A synchronous growth slowdown has hit emerging markets, especially the BRICS, since 2010, with the potential for significant adverse spillovers to the rest of the world. This column estimates that a 1 percentage point decline in BRICS growth could reduce global growth by 0.4 percentage points, and growth in other emerging markets by 0.8 percentage points, over the following two years.

Growth in emerging markets has been slowing, from 7.6% in 2010 to 3.7% in 2015, and is now below its long-run average (Didier et al. 2015). The slowdown is broad based, reaching across regions and affecting an unusually large number of countries. Unprecedented since the 1980s, the majority of the BRICS (Brazil, Russia, India, China, and South Africa) slowed simultaneously, with India being a notable exception, last year. Given their size and integration with the global economy, a synchronous slowdown in the BRICS could have significant adverse spillovers to the rest of the world through various channels. Growth spillovers from the slowdown in China have received much attention (Armstrong et al. 2015), but there has been little work on the broader impact of large emerging markets on global growth. This column briefly analyses the spillover implications from the BRICS slowdown by addressing the following questions (for details, seeWorld Bank, 2016):

- What are the key channels of growth spillovers from the major emerging markets?

- How large are the spillovers from lower growth in major emerging markets?

- What would be the global implications if the slowdown coincides with financial stress?

What are the key channels of growth spillovers from the major emerging markets?

A growth slowdown in major emerging markets could have significant spillover effects given their share of global output and growth. Emerging markets accounted for 60% of global growth during 2010-14 and constituted 34% of global Gross Domestic Product (GDP) (in current market prices) in 2014. In addition, cross-border economic linkages among emerging markets, and with BRICS specifically, have grown significantly since 2000. For instance, 30% of all emerging market exports went to other emerging markets in 2014 (compared with just 12% in 1990). The growth slowdown could transmit to other economies through trade and financial channels, through commodity prices, and through confidence effects.

- Global trade: Reduced import demand from BRICS would weaken trading partner exports. Among emerging and frontier markets, trade linkages with BRICS, especially China, have increased in the last two decades. China is also an important trading partner for some of the advanced markets such as Japan and Germany.

- Global finance: Emerging markets have started playing a major role in a wide range of global financial flows, including foreign direct investment (FDI), banking and portfolio investment, remittances and official development assistance. A growth slowdown can reduce portfolio, FDI and remittance flows to other countries.

- Global commodity markets: Emerging markets, in particular China and to a lesser extent India, are major sources of demand for key commodities. For example, China has accounted for virtually all of the increase in global metals demand since 2000 and half of the increase in global primary energy demand (World Bank, 2015a). Reduced commodity demand would set back investment and growth in commodity-exporting countries around the world, even those without direct trade relations with the source country of the shock (World Bank, 2015b).

How large are the spillovers from lower growth in major emerging markets?

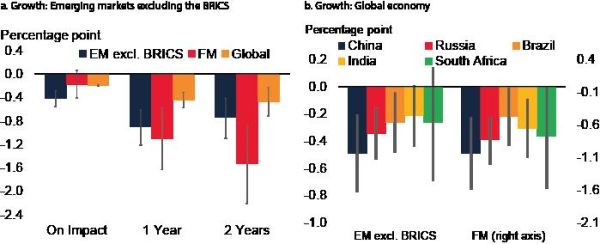

A growth slowdown in the BRICS could reduce global growth, and especially growth in other emerging markets and in frontier markets.We analyse the magnitude of these growth spillovers and find that on an average, a 1 percentage point decline in BRICS growth could, over the following two years, reduce global growth by 0.4 percentage points, growth in other emerging markets by 0.8 percentage points, and growth in frontier markets by 1.5 percentage points (Figure 1a). Sizeable as these are, spillovers from advanced markets are still larger than those from the BRICS, reflecting the dominant role of the former in global trade and finance.

The magnitude of spillovers varies across the BRICS (Figure 1b). A 1 percentage point decline in China’s growth could reduce growth in non-BRICS emerging markets by 0.5 percentage points and in frontier markets by 1 percentage point over two years, whereas a similar shock in Russia would reduce growth in other emerging markets by 0.3 percentage points. Spillovers from a growth shock in Brazil to other emerging markets would be much smaller, and to frontier markets statistically insignificant. In general, spillovers from India and South Africa to other emerging markets and frontier markets would be much smaller.

Figure 1. Spillovers from the BRICS

Source: World Bank staff estimates.

Source: World Bank staff estimates. Notes: A. Cumulated impulse responses for different horizons due to a 1 percentage point decline in BRICS growth on impact. Global is GDP-weighted average of BRICS, emerging and frontier markets, and G7 responses. Bars represent medians, and error bars 16-84% confidence bands. B. Cumulated impulse responses at the end of two years. Shocks are scaled such that China’s growth declines by 1 percentage point on impact. Shock sizes for the rest of BRICS countries are calibrated such that their growth declines by exactly the same amount as China at the end of two years.

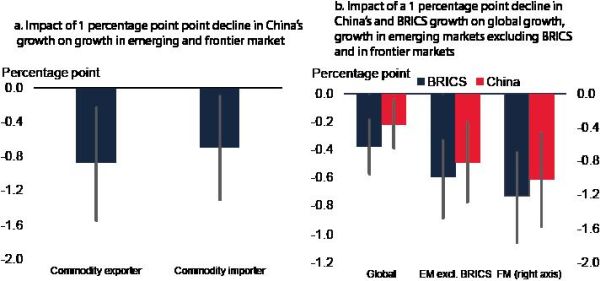

Commodity markets are a key transmission channel of spillovers from China to emerging markets as it is a major source of demand for key commodities. Thus, growth in commodity exporters could slow by somewhat more than growth in importers in response to a growth slowdown in China (Figure 2a).

Notwithstanding the sizeable spillovers from China, a synchronous slowdown in the BRICS would have larger adverse spillover effects than just a slowdown in China. Emerging market, frontier market, and global growth could decline by around 0.1-0.2 percentage points more, over two years, in a synchronous BRICS slowdown than in an isolated slowdown in China (Figure 2b).

Figure 2. Spillovers from China

Source: World Bank staff estimates.

Source: World Bank staff estimates.Notes: A. Cumulated impulse responses of GDP growth, at the two year horizon, due to a 1 percentage point decline in China’s growth. For each group, the figures refer to the cross-sectional average response across all the countries in that group. Commodity exporters include Chile, Malaysia, Paraguay, and Peru. Commodity importers include Bulgaria, Croatia, Hong Kong SAR, China, Hungary, Jordan, Mexico, Poland, Republic of Korea, Romania, Singapore, Thailand, and Turkey. Solid bars denote the median and the error bars denote the 16-84% confidence bands. B. Cumulated impulse responses of emerging markets, frontier markets, and global growth at the two-year horizon. The shock size is such that China’s growth declines by 1 percentage point on impact. The shock size for BRICS is calibrated such that its growth declines by exactly the same amount as that of China at the end of two years.

What would be the global implications if the slowdown coincides with financial stress?

Slower-than-expected growth in the BRICS could coincide with bouts of global financial market volatility. Though the interest rate tightening cycle of the US Federal Reserve is expected to proceed smoothly, as it has long been anticipated and is associated with a robust US economy, it carries significant risks of financial market turmoil (Arteta et al. 2015). Investor sentiment could deteriorate sharply on weakening emerging and frontier market growth prospects. As a result, risk spreads for emerging and frontier market assets could widen steeply and raise overall financing costs for emerging and frontier markets, further dampening growth.

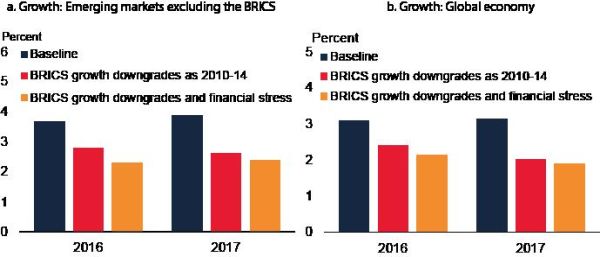

A synchronous BRICS slowdown could have much more pronounced spillover effects if it is accompanied by such financial market stress. If BRICS growth slowed further — by as much as the average growth disappointment over 2010-14 — and if financial conditions tightened moderately — such as during the financial market turmoil of the summer of 2015 — emerging-markets and global growth could be cut by about one-third in 2016 (Figure 3).

Figure 3. Implications of a growth slowdown in the BRICS combined with financial stress

Source: World Bank staff estimates.

Source: World Bank staff estimates. Note: EMBI = Emerging Markets Bond Index. Conditional forecasts of emerging markets excluding BRICS, frontier markets, G7, and global growth, with conditions imposed on future BRICS growth and EMBI. The conditions are: (i) BRICS growth downgrades as 2010-14: BRICS continue to grow during the forecast horizon at its current 2015 level minus the average forecast downgrades it saw during 2010-14. The forecast downgrades are based on the World Bank forecasts. (ii) BRICS growth downgrades and financial stress: The first scenario is combined with EMBI rising by 100 basis points during the forecast horizon. Global growth is the GDP-weighted average of BRICS, emerging markets excluding BRICS, frontier markets, and G7 growth. The baseline forecasts are GDP-weighted average of growth forecasts presented in World Bank (2016) for the sample of countries used in the econometric exercise.

Conclusion

The current growth slowdown in major emerging markets follows a decade during which their record-high growth transformed the global economic landscape by generating sizeable positive spillovers. During this time, they have become more integrated into global trade and financial systems.

As such, the synchronous slowdown in major emerging markets has been a source of painful spillovers to the global economy. Those spillovers would be more pronounced if the slowdown is accompanied by financial market stress.

Policymakers may need to support activity with fiscal and monetary stimulus, at least where policy buffers are sufficient. They could derive substantial gains from well-designed, credible structural reforms that retain investor confidence and capital flows in the short run, and that lift growth prospects for the long run.

A version of this column first appeared on VoxEU.org.

The findings, interpretations, and conclusions expressed in this article are entirely those of the authors. They do not necessarily represent the views of the World Bank, its Executive Directors, or the countries they represent.

Further Reading

- Armstrong, A, F Caselli, J Chadha and W den Haan (2015), ‘China’s Growth Slowdown: Likely Persistence and Effects’, VoxEU.org, 1 September.

- Arteta, C, MA Kose, F Ohnsorge and M Stocker (2015), ‘The Coming U.S. Interest Rate Tightening Cycle: Smooth Sailing or Stormy Waters?’, Policy Research Note 2, World Bank, Washington DC.

- Didier, T, MA Kose, F Ohnsorge and LS Ye (2015), ‘Slowdown in Emerging Markets: Rough Patch or Prolonged Weakness?’, Policy Research Note 4, World Bank, Washington DC.

- IMF (2014), ‘Is it Time for an Infrastructure Push? The Macroeconomic Effects of Public Investment’, in World Economic Outlook: Legacies, Clouds, Uncertainties, International Monetary Fund, Washington DC.

- World Bank (2015a), ‘Commodity Markets Outlook’, World Bank, Washington DC, July.

- World Bank (2015b), ‘Global Economic Prospects: The Global Economy in Transition’, World Bank, Washington DC, January.

- World Bank (2016), ‘‘Global Economic Prospects: Spillovers amid Weak Growth´, World Bank, Washington DC, January.

08 June, 2016

08 June, 2016

Comments will be held for moderation. Your contact information will not be made public.