Conflict can affect economic outcomes through the decisions of key individuals. This article studies the effect of repeated incidents of shelling across the India-Pakistan border, on loan officers working in districts along the border. It finds that in bank branches in affected areas, there is a pronounced increase in interest rates but only a negligible change in disbursed loan amounts.

Conflict can affect economic outcomes through the decisions of key individuals. However, observing these decisions and measuring such outcomes is not easy given the dangers present in a conflict zone and the resultant lack of data. Contrary to popular perception, the incidence of conflict in a particular region does not result in a complete shutdown of economic activity. In fact, it is possible to visit these ‘hot’ zones during fighting pauses to study the effects of conflict (Verwimp et al. 2019). Life in conflict zones continues, albeit with a renegotiation of contracts to better reflect ground realities. However, most studies in the past have relied on ex-post survey data to assess these implications.

Background and research setting

In recent research (Mishra and Ongena 2020), we aim to quantify the effects of conflict in the context of lending, and the ‘premium’ the involved agents attribute to the environment frictions arising there.

Our contextualised setting and unique data allow us to measure this premium better than existing work for three reasons. First, we investigate the impact of contemporaneous and repeated incidences of conflict on a singular, simple, yet pervasive business contract, that is, the bank-to-business credit contract. These incidents occur within a relatively short period; on average eight months after one another. This allows us to minimise the possible measurement bias arising due to intertemporal nature of human recall where events that are more recent tend to get weighted more heavily (Bjork et al. 1974). Indeed, the long look-back periods present in many conflict surveys may induce such errors of judgement, which we can avoid by using actual and contemporaneous information around frequently repeated incidences.

Second, our study covers an intense period of conflict – war-like almost – when a large number of people (living close to the border) decided to leave their homes out of fear for their lives and for damage to their local communities. In contrast, many earlier studies on conflict often rely on incidences with limited or no damage. Finally, our usage of a region-level credit database allows us to directly estimate the ex-post outcomes. Conversely, other studies on conflict commonly only observe outcomes after conditioning affected individuals with a set of emotions bringing them ‘back in time’ to the conflict situation.

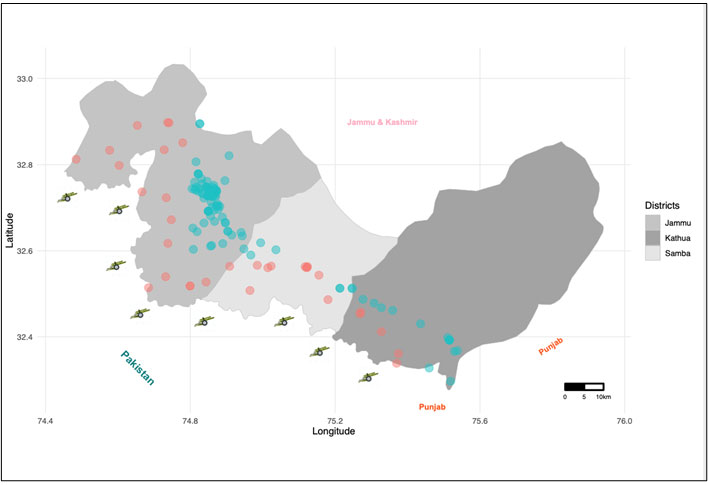

The armed conflict we study is international in nature and involves India and Pakistan in the districts of Jammu, Samba and Kathua situated in the erstwhile Indian state of Jammu & Kashmir along the Radcliffe Line (International Border)1. The inter-state conflict in these border districts manifests itself primarily through shelling, that is, mortar-gun firing across both sides of the border2.

Methodology and findings

We use a staggered difference-in-differences methodology in this analysis3. Our events correspond to those periods where shelling along the three border districts was so intense that it warranted a migration of the population. This distinction is important to make, as isolated incidents of shelling or small arms firing occur as well. The ‘treatment’ group corresponds to those bank branches that lie within 10 km of the international border, whereas the ‘control’ group corresponds to those branches that lie between 10 and 20 km from the international border. The choice of 10 km is dictated by a variety of considerations. One such factor is that the range of the mortar guns is about 7 km, and the Indian government classifies residents dwelling within 6 km as ‘affected’. We extend the classification, as it is plausible that people bank in branches which are a few kilometres outside the affected category. Moreover, our results are robust to the alteration of the cut-off for the treatment group for various values between 7.5 and 10 km.

Figure 1. Location of the ‘treated’ (within 10 km of international border) and ‘control’ (10-20 km) bank branches in three districts along the Radcliffe Line

We find that loan interest rates cumulatively increase by about 20 basis points (bps)4 during the study period for bank branches located in areas affected by shelling, with the effect intensifying across events. The increase for the first two events is about the same, that is, 5.5 bps each, but we see a jump to 9 bps in the third shelling incidence. While we observe a pronounced increase in the interest rates, there are only negligible changes in disbursed loan amounts. This concurrency of increases in loan rates and unchanged loan amounts suggests that both loan supply (effectuated by loan officers who are impacted by the shelling incidents) and loan demand changes.

To account for shelling-specific demand effects, we control for changes in local economic demand using the work-demand pattern from the Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA)5 as a proxy. A database of the number of individuals who demand work under this scheme is drawn up at the village level on a monthly basis. We also use the level of bank deposits (available every quarter) to control for any effects that may be prevalent owing to the deposits channel (Drechsler et al. 2017). This is possible because higher than average deposits could result in lower interest rates and/or higher loan volume.6

Possible mechanisms driving the results

We explore the channels that could be responsible for the observed outcomes. At first sight, it is possible to attribute these changes in the behaviour of the loan officers to altering risk preferences7. However, it is possible that the outcome could be due to a combination (or effect in isolation) of changing risk preferences and/or changes in beliefs about expected future default. Past literature on early life and contemporary experiences tends to entirely attribute outcomes to altering preferences. We, on the other hand, provide suggestive empirical evidence that beliefs dominate the channel, which results in the effects that we observe.

Further, for robustness of our results, we also control for generic variations in supply using the percentage of lending target achieved. We attribute the results thus obtained to supply effects emanating from the incidents of shelling. For additional robustness, we also limit our sample to loan types that tend to be more affected by shelling, and observe similar results. Our analysis also reveals a reallocation of lending towards safer loans, which are less impacted by the shelling. Finally, we reject any possible political interventions that might be driving our results by limiting our analysis to close-contest assembly constituencies8.

Policy implications

While our results are primarily focused on conflict episodes, they can also be used to explore lending behaviour following more commonly observed political or economic shocks. This is especially true in the general context of supply-side credit tightening. As these events occur very close to one another, exploring the short-, medium-, and long-term response of loan officers to these incidences could be instructive in understanding how credit tightening works when they are faced with such shocks. In such circumstances, especially the excessive restricting of credit availability in the medium run by altering loan terms could accentuate downward spirals and credit freezes in environments that are already credit-constrained. This calls for policy action to prevent or limit the intensity of such episodes. Investigating the intensity and timing of credit spirals propagated by the supply side could also be a topic of future research.

Notes:

- As of 31 October 2019, the state of Jammu & Kashmir was re-organised and divided into the two separate federally administered territories of Jammu & Kashmir and Ladakh. No changes were made to the district boundaries.

- The border runs from the Line of Control (LoC), which separates Indian-administered Kashmir from Pakistan-administered Kashmir, in the north, to the Zero Point between the Indian state of Gujarat and Sindh province of Pakistan, in the south.

- Difference-in-differences refers to a technique to compare the evolution of outcomes over time in similar groups that were subject to an intervention with those that did not. In a staggered set-up, once a group is ‘treated’, they remain treated in the following periods.

- 1/100th of a percentage point.

- MNREGA is a demand-driven social welfare scheme instituted by the Government of India, where an individual can demand work from the concerned local authorities.

- Much of the changes in demand effects are absorbed through saturation with fixed effects. Fixed effects control for time-invariant unobserved individual characteristics.

- We use the term ‘loan officers’ to signify a group of individuals working at a particular branch. However, many of these branches are fairly small, and have just one person responsible for loan vetting, approval, and handling.

- Where the difference in votes between the first and second placed candidate was less than the votes polled by the third placed candidate.

Further Reading

- Bjork, Robert A and William B Whitten (1974), “Recency-sensitive retrieval processes in long term free recall”, Cognitive Psychology, 6(2):173-189.

- Callen, Michael, Mohammed Isaqzadeh, James D Long and Charles Sprenger (2014), “Violence and risk preference: Experimental evidence from Afghanistan”, American Economic Review, 104(1):123-148.

- Drechsler, Itamar, Alexi Savov and Philipp Schnabl (2017), “The Deposits Channel of Monetary Policy”, Quarterly Journal of Economics, 132(4):1819-1876.

- Mishra, M and SRG Ongena (2020), ‘The Effect of Conflict on Lending: Empirical Evidence from Indian Border Areas’, Swiss Finance Institute Research Paper No. 20-50.

- Verwimp, Philip, Patricia Justino and Tilman Brück (2019), “The Microeconomics of Violent Conflict”, Journal of Development Economics, 141(102297).

- Voors, Maarten J, Eleonora EM Nillesen, Philip Verwimp, Erwin H Bulte, Robert Lensink and Daan P Van Soest (2012), “Violent conflict and behavior: a Field Experiment in Burundi”, American Economic Review, 102(2):941-964.

28 July, 2020

28 July, 2020

Comments will be held for moderation. Your contact information will not be made public.