On 22 September 2017, the RBI notified that rupee-denominated offshore bonds – popularly known as ‘masala bonds’ – will no longer form part of the limit for investment in corporate bonds by foreign portfolio investors. In this article, Radhika Pandey contends that while this is a step in the right direction, more needs to be done to complete the reform to simplify and rationalise the current regulatory framework.

This year, surging foreign investment in rupee-denominated debt reflected an increasing international interest in the instrument. This was a welcome development for India. While the literature (Bank for International Settlements, 2007) highlights the hazards emanating from excessive reliance on foreign currency borrowing, history shows us the systemic risks resulting from them, as seen in the 1994 Mexican crisis and the East Asian crisis in 1997-98. Recognising this, the Reserve Bank of India (RBI) has been reforming its framework to facilitate foreign investment in rupee-denominated debt for the last couple of years. The latest amendment to this framework, notified as recently as September this year, is particularly timely as recent data suggest not only that rupee-denominated debt issuance is increasing, but that the corresponding foreign currency debt has substantially declined.

India's motivation for reform

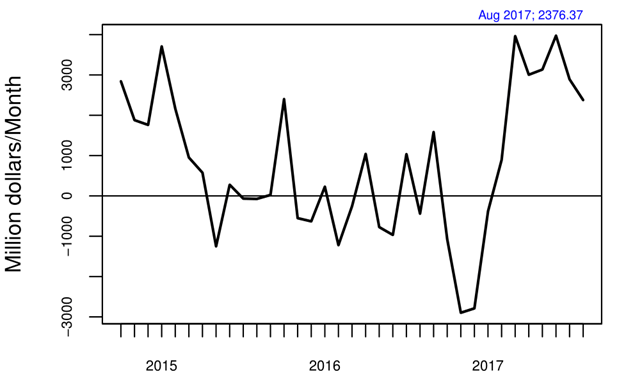

When Indian companies issue debt in foreign currencies, they incur the risk of currency mismatch if the external value of the rupee changes significantly. If many Indian companies face currency mismatch, the problem becomes systemic. When the debt issued is rupee-denominated, however, this risk is borne not by the Indian issuer but the foreign investor instead. Deep and liquid rupee-denominated debt markets stimulate financial stability by ameliorating these risks, and serve as a useful substitute for debt denominated in foreign currency. Financial policy needs to move towards greater liberalisation of rupee-denominated debt. Figure 1 below shows the surge in foreign investments in rupee-denominated debt.

Figure 1. Foreign investment in rupee-denominated corporate debt

Recent amendment to the current framework

In India, foreign investments in rupee-denominated debt can be made both onshore and offshore. Onshore investments are made in India by foreign portfolio investors (FPIs) through various rupee-denominated debt instruments. These investments are subject to a quantitative cap equivalent to US$51 billion. In contrast, offshore issuances are made in the form of rupee-denominated bonds (popularly known as ‘masala bonds’ in Indian parlance) and loans, by certain classes of Indian entities. The latter form part of the overarching External Commercial Borrowing (ECB) framework (RBI, 2015a).

The clear distinction between onshore and offshore frameworks was, until September’s announcement, complicated by the fact that the quantitative cap of US$51 billion was applicable to the total of all (onshore) FPI and (offshore) bond component of rupee-denominated debt, that is, the masala bonds. In the 22 September notification, which came in as the onshore FPI investments approached the US$51 billion quantitative limit, RBI tweaked the framework so that masala bonds no longer form part of this limit (RBI, 2017a).

The purported benefits of the announced changes are:

- Releasing additional space (previously reserved for offshore masala bonds) within the limit for onshore FPI; and

- Harmonising the framework for offshore masala bonds with that of offshore ECB.

Completing the reform: Next steps

While removing offshore masala bonds from the onshore limit is a step in the right direction, more is needed to complete this reform, as:

- Occasional changes in limits (particularly unpredictable ones) may not be sufficient to enthuse foreign investment in rupee-denominated debt, at least not to the extent that a time-bound and pre-defined framework for increase would; and

- True harmonisation would be achieved only once the regulatory framework for masala bonds is made identical to that for parallel rupee-denominated loans.

Drawing on expert committee recommendations and recent changes in similarly placed instruments, the following three steps can constitute a plausible approach for rationalising the foreign investment framework in the bond market.

Moving towards a percentage-based limit

While the recent notification releases masala bonds from the US$51 billion cap, FPI remains subject to this quantitative restriction. Further, when foreign investments approach the stipulated limit, the regulator suspends further foreign participation, jeopardising numerous planned company deals. A simple trade policy perspective on capital controls shows us that quantitative restrictions are the most distortionary kind of restrictions (World Trade Organization (WTO), 1998). Under these restrictions, foreign participation cannot increase beyond the finite cap, unlike with percentage-based limits where foreign participation can vary over time. Quantitative restrictions therefore limit foreign market penetration and insulate the domestic market from international developments. Literature on the design of capital controls also findsm blanket prohibition in the form of quantitative cap to be highly distortionary, and that a conducive environment for facilitating foreign investment in onshore financial markets will foster domestic market development as opposed to investment by foreigners in offshore issuance (International Monetary Fund (IMF), 2000). (See Patnaik et al. (2013) for the conceptual argument in favour of this.)

Similarly, expert committees and literature in this field favour discarding quantitative limits in the bond market as they hinder market development. A reasonable strategy would be to move towards percentage-based caps, similar to the Medium-Term Framework (MTF) for foreign investments in government bonds (RBI, 2015b). Under this framework, the limits for foreign investments are raised according to a specified timetable with the objective of achieving 5% foreign participation in outstanding bonds by March 2018. The periodic increase in quantitative limits imparts predictability to foreign investment inflows. A similar approach could be adopted for foreign investments in corporate debt.

Streamlining regulation for offshore bonds and loans

Since their inception, the framework governing masala bonds has endeavoured to align itself with that governing both offshore loans under the ECB framework as well as FPI investments in onshore issuance (as highlighted in Table 1). Since the September amendment, masala bonds come exclusively under ECB and have no association with the FPI restrictions. While positive, this arrangement could benefit from further streamlining between offshore bonds and loans, especially as recent data suggest that rupee-denominated masala bonds issuance is increasing while ECB denominated in foreign currency has substantially declined.

From the issuer's perspective, the nature of transaction when issuing rupee-denominated bonds is the same as that for loans. While norms governing minimum maturity and amount have been harmonised across bonds and loans, the regulatory framework still differentiates between the two in terms of the interest rate on borrowings. For example, RBI recently imposed a cap on all-in-cost ceiling for masala bonds, but there is no corresponding restriction for loans (RBI, 2017b). As the framework requires the interest rate to be commensurate with market conditions, bonds should also be subject to a generalised treatment similar to that of loans.

Table 1. Changes to the regulatory framework of masala bonds

| Date | Change | Reasoning |

|---|---|---|

| 29/09/2015 | Masala bonds framework introduced | |

| 13/04/2016 | Minimum maturity reduced to three years, limits for individual companies set in Rupee terms | To align with FPI investment in corporate bonds |

| Reporting of borrowings to Foreign Exchange Department | Alignment with ECB | |

| 07/06/2017 | Any proposal of borrowing to be examined by the Foreign Exchange Department | Alignment with ECB |

| All-in-cost ceilings capped at 300 basis points over the prevailing yield of Government of India securities of corresponding maturity | Alignment with ECB | |

| Linking of maturity period and amount | Alignment with EC |

27 November, 2017

27 November, 2017

Comments will be held for moderation. Your contact information will not be made public.