The Covid-19 pandemic and associated lockdowns have had a significant adverse impact on jobs and livelihoods. Using 2006-2021 data from a quarterly survey on business sentiments, this article examines fluctuations in firms’ hiring of temporary/casual and permanent workers across three major economic events – the Global Financial Crisis, demonetisation, and the Covid-19 crisis. It shows that firms use temporary workers to adjust to changes in the demand of their products in response to macroeconomic uncertainty – increasing vulnerability among workers.

The Indian economy has been characterised by jobless growth between 1977 and 2011. Basu and Das (2015) and Abraham (2017) reported stagnant employment growth during 2012-2016. Despite a slowing economy since 2018-191, quarterly Periodic Labour Force Survey (PLFS) data show that urban unemployment rate of people aged 15 and above had fallen from 9.2% in 2018-19:Q4 to 7.8% in 2019-20:Q3, before going up to 9.1% in 2019-20:Q4 at which point Covid-19 hit India.

The National Council of Applied Economic Research (NCAER) Business Expectations Survey (N-BES) has been collecting data about business sentiments since 1991 on a quarterly basis across industry, region, firm size (based on annual turnovers), and ownership. The NCAER Business Confidence Index (N-BCI) – a measure of business sentiments – fell for two consecutive quarters in 2019-20:Q4 and 2020-21:Q1 by 30% and 40% respectively on a quarter-on-quarter basis. It fell to its historical lowest in 2020-21:Q1, recovering by 41.1% and 29.6% respectively in Q2 and Q3 of 2020-21 on a quarter-on-quarter basis. What did this V-shape path of fall and recovery of business sentiments imply for temporary and permanent labour markets? How does the ongoing Covid-19 pandemic compare with previous episodes of economic shock, specifically the Lehman Brothers bankruptcy, that is, the beginning of the Global Financial Crisis (GFC)?

Comparing three major economic events

The Centre for Monitoring Indian Economy (CMIE) reported that urban unemployment rate rose from 8.7% in February 2020 to 25% in April 2020, gradually – though not continuously – falling to 9.1% in December 2020. The N-BES offers a comparable indicator to assess the impact of the pandemic on labour markets from the perspective of firms. As part of the N-BES survey, we have been asking firms about the ‘change in employment of workers over the last three months’ since 1991. There are three possible responses – increase, decrease, and no change. We use these responses to gauge the comparative impact of the Lehman Brothers bankruptcy (15 September 2008) and the Covid-19 pandemic (25 March 2020) on two different types of workers’ markets – permanent and casual/temporary. Exploring labour market decisions of firms can be useful since demand for factor inputs are linked to the expected demand for final goods and services, indicating the macro expectations of firms.

At the outset, there are many limitations to this exercise – we list three of them here. First, one happened more than a decade ago and another is still unfolding with its full impact likely visible only a few years from now. Second, the GFC impacted the economy negatively mainly through demand-side channels2. In contrast, the nationwide lockdown imposed in March 2020 due to the pandemic affected the economy adversely both through demand- and supply-sides channels. The counteracting policies for the Lehman crisis leveraged the demand-side channels whereas during the pandemic, it was concentrated on the supply side3.

We use N-BES data from December 2006 to December 2020 to analyse labour market trends and the impact of various shocks in the 14-year period. Our key findings are discussed below.

Key findings

The share of firms with the response that there has been no change in ‘labour employed over the last three months’ has been quite stagnant. The mode – the value that appears most frequently in the dataset – for this response for temporary workers has been 67% over the last 14 years, and 87.5% for permanent workers. It confirms the empirical evidence about ‘jobless growth’ evidenced between 2004-05 and 2011-12, and thereafter (Basu and Das 2016).

The difference in the magnitude of the modes between temporary and permanent workers indicates that there is a tendency of firms to hire the former. This is consistent with the evidence of increasing contractualisation of workers in India (NCAER, 2018). We look at the impact of three major shocks on the labour markets – Lehman Brothers bankruptcy, demonetisation and the Covid-19 pandemic.

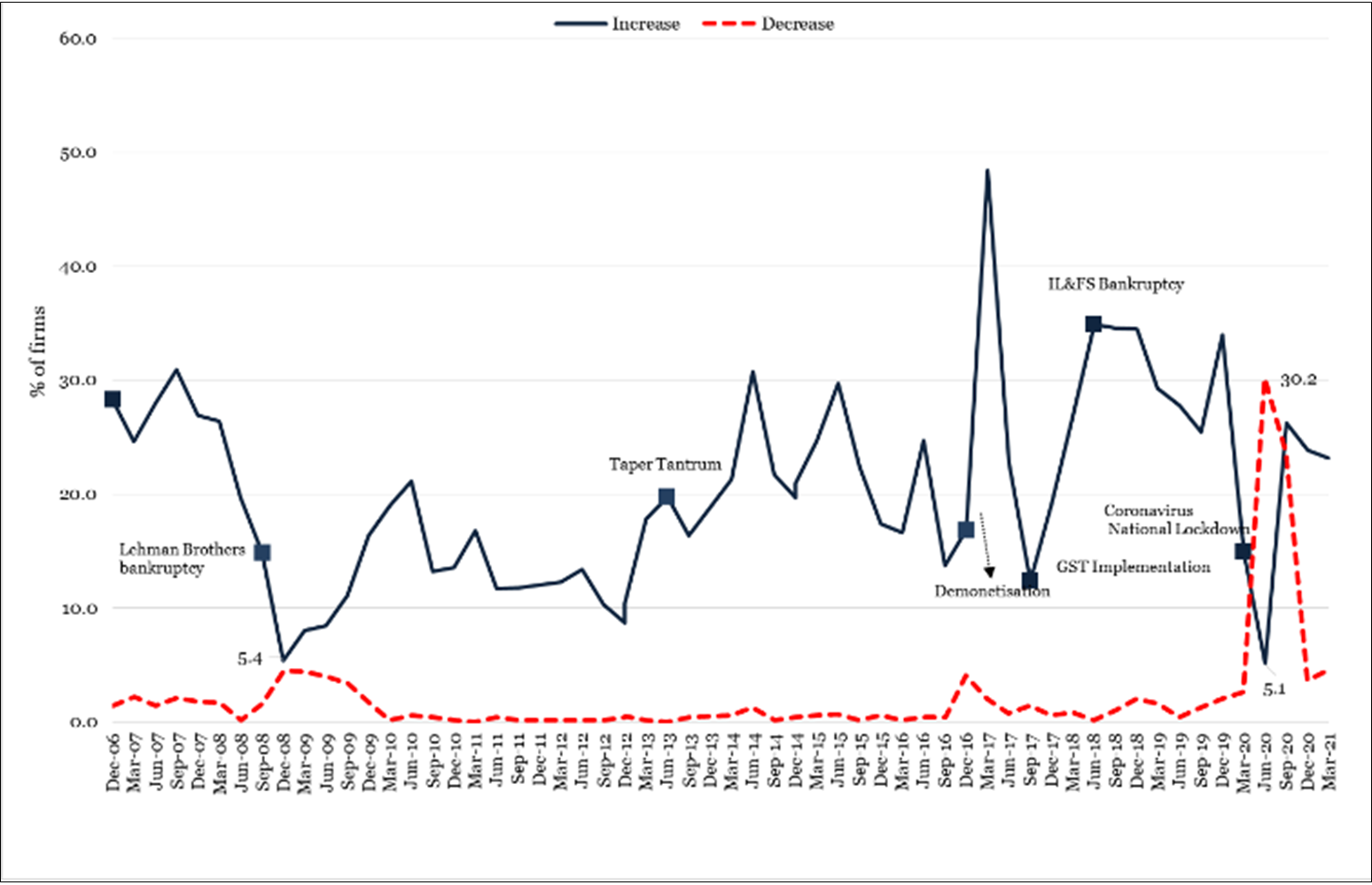

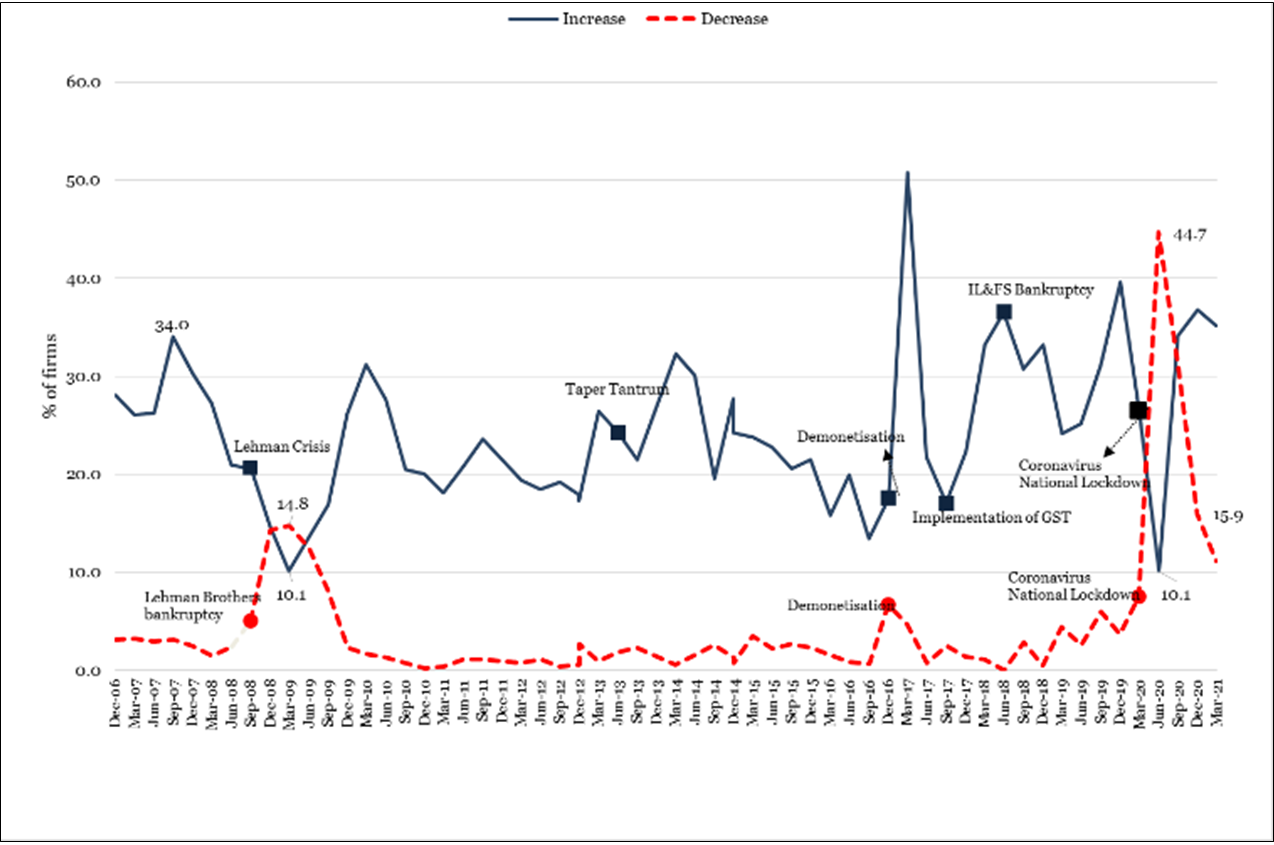

First, we consider the Lehman Brothers bankruptcy (Figures 1 and 2). The share of firms that reported an increase in hiring of temporary workers went down from 20.6% in September 2008 to 10.1% in March 2009. For permanent workers, the share of firms that reported an increase went down from 14.9% in September 2008 to 5.4% in December 2008, before going back up again from March 2009. The share of firms which responded that they had decreased hiring of temporary workers went up from 5.1% in September 2008 to 14.8% in March 2009, declining thereafter. For permanent workers, it increased from 1.6% in September 2008 to 4.5% in December 2008, falling thereafter.

Figure 1. Change in permanent workers employed over the last three months, % of firms

Source: NCAER Business Expectation Surveys.

Notes: (i) Increase means that firms responded that number of employed workers increased in the last three months. Decrease means the reverse. A third option is unchanged, which is not shown in the graph for simplicity purposes. (ii) The months-years indicate when the surveys were carried out.

Figure 2. Change in casual/temporary workers employed over the last three months, % of firms

Source: NCAER Business Expectation Surveys.

Notes: (i) Increase means that firms responded that number of employed workers increased in the last three months. Decrease means the reverse. A third option is unchanged, which is not shown in the graph for simplicity purposes. (ii) The months-years indicate when the Surveys were carried out.

Next, we look at the case of demonetisation. Its impact on labour markets was relatively small and short-lived. Overall, we find that that the post-demonetisation period is characterised by high volatility for hiring temporary workers.

Finally, we consider the Covid-19 pandemic. The share of firms which responded that they had increased hiring of temporary workers went down from 26.5% in March 2020 to 10.1% in June 2020, before going back up again from September 2020. The corresponding numbers for permanent workers were 14.9% and 5.1%, respectively. The share of firms which responded that they had decreased hiring of temporary workers went up from 7.5% in March 2020 to 44.7% in June 2020, declining thereafter. For permanent workers, the corresponding numbers were 2.6% and 30.2%, respectively. By December 2020, we find that 16% of firms responded that they had decreased employment of temporary workers over the last three months, 47.3% responded that it was unchanged, and 36.8% responded that they had increased. The corresponding numbers for permanent workers were 3.6%, 72.5%, and 23.9%, respectively.

Concluding thoughts

From the figures above, three observations are noteworthy. First, the Covid-19 pandemic had a much steeper impact on hiring decisions of firms compared to the GFC. Second, while the immediate impact was stronger in the recent crisis, the recovery in hiring decisions is also steeper. These observations indicate that businesses have so far perceived the current crisis as being short term, with the impact bound to vary with the spread of the Virus. As the lockdown was eased and cases decreased in the later part of 2020, firms’ demand for key factor inputs went up.

Third, firms are using temporary workers to adjust the increase/decrease of demand of their goods and services in response to the macroeconomic uncertainty. The increased share of temporary workers in the workforce would increase their vulnerability. The latest available numbers from the March 2021 survey indicate that the labour market has faltered further for both temporary and permanent workers. The medium-term goal of an equitable and sustainable growth path looks increasingly unattainable given the likelihood it may take India a few years to catch up on its pre-pandemic growth path (NCAER, 2020) with the combined impact of macroeconomic uncertainty and rapid technological changes (Fourth Industrial Revolution) on the quality and quantity of job creation. Without a coherent social security policy (trinity of pensions, unemployment insurance, and health policy), India may get caught up in a vicious cycle of inequitable and inefficient growth patterns.

Notes:

- GDP growth rate fell from the peak of 7.9% in 2018-19:Q1 to 3.1% in 2019-20:Q4.

- Kumar and Vashisht (2009) argued that the Lehman Bankruptcy affected India through three distinct channels: financial markets, trade flows, and exchange rates. Export demand and credit flow were affected, both of which affected the Indian economy through the aggregate demand side.

- Kumar and Vashisht (2009) document an expansionary budget in 2008-09, which included measuresto increase the purchasing power of the farmers and rural sector. Some of these measures were farm loan waivers, allocation to Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA), Bharat Nirman, Prime Minister’s Rural Road Programme, and increased subsidies for fertiliser and electricity. This boosted consumer demand for durable and non-durable goods. Further this was accompanied by three fiscal packages after the Lehman Bankruptcy in September 2008, including increased government spending on infrastructure, reduction in indirect taxes, and some assistance for export-oriented industries. Monetary policy had also become expansionary.During the Covid-19 pandemic, the Atmanirbhar Bharat package concentrated on providing credit and carrying out structural reforms (NCAER, 2020). It included increased allocations for foodgrains for the National Food Security Act beneficiaries, higher MNREGA allocations, free liquefied petroleum gas (cooking gas) to Ujjwala beneficiaries, and cash transfers to the Pradhan Mantri Jan Dhan Yojana accounts. Hence, monetary policy was expansionary in this crisis as well (NCAER, 2020).

Further Reading

- Abraham, Vinoj (2017), “Stagnant Employment Growth: Last Three Years May Have been the Worst”, Economic & Political Weekly, 52(38): 13-17.

- Basu, Deepankar and Debarshi Das (2016), “Employment Elasticity in India and the US, 1977–2011: A Sectoral Decomposition Analysis”, Economic & Political Weekly, 51(10): 51-59.

- Bhandari, B, P Choudhuri, M Das, T Bhattacharya, S Bhadury, G Bahal, S Bandyopadhyay, AK Sahu, P Rawat, M Duggal, R Sanyal and J Prabhakar (2018), ‘Skilling India: No Time To Lose’, NCAER Report.

- Kumar, R and P Vashisht P (2009), ‘The Global Economic Crisis: Impact on India and Policy Responses’, Asian Development Bank Institute Working Paper No. 164.

- Mundle, S, B Bhandari, AK Sharma, S Bandyopadhyay, P Choudhuri and AK Sahu (2020), ‘The NCAER 2020–21 Mid-Year Review of the Indian Economy’, NCAER Report.

- National Statistical Organisation (NSO) (2021), Quarterly Bulletin: Period Labour Force Survey Data, January-March 2020, Ministry of Statistics and Programme Implementation, Government of India.

04 May, 2021

04 May, 2021

Comments will be held for moderation. Your contact information will not be made public.