Global credit has experienced significant changes in the last two decades. Analysing data on 1,160 Indian firms for the 2000-2017 period, this article shows that in the period following the global financial crisis, abundant global credit allowed firms to take advantage of relatively cheap financing abroad. However, since 2013, lenders are differentiating across borrowers and firms’ access to external finance has declined, with an associated reduction in their real investment activities.

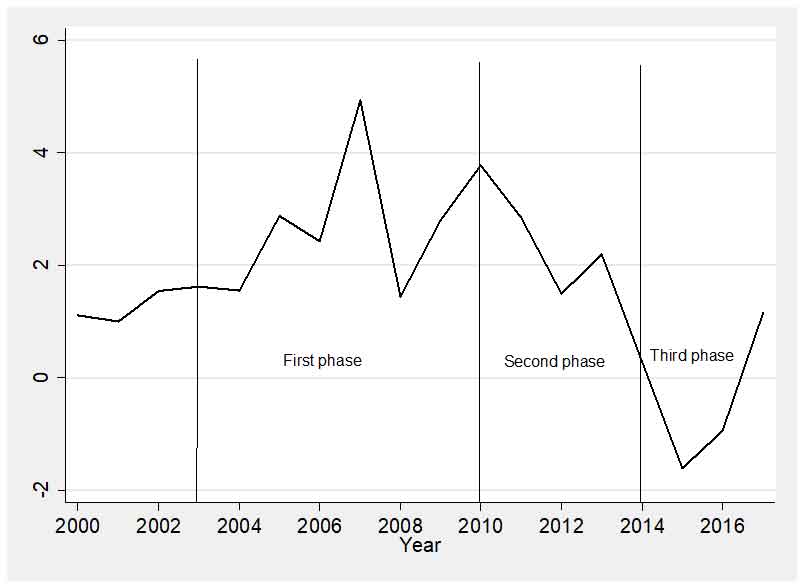

Global credit has experienced significant changes in the last two decades. The abundant credit in the period after the Global Financial Crisis (GFC) has led to substantial growth in corporate debt, increasing co-movement of domestic interest rates with interest rates abroad, and greater exposure to foreign exchange risk in recipient countries (Azis and Shin 2015, Mohanty 2014). Marking the end of this period of benign global credit conditions, the announcement of future tapering of the US Federal Reserve’s quantitative easing1 programme in May 2013, unleashed massive capital outflows from emerging markets. Figure 1 below provides evidence of the slowdown in capital flows to emerging markets in the post-2013 period. This episode, termed as ‘taper tantrum’, has since been followed by other similar episodes such as the extreme capital flow volatility during the first quarter of 2020 triggered by the Covid-19 crisis, characterising a new phase of heightened risk perceptions in international markets and increased capital flow volatility.

Figure 1. Net capital inflows to emerging markets

Source: International Monetary Fund (IMF)'s Balance of Payments (BOP) database.

Note: The figure reports the average of net capital inflows as a share of GDP (gross domestic product) for a set of 44 emerging markets.

Foreign borrowings in India

In new research, we investigate how global credit dynamics affect the access of firms to external finance by employing a dataset on 1,160 Indian firms for the period of 2000-2017 from Centre for Monitoring Indian Economy (CMIE)’s Prowess database (Banti and Bose 2021). We study global credit during two distinct phases: the post-GFC crisis period (2010-2013) characterised by firms issuing directly on international bond markets; and the post-2013 period (2013-2017) of capital flow volatility marked by a declining influence of global factors and an increased role of regional and domestic banks in the provision of international credit to emerging markets. In light of the receding role of global players during the post-2013 period, we investigate whether the most recent changes in risk perceptions have substantially affected firms’ access to external finance.

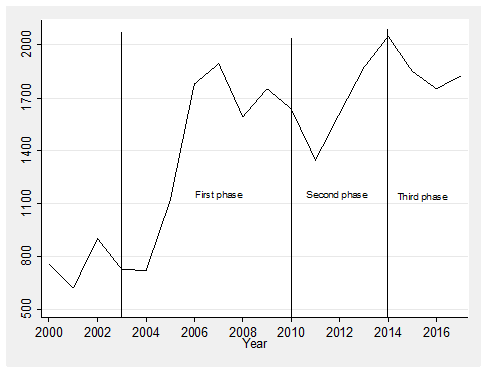

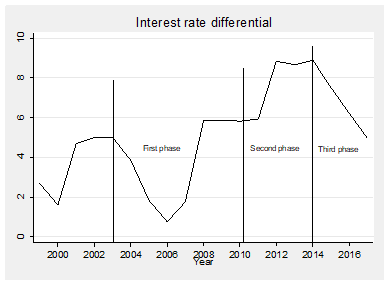

India provides an interesting case study for such empirical analysis for two main reasons. First, across the emerging market economies, India is second only to China with respect to the size of external debt funding (in absolute terms) among non-financial corporations at the end of 2019 (Avdjiev et al. 2020). Second, India experienced shifts in global financing conditions particularly due to changes in the US monetary policy during the post-2013 taper tantrum period that resulted in record net bond outflows of US$13 billion according to data from the Institute of International Finance (IIF). In addition, as evidence of increasing regional financial linkages, credit provision to Indian borrowers from Japanese and Australian banks increased substantially in the post-GFC period2, with a third of international bank credit to India originating from Japanese banks at the end of 2017 as per the BIS’ Locational Banking Statistics (LBS). Figure 2 shows the dynamics of foreign borrowings by Indian firms and global conditions over the period of 2000-2017.

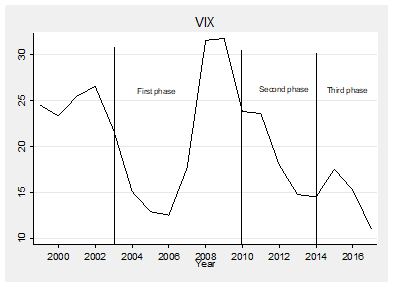

Figure 2. Foreign borrowings and global conditions, 2000-2017

(a) Foreign currency borrowings by Indian firms (in Rs. million)

(b) Global financing conditions

Source: Chicago Board Options Exchange (CBOE) database

Note: VIX is an index representing market expectations for volatility over the coming 30 days.

Role of firm heterogeneity

We find that foreign borrowings by firms increase when global risk is low and the interest rate differential between India and the US is favourable. However, we find that this effect has reversed since 2013. More specifically, we find that only firms with higher credit worthiness are able to raise foreign financing at times of higher global risk and unfavourable global financing conditions during the post-2013 period. The bank lending channel of monetary policy transmission offers a potential explanation for this finding. In the context of increased risk and risk aversion in the post-2013 period, lenders may be less willing to provide credit abroad as their leverage constraints tighten and funding costs increase due to the contractionary US monetary policy. Thus, in the context of greater market turbulence in the post-2013 period, we find that lenders differentiate across borrowers, and the less risky and more profitable firms – that are exposed to global factors – are increasing their foreign borrowings at times of higher global risk.

Role of regional lenders

The declining exposure of firms’ external borrowings to global factors may also be related to a ‘composition effect’ – as regional banks replace global investors as the main credit providers to emerging markets. Although we document that firms do increasingly rely on external finance from regional lenders in the post-2013 period, this effect is not large enough to offset their exposure to global factors. We also find that the response of domestic credit to global factors is similar to foreign borrowings. Hence, they act as complements rather than substitutes for global credit. Finally, we find that firms cut back on their investment spending as a consequence of changes in global credit dynamics in the post-2013 period.

Concluding remarks

Given the policy relevance of this study, we conclude that understanding the exposure of the domestic corporate sector to global credit conditions is the key to manage the build-up of vulnerabilities driven by changes in external conditions over which domestic authorities have little to no control. Thus, even though global credit improves borrowers’ access to external finance, they also pose threats to the financial stability of economies.

I4I is now on Telegram. Please click here (@Ideas4India) to subscribe to our channel for quick updates on our content.

Note:

- Quantitative easing (QE) is a policy strategy of seeking to reduce long-term interest rates by buying large quantities of financial assets when the overnight rate is zero.

- This increase was due to the increasing regional linkages – this is a trend evidence in various regions, and especially in Asia.

Further Reading

- Banti, Chiara and Udichibarna Bose (2021), “Shifts in Global Credit and Corporate Access to Finance?”, Journal of Financial Stability (in press), 100853.

30 April, 2021

30 April, 2021

Comments will be held for moderation. Your contact information will not be made public.