Investments in transport infrastructure reduce trade costs and lead to integration of villages with urban markets. This article suggests that this spatial integration could have the unintended consequence of increasing land inequality in rural India. It isolates the effects of market access using colonial railroad locations and the distance of a village from the Golden Quadrilateral highway network. The study finds that integration also increases the share of landless households and the adoption of productive farming technology, which would lead to large farms getting bigger and increase land inequality.

Have you ever wondered why farms in the USA are sprawling agro-businesses while farms in developing countries such as India tend to be small family plots? A couple of factors immediately come to mind: USA is a comparatively land abundant country, and a farmer in the USA has access to a large national market, well integrated by extensive all-weather road and highway networks. More generally, the extent and evolution of land inequality in a country is the outcome of complex interactions among its land endowment, history, politics, technology and market forces. Recent evidence suggests that, globally, land inequality decreased steadily from the early 20th century until the 1980s, when it began to increase (Bauluz et al. 2020). The turning point in land inequality coincided with spatial market integration through economic liberalisation and huge investments in transport infrastructure. This raises the question of whether the dramatic decline in trade costs because of transport infrastructure investments had a role in the observed reversal of the decline in land inequality trend in more recent decades.

Theoretical analysis by Braverman and Stiglitz (1989) suggests that lower trade costs from improvements in transport infrastructure can increase land inequality in villages when credit markets are imperfect. Lower trade costs increase producer prices of agricultural goods, and the profitability of farming technology. Large farmers have better access to credit, especially from formal banks, and they also get lower interest rates compared to the small farmers who often rely on moneylenders. The large landowners can thus adopt new technology at a lower cost to reap the returns to scale and buy land from credit constrained smaller farms. This would lead to increasing land inequality as larger farms got bigger while small farms either didn’t change, became smaller through divisions by inheritance, or were bought out. In our recent paper (Berg et al. 2023), we provide the first evidence on the effects of market integration on land ownership inequality in rural India caused by transport infrastructure development in the long run.

Empirical strategy

Does the Braverman-Stiglitz hypothesis hold up when confronted with the data? To find out, we turned to the experience of India, a leader in transportation investment and spatial integration. Huge investments in roads, highways, bridges, and railways throughout its history have lowered trade costs in India. During the colonial era, the British invested heavily in a network of railways. More recently, the Indian government massively upgraded and expanded its transportation network, with the Golden Quadrilateral (GQ) as its crown jewel. Built between 2001 and 2013, the GQ connects India’s major cities: Delhi (in the north), Kolkata (in the east), Mumbai (in the west) and Chennai (in the south). These transportation networks have led to spatial market integration – according to a popular measure of market access, the Gravity measure, average market access increased by 25% each decade, between 1962 and 2011.

Using data on rural districts from the India Human Development Survey-II (IHDS-II) in 2012, we provide an empirical analysis of the effects of market integration on land inequality, and explore the role of technology adoption as a mechanism. Specifically, we study the relationship between measures of land inequality and of market access, while taking into account other factors that might influence the relationship.

Our analysis focuses on two measures of land inequality: (i) land Gini index1 and (ii) the share of landless households. Our measure of market access, the Gravity measure, uses population of cities and travel time along roads and highways, with population capturing the size of the destination market, and a higher travel time indicates reduced market access.

To establish causality – over and above correlation – we control for other important factors that might influence both land inequality and market access. So, we control for the geography – slope, elevation, crop suitability, rainfall, temperature, – and population density in 1961, since history is a strong predictor of current land inequality.

Even with all this, we would still not know if market access causes land inequality because roadways and highways are not built randomly across different districts. Rather, they are motivated by the objectives of the government, which can also directly influence the land market and thus land inequality. We take two approaches to dealing with this issue. First, we turn to history: the location of historical railroad infrastructure built by the colonial British government up to the 1880s were primarily dictated by defense rather than economic objectives (Donaldson 2018)2 . That means their placement is not directly related to the economic potential of a district, and thus should not affect the evolution of land inequality other than through market access.

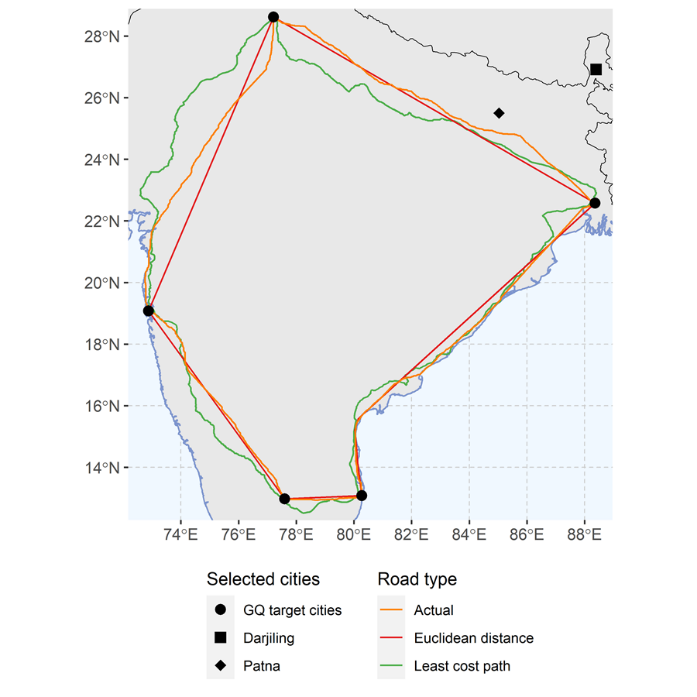

Figure 1. Golden Quadrilateral connecting networks

Second, we use an ‘inconsequential place’ research design inspired by the GQ network in Figure 1. For example, the fact that the distance from Patna (in the state of Bihar) to the Delhi-Kolkata arm of GQ is much lower than that from Darjeeling (in the state of West Bengal) is not because GQ was targetted to exploit its economic potential or to help the poor in Patna; therefore, the better exposure to markets for Patna is incidental. The actual placement of the GQ arms may, however, deviate from the least-cost path, and this may reflect political lobbying. To get around such potential endogeneity of the actual route, we instead use the hypothetical linear route connecting the nodal cities for our study. We use an instrumental variables (IV) approach3 so that we can utilise only that part of the variation in market access, across districts, which is driven by historical railroads and distance to the nearest GQ arm, thus purging out any potentially endogeneity.

Our findings

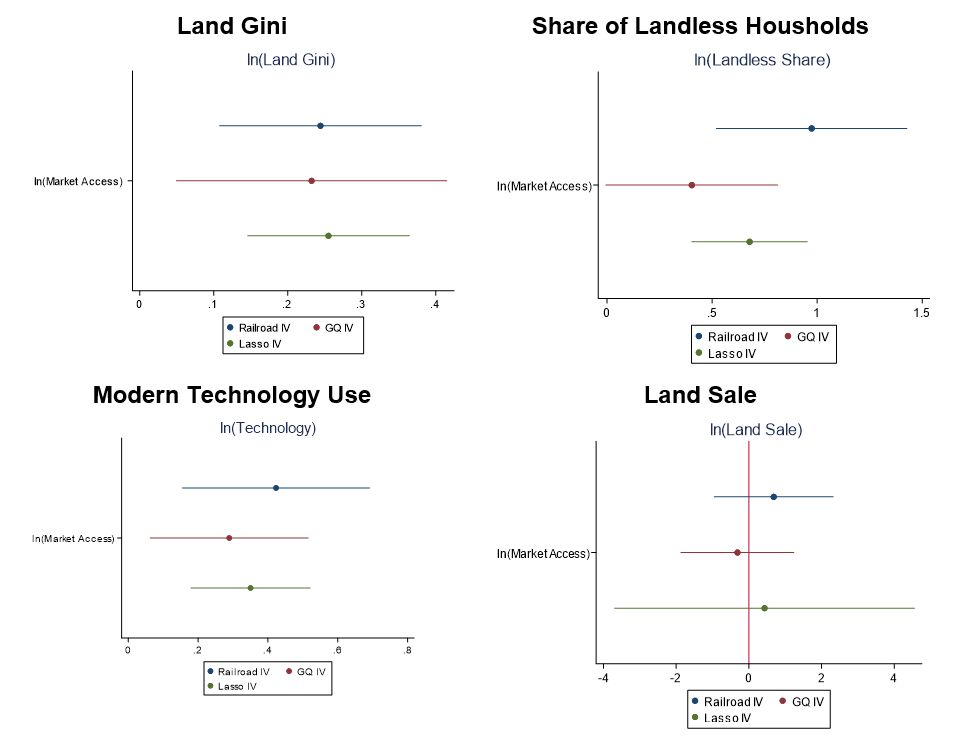

Figure 2 illustrates the estimated results under three alternative estimation strategies. The first uses colonial railroad length as an instrument (Railroad IV), and the second uses the distance to the Golden Quadrilateral network (GQ IV). The third uses a statistical method to choose between a set of possible instrumental variables, including these two (Lasso IV)4 While there is some variation in the estimates, the results are fairly consistent.

Figure 2. Estimated elasticities with respect to market access

Our results indicate that a 10% increase in market access increases the land Gini coefficient by 2.5% and the share of landless households by 6.8% in the long run, both statistically significant and meaningful increases5 To put this into perspective, about half of the households in the average district are landless (56.4%), so an increase of 6.8% means that the new share would be about 60.24%. In a nutshell, increasing market access causes a considerable increase in land inequality.

The analysis also lends support to the theory proposed by Braverman and Stiglitz (1989), namely that lower trade costs increase returns to scale by boosting the profitability of technology adoption. A 10% increase in market access increases the returns to adoption of farming technology by 3.5%. There is some indication that market access is associated with increased land sales, but these estimates are less precise, and the evidence is not conclusive.

Conclusion

In sum, the estimation results deliver two important conclusions. First, huge investments in roads and highways in India are likely to increase land inequality. Second, the big push to integrate the rural hinterlands with the urban markets would help in increasing returns to farming technology adoption and agriculture growth.

An important policy implication of this is that improving credit access for small and medium farmers may bring double dividends, by improving both efficiency and equity. With better access to credit, small and medium farmers will be able to compete with large farmers by adopting new technology. While in certain cases relatively inefficient small and medium farmers may be better off selling their land, and migrating (or commuting) to the nearby urban labour market, or starting a nonfarm business, it is important to ensure that the small and medium farmers are not losing out because of a lack of access to credit market. The government needs to consider credit market policies along with the investments in transport infrastructure.

Notes:

- A Gini index measures the extent to which the distribution of land (or income or consumption) among individuals or households within an economy deviates from a perfectly even distribution. A Gini index of 0 implies perfect equality while 100 implies perfect inequality.

- Railroads constructed after 1880 by British were partly targetted to poor areas because of the famine commission report.

- Instrumental variables are used in empirical analysis to address endogeneity concerns. The instrument is correlated with the explanatory variable (that is, market access in our study) but does not directly affect the outcome of interest (land inequality, except for its impacts through market access). The instruments can be used to measure the causal relationship between the explanatory factor and the outcome of interest.

- Lasso chosen IVs are distance to GQ interacted with slope; distance to GQ interacted with elevation; and railroad length interacted with crop suitability.

- This estimate is based on the Lasso IV results. If we use the 2SLS estimates, a 10% higher market access implies a 7.6% increase in the landless households in a district.

Further Reading

- Bauluz, L, Y Govind and F Novokmet (2020), ‘Global Land Inequality’, World Inequality Lab Working Paper No. 2020/10.

- Berg, C, B Blankespoor, MS Emran and F Shilpi (2023), ‘Does Market Integration Increase Rural Land Inequality? Evidence from India’, World Bank Policy Research Working Paper.

- Braverman, A and J Stiglitz (1989), ‘Credit rationing, tenancy, productivity, and the dynamics of inequality’, In Bardhan, P (ed.), The Economic Theory of Agrarian Institutions, Oxford University Press.

- Donaldson, Dave (2018), “Railroads of the Raj: Estimating the Impact of Transportation Infrastructure”, American Economic Review, 108(4-5): 899-934.

08 August, 2023

08 August, 2023

Comments will be held for moderation. Your contact information will not be made public.