Gender gaps in women’s economic opportunities – in the labour market and in entrepreneurship – have remained high in India. This article analyses the macroeconomic impact of closing gender gaps in access to formal sources of finance for women entrepreneurs. It suggests that closing the gender gap in access to formal finance and worker skills increases female economic participation, which could boost India's GDP by close to 6%.

Despite rapid economic growth, gender disparities in women’s economic participation in India have remained deep and persistent. The 2018 World Economic Forum's Gender Gap Index ranked India 142 out of 149 countries on economic participation and opportunity, indicating large gender gaps in the labour market and in entrepreneurship.

How large are the gender gaps?

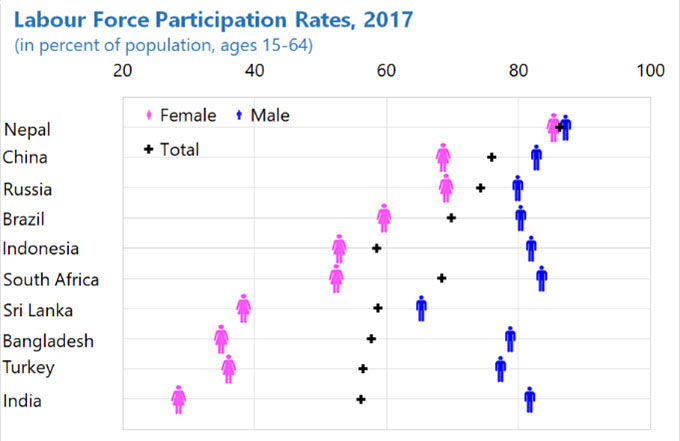

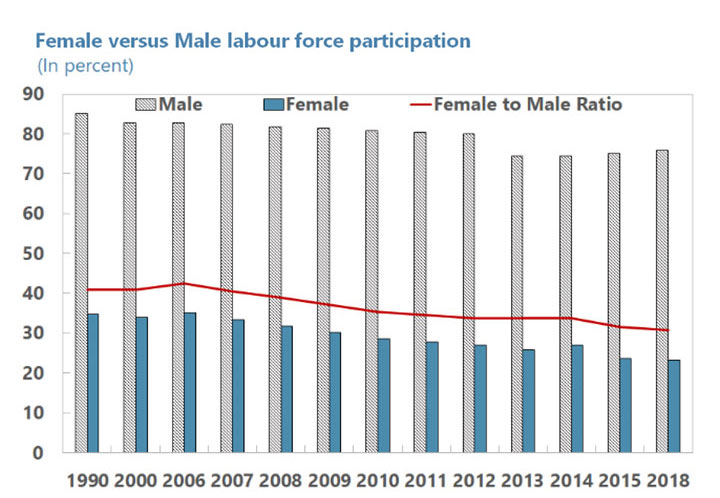

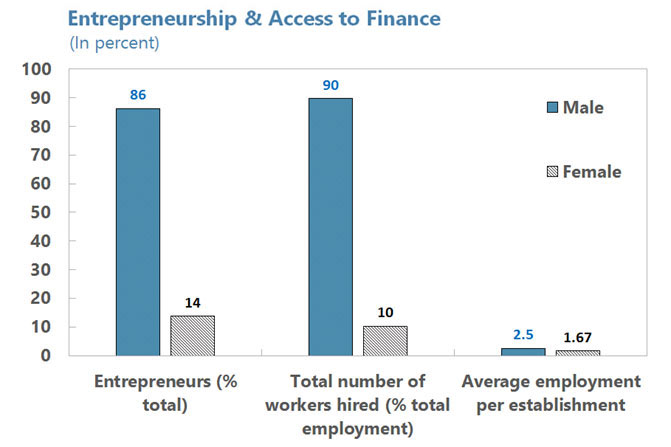

Female labour force participation (FLFP) in India – which is at one-third of male labour force participation (at around 23.3%) according to the Periodic Labour Force Survey (PLFS, 2017-18) – is the lowest amongst its emerging market peers, and declining (Figure 1). Moreover, women entrepreneurs comprise only about 10% of the total number of entrepreneurs in India, and they largely own smaller-sized firms: 98% of women-owned businesses are micro-enterprises1. Of all the women-owned enterprises, 84% do not have any hired workers (Figure 2). In addition, women receive lower wages for equal work, have lower average years of schooling, and are responsible for a much larger share (close to 30 times more) of household-related work in comparison to men.

Figure 1. Are women participating in the labour market?

Source: World Bank, World Development Indicators.

Source: World Bank, World Development Indicators. Source: PLFS (2017-18), National Sample Survey Organisation (NSSO).

Source: PLFS (2017-18), National Sample Survey Organisation (NSSO). Why such few women-owned businesses?

Women entrepreneurs face various challenges to financing, owning, and growing a business.

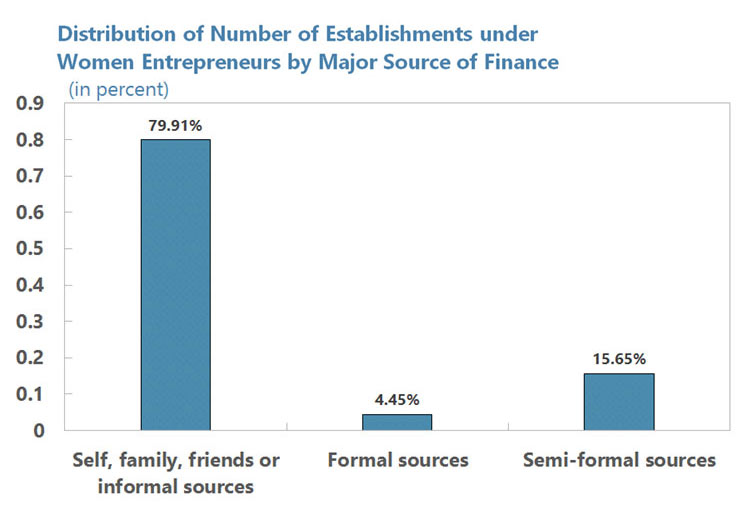

Access to formal finance is the key barrier to growth of women-owned enterprises, leaving them to rely on informal sources of finance (over 90% of establishments do – Figure 2). Women in India rarely own property – due to limited financial awareness and social restrictions around inheritance and land ownership rights – that they might use as collateral for borrowed start-up capital. Moreover, banks generally consider women-owned enterprises as a high-risk sub-segment, as these enterprises are usually micro in scale and operate mostly in the informal (unorganised) sector.

Figure 2. Do women own businesses?

Why should policymakers care?

The evidence that gender inequality is impeding economic growth is growing, and the potential gains from greater inclusion of women in the Indian economy are estimated to be large. According to Cuberes and Teignier (2016), closing the gender gap in entrepreneurship and workforce participation in India could boost GDP (gross domestic product) by 27%. Although, in terms of relative magnitudes, India’s gains should be and are indeed found to be larger than most countries, this may be an overestimate. Their results are based on a framework that does not take into consideration a key unique feature of the Indian labour and goods market – the extremely high degrees of informality – which would dampen the gains from any gender-based reforms (Khera 2016).

Why does informality matter?

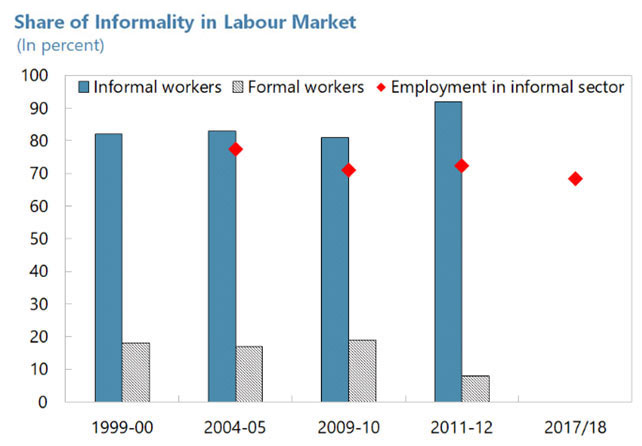

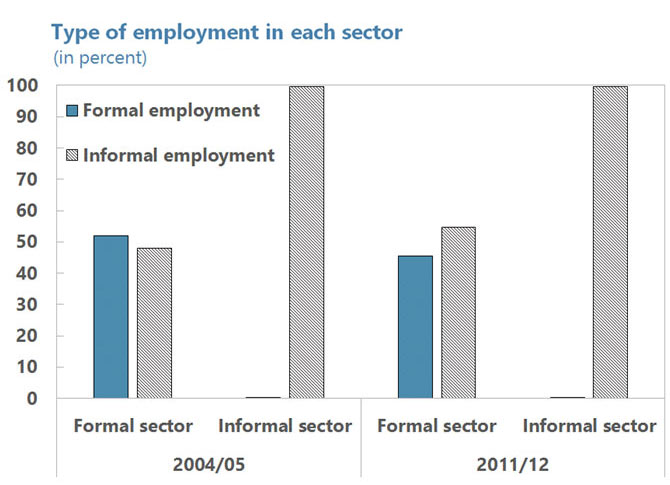

According to the most recent PLFS (2017-18), the vast majority of workers in India – close to 70% – are employed in the informal sector, and the informal sector contributes nearly half to India’s GDP. The share of total informal employment (which includes informal employment outside the informal sector) is even larger, and above 90% according to the 68th round (2011-12) of the National Sample Survey (NSS). Even formally established firms have been hiring more informally over time (Figure 3). Strict and complex labour regulations have been identified as the main drivers of this large informality, which discourage firms from hiring full-time employees on full benefits (Besley and Burgess, 2014). Although the Industrial Disputes Act (IDA) of 1947 is the basis for industrial labour regulations in India (requiring firms employing 100 workers or more to seek government permission to dismiss a worker or close a plant), firms are required to comply with numerous laws – numbering around 250 at central and state level – governing different aspects of the labour market, all of which hinder the growth of the manufacturing sector.

Figure 3. How large is the informal sector?

Although the informal sector provides useful employment opportunities, a high level of informality has failed to improve labour welfare. According to the Economic Survey 2015-16, average wages in the formal sector are 20 times higher than those in the informal sector, and there is no job security in the informal sector, negating the very motive of India’s pro-worker regulations.

Moreover, informality impacts women disproportionately more. This is because women are largely employed in low productivity informal jobs in the agriculture and services sector (only 20% of workers in the formal sector are women). Among women entrepreneurs, 90% of them are operating informally, limiting their growth potential.

Closing gender gaps in the presence of informality

In recent research (Khera 2019), I focus on analysing the macroeconomic impact of closing gender gaps in access to formal sources of finance in India. This is done by building a comprehensive general equilibrium model which accounts for the above mentioned characteristics of the Indian economy:

- Gender gaps in entrepreneurship, and in the labour market driven by gender gaps in skills, access to finance, household work, and discrimination;

- Large unregulated, informal labour and goods market characterised by no labour regulation-driven hiring and firing costs, as well as no regulatory costs of setting up a business in comparison to the formal sector;

- Access to formal and informal credit where the former has higher collateral requirements.

Hence, this framework allows us to capture not only the impact on output, employment, and entrepreneurship in India, but also the interplay and reallocation of resources between the formal and the informal economy.

Equal access to finance at the cost of lower worker welfare?

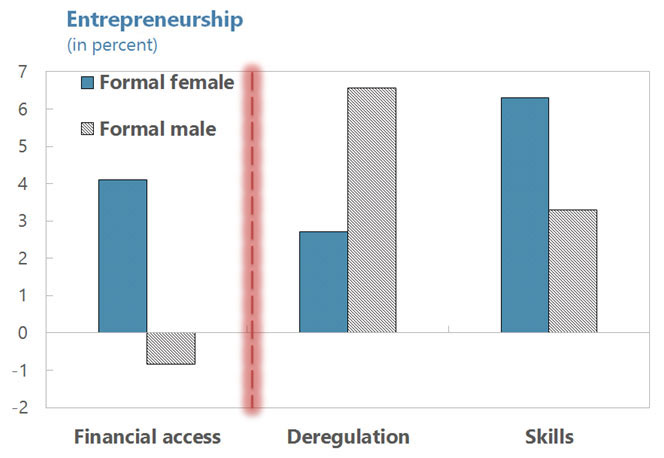

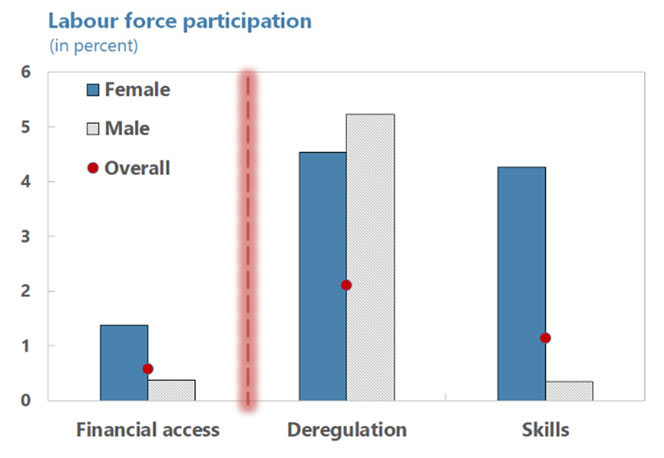

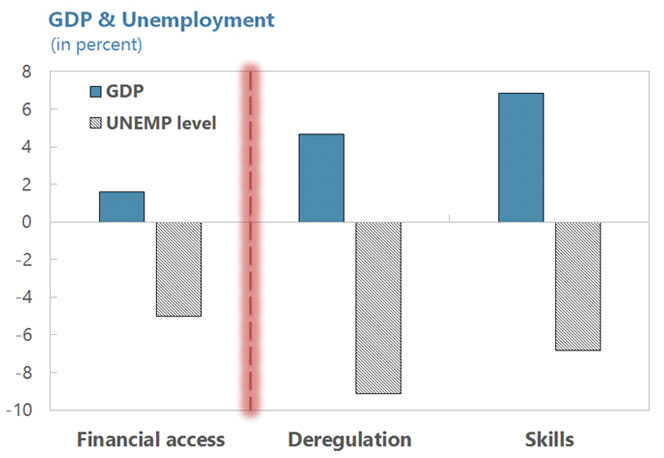

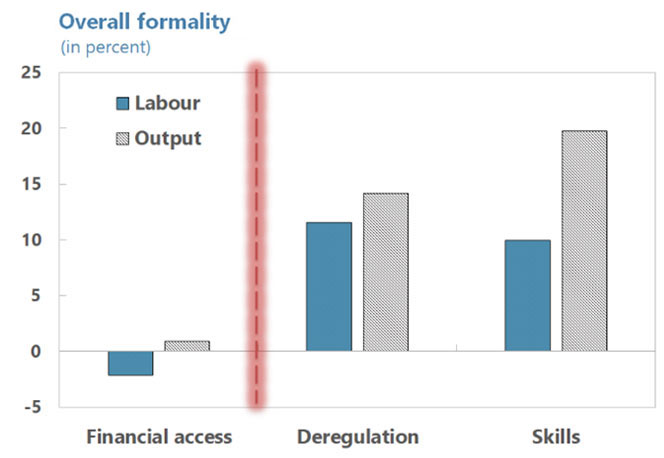

I find that in the case of India, closing gender gaps in access to finance will lead to higher GDP (increases by 1.6%), lower unemployment, and lower gender gaps in entrepreneurship and labour market (see ‘Financial access’ in Figure 4).

How? When women have greater access to formal sources of credit and hence capital, this promotes more women-owned businesses to be set up formally, and for the existing ones to expand. These new and growing firms hire more workers – both males and females – which increases overall employment and labour force participation, all of which have a positive impact on the economy.

Is this sufficient for India to tap its full potential? Although access to finance promotes female entrepreneurship and overall employment, it comes at the cost of lower welfare of the workers. This is because majority of the increased labour participants get employed informally – with lower wages and no employment protection – as strict labour regulations discourages both men- and women-owned firms from hiring formally. Hence, with limited progress on reforming labour laws, job creation, and productivity gains from financial inclusion reforms are likely to be small.

Equal access to finance with more flexible labour markets?

Does that mean relaxing labour market regulations is the solution? Yes, if labour market policies take into account gender-sensitive aspects. Relaxing labour-market regulations while increasing financial access will create more formal employment and result in even higher gains for the Indian economy (GDP increases by 4.7%). However, I find that labour-market deregulation benefits men more, as they are the ones who tend to get these new jobs in the formal sector as opposed to women, thus worsening the already large gender gaps in the labour market (see ‘Deregulation’ in Figure 4).

Why? Lower education (skill) of female workers and gender discrimination drives firms’ preferences to hire more male workers. Moreover, social norms, safety issues outside home, and poor infrastructure also lead to fewer incentives for women to participate in the labour market. I find that labour-market deregulation policies, without addressing constraints specific to women’s participation, will worsen gender equity and hence have a limited positive impact. This should be factored into the design of labour-market policies to fully utilise the gains from such reforms.

Equal access to finance and education?

What if women have equal access to finance and education? The latter increases productivity of female workers, thus making them more employable, leading to an increase in their formal employment with higher wages, thus improving gender gaps in the labour market. Equal access to finance promotes female entrepreneurship, while male entrepreneurship also goes up in response to higher consumption demand. This could boost India’s GDP by close to 6% (see ‘Skill’ in Figure 4).

Figure 4. Maximising economic gains

Note: Financial access in the figure refers to an increase in access to formal finance for female entrepreneurs (that is, no gender gaps in access to formal finance); Deregulation refers to lower hiring costs in the formal labour market along with no gender gaps in financial access; Skills refers to an increase in females’ average years of schooling (that is, no gender gaps) along with no gender gaps in access to finance.

Policy implications

The good news is that gender issues feature prominently in the government’s reform agenda for inclusive development. Recent financial sector initiatives of the Indian government have seen some success in enhancing various aspects of financial inclusion. More than 357 million previously unbanked individuals, of whom about 53% percent are women, have gained access to bank accounts since the launch of the Pradhan Mantri Jan Dhan Yojana (PMJDY) in August 2014. Moreover, the Pradhan Mantri MUDRA Yojana (PMMY) scheme has been successful in enabling women-owned businesses to access collateral-free finance (75% of total loan disbursements have gone to female entrepreneurs).

While the above policies will enable higher female entrepreneurship, women face multiple and intertwined constraints, and hence, single-sector interventions have a limited impact. The government should measure the success of its interventions by the extent of rise in female formal entrepreneurship, mobility of their firms to medium and large sizes, and by the extent of improvement in female labour market participation.

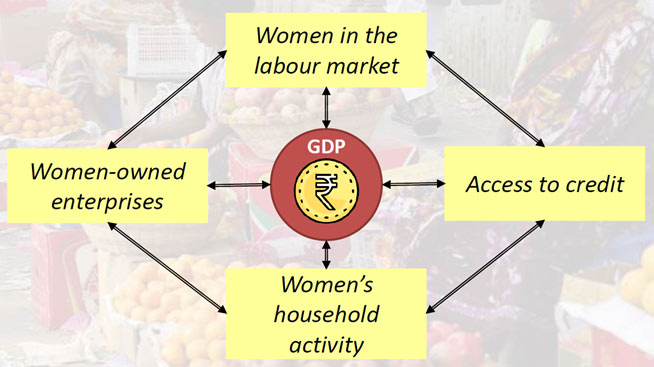

Figure 5. A multidimensional policy approach

To achieve this, a multidimensional policy approach – such as targeted and enhanced implementation of financial literacy programmes (especially in rural areas) to boost women’s demand for financial services; spreading awareness of their land inheritance rights to mitigate resource restrictions on women’s access to finance; effective and more targeted implementation of skill training programmes for women to enhance their employability across various industries - is needed. Simultaneously enabling a labour-market environment that facilitates the transition from informality, and leads to higher employment and better quality jobs is also key. On the fiscal front, rural infrastructure spending on access to clean water, sanitation and transportation could also reduce the time women spend on domestic tasks and facilitate their access to markets.

The views expressed are those of the author(s) and do not necessarily represent the views of the International Monetary Fund (IMF), its Executive Board, or IMF management.

Notes:

- In accordance with the Micro, Small & Medium Enterprises Development (MSMED) Act, 2006, manufacturers and service providers with less that Rs 25. lakh investment in plant and machinery are termed ‘micro-enterprises’.

Further Reading

- Anand, R and P Khera (2016), ‘Macroeconomic Impact of Product and Labor Market Reforms on Informality and Unemployment in India’, IMF Working Paper 16/47, International Monetary Fund, Washington, DC.

- Besley, Timothy and Robin Burgess (2004), “Can Labor Regulation Hinder Economic Performance? Evidence from India”, Quarterly Journal of Economics, 119:91-134.

- Cihak, M and R Sahay (2018), ‘Women in Finance: A Case for Closing Gender Gaps’, IMF Staff Discussion Note 18/05, International Monetary Fund, Washington, DC.

- Cuberes, David and Marc Teignier (2016), “Aggregate Costs of Gender Gaps in the Labor Market: A Quantitative Estimate”, Journal of Human Capital, 10(1).

- Cuberes, David and Marc Teigner (2018), “Macroeconomic costs of gender gaps in a model with entrepreneurship and household production”, B.E. Journal of Macroeconomics, 18(1):1-15.

- Ghani, E, W Kerr and S O’Connell (2013), ‘Promoting Women’s Economic Participation in India’, Economic Premise No. 107, World Bank, Washington, DC.

- Hirway, I (2017), ‘India’s time use data show women spend 69.03 hours on total work, men spend 62.71 hours’, Counterview.Org, 12 April 2017.

- Khera, P (2016b), ‘Macroeconomic Impacts of Gender Inequality and Informality in India’, IMF Working Paper 16/16, International Monetary Fund, Washington, DC.

- Khera, P (2019), ‘Closing Gender Gaps in India: Does Increasing Womens’ Finance Help?’, IMF Working Paper 18/212, International Monetary Fund, Washington, DC.

- Klasen, Stephan and Francesca Lamanna (2009), “The Impact of Gender Inequality in Education and Employment on Economic Growth: New Evidence for a Panel of Countries”, Feminist Economics, 15:91-132.

- Ostry, JD, J Alvarez, R Espinoza and C Papageorgiou (2018), ‘Economic Gains from Gender Inclusion: New Mechanisms, New Evidence’, IMF Staff Discussion Note 18/06, International Monetary Fund, Washington, DC.

- Schwab, K (2018), ‘The Global Competitiveness Report 2018’, Insight Report, World Economic Forum.

- Sharma, S (2009), ‘Entry Regulation, Labor Laws, and Informality’, Enterprise Surveys Note; No. 1. Informality, World Bank, Washington, DC.

16 August, 2019

16 August, 2019

Comments will be held for moderation. Your contact information will not be made public.