Consumers in India face frequent power outages despite relatively high-quality infrastructure and ample supply of power plants. This article identifies a novel explanation for India’s blackouts: when the cost of purchasing electricity rises, utilities choose to buy less from power plants, thereby restricting the amount of power that reaches end-users. Reforms in wholesale supply that lower wholesale prices may help reduce blackouts in a cost-effective manner.

Wealthy countries across the world consume large amounts of electricity (Gertler et al. 2016). Electricity demand in developing countries is projected to rise dramatically over the coming decades, as households become richer and purchase electric appliances (Wolfram et al. 2012). However, electricity blackouts remain ubiquitous in the developing world (Abeberese 2021, Gertler et al. 2017). Blackouts are costly, as they reduce firm productivity (Allcott et al. 2016, Cole et al. 2018), increase production costs (Steinbuks and Foster 2010, Fisher-Vanden et al. 2015), and lower household incomes (Burlando 2014).

Several factors contribute to the high frequency of blackouts in developing countries. The complex system of generators and wires that provides electricity to consumers is only as strong as its weakest link. Voltage spikes and grid disruptions occur more frequently in places where infrastructure quality is poor (McRae 2015). Low-income countries may also have too little electricity generation capacity to produce enough electricity to meet demand, as in Ghana’s Dumsor crisis (Dzansi et al. 2018). However, in India, consumers face frequent power outages despite relatively high-quality infrastructure and an ample supply of power plants. In new research (Jha et al. 2022), we identify a novel explanation for India’s power outages: when the cost of purchasing electricity rises, utilities choose to buy less from power plants, thereby restricting the amount of power that reaches consumers.

Indian utilities choose when to provide power

It might sound obvious that utilities would choose to buy less power when the cost of power rises. In virtually every setting, demand falls as prices rise. However, in high-income countries, regulations force electric utilities to buy enough electricity to satisfy the demand of all consumers – regardless of cost (National Association of Regulatory Utility Commissioners, 2021). As a result, if someone would like to turn their lights on, the utility is legally obliged to sell them the electricity that lets them do so. In India and other developing countries, such regulations are weak or non-existent. When an Indian utility faces a high cost of purchasing wholesale electricity to meet the demand of retail consumers – say, on a hot day, when inefficient power plants must fire up to produce the electricity to operate air conditioners – the utility can choose to purchase less electricity. This results in blackouts, where Indian households may not be able to use their air conditioners, and have no way of communicating to the utility how much they would be willing to pay to use their air conditioners.

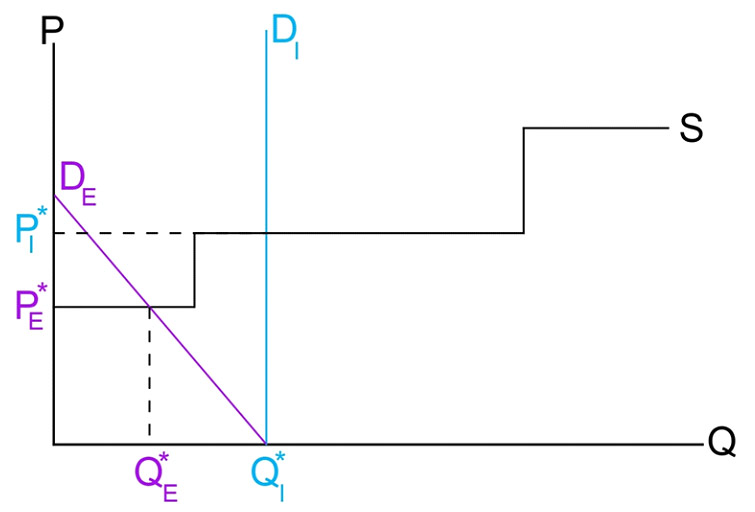

Figure 1 illustrates the difference between demand in US electricity markets versus the Indian power market. The downward-sloping line (in purple) is the Indian wholesale demand curve: as prices increase, utilities demand less electricity from the market. The vertical line (in light blue) is what wholesale electricity demand looks like in the US or much of Europe: utilities are mandated by regulators to purchase enough electricity from the wholesale sector to satisfy all electricity demand, regardless of the wholesale price. Finally, the supply curve (in black) documents that the quantity of electricity supplied increases with prices; it is a ‘step function’ because power plants can have very different marginal costs of producing an additional unit of electricity. By intersecting supply and demand, we can see the trade-off inherent to mandating that all electricity demand must be satisfied. On the one hand, more electricity is supplied to end-users. On the other hand, wholesale electricity prices are higher under this mandate, likely leading to higher prices faced by end-use consumers as well.

Figure 1. Supply and demand of electricity in the US versus the Indian power market

Using detailed administrative data on the Indian power sector from 2013 to 2019, we show that Indian utilities increase blackouts when their own procurement costs rise. We digitise thousands of supply and demand curves from the Indian Energy Exchange (IEX), the largest wholesale power market in India where utilities submit bids to purchase the electricity they resell to consumers. Across all hours of the day, utilities’ demand is downward sloping, with an average elasticity greater than 1. This means that if the wholesale electricity price increases by 1%, utilities will respond by decreasing the quantity of power they provide to consumers by more than 1%.

We also investigate what happens to the quantity of electricity supplied to consumers when power plants shut down due to equipment malfunctions – thereby raising the aggregate costs of electricity supply. We estimate that the quantity supplied in a state decreases when more power plants in that state have equipment failures, even when other power plants were available to generate.

Power plant incentives also lead to blackouts

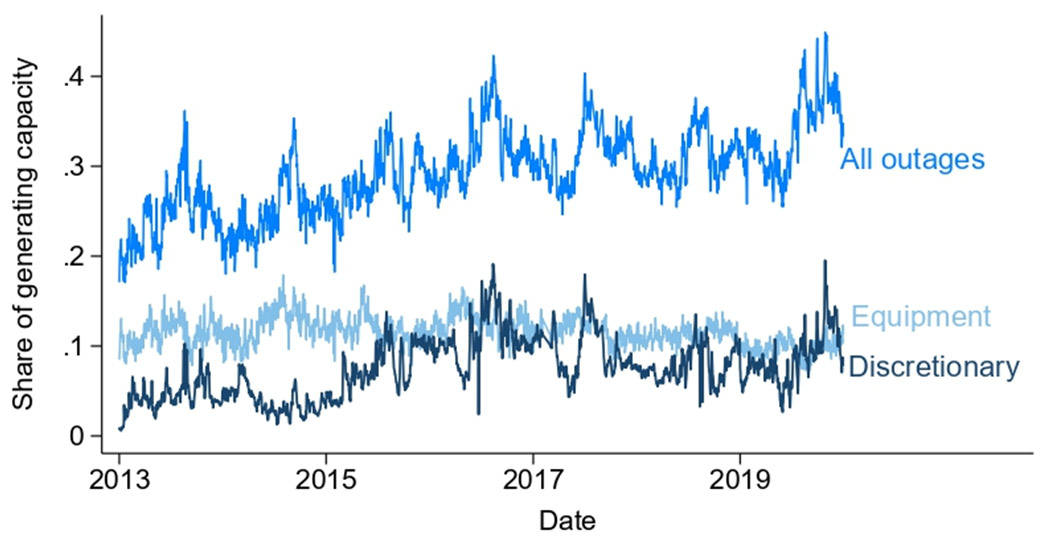

This implies that India could reduce blackouts by making its existing fleet of power plants available to generate more often. This would require addressing ongoing inefficiencies in Indian electricity supply: on a typical day, roughly 27% of the country’s non-renewable generating capacity is down (see Figure 2, which uses daily data from the Central Electricity Authority of India). Many of these outages are due to technical issues, like equipment failures. However, for a substantial share of outages, plants cite economic factors, including rigid contracts that restrict their ability to sell electricity to buyers other than the single utility specified in their contract. Allowing sellers and buyers to trade contracted positions based on current economic conditions would incentivise low-cost plants to avoid ‘discretionary’ outages on days when their electricity is especially valuable. We find that this could increase the quantity of power supplied in the day-ahead market by up to 13%.

Daily share of generating capacity on outage

What if Indian regulators eliminated blackouts?

Imposing a regulatory mandate that utilities must supply power to all consumers may seem like an obvious policy solution. As illustrated in Figure 1, imposing such a ‘full demand’ mandate will increase both quantity supplied to end-users and wholesale electricity prices – potentially placing an extremely high financial burden on utilities to eliminate every last blackout. In a perfect world, the economists’ answer is simple consumers should be stacked from highest to lowest willingness to pay for electricity, and power plants should supply consumers until the marginal cost of producing an additional unit exceeds the next consumer’s willingness to pay – else the utility can fall into a trap where non-payment undermines access (Burgess et al. 2020). One way to benchmark the average consumer’s willingness to pay is to note that many Indian consumers currently pay roughly Rs. 13,000-36,000 per megawatt hour (MWh) to purchase and run diesel backup generators.

Our results suggest that if Indian regulators impose a mandate forcing utilities to prevent all blackouts, the cost to utilities per MWh would be 2-7 times greater than the costs of diesel backup generation. However, the costs would be much more reasonable if Indian regulators also enact contracting reforms to eliminate ‘discretionary outages’ at power plants, since more low-cost power plants would be available to generate electricity. In a world without discretionary outages, the costs of a regulatory mandate would be comparable to the costs of purchasing and operating a diesel backup generator.

Lessons going forward

Electricity blackouts continue to impose major costs on firms and households around the developing world. There are many causes for these blackouts, including limited electricity generating capacity and failing distribution infrastructure. We provide a new explanation for blackouts: utilities choose to purchase less electricity from the wholesale sector when procurement costs are high, leading to less electricity reaching end-users. Improving the profitability of utilities through reforms in the retail sector is a tough challenge in many developing countries where electricity theft and bill non-payment remains prevalent (Khanna and Rowe 2021). Our results suggest that reforms in wholesale supply that lower wholesale prices may reduce blackouts in a more cost-effective manner.

These types of reforms are becoming increasingly important as developing countries transition towards renewable energy. Wind and solar resources have very low operating costs but produce only intermittently – when the wind is blowing, or the sun is shining. If suppliers’ contracts are not flexible enough to respond to large fluctuations in wind/solar generation, reducing the incidence of blackouts will become even more challenging.

This article has been published in collaboration with VoxDev and VoxEU.

I4I is on Telegram. Please click here (@Ideas4India) to subscribe to our channel for quick updates on our content

Further Reading

- Abeberese, AB (2021), ‘The cost of power: Electricity pricing and firm output in India’, VoxDev, 12 February.

- Allcott, Hunt, Allan Collard-Wexler and Stephen D O’Connell (2016), “How do electricity shortages affect industry? Evidence from India”, American Economic Review, 106(3): 587-624.

- Allcott, H, A Collard-Wexler and SD O’Connell (2015), ‘Electricity shortages and industry: Evidence from India’, VoxEU, 3 December.

- Burgess R, M Greenstone, N Ryan and A Sudarshan (2020), ‘Should electricity be a right? Evidence from India’, VoxDev, 18 November.

- Burlando, Alfredo (2014), “Transitory shocks and birth weights: Evidence from a blackout in Zanzibar”, Journal of Development Economics, 108:154-168.

- Cole, Matthew A, Robert JR Elliott, Giovanni Occhiali and Eric Strobl (2018), “Power outages and firm performance in Sub-Saharan Africa”, Journal of Development Economics, 134:150-159.

- Dzansi, J, SL Puller, B Street and B Yebuah-Dwamena (2018), ‘The vicious circle of blackouts and revenue collection in developing economies: Evidence from Ghana’, IGC Working Paper.

- Gertler, PJ, K Lee and AM Mobarak (2017), ‘Electricity reliability and economic development in cities: A microeconomic perspective’, UC Berkeley: Center for Effective Global Action Working Paper.

- Gertler, Paul J, Orie Shelef, Catherine D Wolfram and Alan Fuchs (2016), “The demand for energy-using assets among the world’s rising middle classes”, American Economic Review, 106(6): 1366-1401.

- Jha, A, L Preonas and F Burlig (2021), ‘Blackouts in the Developing World: The Role of Wholesale Electricity Markets’, NBER Working Paper No. 29610.

- Khanna S and K Rowe (2021), ‘Escaping the subsidy-quality trap in India’s retail electricity market’, Ideas for India, 19 May.

- McRae, Shaun (2015), “Infrastructure quality and the subsidy trap”, American Economic Review, 105(1): 35-66.

- National Association of Regulatory Utility Commissioners (2021), ‘The Role of State Utility Regulators in a Just and Reasonable Energy Transition’, Report.

- Steinbuks, Jevgenijs and Vivien Foster (2010), “When do firms generate? Evidence on inhouse electricity supply in Africa”, Energy Economics, 32: 505-514.

- Wolfram, Catherine, Orie Shelef and Paul Gertler (2012), “How will energy demand develop in the developing world?”, Journal of Economic Perspectives, 26(1): 119-138.

08 April, 2022

08 April, 2022

Comments will be held for moderation. Your contact information will not be made public.