs and revenue, any faster than other states.

Direct Benefit Transfers for Electricity as a viable reform

We advocate for a reform programme centered on Direct Benefit Transfers for Electricity (DBT-E). Direct benefit transfers, in principle, are the most efficient means of delivering benefits to households and to farmers. Consumers are entitled to a fixed number of discounted units of electricity. The subsidy value of this entitlement is transferred to the consumer at the time a bill is issued, and the consumer is then billed at the full tariff rate. This provides an incentive to conserve, as consumers that use less either reduce their bill or, if they are drawing less than their entitlement, received a refund for the subsidy not drawn.

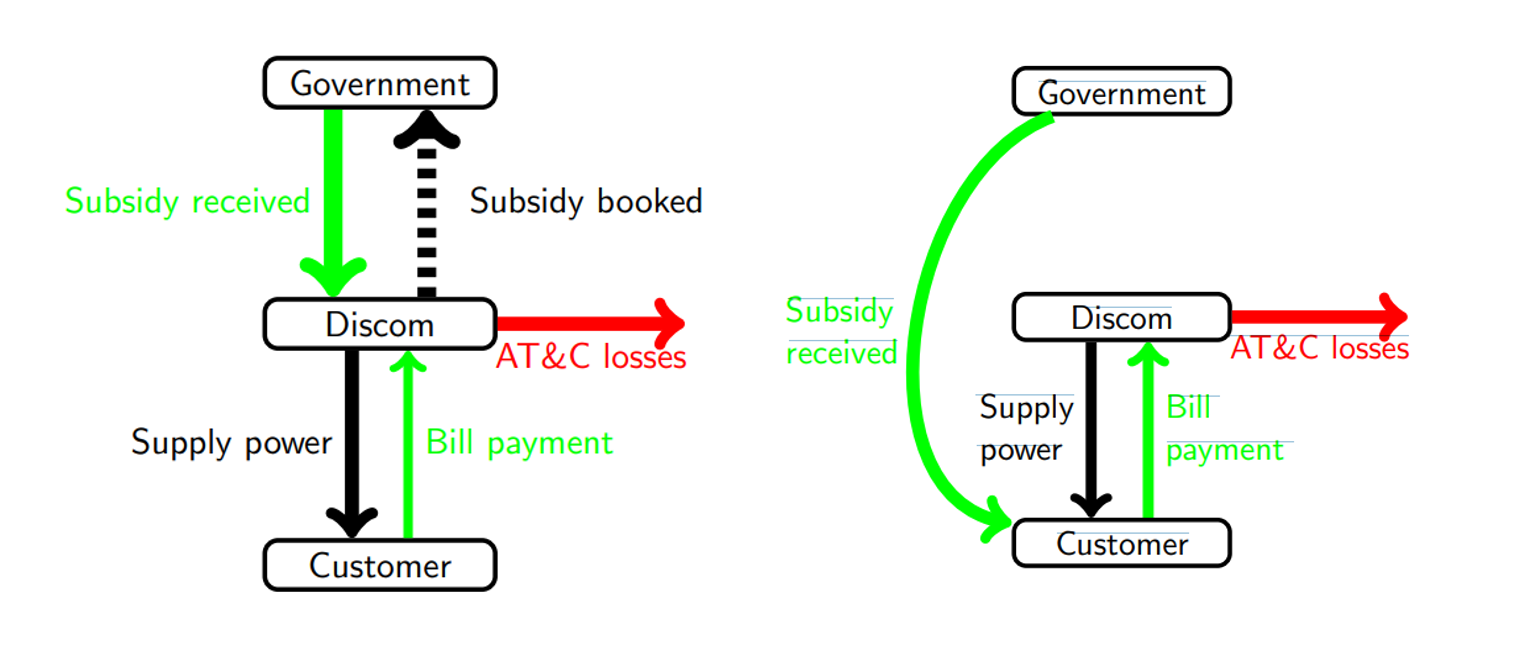

The potential of DBT-E is not only as a more direct channel to transfer benefits but as a structural reform to improve the incentives of discoms to serve customers, reduce costs, and collect revenue. The structural problem in the status quo (left panel of Figure 4) is that subsidy support from states depends on discom reports of supply to subsidised consumers (as reviewed and approved by State Electricity Regulatory Commissions). These reports are impossible to verify, since many subsidised consumers are not metered or are billed inaccurately or on flat rates. As a result, discoms have little incentive to reduce losses. Under DBT-E (right panel of Figure 4), the value of subsidies is paid to consumers directly. Discoms have to supply power and bill consumers for power to access subsidy funds. If they reduce supply to subsidised customers, due to AT&C losses, this cuts their own revenue, creating a strong incentive for loss reduction.

Figure 4. Commercial orientation under the status quo (left) and direct benefit transfers (right)

The aggregate value of electricity subsidies in India, at Rs. 1.6 trillion annually and growing, is more than the combined expenditure on the Mahatma Gandhi National Rural Employment Guarantee (MGNREGA) programme (Rs. 615 billion) and the Pradhan Mantri Kisan Samman Nidhi (PM-Kisan) (Rs. 750 billion) (Budget of India, 2020). If this electricity subsidy were converted to DBT, it would not be new expenditure, but rather a redirection of subsidy support from discoms directly to customers. This redirection is likely to have large benefits in improving efficiency and bringing down the cost of power in the sector as a whole.

Recent investments in the electricity sector and beyond will make DBT-E feasible on a mass scale. The most general investment is the Aadhaar platform for financial transfers to households and farmers. In electricity specifically, the formalisation of state electricity subsidies brings these transfers onto the books and the funding for universal smart metering under the Rs. 3 trillion Revamped Distribution Sector Scheme (RDSS) makes it possible to remotely measure consumption to calculate transfers. Logistically, the fixed costs for DBT-E have already been paid or budgeted.

The remaining question is whether such a change would be acceptable to subsidised consumers themselves. In principle, consumers should value the chance to get transfers if they reduce consumption of electricity or do not use the full value of the subsidy. Co-author Nicholas Ryan has been involved in the design and evaluation of two pilot programmes for agricultural customers in Rajasthan and Punjab. In both states, power is heavily subsidised for agricultural use, resulting in both fiscal and environmental strain.

While the scale of the pilots has been modest, and the evaluation of the pilot in Punjab is ongoing, several encouraging results have emerged. We find that acceptance of DBT-E is high among enrolled farmers – in Rajasthan, 96% of farmers who enrolled say they would recommend the scheme to others, and in Punjab, 89% of farmers said the same. DBT-E is estimated to conserve electricity. In Rajasthan and Punjab, farmers that enrolled in DBT-E reduced their consumption by 37% and 9%, relative to the energy consumption of farmers in the same area respectively. This reduction in consumption lowered state power procurement costs and reduced subsidy expenditures at the same time.

Conclusion

The evidence is encouraging that states should be seeking to expand DBT-E beyond a pilot scale. The Centre could encourage such adoption by making the receipt of RDSS funds for smart metering, contingent on the adoption of DBT-E for subsidised consumers, or by offering to fund a portion of subsidies delivered through direct benefit transfers in the early years of adoption.

This is a summary of a preliminary paper draft prepared for the NCAER’s India Policy Forum 2023.

Further Reading

- Bhattacharya, Saugata and Urjit Patel (2008), “The Power Sector in India: An Inquiry into the Efficacy of the Reform Process”, in S Bery, B Bosworth and A Panagriya (eds.), India Policy Forum, Vol. 4, National Council of Applied Economic Research, New Delhi.

- Budget of India (2020), ‘Outlay on Major Schemes’.

- Lakshamanan, R (2022), ‘Saubhagya – A Dream We Dared to Achieve’, Mint, 1 April.

- Wolak, FA (2008), ‘Reforming the Indian Electricity Supply Industry’, in Sustaining India's Growth Miracle, Columbia University Press.

11 July, 2023

11 July, 2023

Comments will be held for moderation. Your contact information will not be made public.