The key issues in the Indian financial sector in general, and banking in particular, are bearing risk and allocating capital. These are especially important now as India enters into a prolonged phase of economic crisis due to Covid-19 and the associated lockdown. In this post, Sengupta and Vardhan discuss what steps need to be taken to address the heightened risk aversion in the banking system in order to increase the effectiveness of the policy actions taken by the Reserve Bank of India.

The Indian economy is experiencing an unprecedented shock with the outbreak of the Covid-19 epidemic and the subsequent country-wide lockdown. During such crisis times, one sector of the economy that is required to play a crucial role to alleviate some of the pressures is the financial sector. The need of the hour is to keep credit flowing to all economic agents in order to help them tide over this crisis.

In a bank dominated economy, particularly at a time when the stock market is touching new lows every day, the financial intermediaries that most firms will turn to are the banks. Actions taken by the banks would be crucial in addressing the ongoing economic challenge. Banks also play a vital role as institutional participants in the debt market.

However, banking sector in India is badly broken. So far, the problems in this sector were adversely affecting credit growth. Now this has begun to hurt the debt markets as well. This could rapidly become a serious choke point as the Indian economy struggles to come to terms with a shock that many are now claiming can trigger a Great Depression type of slowdown.

Banking system in the pre-Covid-19 period

Over the last few years, India has been dealing with the Twin Balance Sheet (TBS) crisis. This was a consequence of high levels of non-performing assets (NPAs) in an inadequately capitalised banking system, combined with over-leveraged and financially weak firms in the private corporate sector (Sengupta and Vardhan, 2017, 2019).

The government and the banking regulator (Reserve Bank of India (RBI)) took a series of steps to address the crisis. These included putting the weakest 10 banks in a Prompt Corrective Action framework, which prevented them from expanding their books; initiating investigations by the Central Vigilance Commission (CVC), Central Bureau of Investigation (CBI), etc. against senior officials of the banks; and directing banks to trigger the Insolvency and Bankruptcy Code (IBC, 2016) against defaulting firms and accept large haircuts even when capital to provide for the losses was not sufficient.

In some cases, senior officials of banks were arrested for allegedly fraudulent credit transactions. In February 2016, the Supreme Court issued a ruling which held that employees of all banking companies, foreign as well as domestic, are ‘public servants’ under India's Prevention of Corruption Act, 1988 (POCA). This implies that all bank employees now face the risk of investigation and prosecution under the POCA for issues related to corruption. Nearly any decision about NPAs could come under the scanner. This single step is likely to deter bank officers from taking commercial decisions. This is particularly worrisome, given the expansive description of corruption under POCA and minimal restrictions on investigations, as highlighted by commentators at the time. These measures arguably led to a rise in risk aversion in the banking system

As the NPA crisis began plateauing out, the financial system faced another blow when a large non-banking finance company (NBFC), IL&FS (Infrastructure Leasing & Financial Services) defaulted on its debts in September 2018. This sent shockwaves through the banking system as well as the debt markets – the two biggest funding sources for the NBFC sector. The reaction of the bond markets was reflected in sharp increase in credit spreads of all financial sector bond issuers. The total volume of bond issuances dropped significantly, not just for financial sector firms but for all borrowers.

Banks continued lending, primarily encouraged by the RBI and the government, but this lending was limited to a handful of highly rated NBFCs. The IL&FS episode further worsened the risk appetite of the banks and triggered risk aversion in the debt markets as well.

One direct consequence of the heightened risk aversion in the banking system has been the lack of growth in commercial credit supply. Banks, especially the public sector banks (PSBs) which account for close to 90% of the NPAs, severely cut back lending to the private corporate sector. By FY (fiscal year) 2017, net bank credit was growing at a decade's low of 2.69% per year. By FY 2018, PSBs were lending mostly to NBFCs, whereas private sector banks were mainly lending to retail customers. Credit to industry had declined dramatically.

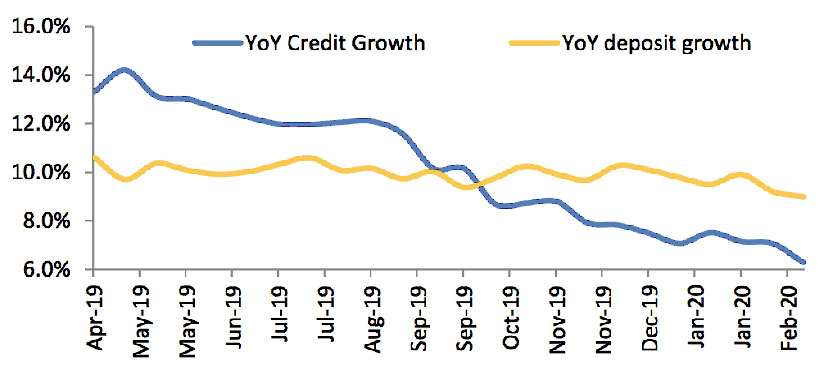

Post the IL&FS crisis, credit spreads on corporate debt securities remained elevated, and bank lending, after an initial spurt in the last quarter of FY2019 (mostly lending to NBFCs), tapered off (see figure 1). Commercial credit witnessed a sharp decline of almost 90% in the first half of FY2020. In February and March 2020, the near-demise of Yes bank, triggered the risk of deposit squeeze for private sector banks which would potentially further curtail credit growth (Pandey and Priyadarshini 2020). Credit growth declined sharply despite the RBI lowering the policy repo rate by 135 basis points to 5.15% in 2019. This was the lowest policy rate in nearly a decade.

Figure 1. Year-on-year (YoY) credit and deposit growth of the banking sector

Risk aversion due to Covid-19

As the ramifications of the health shock and the repercussions of the country-wide lockdown become clear with each passing day, the risk aversion of the banking system will get significantly aggravated. As more and more firms struggle to stay afloat and repay their dues amidst the massive demand and supply disruptions, corporate delinquencies will go up and the level of NPAs in the already fragile banking system will increase precipitously (Sengupta 2020).

In the 2011-2020 period, bulk of the NPAs originated in the private corporate sector. These were secured loans where some recoveries are possible especially given the IBC, 2016. With Covid-19 disrupting jobs and income sources of millions of people, defaults from the retail sector are likely to soar. These are all unsecured loans which make the situation worse. India does not have a personal insolvency law yet. There is no recourse for either the defaulting individuals or the banking system when personal loan defaults start rising, both from urban and rural regions of the country.

Defaults will not only rise in the banking system but also in the NBFCs who lend to the MSME (micro, small, and medium enterprises) sector as the latter's earnings will fall sharply. Especially vulnerable will be the micro-finance institutions (NBFC-MFIs) who are already facing non-repayment of loans. To the extent that these NBFCs have been borrowing from banks, the probability of them defaulting will commensurately go up.

As the NPAs on existing loans keep accumulating, officers in an already risk-averse banking system who also face potential prosecution in the event of 'wrong' decisions, are likely to become even more reluctant to extend fresh credit to firms, especially if the banks are not adequately capitalised.

Risk aversion and turmoil in the debt markets

The consequences of heightened risk aversion in the banking system have begun hurting the debt markets. In a situation where bank credit growth has been at a multi-decade low, debt market – especially the short-term debt market – plays a vital role in financing firms.

Just as the debt market was beginning to regain its appetite for corporate debt securities in the post IL&FS default period, it was hit by the Yes Bank episode (Pandey and Priyadarshini 2020). As part of the restructuring of Yes Bank, its Additional Tier 1 (AT-1) bonds were written down completely1. These AT-1 bonds are an important component of capital for banks. Roughly Rs. 890 billion worth of bonds were outstanding in the banking system as a whole, at the time of this write-down. These were widely held by mutual funds, pension funds, and even retail investors.

Credit spreads on all AT-1 bonds shot up and several planned issuances were cancelled. It is unlikely that any bank will be able to issue these bonds in the near future making it difficult for banks, especially private sector banks, to raise capital. In other words, the problems in the fragile banking sector have been getting compounded.

Since the outbreak of the Covid-19 pandemic, there has once again been turbulence in the debt markets. Liquidity has dried up, and in some cases credit spreads of corporate debt papers have risen sharply to levels higher than what was witnessed in the aftermath of the IL&FS crisis of September 2018. Debt mutual funds, even those that invest at the short end of maturity – liquid funds, ultra-short duration funds, etc. – have taken serious hits to their net asset values (NAVs), making investors nervous.

These funds are considered to be investments second only to bank deposits in terms of safety. The decline in their NAVs is therefore a matter of concern. Widespread fear triggered by the Covid-19 outbreak and the associated business disruption are likely to push many firms to redeem their investments in debt funds and stock-pile cash. This has already created extraordinary redemption pressures on mutual funds.

Ideally, mutual funds would respond to these redemption pressures by selling the debt securities that they have been holding, to interested buyers in the secondary market. However, we are now facing a peculiar situation wherein the mutual funds are not able to do so because of high risk aversion on part of the biggest liquidity suppliers in the markets – the banks. Indian banks have been largely absent from participating in the secondary debt market.

With the largest liquidity pool away from the secondary markets, mutual funds are left with no option other than distress selling securities at whatever price they get in order to meet the redemptions. This has severely impacted their NAVs which may further exacerbate investor concerns leading to more redemptions and triggering a vicious cycle.

Policy options

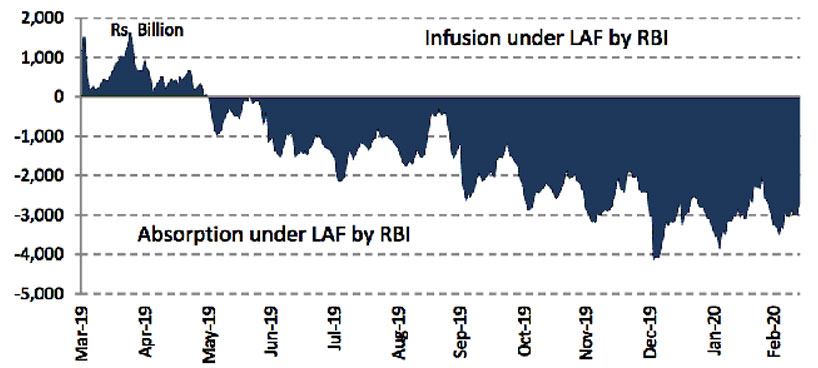

In order to ensure that there is enough money is the system, the RBI has been systematically injecting liquidity into the banking sector, both through open market operations (OMOs)2 and through the Liquidity Adjustment Facility (LAF) window3, as shown in Figure 2.

Figure 2. Liquidity infusion/absorption under LAF by RBI

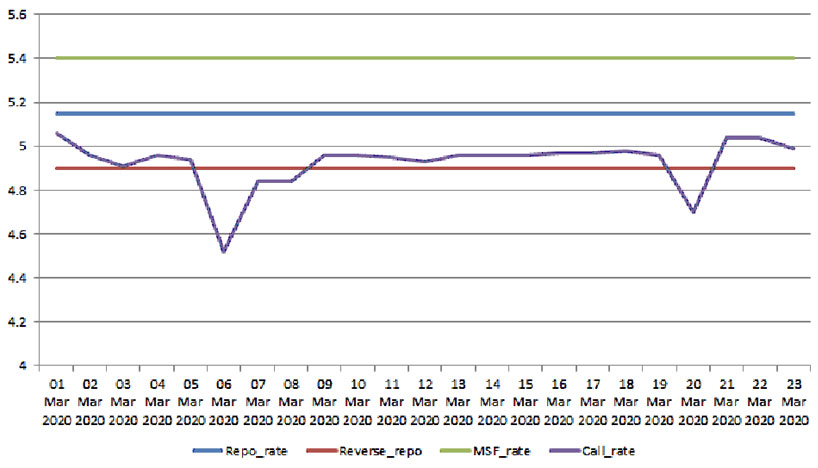

Figure 3 shows the weighted average call money market rate juxtaposed against the ‘corridor’ defined by RBI’s repo4, reverse repo5, and marginal standing facility6 rates. The call rate remains close to the reverse repo rate which indicates that banks are flush with liquidity. There has not been a sharp rise in demand for funds in the overnight money market. It appears that the banks are hoarding liquidity yet despite having a large enough liquidity cushion, bank lending has not picked up significantly.

Figure 3. The call money rate vs. RBI's LAF 'corridor': March 2020

The RBI has now announced a slew of measures to further boost liquidity by Rs 3.75 trillion. The announcement of long-term targeted repo operations (LTRO) wherein banks can borrow money from the RBI, with the condition that they will invest in secondary market instruments (such as commercial papers and corporate bonds), is a welcome step. This may help revive much needed participation by the banks in the debt market.

However, it is questionable whether adding more liquidity to a system that is already flush with it is going to boost credit growth in and of itself, given the heightened risk aversion in the banking sector. While part of the fall in commercial credit growth may have been due to lack of demand given the balance sheet crisis in the private corporate sector, anecdotal evidence suggests that reluctance in banks to extend credit has also been a big factor. As admitted by the RBI Governor himself in recent times (italics and highlight added): “In view of subdued profitability and deleveraging by certain corporates, risk-averse banks have shifted their focus away from large infrastructure and industrial loans towards retail loans.”

Moreover, banks have reduced their participation in the bond market, even for government securities (G-Secs). The share of commercial banks in the ownership of outstanding G-Secs has progressively gone down from 47.3% in December 2011 to 39.1% in December 2019.7 This points at extreme risk aversion.

Unlike the last few years when firms have been deleveraging in response to the TBS crisis, now with firms' revenues collapsing, there will be a big surge in demand for credit. As shown by Sane and Sharma (2020), most firms cannot last very long on the cash they have, even if they restrict their payments to the minimum. Hence the need of the hour is for the banks to start lending aggressively, not just to their existing customers, but also to new firms that need credit support.

By reducing the reverse repo rate, the RBI has effectively increased the opportunity cost for banks that are not lending commercially. While this is an attempt to enhance bank lending, once again risk aversion on part of the banks is likely to limit the gains. Banks will most likely be content with lower returns on liquidity than take on additional risk.

If risk aversion is the key problem, then steps need to be taken to first reduce this in order to make any policy action effective. This cannot be resolved by regulatory tweaks alone. Government as the owner of nearly 70% of the banking sector needs to step in as well. Some of the steps that can be taken are:

- Recapitalise the banks adequately or issue a promise of capital, so that the banks are able to provide for the impending surge in NPAs, instead of postponing the recognition and kicking the can down the road. This may encourage banks to start lending.

- Provide interest subvention in lending to specific segments, and create a dedicated fund to provide this subvention. This will improve banks’ ability to appropriately price the risk they are taking.

- Create credit enhancement mechanisms/institutions (for example, credit guarantee and insurance) for improving the credit rating of commercial borrowers which will make it easier for the banks to take lending decisions.

- Notify the personal insolvency sections of the IBC so that banks are better equipped to deal with the rise in NPAs owing to impending defaults in the retail sector.

- Reform the IBC for faster and more effective resolution of stressed assets in the corporate sector. This will give confidence to the banks to bear risk and allocate capital to firms facing cash flow problems.

- Release the banks, both domestic and foreign, from the ambit of the POCA, in order to encourage them to freely take business decisions, including extending loans to new customers.

Conclusions

The main issues in the financial sector in general, and banking in particular, are bearing risk and allocating capital. These are especially important now as India enters into a prolonged phase of economic crisis. The problem of allocating capital should be resolved by the banks as they are best equipped to take this decision. As regards bearing risk, this can only be done by the banks if they get support from the government in the form of say capital or credit guarantees, given the heightened risk aversion in the sector. Policymakers need to take actions accordingly.

Notes:

- Additional Tier-1 bonds are a type of unsecured, perpetual bonds that banks issue to shore up their core capital base to meet the Basel-III norms.

- RBI conducts monetary policy through open market operations (OMO) – purchase (or sale) securities to infuse (or absorb) liquidity. OMO though essentially a monetary tool, has to factor in the large market borrowing at times to maintain orderly financial conditions.

- RBI provides short-term liquidity on demand, largely to banks, under the liquidity adjustment facility (LAF).

- Repo rate is the rate at which RBI lends money to commercial banks on the LAF window.

- Reverse repo rate is the rate at which banks lend money to the RBI on the LAF window.

- Marginal Standing Facility refers to the penal rate at which banks can borrow money from RBI over and above what is available to them through the LAF window.

- Source: Public Debt Management Quarterly Report (Oct-Dec, 2019) and Status Paper on Government Debt for 2017-18 (December 2018), Department of Economic Affairs, Ministry of Finance, Government of India.

Further Reading

-

Pandey, R and D Priyadarshini (2020), 'Yes Bank: The anatomy of a crisis', Ideas for India, 23 March 2020.

- Sane, R and A Sharma (2020), 'Holding their breath: Indian firms in an interruption of revenue', The Leap Blog, 3 April.

-

Sengupta, Rajeswari and Harsh Vardhan (2017), “This time it is different: Non-performing assets in Indian banks”, Economic & Political Weekly, 52(12), 25 March 2017.

-

Sengupta, R and H Vardhan (2019), ‘How banking crisis is impeding India’s economy’, East Asia Forum, 3 October 2019.

- Sengupta, R (2020), 'Covid-19: Macroeconomic implications for India', Ideas for India, 24 March 2020.

06 April, 2020

06 April, 2020

Comments will be held for moderation. Your contact information will not be made public.