In this part of the series on Piketty, Debraj Ray, Professor of Economics, New York University, attempts to clear the confusion caused by the theoretical discussion in Piketty’s book.

Thomas Piketty’s heart is definitely in the right place. Capital in the Twenty First Century addresses the great question of our times: the phenomenon of persistent and rising inequality. Piketty has amassed data — both from a motley collection of sources and from his own empirical work — that shows how inequality has not just been high, but on the rise. Piketty purports to provide an integrated explanation of it all. Paul Krugman calls it “the unified field theory of inequality.” Comparisons to Marx’s great Capital abound (perhaps not entirely unsolicited). Even in this quick-moving bite-hungry world, everyone is still cheering, over a year after the English translation has appeared. That’s pretty amazing.

Amazing, but at another level, unsurprising. We’ve been handed a Messiah — in the form of a sizable tome that contains the laws of capitalism, yes, Laws! The tome has been approved — nay, embraced — by seemingly sensible economists and reviewers. It is written by a good economist whose intellectual acumen is undisputed (I have first-hand evidence for this). It unerringly asks the right questions. So the knee-jerk intellectuals are all a-Twitter, so to speak.

Yet, Piketty’s heart apart, the rest of him is a little harder to locate, and I don’t just mean his coy statement that “I was hired by a university near Boston,” or his distancing from those economists that just do economic theory without studying the real world: “Economists are all too often preoccupied with mathematical problems of interest only to themselves.” Those remarks are at worst a mildly irritating digression. What I mean is Piketty’s positioning on the whole business, his little nod-and-wink to the media and his vast potential audience who feel they already know what economics is all about: look guys, there’s Marx, then a bunch of punctilious theorem-provers, then a small-fisted clutch of real economists, and then there’s me, Piketty, and in case you’re not getting the point, read the title of my book.

Which, by the way, is probably all what many people who are raving about the book have done.

Piketty’s very long opus, which would benefit not a little from severe compression to around half its size or perhaps less, can be viewed as having the following main components:

- The empirical proposition that inequality has been historically high, and apart from some setbacks, has been growing steadily through the latter part of the twentieth century (with capital incomes at the heart of the upsurge), and

- A theoretical apparatus that claims to explain this phenomenon, via the promulgation and application of three “Fundamental Laws of Capitalism.”

I begin with the empirics, but my main points will be about theory.

Long ago, there was Simon Kuznets, an American economist who painstakingly (but with relatively little at his informational disposal) attempted to piece together data on economic inequality in developed and developing countries. With a rather remarkable leap of intellectual virtuosity, Kuznets formulated what soon became known as the Inverted-U Hypothesis (or the Inverted-U Law in some less timid circles): that economic inequality rises and then inevitably falls in the course of economic development. Remember, Kuznets was writing in the 50s and 60s, when all within his experiential ken was agriculture and industry and not much else. So, to him, the story was clear: as an agricultural society transits to industrial production, a minority of the labour force begins to work in industry, and both this minority as well as the relatively few industrial capitalists receive high profits, thereby driving up inequality. Later, as the minority of industrial workers turns into a majority, and as other industrialists come to challenge the incumbent capitalists, the initial inequalities are competed away, leading to a phase of falling inequality.

This is a sensible story, but necessarily incomplete, because as we all know now, agriculture and industry are not the only games in town. Here, for instance, is me writing in 1998 (in an even larger book which could also do with some serious pruning):

"Even without the biases of technical progress, industrialization itself brings enormous profits to a minority that possess the financial endowments and entrepreneurial drive to take advantage of the new opportunities that open up. It is natural to imagine that these gains ultimately find their way to everybody, as the increased demand for labor drives up wage rates. However, the emphasis is on the word ‘ultimately’...

"Such changes may well create a situation in which inequality first rises and then falls in the course of development . . . but to go from this observation to one that states that each country must travel through an inverted-U path is a leap of faith. After all, uneven (and compensatory) changes might occur not only under these situations, but in others as well. Thus it is possible for all countries to go through alternating cycles of increasing and decreasing inequality, depending on the character of its growth path at different levels of income. The complexity of, and variation in these paths (witness the recent upsurge in inequality in the United States) can leave simplistic theories such as the inverted-U hypothesis without much explanatory power at all.” (Development Economics, 1998, Princeton University Press.)

At the time of that writing, and coming into the end of a long stock market boom in the United States, the fact of rising inequality was already widely visible, and several papers were being written on the subject. Two of the main contenders were labour-displacing technological change (computers, for instance) and the rise of globalisation, which kept domestic wages down while allowing profits to grow. There was much discussion and healthy debate. My goal is not to review the debate, but to point out to the hyperventilating readers of Piketty that such a debate was indeed alive and well.

What Piketty brings to this particular table are the following points:

- Inequality has been rising, and to see it well, one should study “top incomes,”: those of the top 1% or even, in a variant which we might call Super Occupy, the top 0.1% or 0.01%. This is an extremely important observation. There are lots of people in the top 1% (more in India, for instance, than in a good-sized European country), and they cast a long and enviable shadow. Theirs are the cars you see gliding by on the streets. Theirs are the gadgets we’d like to buy. Theirs are the lives the media gorge on. Theirs are the styles we covet. Even a large sample survey will often fail to pick these people up, so Piketty’s meticulous examination of tax records (along with co-authors) in different countries is to be applauded. This is data work at its best, with a well-defined reason for doing it, and when I read the papers with Emmanuel Saez and Tony Atkinson that put these findings together, I felt I had learnt something.

- Piketty’s second point is that the rise in inequality is driven, by and large, by the progressive domination of capital income. Piketty presents different pieces of evidence to suggest that “capital” is making a comeback, and yes, it is important to put capital in quotes because he does lump together a variety of forms of capital in that term: ranging from capital holdings that directly bear on production (such as stocks or direct investments) to those that might serve a more speculative purpose (such as real estate). On these matters the empirical story is far less firm, though Piketty doggedly sticks to Capital (oh, but the title at all costs!). For instance, Bonnet et al. (2014) observe that once housing prices are removed from the Piketty compilation of capital, the phenomenon of rising share of capital income goes away. At the time of writing, the Financial Times (May 23, 2014) is reporting arithmetical errors in some of the Piketty spreadsheets. I am not yet competent enough to comment on these empirical critiques, but I’m pretty sure that the overall observation of rising inequality will stand in some definitive shape or form. Nevertheless it is disconcerting to see how the aggregation of disparate “capital holdings,” some productive, others less so, might drive the finer details of a trend.

There is also the not-so-small matter of the United States, an exception noted by Piketty. It is unclear that the story of rising inequality in the US is one of physical (or financial) capital coming to dominate. Rather, inequality in the United States appears to be propelled by incredibly high returns to human capital at the top of the wage spectrum. This points to a very different set of drivers, and also shows that the physical capital story is not pervasive.

Which brings me to the Fundamental Laws of Piketty. “Make no mistake,” (to quote one of his favourite phrases) description is not enough, and it is laudable that Piketty, despite his distaste for mere theorising, feels the need for deeper understanding — for an explanation as opposed to a mere description — of the great phenomenon of rising inequality. That he feels this need is worthy of acclaim in itself, for in fact too many researchers today are content with mere description. Whether he succeeds is a different matter, to which I now turn.

Piketty’s Laws 1 and 2 can, alas, be dismissed out of hand. (Not because they are false. On the contrary, because they’re true enough to be largely devoid of explanatory power.) For the benefit of the reader interested in a brief, self-contained account, I have relegated a statement of these Laws to an appendix (see below, but here is an even briefer description.

Law 1 is merely an accounting identity, a simple tautology that links variables: the rate of return on capital, capital’s share in income, and the capital-output ratio. These are all outcomes or “endogenous variables,” no subset of which can have explanatory significance for the rest unless something more is brought to bear on that piece of accounting (which as far as I could tell, isn’t).

Law 2, which links the savings rate, the capital-output ratio and the growth rate, is the famous Harrod-Domar equation. This goes further than mere tautology, unless we allow all these three variables to freely move, in which case it is not much better than Law 1. Law 2 turns into a falsifiable theory once we impose further restrictions: Harrod did so by presuming that the capital-output ratio is constant. Solow did so by presuming that the capital-output ratio evolves along a production function. Piketty, as far as I can tell, does neither. For instance, there are sections in the book that explain the rise in the capital-output ratio by referring to a fall in the rate of growth. (See the Appendix.) This is silly, because the rate of growth is as much an outcome as the capital-output ratio, and cannot be used as an “explanation” except one of the most immediate (and therefore un-illuminating) variety.

Moreover, these relationships pertain to simple equations that link macroeconomic aggregates: national income, capital-output ratios, or the overall rate of savings. Without deeper restrictions, they are not designed to tell us anything about the distribution of income or wealth across individuals or groups. And indeed, they do not.

And so we come to Piketty’s Third Fundamental Law, what he calls “the central contradiction of capitalism”:

The rate of return on capital systematically exceeds the overall rate of growth of income: r > g.

Relatively speaking, this is the most interesting of the three Laws. It is a genuine prediction. It is falsifiable. And empirical research throws real light on this phenomenon: Piketty amasses data to argue that this inequality has held, by and large undisturbed, over a long period of time. (And reading this description of empirical trends, I continue to be impressed.)

Here is what Piketty concludes from this Law, as do several approving reviewers of his book: that because the rate of return on capital is higher than the rate of growth overall, capital income must come to dominate as a share of overall income. Once again, we are left with a slightly empty feeling, that we are explaining one endogenous variable by other endogenous variables, but I don’t want to flog this moribund horse again. Rather, I want to make two related points: (a) the above assertion is simply not true, or to be more precise, it may well be true but has little or nothing to do with whether or not r > g, and (b) the Law itself is a simple consequence of a mild efficiency criterion that has been known for many decades in economics. Indeed, most economists know (a) and (b), or will see these on a little reflection. But our starry-eyed reviewers and genuinely interested readers might benefit from a little more explanation, so here it is.

The rate of return on capital tracks the level of capital income, and not its growth. If you have a million dollars in wealth, and the rate of return on capital is 5%, then your capital income is $50,000. Level, not growth. On the other hand, g tracks the growth of average income, not its level. For instance, if average income is $100,000 and the growth rate is 3%, then the increase in your income is $3000. Saying that r > g implies that capital income will grow faster than labour income is a bit like comparing apples and oranges.

To make the point clear, I’m going to expand upon this argument in two ways. First, let us look at a situation in which the argument apparently holds. Suppose that capital holders save all their income. Then r not only tracks the level of capital income, it truly tracks the rate of growth of that income as well, and then it is indeed the case that capital income will come to dominate overall income, whenever r > g. But the source of that domination isn’t r > g. It is the assumption that capital income owners save a higher fraction of their income!

Now, is there anything special about capital income that would make their owners save more of it? After all, a dollar is equally green no matter where it grows. The answer is a measured “not really,” with the little hesitation added to imply: well, possibly, because the owners of capital income also happen to be richer than average, and richer people can afford to (and do) save more than poorer people. But that has to do with the savings propensities of the rich, and not the form in which they save their income. A poor subsistence farmer with a small plot of land (surely capital too) would consume all the income from that capital asset. It may well be that the return on that land asset exceeds the overall rate of growth, but that farmer’s capital income would not be growing at all.

In short, I’m afraid that as far as “explaining” the rise of inequality goes, Piketty’s Third Law is a red herring. In the discussion above, everything depends on the presumption that the savings is a convex function of income, thus generating ever-widening inequality over time. That argument does not pin down whether such inequality will manifest itself in the ultimate domination of capita/income, as defined by Piketty. It might, if the rich choose to save their wealth — or transfer it over generations — in the form of dividend-paying capital assets. And they do, more often than not. But it won’t, if the rich use skill acquisition as the vehicle for their intergenerational transfer. It would show up in human capital inequality instead. (And indeed, some version of this discussion appears to be true for the United States, a notable exception to the Piketty argument, though my argument shows that the exception isn’t so exceptional after all.1)

But the Piketty faithful will still cling to the magic of that all-pervasive formula: r > g. That looks right, doesn’t it, and besides, it is impressive how empirically the Law appears to hold through decades of data. My answer is: yes, it does look right, and its empirical validity is indeed impressive, but to me it is impressive for a different reason: that it is a mini-triumph of economic theory.2

Here is a fact. Take any theory of economic growth that is fully compatible with “balanced income growth” of all individuals, the kind we already know does a bad job in explaining rising inequalities. Under the mildest efficiency criterion — one that essentially states that it must be impossible to increase consumption for every generation, including the current generation, by lowering savings rates — it follows, not empirically but as a matter of theoretical prediction, that r > g. Piketty’s Third Law has been known to economic theorists for at least 50 years, and no economic theorist has ever suggested that it “explains” rising inequality. Because it doesn’t. It can’t, because the models that generate this finding are fully compatible with stable inequalities of income and wealth. (More on this in the appendix below). You need something else to get at rising inequality.

What then, explains the marked and disconcerting rise of inequality in the world today? Capital, in the physical and financial sense that Piketty uses it, has something to do with it. But it has something to do with it because it is a vehicle for accumulation. It is probably the principal vehicle for accumulation by the top 1% or the top 0.01%, simply because there are generally limits on how high the compensation to human capital can be in any generation. It is hard enough to make a few hundred thousand dollars in annual labour income, and reaching the million-dollar mark (let alone tens of millions) is far harder and riskier. But physical capital — land and financial assets — can be steadily and boundlessly accumulated. In this sense Piketty is right in turning the laser on capital. But, as I said, it’s just a vehicle. (Even a lower middle class family in a high-income country can buy a few shares of Apple or Google.) What’s driving that vehicle is the main question. On this I have three things to say.

The first is that economic growth is fundamentally an uneven process. Whether or not the workhorse growth models satisfy r > g (as I’ve said, they do by and large), they fail on the grounds that they do not capture this intrinsic unevenness. Agriculture to industry was just one of the greatest structural transformations. But there are others. The information technology (IT) revolution brought about another seismic shift, and a great displacement of unskilled labour that is still not over. When the dust has settled, that too will have created a rise in inequality, followed by a Kuznets-like adjustment as job-seekers across generations struggle to deal with the creation of new occupational niches, and the disappearance of others. There are other, perhaps smaller revolutions, but important enough to be visible at the country level: the rise of services, or the software industry, or a boom in finance or engineering. The fact of the matter is that there isn’t just one Kuznets inverted-U. To caricature things a little (but only a little), there are many overlapping inverted-Us, one for each source of uneven growth. Each creates its own inequalities, as the lucky or farsighted individuals already in the beneficiary sector experience an upsurge in their incomes. That inequality then serves as an impetus to reallocation, as the individuals in the “lagging” sectors (or their progeny) attempt to relocate to the growing sector. Whether or not that reallocation can occur will depend on how quickly the new generation can adjust, and on their access to resources (such as the capital market). Whether or not that reallocation is successful depends on the next tsunami of unevenness and where it hits, and so it goes.

The second point is that such unevenness is invariably exacerbated in a globalising world. As countries open up to trade, some sectors, propelled by comparative advantage, will reap immense rewards, and the inhabitants of those sectors will be the beneficiaries. Each wave of globalisation starts off a potential Kuznets curve in each country that reacts in this way.

My third point is that in this uncertain, uneven world, inequalities will invariably rise and fall with the great shifts: industry, IT, and whatever is to come. Is it possible to predict whether the rise and fall will bring us back to the same starting point in “inequality space”? In other words, is there a long-run, secular trend to inequality? I believe that there will be, for a few important reasons.

To begin with, the reallocations demanded by uneven growth can be best dealt with by the already-wealthy. They have the deep pockets to finance the human capital of their children. In a world with perfect credit markets, this problem would go away. But the world does not have perfect credit markets.

Next, the savings rate climbs with higher incomes. This is an important driver of secular inequality. One can pass through several Kuznets cycles, but the rich will always be in a better position to take advantage of them, and they will save at higher rates in the process. The process is cyclical, but not circular.

And finally, if I may be so bold as to supplement Piketty’s Three Laws by yet another, here it is:

The Fourth Fundamental Law of Capitalism. Uneven growth or not, there is invariably a long-run tendency for technical progress to displace labour.

There is a simple argument why this Law must hold. It is this: capital can be indefinitely accumulated, while the growth of labour is fundamentally limited by the growth of population. Therefore there is always a tendency for capital to become progressively cheaper relative to labour, and so all technical progress must be fundamentally redirected away from labour. But there is a subtlety here: that redirection must of necessity be slow. If it is too fast, then the demand for labour must fall dramatically, resulting in labour being too cheap. But if labour is too cheap, the impetus for labour-displacing technical progress vanishes. So, this change must be slow. But it will be implacable. To avoid the ever widening capital-labour inequality as we lurch towards an automated world, all its inhabitants must ultimately own shares of physical capital. Whether this can successfully happen or not is an open question. I am pessimistic, but the deepest of all long-run policy implications lies in pondering this question.

Appendix: The Fundamental Laws

The First Fundamental Law: The share of capital income in total income equals the rate of return on capital multiplied by the capital-income ratio.

Or, more succinctly and yet more transparently:

Now it is absolutely evident that the above is an accounting identity (of course Piketty recognises this as well), and can hardly deserve the status of a “law.” It may well be useful in organising our mental accounting system, but it explains nothing.

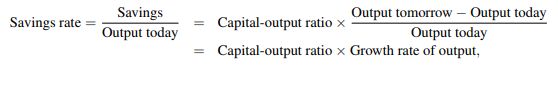

The Second Fundamental Law: The rate of growth of national output equals the savings rate out of national output (net of depreciation) divided by the capital-output ratio.

This is slightly more complicated, but nonetheless with enough freedom given to each of these variables, it is also largely devoid of explanatory power. First we need to understand what the Law means. Savings, net of depreciated capital stock, augments the total stock of capital, so that

where we have made the very mild simplifying approximation that the capital-output ratio is roughly steady over two adjacent periods of time. Now divide both sides of this elementary equation by “output today”, to see that

which is the Second Law. I trust my reader will take it on faith that something that takes a line or two of middle-school algebra to derive, with no reference to the great forces that determine any of the variables in question, should perhaps not be treated as a Law of Capitalism, let alone a “Fundamental Law.” Nevertheless, this equation has served as a starting point on which some venerable economic theory has rested, including the models of Harrod and Domar, which impose the constancy of the capital output ratio for all time, or the classic variant introduced by Solow, which posited that the capital-output ratio evolved according to a production function that was subject to diminishing returns. Leaving both these variables free of constraint, as Piketty appears to do in numerous assertions in the book, is really to say very little. As just one example (page 175):

“If one now combines variations in growth rates with variations in savings rate, it is easy to explain why different countries accumulate very different quantities of capital, and why the capital income ratio has risen sharply since 1970. One particularly clear case is that of Japan: with a savings rate close to 15 percent a year and a growth rate barely above 2 percent, it is hardly surprising that Japan has over the long run accumulated a capital stock worth six to seven years of national income. This is an automatic consequence of the [second] dynamic law of accumulation.”

Or later, page 183:

“The very sharp increase in private wealth observed in the rich countries, and especially in Europe and Japan, between 1970 and 2010 thus can be explained largely by slower growth coupled with continued high savings, using the [second] law. . . ”

(Emphasis mine in both quotes.) These observations — and several others that I do not have the space or the inclination to record — calls into question the entire notion of “explanation”. What does it mean to explain the rise in the capital-output ratio by a slowdown in growth, when that latter variable is just as much an outcome rather than a primitive cause?

The Third Fundamental Law. The rate of return on capital systematically exceeds the rate of growth: r > g.

This one is different. It definitely aspires to the status of a law, not because it is correct for all times and places (it isn’t), but because it is falsifiable and also because Piketty has shown through his painstaking empirical description that it appears to hold. But that does not mean, as Piketty asserts, that it is “the central contradiction of capitalism” (page 571). On the contrary, it is a famous condition known in various guises for several decades: dynamic efficiency, or the transversality condition. The easiest manifestation of this Law comes from studying a Harrod-style growth model in which output is linearly produced by capital, so that the capital-output ratio is constant:

Output = r x Capital,

where r is obviously the net rate of return on capital, and 1/r is the capital-output ratio. Using this in the Second Law, we must conclude that

s = g x (1/r),

where s is the savings rate and g is the growth rate of output. The condition r > g now pops out of the simple restriction that countries are not in the habit of saving 100% of all their income, so that s < 1. Note how this has nothing to do with whether inequality is narrowing or widening in that country. There is no contradiction here, let alone a central contradiction.

What is interesting is that r > g is not just a consequence of this simple model, it is a consequence of any model of growth (including the Solow model), provided that we insist on “dynamic efficiency.” Dynamic efficiency simply states that an economy does not grow so fast as to spend so as to negate the initial (economic) purpose of growth, which is to consume. For instance, in the simple Harrod model, if the savings rate s = 1, then the economy will grow as fast as it can, but no one would ever consume anything (now that would be a better central contradiction). Any other savings rate in the Harrod model is actually dynamically efficient: there is no way to alter the resulting path of consumption and output so as to provide higher consumption at all dates.

So much for the Harrod model. In more general models of growth, this condition is more subtle and imposes deeper restrictions. One beautiful manifestation of this is the celebrated Phelps-Koopmans theorem, which places limit on how quickly an economy can grow in order to satisfy dynamic efficiency. That theorem yields r = g. The strict inequality follows with just a bit of discounting of the future.

Don’t get me wrong. I am not trying to suggest that a simple, aggregative condition such as that derived in the Phelps-Koopmans theorem explains the world. All I am saying is that it explains why r exceeds g. But the fact that r exceeds g explains nothing about the rise in inequality.

This article first appeared on Debraj Ray’s personal blog.

Further Reading

- Bonnet, O, P-H Bono, G Chapelle and E Wasmer (2014), ‘Does housing capital contribute to inequality? A comment on Thomas Piketty´s Capital in the 21st Century’, Sciences Po Economics Discussion Paper 2014-07.

- Krugman, P (2014), ‘Why We’re in a New Gilded Age’, New York Review of Books, 8 May 2014.

- Piketty, T (2014), Capital in the Twenty-First Century, English edition translated by Arthur Goldhammer, Harvard University Press, Cambridge, MA.

- Ray, D (1998), Development Economics, Princeton University Press, Princeton, NJ.

- Giles, C (2014), ‘Piketty findings undercut by errors’, The Financial Times, 23 May 2014.

15 June, 2015

15 June, 2015

Comments will be held for moderation. Your contact information will not be made public.