The current consensus that the finance-growth nexus is more complex than previously assumed has led to concerns about ‘too much finance’. Using a large panel dataset over six decades, this article finds some evidence of a detrimental effect of ‘too much finance’, but not for highly financially developed countries or for the long-term growth trajectories of countries with intermediate levels of financial development.

In the aftermath of the Global Financial Crisis, the literature on finance and growth experienced a 'paradigm shift' whereby a pre-Crisis consensus of a strictly positive and linear relationship (for example, Beck et al. 2000, Levine et al. 2000, Beck et al. 2004, Levine 2005) was replaced by a new consensus of a more complex, likely concave relationship – economies could experience ‘too much of a good thing’. The influential work by Arcand et al. (2015), among others, established the presence of such a non-linearity at the top of the financial development distribution (Arcand et al. 2011, Beck 2015, Beck et al. 2013, Beck 2013).

The 'darker side' of financial development (Loayza et al. 2018) can occur if increased deepening of advanced financial markets: (a) furthers services with lower growth potential (for example, household rather than firm credit); (b) leads to a misallocation of talent (for example, a 'brain drain' to financial services); and/or (c) results in an increased vulnerability to financial crises. The latest is the subject of a large separate literature (Sufi and Taylor 2021) with a "near-consensus view" (Bordo and Meissner 2016) that banking crises are "credit booms gone bust" (Schularick and Taylor 2012, Schularick and Taylor 2009), although capital flow bonanzas also feature prominently as crisis triggers1 (Reinhart and Rogoff 2013, Ghosh et al. 2014, Caballero 2016, Reinhart and Reinhart 2008, Ghosh and Qureshi 2012).

In a recent study (Cho et al. 2022), we revisit the implications of potentially 'excessive' levels of financial development, proxied by private credit/GDP (gross domestic product), for economic prosperity in the long run and susceptibility to banking crises in the short run. Our empirical setup departs from much of the existing literature in four ways: first, we think of 'too much finance' as being above some threshold for credit/GDP (we adopt 92% and 119%) and study the 'treatment' effect of being in this 'danger zone' relative to the growth experience of countries which permanently remained below the threshold2. Second, we estimate the treatment effect at the country level, which enables us to consider the length of time countries have spent in the 'danger zone'. If excessive levels of finance are detrimental to prosperity, we would expect this effect to be more pronounced in countries with many years of 'too much finance'. Third, we extend our analysis to the study of banking crises. If 'too much finance' triggers banking crises, we would expect that the dominant triggers in the literature play a prominent role. Hence, we ask whether within the same country, credit booms, unfettered capital inflows, and commodity price movements induce a stronger effect on crisis propensity above, relative to below a 'too much finance' threshold. And finally, motivated by descriptive analysis, we investigate these matters not just in advanced economies at the top of the credit/GDP distribution, but also in emerging economies at intermediate levels.

Financial development and economic growth in the long run

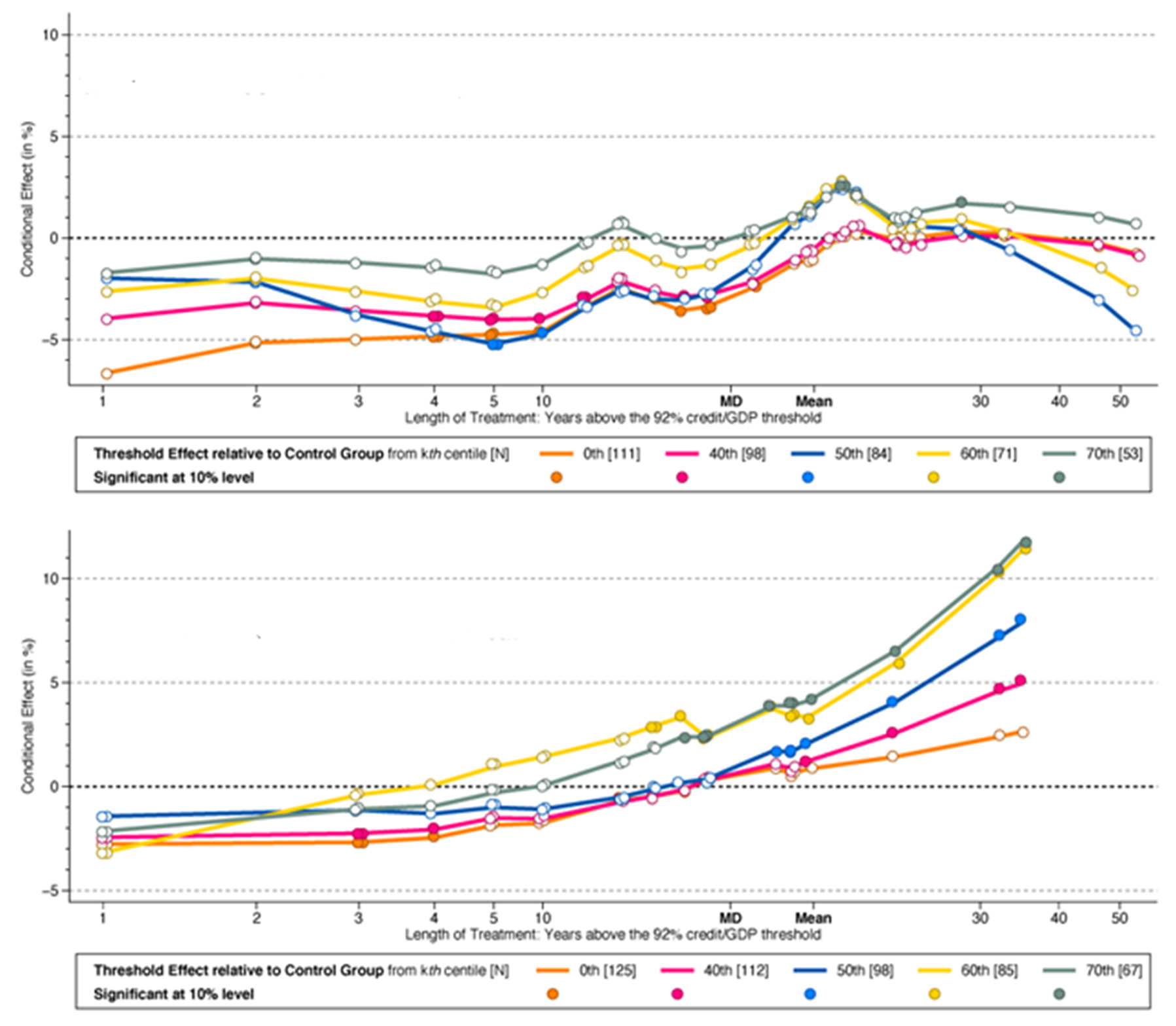

Figure 1 presents results from our treatment effects models for 'too much finance'. On the vertical axis, we chart the magnitude of the economic effect (in percentage), and on the horizontal axis, the number of years a country has spent in the 'danger zone'. We use local linear regression to smooth the individual effects relative to the years of treatment, and these smoothed predictions are presented here. The economic effects are derived from difference-in-differences3 regressions. The different lines within each plot are for alternative control samples – curtailing the control sample moves the 'counterfactual' closer to the treated sample in terms of shared characteristics4. The markers indicate individual country estimates. If a marker is filled (hollow), we can(not) reject the null hypothesis that the effect is zero for countries with this number of years of 'too much finance'. The top panel is for a 92% credit or GDP threshold, and the bottom panel is for 119%. These are the 90th (includes 39 countries) and 95th (includes 25 countries) percentiles, respectively of the credit/GDP distribution in our full sample of 152 countries over 1960 to 20165.

Figure 1. The long-run growth effects of 'too much finance', threshold effect of 92% credit/GDP (top panel) and 119% credit/GDP (bottom panel)

Notes: (i) The plots present the smoothed country estimates from Chan and Kwok's (2021) PCDID regressions of per capita GDP (in logs) on a dummy for 'too much finance' (92% or 119% credit/GDP threshold) and additional control variables as well as estimated factors extracted from the control sample via Principal Component Analysis, For more details see Cho et al. (2022). (ii) These are the results for the models augmented with four estimated common factors. (iii) The different lines in each plot represent different control samples with sample size indicated in each case. (iv) The treatment sample is the same within each panel, as stated. (v) Filled (hollow) markers indicate a statistically (in)significant difference from zero. (vi) Markers are minimally perturbed for ease of visual presentation. (vii) The horizontal axis is transformed using the inverse hyperbolic sine function. (viii) The sample mean and median years of treatment are highlighted in the axis labels.

While for the 92% threshold, many years of 'treatment' are associated with negative effects, very few of these are statistically significant, and the results for more restricted control samples are of very small magnitude compared with those adopting an indiscriminate control sample6. For the median and mean number of years in the 'danger zone' the results for the most restricted control samples (yellow and teal lines) indicate statistically insignificant, marginally negative, and marginally positive effects, respectively – for the average country in the 'danger zone' such high levels of financial development did not yield higher growth but did no harm either. In the 119% threshold figure, we see a different, upward-sloping relationship with time spent in the 'danger zone'. Here, even the most indiscriminative control sample suggests the average country (median or mean of years above the threshold) experienced a positive effect, and for more restrictive control samples, this effect is statistically significant and rising with time. A conservative interpretation of these results is that there is no evidence of a large and statistically significant negative long-run effect of 'too much finance' on economic prosperity.

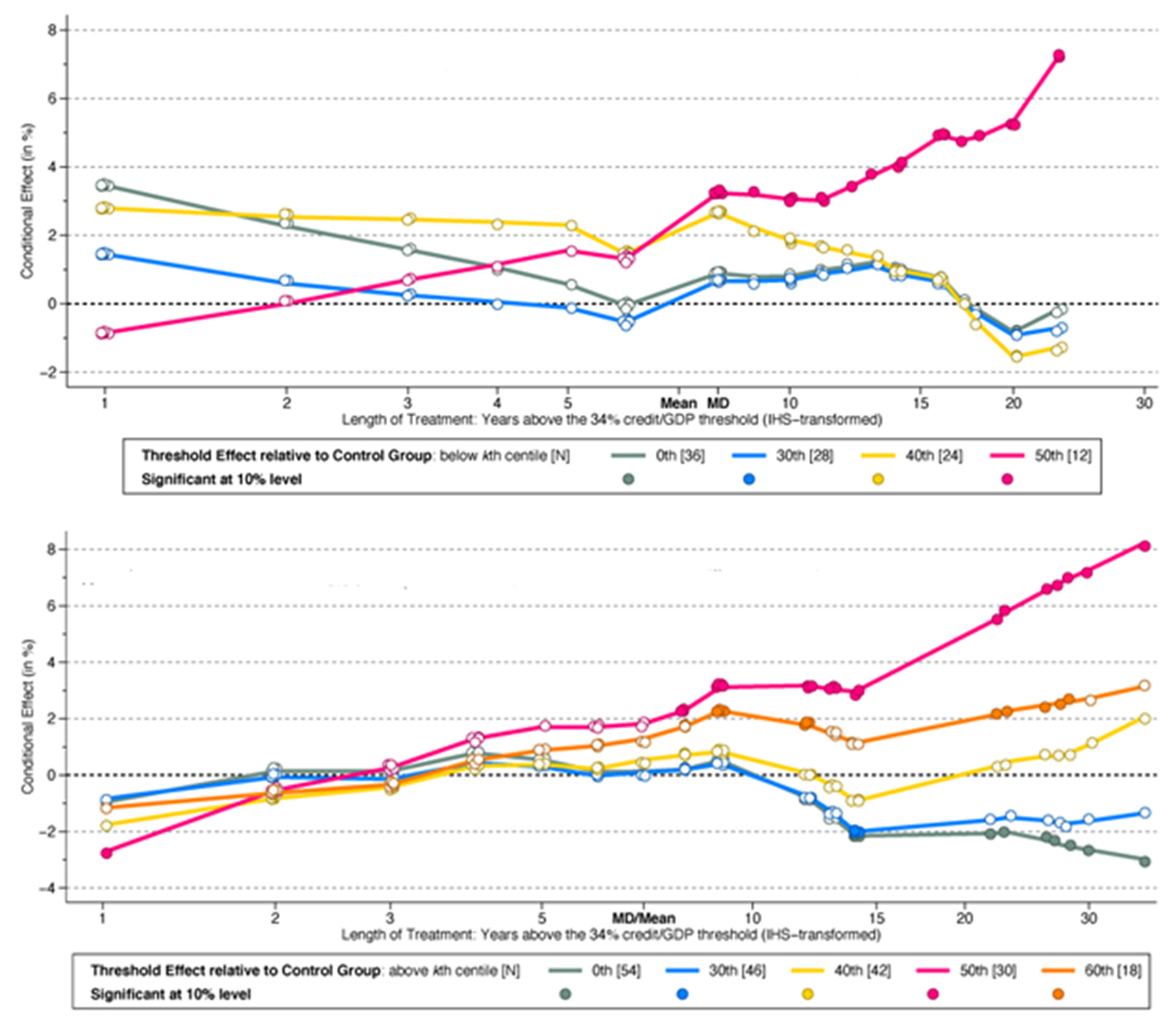

In Figure 2, we present some of the results of emerging economies, where the 'too much finance' narrative is investigated adopting the 34-65% and 47-92% credit/GDP ranges (60th-80th and 70th-90th percentiles of the credit/GDP distribution). We define ranges of values since we want to avoid countries like Singapore – which moved from 33% to 135% credit/GDP – being included in the treatment sample. In both panels, the treatment effects for the country with the median number of years in the 'danger zone' are positive, albeit statistically insignificant. For the most part, treatment effects remain positive and even rise with additional years. Again, at the very least, these results suggest that there is no evidence for a significant detrimental effect on long-run prosperity in this sample of emerging economies.

Figure 2. Finance for development?

Notes: (i) These plots adapt the notion of ‘too much finance’ to the emerging economy context. (ii) In the upper panel, this is defined as a credit/GDP ratio between 34% and 65% (60th and 80th percentiles of the distribution; 42 countries), in the lower panel between 47% and 92% (70th and 90th percentiles; 47 countries). (iii) The most restrictive control samples are now for the plots in yellow, pink, and orange. See Figure 1 notes for other details.

Financial development and systemic vulnerability

Our empirical analysis of banking crises uses interaction effects to investigate whether within countries, salient crisis triggers such as credit booms, unfettered capital inflows, and aggregate commodity prices have stronger effects when countries are above the 'too much finance' threshold. We begin, however, by ignoring this distinction to demonstrate that these 'dominant narratives' play an important role in triggering banking crises, in our samples for advanced and emerging economies.

The patterns we establish using the 92% threshold suggest that credit booms and large capital inflows increase crisis propensity below the threshold, while the coefficients on the interaction terms are frequently negative, implying lower crisis propensity above the threshold. While the interaction terms for credit growth using the 119% threshold indicate a higher propensity for banking crises, these results are very imprecise and never statistically significant. In the capital flow analysis, we once again detect a weak pattern of higher crisis propensity below the 'danger zone'. The notion of differential (and stronger) effects, within countries above relative to below the 'too much finance' thresholds, is hence not supported in the data.

In the investigation of the 34-65% and 47-92% ranges for 'too much finance' in emerging economies, we can again detect the credit boom and also an aggregate commodity price effect if we ignore thresholds. The evidence using interaction terms suggests that capital inflows and commodity price movements have an amplified effect when countries have high levels of financial development. These results are statistically weak but more suggestive of a detrimental effect than those in the advanced country sample.

What remains of the 'too much finance' narrative?

Until fairly recently, there was relatively little doubt in the literature about the economic benefits from financial development. The experience of the Global Financial Crisis then led to renewed research activity resulting in the suggestion that economies could experience ‘too much of a good thing’. Now, a non-linearity in the finance-growth relationship is the new consensus in the literature.

We challenge this conclusion by analysing the finance-growth relationship with: (i) more flexible empirical specifications embedded within a causal treatment effects framework; (ii) a focus on country-specific effects, treatment length, and hence the long-run equilibrium relationship; and (iii) a methodological extension to study the impact of finance on the dominant banking crisis determinants in an early warning system approach which focusses on the short-run. We find no convincing evidence that highly financially developed countries experience lower economic growth or are more susceptible to systemic banking crises once they cross a certain threshold. In a sample of countries with intermediate levels of financial development, we find statistically weak evidence for a detrimental effect on financial vulnerability. No matter how (in)substantial this increased vulnerability to banking crises may be, these short-run implications of financial development do not hamper growth in the medium to long term. Hence, what remains of the 'too much finance' narrative? We would argue that for advanced and emerging economies, there simply is no evidence of any significant detrimental effect.

A version of this article first appeared on VoxEU.

I4I is now on Telegram. Please click here (@Ideas4India) to subscribe to our channel for quick updates on our content

Notes:

- In the analysis of developing countries, aggregate commodity price movements appear to dominate these two determinants (see Eberhardt and Presbitero 2021).

- We adopt the principal component difference-in-difference (PCDID) estimator in Chan and Kwok (2021), which allows us to model a country endogenously entering the ‘danger zone’ and which can further account for non-parallel trends, most importantly between treated and non-treated countries. To achieve this, the heterogeneous regression for each treated country is augmented with common factors estimated from residuals of an equivalent regression in the control sample (naturally without the treatment dummy). In the long-run growth analysis, we smooth these country estimates against the years of ‘treatment’, further controlling for sample characteristics and country minimum credit or GDP value. In the banking crisis analysis, we compute average treatment effects on the treated.

- Differences-in-differences is a technique to compare the evolution of outcomes over time in similar groups, where one experienced an event with the other did not.

- The intuition is that the economic implications of ‘too much finance’ in a highly financially and economically developed economy (for example, Australia) should not be benchmarked against those in an economy with significantly underdeveloped financial institutions (for example, Mali).

- We take ‘private credit by deposit money banks and other financial institutions to GDP’ from the July 2018 version of the Financial Development and Structure Dataset (FSFD; Becket al. 2000, Beck et al. 2009). Our dependent variable, real GDP per capita in 2005 US$ values, as well as additional controls (inflation, trade as a share of GDP) are taken from the World Bank World Development Indicators.

- The control samples reported in the legends of each panel should be read as follows: 0th - any country which stayed below the 92% or 119% threshold is included in the control sample; 40th- only countries with a credit/GDP peak between 20% (40th percentile of the distribution) and 92% or 119% are included in the control sample; 50th – only countries with a credit/GDP peak between 26% (50th percentile of the distribution) and 92% or 119% are included in the control sample; and similarly for the remaining alternatives.

Further Reading

- Arcand, Jean-Louis, Enrico Berkes and Ugo Panizza (2015), "Too much finance?", Journal of Economic Growth, 20(2): 105-148.

- Arcand, JL, E Berkes, U Panizza (2011), ‘Too much finance?’, VoxEU, 7 April.

- Beck, T (2015), ‘Finance and growth – beware the measurement’, VoxEU, 30 September.

- Beck, T, A Demirguc-Kunt and R Levine (2004), ‘Finance, inequality, and poverty: Cross-country evidence’, NBER Working Paper No. 10979.

- Beck, T, H Degryse and C Kneer (2013), ‘Is more finance better? Disentangling intermediation and size effects of financial systems’, 8 April.

- Beck, T, R Levine and N Loayza (2000), "Finance and the sources of growth", Journal of Financial Economics, 58(1-2): 261-300.

- Bordo, MD and CM Meissner (2016), ‘Fiscal and financial crises’, in JB Taylor and H Uhlig (eds.), Handbook of Macroeconomics.

- Buera, Francisco J, Joseph P Kaboski and Yongseok Shin (2011), "Finance and development: A tale of two sectors", American Economic Review, 101(5): 1964-2002.

- Caballero, Julián A (2016), "Do surges in international capital inflows influence the like-lihood of banking crises?", Economic Journal, 126(591): 281-316.

- Chan, Marc K and Simon S Kwok (forthcoming), "The PCDID approach: difference-in-differences when trends are potentially unparallel and stochastic", Journal of Business & Economic Statistics.

- Cho, R, R Desbordes and M Eberhardt (2022), ‘Too Much Finance... For Whom? The Causal Effects of the Two Faces of Financial Development’, CEPR Discussion Paper 17022.

- Eberhardt, Markus and Andrea F Presbitero (2021), "Commodity prices and banking crises", Journal of International Economics, 131: 103474.

- Ghosh, AR and MS Qureshi (2012), ‘What drives surges in capital flows?’, VoxEU, 26 January.

- Ghosh, Atish R, Mahvash S Qureshi, Jun Il Kim and Juan Zalduendo (2014), "Surges", Journal of International Economics, 92(2): 266-285.

- Levine, R (2005), ‘Finance and growth: theory and evidence’, in P Aghion and S Durlauf (eds.), Handbook of Economic Growth.

- Levine, Ross, Norman Loayza and Thorsten Beck (2000), "Financial intermediation and growth: Causality and causes", Journal of Monetary Economics, 46(1): 31-77.

- Loayza, N, A Ouazad and R Rancière (2018), ‘Financial development, growth, and crisis: is there a trade-off?’, in T Beck and R Levine (eds.), Handbook of Finance and Development.

- Reinhart, C and V Reinhart (2008), ‘From capital flow bonanza to financial crash’, VoxEU, 23 October.

- Reinhart, Carmen M and Kenneth S Rogoff (2013), "Banking crises: an equal opportunity menace", Journal of Banking & Finance, 37(11): 4557-4573.

- Schularick, Moritz and Alan M Taylor (2012), "Credit booms gone bust: Monetary policy, leverage cycles, and financial crises, 1870-2008", American Economic Review 102(2): 1029-61.

- Schumpeter, J (1912), The Theory of Economic Development, Harvard University Press.

- Sufi, A and A M Taylor (2021), ‘Financial crises: A survey’, NBER Working Paper No. 29155.

- Taylor, AM and M Schularick (2009), ‘Credit booms go wrong’, VoxEU, 8 December.

30 May, 2022

30 May, 2022

Comments will be held for moderation. Your contact information will not be made public.