Communities are monitoring service providers, and local governments are delivering development and welfare programmes in developing countries. This article indicates the potential value of enlarging the set of potential intermediaries for agricultural development interventions to include private traders, owing to their specialised information about the productivity and reliability of farmers in these communities, and their incentives to help farmers take advantage of these interventions.

Public programmes in developing countries are increasingly being implemented at the local level. Communities are monitoring service providers, and local governments are delivering development and welfare programmes. However, despite the promise that decentralisation would leverage local information to improve targeting and implementation, there is not much evidence that these programmes have transformed local decision-making or increased empowerment. Community-led programmes are often captured by local elites, while local governments frequently target their vote bank rather than those who stand to benefit the most.

On the other hand, several recent papers (Banerjee et al. 2013, Beaman and Magruder 2012, and Berg et al. 2018) find that central individuals in local networks can effectively target beneficiaries, diffuse information, and increase programme take-up. We bring to this literature the observation that village life is usually characterised by multiple networks ─ economic, political, and social ─ and that the nodal agents of these networks might differ in their competencies and incentives to implement development programmes.

Study design

In recent research (Maitra et al. 2019a), we carried out an experiment where nodal agents of different networks were chosen to intermediate an agricultural credit programme for smallholder farmers.

The credit programme provided non-collateralised individual liability loans to low-wealth borrowers. Selection of borrowers was delegated to an intermediary agent who was a prominent trader-lender within the village in one ‘treatment’ (TRAIL), or selected from a list provided by the locally elected village council (GRAIL) in the other treatment. The loan programmes as well as the formal role of the agent were identical across the two schemes; in both the agent was incentivised by a commission linked to the repayment behaviour of the borrowers they recommended. The agent was asked to recommend 30 farmers owning less than 1.5 acres of cultivable land, of whom 10 were randomly chosen to receive the loan offer. This design enables us to separately estimate selection effects and loan treatment effects conditional on selection. Farmers recommended by the agent were offered individual liability loans at below market interest rates, with a duration of 4 months in each cycle, and fast-growing credit limits conditional on repayment.

Starting in October 2010, a local microfinance institution implemented the TRAIL and GRAIL schemes in 24 villages each, randomly selected in two potato-growing districts in the state of West Bengal, India. The interventions took place over nine 4-month loan cycles. Our survey teams interviewed a sample of 50 households in each village three times a year from 2010 to 2013, to collect detailed data about their agricultural cultivation.

Experimental results

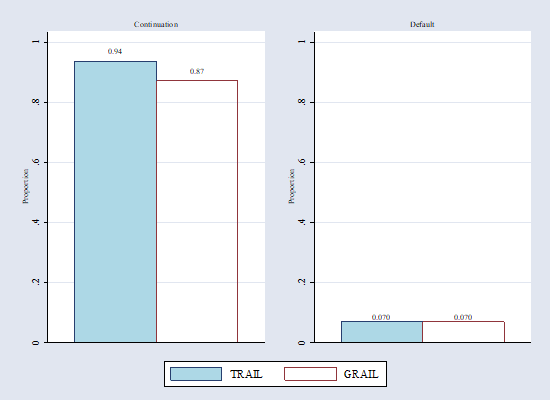

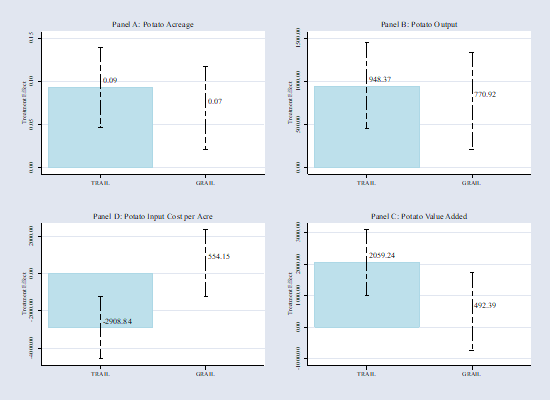

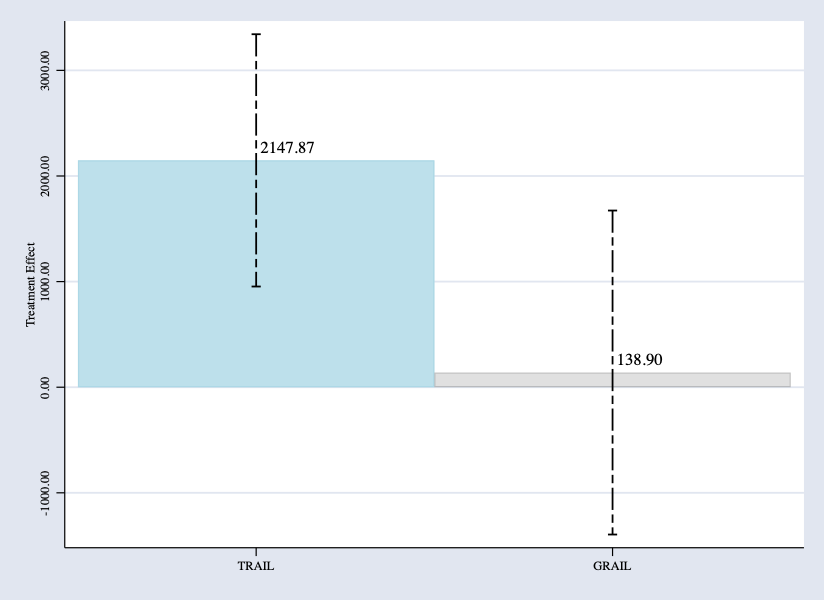

The TRAIL loans had higher take-up rates, and were repaid at the same high rate (93%) as GRAIL loans (see Figure 1). In both interventions, treatment households borrowed more and cultivated greater areas under potatoes than the ‘control 1’ households who had also been recommended but were not treated (Figure 2, panel A). In both schemes, treatment households produced 25% more potato output than control 1 households (Figure 2, panel B). In addition, TRAIL treatment farmers incurred lower per-acre production costs than the control 1 (Figure 2, panel C) and consequently increased potato value-added by 40% (Figure 2, panel D) and aggregate farm income by 21% (Figure 3). By contrast in GRAIL, treatment farmers failed to lower unit costs relative to their control 1 counterparts, ending up with a negligible, statistically insignificant increase in potato value added (4%) and farm incomes (1.4%). Thus, TRAIL provides a rare instance of a microcredit experiment that successfully raised borrower production and incomes, while maintaining high repayment rates and take-up. In contrast, the GRAIL scheme did not succeed in raising farmer incomes appreciably.

Figure 1. Loan performance: Continuation, default rates

Figure 2. Average treatment effects on potato cultivation

Figure 3. Average treatment effects on farm value added

Mechanisms and discussion

One possible reason for these divergent outcomes could have been that compared to the GRAIL agent, the TRAIL agent recommended more productive farmers who then made better use of the loans provided. Using the panel feature of our sample, we estimate the productivity of each farmer, and find that the farmers recommended by the TRAIL agent were indeed more productive than those recommended by the GRAIL agent (Figure 4). However, it turns out less than 10% of the differences in the average treatment effects on farm income can be explained by selection differences. Instead, approximately 75% of the difference is accounted by treatment effects conditional on productivity. Since the loan schemes were identical, and the selection effects negligible, this indicates that the difference in outcomes between TRAIL and GRAIL owed mainly due to differences in the way that the respective agent interacted with the treated borrowers.

Figure 4. TRAIL-recommended borrowers were more productive than GRAIL-recommended

Our research then develops and tests a theoretical model of agent-farmer interactions, with the following features. The TRAIL agent enters into an interlinked lending-cum-marketing contract with farmers, and the agent’s profit mainly consists of middleman margins from reselling the farmers’ output to wholesale buyers. So the agent is motivated to help farmers by providing business advice on input sourcing and timing of sales, which induces them to produce and sell more to the agent. Treated (and especially among them, the higher productivity) borrowers benefit more from such advice; this motivates the TRAIL agent to help them more.

On the other hand, the GRAIL agent lacks both business expertise and profit motives, and is motivated primarily to serve the local incumbent party’s pro-poor agenda for either ideological or vote-buying purposes. Accordingly, he focuses on the poorer, lower-productivity borrowers, and monitors them intensively to reduce their crop and default risks. In turn, this prevents them from lowering production costs and raising yields.

The predictions of the model successfully match patterns in the data. For instance, the TRAIL agent spent more time talking (about production, harvest, and sales) to high productivity TRAIL borrowers, whereas the GRAIL agents interacted more with the lowest productivity GRAIL borrowers. Low-productivity GRAIL borrowers experienced fewer defaults than corresponding low-productivity TRAIL borrowers; while default rates were similar for higher-productivity borrowers.

Our results underline the importance of looking beyond the architecture of local networks, and incorporating the effects of policy treatments on relationships within the network. More generally, they indicate the potential value of enlarging the set of potential intermediaries for agricultural development interventions to include private traders. Their specialised information about the productivity and reliability of farmers in these communities, and incentives to help farmers take advantage of these interventions, imply that they could be valuable partners in development interventions.

This article is posted in collaboration with VoxDev.

Further Reading

- Banerjee, Abhijit, Arun G Chandrasekhar, Esther Duflo and Matthew O Jackson (2013), “The Diffusion of Microfinance”, Science, 341:363-372.

- Beaman, Lori and Jeremy Magruder (2012), “Who Gets the Job Referral? Evidence from a Social Networks Experiment”, American Economic Review, 102(7):3574-3593. Available here.

- Berg, Erlend, Maitreesh Ghatak, R Manjula, D Rajasekhar and Sanchari.Roy (2018), “Motivating Knowledge Agents: Can Incentive Pay Overcome Social Distance?”, Economic Journal, 129(617):110-142.

- Maitra, P, S Mitra, D Mookherjee and S Visaria (2020), ‘Decentralized Targeting of Agricultural Credit Programs: Private versus Political Intermediaries’, Bureau for Research and Economic Analysis of Development (BREAD) Working Paper No. 570.

02 March, 2020

02 March, 2020

Comments will be held for moderation. Your contact information will not be made public.