The price of land in India is high relative to its fundamental value, impacting economic development in the country. In this post, Gurbachan Singh explains why this is so, in terms of two broad factors – the license-permit-quota Raj in urban India, and the Land Acquisition Act, 2013 in rural India. He recommends phasing out the Raj, and eventually abolishing the pricing provisions of the Act.

A stylised fact about India is that the price of land is high as compared to its fundamental value. It is also high relative to the market price of land in several advanced countries such as the Netherlands and other parts of Europe (Chakravorty 2013, Singh 2016). High price of land matters not just for familiar objectives like affordable housing; it is also relevant to economic development more generally.

My focus in this post is different from that in other related writings such as Ghatak and Ghosh (2011), which analyse the process of land acquisition, compensation for the land acquired, and pricing of land through auctions. I refer to previous (Singh 2017) and forthcoming work to explain why land is expensive in India and what can be done about it.1 The explanation is, broadly speaking, in terms of two factors – the ‘license-permit-quota’ Raj (hereafter, the LPQ Raj) in the real estate sector in urban India, and the Land Acquisition Act, 2013 in rural India. While the Land Acquisition Act is fairly well-understood, the same cannot be said for the LPQ Raj. Let us, to begin with, discuss this.

The license-permit-quota Raj

LPQ Raj refers to a system of strict rules, regulations, bureaucracy and political discretionary decision making. It gained importance in the 1950s, when there was considerable emphasis on promoting the public sector, controls over the private sector, and planning vis-à-vis market forces. Although the LPQ Raj was abolished in the country’s manufacturing sector in the early 1990s, it has more or less stayed on in the real estate sector – particularly in urban India – driving up the price of urban real estate. It is true that there is a need for, what are sometimes called, zoning laws, which ensure orderly development of an urban area. But there can be ‘excessive’ restrictions. These excessive restrictions are the subject matter of the LPQ Raj.

Builders need approvals for real estate development and construction. In India, these approvals are numerous, effectively discretionary, time consuming, very costly, and largely available through contacts with officials, politicians and ‘godfathers’ with the use of bribes or ‘speed’ money in cash or kind. Also, the floor area ratio (FAR)2 is often kept low. All this is sometimes viewed as constituting the LPQ Raj – however, this is actually a narrow view.

Even if approvals for development and construction within the designated area are without difficulties, there is a more basic problem. Typically, town planners demarcate some area within which urban development can be carried out; and the government provides the basic infrastructure for the designated area. While the usual view of the LPQ Raj does not raise questions over whether or not the designated area is adequate, the designated area is often small relative to the needs of the urban economy.

It is true that there is a provision to seek permission for Change of Land Use (CLU). However, again, the permissions are highly problematic. But equally (if not more) important, the CLUs are typically issued in the context of an area that is limited in size and that is somewhat close to an already approved area. Hence, the provision for CLUs typically does not apply for expansions that are large and that lie in what are perceived to be far-flung areas. There is also a related coordination problem within the government, as different departments are involved.

CLUs are often denied for new townships if external development in a new area is inadequate (internal development is, in any case, to be provided by the developers). On the other hand, external development is often not provided by the government, given that there is hardly any pre-existing need for the same in the concerned area. It is a vicious circle. There is also often a de-jure or de-facto absence of an enabling framework under which the private sector can provide the external development for an altogether new township or city. The bottom line is that the quantity gets restricted, and the price of real estate is correspondingly high in urban India.

The story does not end here. The LPQ Raj is accompanied by black money, ‘bad’ behaviour of public authorities, irregularities (and even crimes), harassment, time wastage, little effective access to the judiciary, and other such features. All of this serves to deter entry for honest, competent, creative and hardworking professionals. So even if there are large numbers of sellers, traders and investors, the effective competition is limited. This too contributes to the high price (and low quality).

After 2014, there was an initiative by public authorities in the form of an attempt to develop 100 new cities that would be "Smart Cities”3 However, it was soon changed to a mission of 100 (mostly existing) cities that would be made ‘smart’. This emphasis on quality, while keeping the quantity limited, is yet another form that the overall restrictive policy is taking, which makes land prices high.

A simple model of price

Consider an economy in which there is a fixed amount of raw land of uniform quality which has, for simplicity, only two uses – it can be used in the rural economy or urban economy. The model here abstracts from the issue of location of different pieces of land, which is about the relative price of one piece of land within the rural or urban economy vis-à-vis another. The focus in this model is on the price of representative land in the rural economy relative to the price of representative land in the urban economy. It is assumed that all the urban land is used with a given FAR. The model also abstracts from the premium in the price of urban land compared to that of rural land, which is due to the benefits of agglomeration that give meaning to a city. Instead, the focus here is on the price of raw land.

The maximum value of the total land is obtained if the marginal value of land (that is, the value of one additional unit of land) in the rural economy is equal to that in the urban economy. Think of a competitive market where in equilibrium the market price is equal to the marginal value. So, in case of optimal allocation, the price of raw land is the same in either use whether it is in the rural economy or in the urban economy.

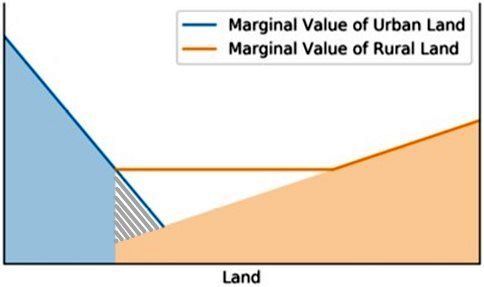

Figure 1. Effect of LPQ Raj and Land Acquisition Act, 2013 on land prices in India

Notes: (i) The horizontal axis shows a fixed quantity of land. The vertical axis on the left-hand side shows the marginal value of land in the urban economy, while the vertical axis on the right shows the marginal value of land in the rural economy. (ii) The two curves – in blue and brown – represent the marginal value of land in the urban economy and rural economy, respectively. (iii) The marginal value of land is diminishing at a constant rate here.

Assume now that the government intervenes and the allocation of land in the urban economy is reduced. The motivation for the scenario in (static) Figure 1 is as follows. Suppose that over time the urban economy expands but the allocation of land (and the provision or the enabling of the provision for infrastructure) does not keep pace (for simplicity, it is constant in the figure). Then, we have under-allocation of land for the urban economy. Relatedly, we have now a ‘deadweight loss’4, and the market price of raw land in the urban economy is much higher than the market price of raw land in the rural economy.

Consider the case when the farmers’ lobby insists on a higher price of land that may be acquired from the rural economy. The higher price can be at any level above the ‘free market’ equilibrium level in the rural economy. Let us assume that the price aspired for the rural land is at a level equal to that in the urban economy (see the orange horizontal line in Figure 1). Where do we go from this model?

Land use in India

Due to the LPQ Raj in India, we have had suboptimal allocation of land for urban India, and the price of urban land is high relative to the price of rural land. The deadweight loss (striped grey area in Figure 1) is symbolic of the potential for additional prosperity, which isn’t realised because the improper allocation of land comes in the way. We may take the horizontal orange line in Figure 1 to represent, in a simple way, the pricing part of the Land Acquisition Act, 2013. The policy implications of the analysis is that the public authorities need to be flexible, keep pace with the needs of the economy, and tilt the land use policy over time towards the urban economy. This keeps the price of land in urban India in check, which in turn, helps in reducing the pressure on prices for rural land.

All this has an interesting corollary. If the availability of land is kept at the optimum level (which is to say that in a dynamic version of the above model, the supply of land for the urban economy is ‘elastic’ over time), the appreciation in the price of land over time becomes limited. Accordingly, the scope for speculation, underutilisation of land, vacant homes, and real estate bubbles is reduced. All this too can contribute to the growth and stability of gross domestic product (GDP).

It may be argued that agricultural production can suffer as land is shifted from the rural economy to the urban economy. However, the top 10 most populous cities occupy approximately 0.2% of the national land mass in India (Das et al. 2019). Therefore, there is scope for shifting some land to urban India.

It may appear that though under the proposed set of policies the farmers get a price that is not low relative to the price in the urban economy, they do stand to lose in terms of the absolute price of land. However, such a high price is actually not very relevant for most farmers in India because they typically do not choose to sell their land even though the price is high, and there are good reasons for this. There is a lack of trust amongst farmers in the whole process of selling. Also, if land is sold, there is an absence of reliable financial advice on reinvestment of sale proceeds. Additionally, farmers lack meaningful education or skills that would enable them to take up alternative livelihoods after selling the land.

Another corollary of the analysis and policy prescription in this post is that as urban India has more land, and the price of urban land is lowered, urban housing can get cheaper on its own. This reduces the need for schemes like Pradhan Mantri Awas Yojana (PMAY) which explicitly or implicitly rely primarily on public finance for the provision of affordable housing. The analysis in this post relies primarily on public policy.

Policy takeaways

As I outline in this post, the explanation for the high price of land in India has two elements. First, the LPQ Raj makes price of urban real estate high in India. Second, given the high price of land in urban India, the farmers and their representatives insist on a high price for land that is acquired from them under the pricing provisions of the Land Acquisition Act, 2013. This makes the price of the land in rural India high as well.

There is a need to move towards repealing or abolishing a part of the Land Acquisition Act, 2013, which relates to a high price for land to be acquired from the rural economy. But prior to that, there is a need to phase out the LPQ Raj in the urban economy, in order to keep a check on urban land prices. This can, in turn, pave the way for greater acceptance of a partial amendment of the Land Acquisition Act, 2013.

The views expressed in this post are solely those of the authors, and do not necessarily reflect those of the I4I Editorial Board.

Notes:

- See also Gyourko and Raven (2015)

- The FAR of a building is equal to its total floor area divided by the area of the land parcel on which it is built. Lower FAR values lead to low building height and implies stricter building regulations.

- Under the Smart Cities Mission, 100 cities received funding and support from the central and state governments to implement projects focusing on infrastructure development and urban planning to enhance quality of life.

- Deadweight loss occurs when the allocation of resources is not optimum. In a simple model of competition in a market, optimal allocation is achieved when quantity supplied equals demand. If the (non-market) equilibrium quantity is different, it results in a deadweight loss. This is a loss to the economy, unlike a case where if one person loses, someone else gains.

Further Reading

- Chakravorty, Sanjoy (2013), “A New Price Regime - Land Markets in Urban and Rural India”, Economic & Political Weekly, 48(17).

- Das, P, R Aroul and J Freybote (eds.) (2019), Real estate in South Asia, Routledge.

- Ghatak, Maitreesh and Parikshit Ghosh (2011), “The land acquisition bill: A critique and a proposal”, Economic & Political Weekly, 46(41). Abridged for Ideas for India here.

- Gyourko, J and R Molloy (2015), ‘Regulation and Housing Supply’, in G Duranton, JV Henderson, and WC Strange (eds.), Handbook of Regional and Urban Economics, Volume 5B.

- Singh, G (2016), ‘Land in India: Market price vs fundamental value’, Ideas for India, 29 February.

- Gurbachan (2017), “Land price, bubbles, and Permit Raj”, Review of Market Integration, 8(1-2).

- Singh, G (forthcoming), Macroeconomics and Asset Prices - Thinking Afresh on Basic Principles and Policy.

29 February, 2024

29 February, 2024

Comments will be held for moderation. Your contact information will not be made public.