Analysing RBI data from June 2017 – six months after demonetisation was announced on 9 November 2016 – Mukherjee and Wadhwa show that reliance on cash has reverted to pre-demonetisation levels, and the sharp increases in digital transactions did not sustain. While consumers don’t seem ready to give up cash just yet, the experience proves that the digital financial ecosystem of India is in good health.

It has been over nine months since the day Indians were asked to change their old Rs. 500 and 1,000 notes following the ‘demonetisation shock’ announced by the government. The turmoil in the economy has since calmed to a large extent. In the past months, the government launched a concerted effort to wean Indians away from cash as the preferred method of payment for transactions. And within a short period of time, ‘digital’ and “cashless” became common parlance. It seemed as if India was poised for a complete restructuring of its economy leaping into the digital future. But did that happen?

Our analysis of RBI (Reserve Bank of India) data released in June 2017 shows that the initial euphoria has died down, but digital payments are here to stay. Digital financial inclusion was only expressed as a goal of the demonetisation policy well after it was originally announced - yet the Indian government adroitly exploited this opportunity to develop a more robust digital ecosystem. The data, however, say something very interesting: Indians are moving to digital transactions, but at a pace of their own choosing. Cash is still the king – or so it seems.

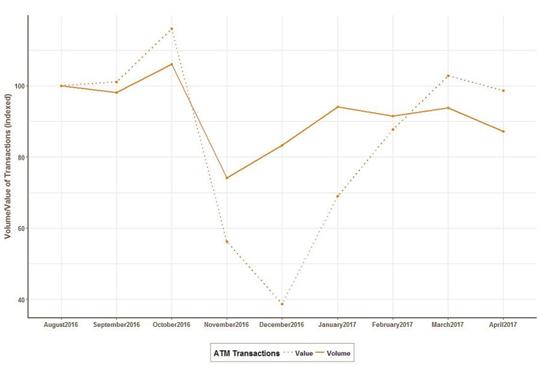

Figure 1. ATM transactions in India by value and volume, August 2016-April 2017

ATM transactions are a strong indicator of reliance on cash. With restrictions on cash in the economy in November and December last year, the volume and value of ATM transactions dramatically fell. However, once cash was restored in the economy, ATM transactions achieved close to pre-demonetisation levels.

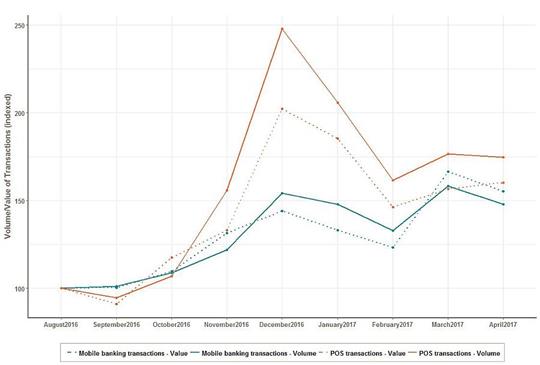

As expected, transactions using mobile banking and point-of-sale (POS) that experienced sharp increases during the demonetisation phase also did not sustain after December. While the volume and value of mobile banking and POS transactions have not fallen to pre-demonetisation levels, given that they were on a steady growth trajectory pre-demonetisation, India may have simply regressed to the previous trend. (The volume of transactions for March and April can be misleading because at the time of financial year closure, a higher volume of transactions generally take place.)

Figure 2. Mobile banking and POS transactions in India by value and volume, August 2016-April 2017

The quick reversion to business-as-usual signals that consumers are not ready to give up cash just yet. There are several reasons for this: 1) digital transactions have explicit overhead costs; 2) a neighborhood grocery store in India would most likely charge extra for the same product if it is paid by any non-cash instrument; 3) India also still has a dominant informal sector; and 4) reliance on cash is inevitable for economic activities to remain outside the tax net.

However, cash is also implicitly expensive – lost tax revenue due to under-reported income; risk of counterfeit and theft; and access to cash is far more time-consuming. But such costs are often not internalised when comparing cash to digital transactions. Thus, a behavioural shift to digital finance cannot be coerced, but requires gradual improvements in financial literacy and formalisation of the economy.

The Indian government, however, has taken an atypical approach to transition into a digital financial economy. Most developed economies transitioned to a cash-lite economy due to market-driven consequences. The Indian government, on the other hand, has taken an active part in incentivising citizens to shift towards digital finance. While demonetisation may not have been successful in this vein, the Modi government capitalised it to launch several novel digital payment instruments, such as the BHIM application that utilises the Unified Payments Interface for instant bank transfers, and AadhaarPay that connects the Aadhaar-enabled biometric identification as an authentication process for mobile banking.

With several digital financial instruments in the market, the consumer now has more choice than ever. Demonetisation forced consumers to hastily adapt to non-cash instruments, proving the digital financial ecosystem of India is in good health. With careful attention to crafting the right incentives, the Indian government could play a successful role in furthering India’s journey towards true digital financial inclusion.

This article first appeared on the CGD Blog: https://www.cgdev.org/blog/six-months-out-demonetization-digital-finance-india-future.

16 August, 2017

16 August, 2017

Comments will be held for moderation. Your contact information will not be made public.