It is surprising to note that labour intensity in the organised manufacturing sector in India, particularly in industries with greater labour requirements, has shown a sustained decline over the past three decades. This column finds that the key explanation is trade reforms that targeted capital goods and brought their prices down over time. This inadvertently incentivised firms to invest in machines and employ fewer workers

India’s disappointing performance in creating jobs in the organised manufacturing sector1 is one of the most compelling and least understood aspects of India’s post-reform economic development. Given the large numbers of surplus labour in the low-productivity agriculture sector in India, the expectation was that the 1991 economic reforms and the removal (at least in part) of existing distortions in factor and capital markets (such as the industrial licensing system and interest rate controls), would lead to a shift in the structure of production towards labour-intensive sectors and an increase in labour-intensity across the board in Indian manufacturing.

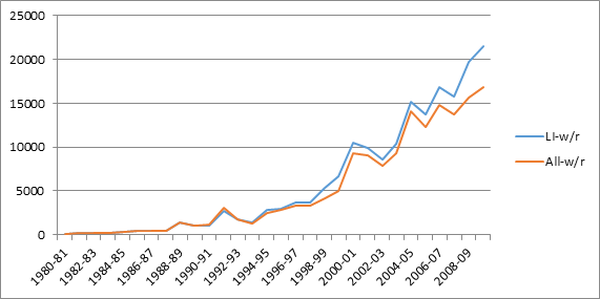

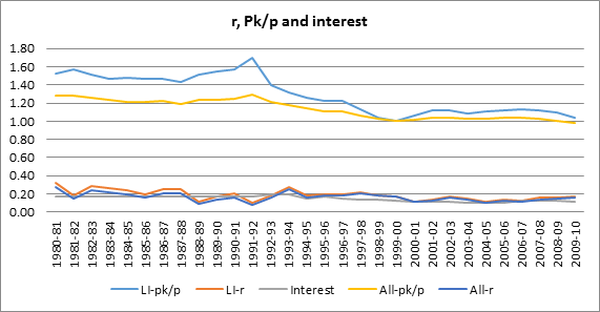

In fact, the opposite has happened, with overall labour intensity in organised manufacturing falling from an average of 1.45 in the 1980s to 0.33 in the 2000s. This implies that while there were roughly 1.5 per unit of capital in the 1980s, there was only one worker per three units of capital in the 2000s. What is remarkable about this phenomenon is that the decline has particularly occurred in the labour-intensive sectors2, where labour intensity fell from an average of 3.34 in the 1980s to 0.78 in the 2000s (Figure 1). While falling labour intensity may not be surprising in capital-intensive sectors as firms in these sectors engage in ‘defensive innovation’ and invest in computerisation and machines to ward off foreign competition, the decline in labour intensity in the labour-intensive sectors is not what one expects, given that labour is the source of comparative advantage in these sectors.

Figure 1. Declining labour intensity in Indian industry, 1980-81 to 2009-10

Explaining weak performance of labour-intensive sectors in India

What explains the sustained decrease in labour intensity in the labour intensive-sectors over 30 years in organised Indian manufacturing? There are two standard explanations for the weak performance of labour-intensive sectors in India. The first explanation highlights the stringent nature of labour laws in India. A second explanation highlights a range of supply-side factors, such as infrastructural bottlenecks, poor skills and low literacy rates among unskilled workers in India as possible reasons for firms substituting labour with capital. With respect to the first explanation, several papers have shown that stringent employment protection legislation (for organised sector workers) – among the most protective in the world – has reduced the incentive of firms, especially those in the purview of employment protection legislation, to hire workers on permanent contracts. It has pushed them towards more capital-intensive modes of production, than warranted by existing costs of labour relative to capital. The first explanation may be able to explain the level of labour intensity, and why Indian firms tend to use less labour per unit of capital than firms in other countries at similar level of economic development. However, to explain decreasing labour intensity over time, one would need labour restrictions to become tighter over time. This has not happened, with an absence of pro-worker labour legislations for much of the 1990s and 2000s in most Indian states. On the contrary, Indian firms are increasingly getting around employment protection legislation by using contract workers in place of permanent workers (Saha, Sen and Maiti 2013).

The second explanation may be able to explain why labour-intensive manufacturing sectors in India have not been able to compete effectively against similar sectors in other countries (such as garments in Bangladesh). But the lack of adequate infrastructure and skills in the workforce cannot be an explanation for the sustained decline in labour intensity that we have observed across all sectors in Indian manufacturing.

Rising real wages, falling capital prices

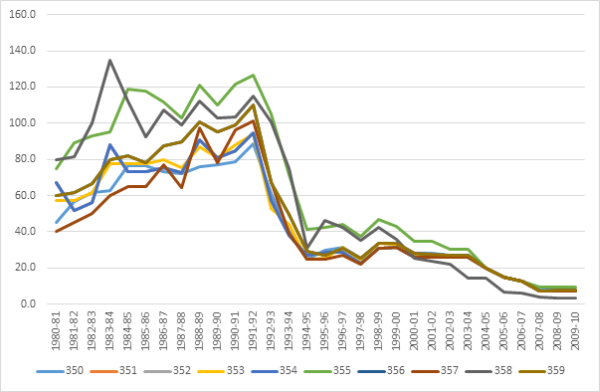

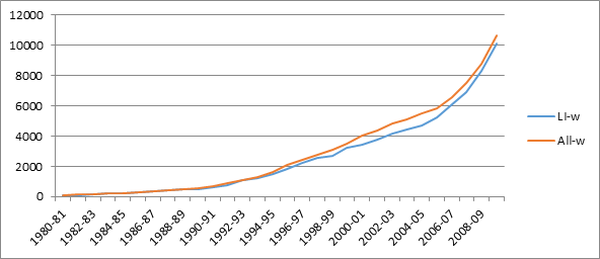

In mainstream economics, the standard explanation for why we may observe a fall in the labour to capital ratio is that this is due to an increase in the real wage to rental price of capital ratio, where the rental price of capital is the product of the real interest rate and the relative price of capital goods3. Can this explanation be offered for the puzzling decline of labour intensity in organised Indian manufacturing? When we plot the wage/rental price of capital ratio, we see a sustained increase in this ratio (Figure 2), suggesting this increase is the primary reason for the fall in the labour to capital ratio in organised Indian manufacturing. The increase in the wage/rental price of capital ratio has been driven both by an increase in the real wages and a fall in the rental price of capital (Figure 3). The fall in the latter is in turn to due to the fall in the relative price of capital goods, rather than a fall in the real interest rate (Figure 4).

Figure 2. The wage/rental price of capital ratio (w/r) for organised manufacturing in India

Source: Sen and Das 2014

Source: Sen and Das 2014 Note: ‘All’ refers to all sectors within organised Indian manufacturing; ‘LI’ refers to labour-intensive sectors in organised Indian manufacturing 4.

Figure 3. Real wages in organised manufacturing in India

Figure 4. The rental price of capital (r), relative price of capital goods (Pk/P), and real interest rate (interest) in organised manufacturing in India

Liberalisation of trade regime with respect to capital goods

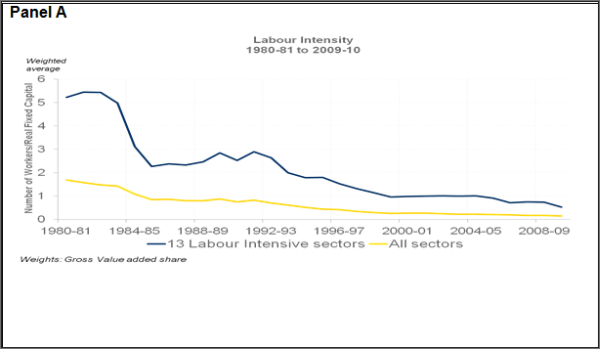

While both the increase in real wages and the fall in the rental price of capital has led to an increase in the wage to rental price of capital ratio, real wage growth during the 1990s and 2000s has not been excessive, with declining bargaining power of trade unions as firms gradually employed contract workers. In fact, during this period, wage share of income fell continuously, reflecting the decreasing bargaining power of organised workers. So the real culprit for the rise in the wage to rental fall of capital ratio is the sharp decline in the relative price of capital goods, especially since the 1990s. What has been the reason for this decline? This has been mostly due to the significant liberalisation of the trade regime with respect to capital and intermediate goods since 1991. There was a sharp decline in import tariffs for a range of capital goods, and this decline was not simply due to the one off trade liberalisation that occurred in the early 1990s but was sustained all the way to the 2000s (Figure 5).

Figure 5. Nominal protection rates for selected capital goods in India

Note: Industry Classification: 350: Agricultural machinery and equipment 351: Construction and mining industries, prime movers, boilers, steam generating plants 352: Nuclear reactors 353: Industrial machinery for food and textile industry 354: Industrial machinery other than food and textile 355: Manufacturing of refrigerators, AC’s 356: General purpose machinery 357: Machine tool parts and accessories 358: Office, computing and accounting machinery and parts 359: Special purpose machinery and equipment/ component/ accessories

Note: Industry Classification: 350: Agricultural machinery and equipment 351: Construction and mining industries, prime movers, boilers, steam generating plants 352: Nuclear reactors 353: Industrial machinery for food and textile industry 354: Industrial machinery other than food and textile 355: Manufacturing of refrigerators, AC’s 356: General purpose machinery 357: Machine tool parts and accessories 358: Office, computing and accounting machinery and parts 359: Special purpose machinery and equipment/ component/ accessories Source: Sen and Das 2014

Thus, as protection for capital goods was removed slowly over time, their domestic prices fell relative to the overall price level. This led to a fall in the price of machines relative to the price of labour, and increasingly made firms in the organised sector substitute labour for machines. In sum, the key determinant of the declining labour intensity of labour-intensive industries in India, and across organised manufacturing, were trade reforms which targeted capital goods in particular, and brought their prices down over time. While this may have led to an increase in the rate of private fixed investment in machines, and consequently, economic growth (see Sen 2007), one inadvertent consequence of the trade reforms was to lessen the incentives of firms to employ workers, and to quicken the adoption of machines in their workplaces, across the board in organised Indian manufacturing.

Notes:

- The organised (or formal) manufacturing sector in India comprises firms which are registered under the Factories Act of 1948 of the Government of India. Firms have to register with the Indian government under the Factories Act if they employ ten or more workers and use electricity in their operations, or if they employ twenty or more workers without the use of electricity in their operations. The Factories Act regulates the conditions of work in the formal manufacturing sector, including minimum safety, sanitary, health and welfare standards, as well as stipulating regulations on hours of work, leave with wages and holiday provisions for workers, which employers in the formal sector need to follow or face stiff penalties.

- Labour-intensive sectors were identified as those industries whose labour intensity was above average for the manufacturing sector as a whole for the period 1980-81 to 2009-10. These industries were grain mill products, other food products, tobacco products, knitted and crocheted fabrics, wearing apparel, dressing and dyeing of fur, tanning and dressing of leather, footwear, saw milling, wood products, railway locomotives, furniture and manufacturing not elsewhere classified. See Sen and Das (2014) for more details on how the classification of labour-intensive industries was arrived at.

- The rental price of capital is the cost of hiring capital (machines and commercial real estate). The higher the real interest rate and the higher the relative price of capital goods (the ratio of the price of capital goods to the general price level), the higher is the cost of capital. An increase in the real wage relative to the rental price of capital makes workers more expensive to hire relative to capital goods, and induces firms to use more capital as compared to labour.

- This applies to Figures 3 and 4 as well.

Further Reading

- Saha, B., K. Sen and D. Maiti (2013), “Trade open-ness, Labour Institutions and Flexibilisation: Theory and Evidence from India”, Labour Economics, Vol. 24, pp. 180-195.

- Sen, Kunal (2007), “Why Did the Elephant Start to Trot? India’s Growth Acceleration Re-Examined”, Economic and Political Weekly, October 27-November 2, Vol. 43, pp. 37-49.

- Sen, Kunal and Deb Kusum Das (2014), ‘Where have the workers gone? The Puzzle of Declining Labour Intensity in Organised Indian Manufacturing’, DEPP Working Paper No. 36, IDPM, University of Manchester.

25 April, 2014

25 April, 2014

Comments will be held for moderation. Your contact information will not be made public.