To enhance government revenues, it is important to tackle the menace of tax evasion. This column discusses an experiment that tests whether sharing a firm’s tax compliance status with neighbouring firms and/ or providing social recognition for compliance helps increase compliance. It finds that these interventions do bring about a positive behavioural change, but only for non-compliant firms in areas where some firms were already complying.

High rates of economic growth, in-migration and urbanisation have resulted in great stress on the aging infrastructure in Dhaka, which is the epicentre for economic activity in Bangladesh. Bangladeshi firms report facing more than one power outage per working day in the World Bank Enterprise Survey, and Dhaka is consistently ranked near last place in the Economist Intelligence Unit’s City Livability Index. Addressing these acute infrastructure challenges and sustaining economic growth requires investments, which in turn requires raising revenues, but Bangladesh has one of lowest tax to Gross Domestic Product (GDP) ratios in the world. Revenue collection using audits, fines and other punishment-based methods has proven difficult due to firms’ ability to evade payment, and the difficulties of enforcing legal sanctions.

Increasing tax compliance in Bangladesh

We instead attempt to leverage firms’ interest in social recognition to increase Value Added Tax (VAT) compliance. If a government agency can cheaply provide recognition, and firms find that valuable and attractive, then recognition and status programmes may be cost-effective methods to raise tax revenues. Universities, charities and museums in the United States and other countries successfully leverage people’s interest in status and public recognition to generate funding (example, by naming exhibits or buildings after large donors). This same approach may be applicable for tax collection.

I, along with Raj Chetty and Monica Singhal of Harvard University, partnered with the Bangladesh National Board of Revenue (NBR) to implement a range of programmes that attempt to exploit firms’ interest in social incentives and recognition among peers to increase voluntary tax compliance among firms. We conducted a multi-arm1 randomised controlled trial to rigorously evaluate the impact of these programmes on tax payments.

Selecting firms and sending letters

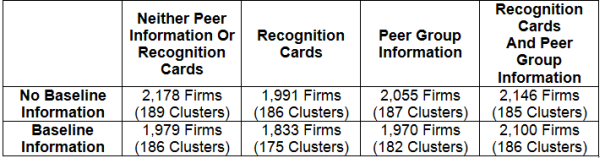

We worked with 32,432 firms in the area administered by the NBR Dhaka-South Commissionerate to investigate the impact of three distinct information interventions on tax compliance and payment for the fiscal year that ended in June 20132. Based on information collected through a baseline survey, we identified 23,034 VAT-relevant firms across 1,522 clusters3 suitable for our experiment. Out of these 23,034 firms, we were able to successfully deliver an initial letter to 16,252 firms containing information about that firm’s registration and payment status and a list of firms in their cluster4. Eight different types of letters were randomly allocated across clusters, with all firms within a cluster receiving the same letter. Each letter contained either zero, one, two or all three of the following information interventions, and these combinations varied across the eight groups (see Table 1):

- Baseline information: Firms assigned to this intervention group received additional information on the aggregate registration, filing, and payment rates for their cluster in the previous period.

- Recognition cards: Firms in this intervention group were told that they would be eligible to receive a gold, silver or bronze recognition card based on their tax compliance and their cluster’s tax compliance.

- Peer group information: Firms assigned to this intervention group were told their tax compliance behaviour would be shared with other firms in their cluster in a subsequent letter.

Table 1. Sample sizes

Bringing firms into the tax base

We digitised all registration and tax payment records for the Dhaka-South area before intervention groups were assigned. The pre-intervention data shows low rates of VAT compliance and payment with only 9.3% of firms paying the VAT in 2012.

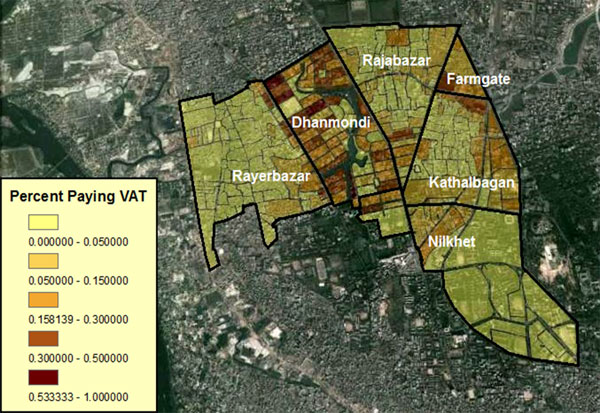

Figure 1. Taxpayer compliance rates (pre-intervention) in area of study

Given the low share of firms paying any amount of the VAT, the primary potential margin of improving tax collection is shifting firms from zero to positive VAT payments. In our analysis, we divided clusters into two groups based on baseline tax compliance: ‘Low compliance’ (where less than 15% of firms within a cluster paid the VAT in 2012 and ‘high compliance’ areas where at least 15% of firms within a cluster paid the VAT in 2012.

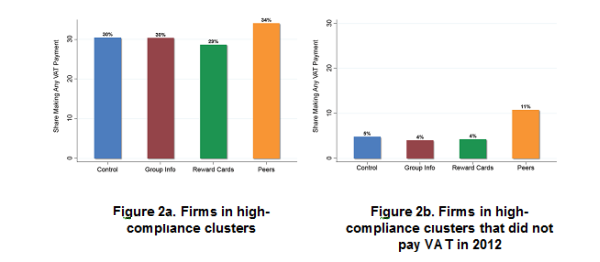

In low-compliance clusters, there were no statistically significant changes in VAT payment rates after the interventions were undertaken, across any of the letter types. In high-compliance clusters, firms that received the peer group information intervention were 3.4 percentage points more likely to make a payment in the post-intervention period (as compared to firms in high-compliance clusters that did not receive the peer group information intervention). The effect is even more pronounced for firms that did not pay any VAT in 2012; firms in this group were 6 percentage points more likely to make a payment during the post-intervention period.

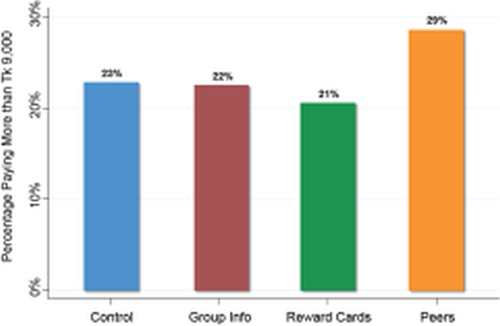

Figure 2. Percentage of firms making VAT payments (June-Oct 2013), by intervention group

Note: “Control” group includes high-compliance clusters that did not receive any of the three interventions – baseline information, recognition cards or peer group information.

Note: “Control” group includes high-compliance clusters that did not receive any of the three interventions – baseline information, recognition cards or peer group information. Increasing total tax revenue

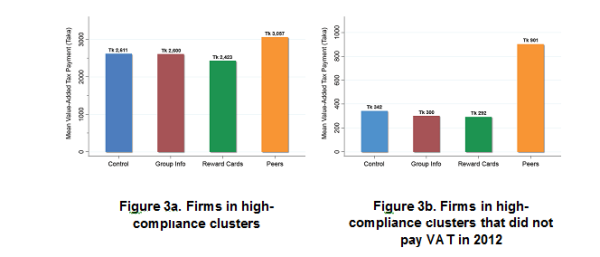

In high-compliance clusters, firms receiving the peer information intervention were not only more likely to pay, but conditional on paying, paid more than firms not receiving this intervention. Combining these two effects, firms receiving the peer information intervention paid 17% more on average during the post-intervention period than other firms in high-compliance clusters. High-compliance areas account for 66% of all VAT revenues generated from the study area thus the 17% increase represents a quantitatively meaningful increase in total revenues. The estimated increase in revenue from the small sample of firms in our study area alone is Tk 870,000 ($11,441) during the short five-month duration of the experiment. The cost of printing and hand-delivering these letters is quite low, and results in a benefit-cost ratio of about 5 to 1.

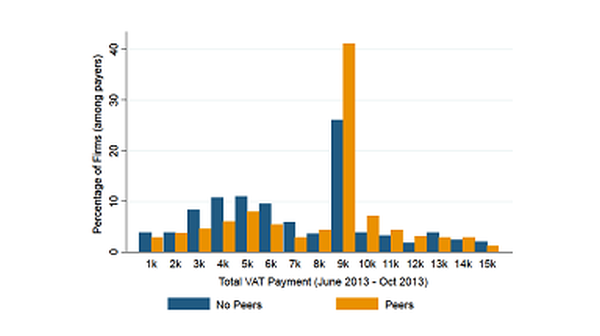

Figure 3. VAT payment amounts (June-Oct 2013), by intervention group

The increase in payments is derived from a 17 percentage point increase in firms paying exactly the package VAT amount, and a 6 percentage point increase in firms that make payments exceeding the package VAT amount.5

Figure 4. Distribution of VAT payments in high-compliance clusters

Figure 5. Percentage of firms paying more than VAT package amount in high-compliance clusters

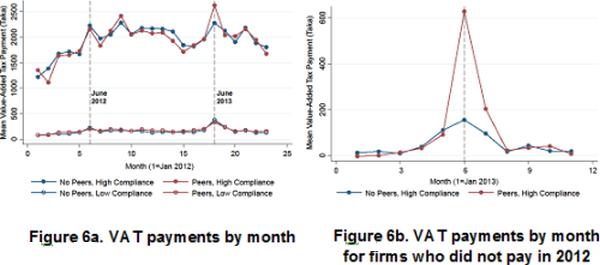

When examining the timing of the increase in VAT payments, we see that the spike in payments in the peer intervention group occurred exactly in the month when the intervention was implemented. Furthermore, the time series of payments in high compliance clusters by those who did not pay VAT in the previous year shows a substantial increase in payments over the group that did not receive the peer information intervention in the month of the intervention.

Figure 6. VAT payments by month

It is clear that there is a strong behavioural response to the peer information intervention; however what drives the observed increase in payments may be attenuated by firms who had already committed to paying at the bank, but exerted more effort after receiving the intervention letters containing the peer information intervention to ensure that their payments are correctly recorded by the NBR. In other words, all the estimates we report are the combined behavioural response of firms of increased tax payments and the improved recording of payments. While improved record-keeping is valuable for the NBR, generating new revenues is the bigger prize. Regardless, our findings clearly demonstrate that firms pay attention to peer-recognition letters and react in ways predicted by simple economic theory. Firms who are deviating from the norm of at least some tax payments in their cluster, and therefore at greatest risk of ‘negative’ information revelation relative to their peers react most strongly. This suggests that there is significant potential for improving tax compliance and revenue collection through peer information programmes. Firms are either paying as a result of the intervention or are ensuring that their tax payments are recorded – which are both important behavioural changes that are vital to establishing an effective tax collection system.

Policy recommendations

The interventions that we tested could feasibly be implemented by governments on a large scale in practice. Our results suggest that exposing information about firms to their peers can increase tax compliance and payment. An example of a potential programme for the NBR to consider is to mandate market and shop associations to displays lists containing tax information about firms in public locations inside the shopping centres. This could act in a similar way to the peer information intervention in our experiment to increase tax revenues. Further, it may induce additional incentives for firms to become tax compliant since publicly available information about tax compliance may affect consumer behaviour, perhaps steering customers towards tax-compliant businesses. Scaling this programme to a larger geographic area than that of our study, in addition to potential changes in consumer behaviour, may lead to increases in revenue far greater than what is predicted by our study.

Notes:

- This means that the experiment involves testing the effect of multiple, cross-cutting interventions. Some clusters receive one intervention, some receive two, some receive all three, and some receive none.

- The intervention was implemented in Jun 2013 and the impact of the intervention was studied over the June-Oct 2013 period.

- Firms were clustered on the basis of geographic proximity, often by market block for outdoor firms and by floor for indoor markets. Clusters contain between 3 and 80 firms each, with a median of 10 firms per cluster.

- The vast majority of the non-deliveries (85%) were due to firm closure between the baseline survey and intervention periods.

- Firms can elect to pay a package VAT, where they pay a flat amount of 9,000 Tk once a year in lieu of submitting receipts and calculating their detailed VAT bill. Only small shopkeepers/ traders are eligible for this VAT package; eligibility is subject to review by NBR.

15 September, 2014

15 September, 2014

Comments will be held for moderation. Your contact information will not be made public.