The global financial crisis and domestic policy paralysis led to a decline in firms’ investment activities and investors’ business confidence in India. Could this have affected the economy’s long-term growth? This column contends that institutional capacity for reform and the right policy action can render the negative investment shock temporary, and ensure that the trend growth of output remains strong.

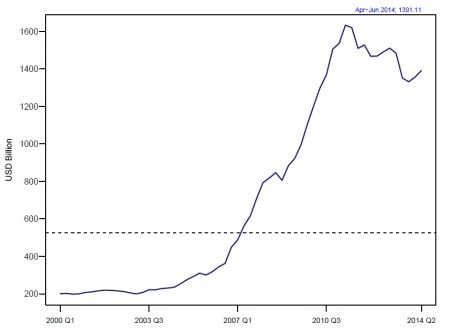

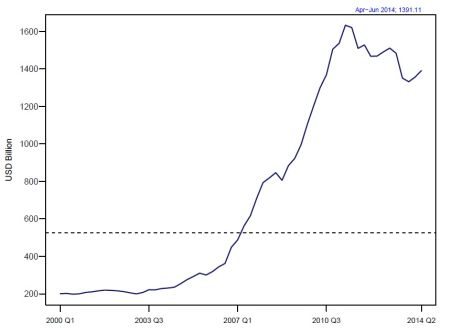

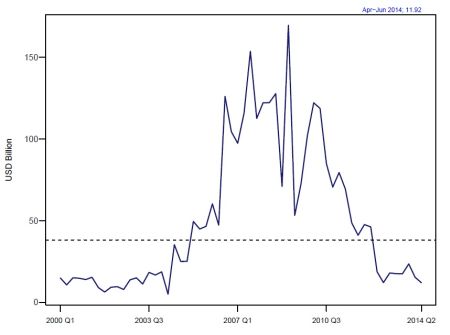

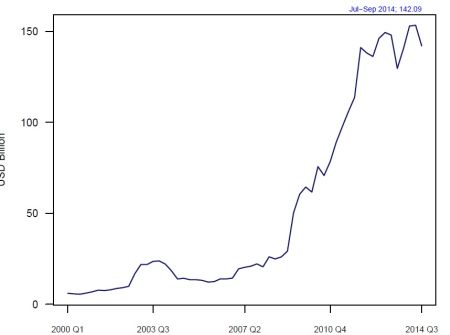

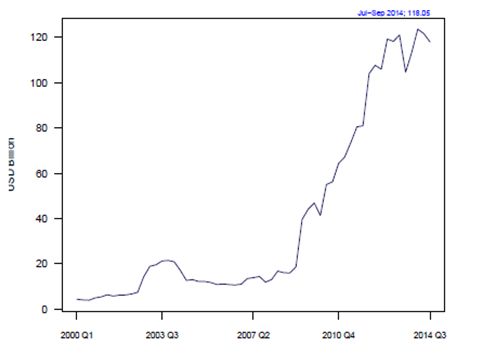

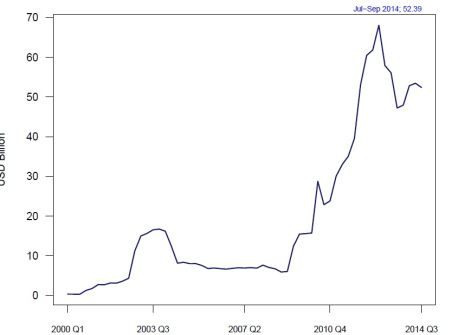

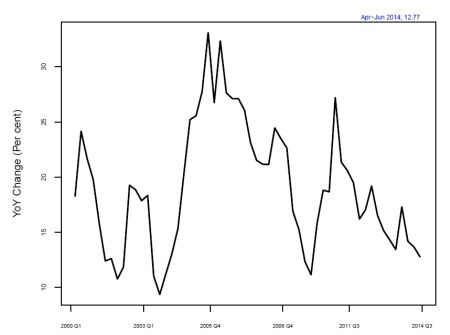

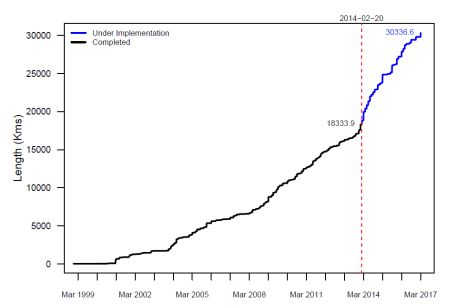

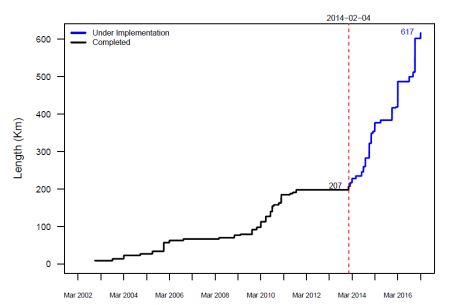

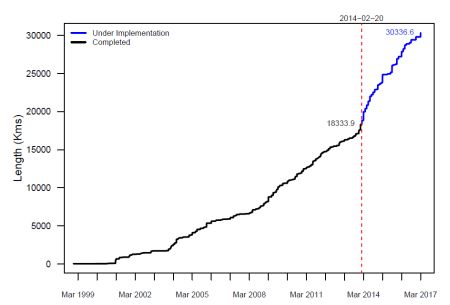

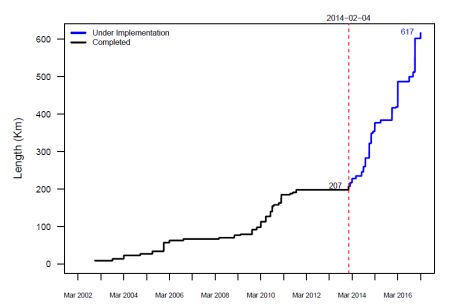

Post global financial crisis, investment in physical capital in particular declined, raising concerns about a slowdown in the Indian economy. Firm-level data shows the value of projects under implementation by non-financial firms increased over the years to reach US$1.6 trillion in 2011, after which it started falling (Figure 1a). This pattern is reflected in new projects which saw a boom between 2005, when it crossed the long-run average, and 2008, followed by a decline (Figure 1b). On the flip side, projects under implementation in all industries, and in private and infrastructure firms that were stalled, drastically increased after 2008 (Figures 1c, 1d, 1e). Figure 1f on bank lending to the commercial sector gives an insight into the slowdown in investment activity of firms. The economy witnessed an upswing in the cycle, primarily led by high credit growth during the boom years of 2005–2007 when firms borrowed and initiated a number of projects. But with the onset of the crisis in 2007, export demand declined and investment was affected by adverse global conditions. Many projects that were started earlier became unviable and were, therefore, stalled or shut down.

Figure 1. Firm data and credit

1a. Projects under implementation

1b. New projects

1c. Stalled projects - all industries

1d. Stalled projects - private

1e. Stalled projects - infrastructure

1f. Bank credit to commercial sector

Source: Centre for Monitoring Indian Economy Pvt. Ltd. (CMIE); CAPex database

Source: Centre for Monitoring Indian Economy Pvt. Ltd. (CMIE); CAPex database

Besides external and domestic cyclical reasons, investment projects were also stalled due to policy decisions, or in some cases, policy inaction in the face of regulatory hurdles, and severe bottlenecks related to land acquisition, corruption scandals, taxation, etc. The policy framework that hampered firms’ investment activity and investors’ business confidence acted like a negative shock which could have affected the long-term component of output growth, namely the trend.

India’s long-term growth

Against this backdrop, we ask the question: where is India’s growth headed? (Patnaik and Pundit 2014). We believe that there are two reasons that support the long-run growth of output. One is that negative shocks to trend arising from policy uncertainty can be rendered temporary by appropriate policy changes that can act as positive shocks to growth. The question is if India has the institutional framework to overcome negative shocks through such policy reform. Pritchett and Summers (2014) make the point that institutional reforms are crucial, but the process of reform may itself result in slower trend growth in the erstwhile rapidly growing Asian economies. In the case of the China, they argue that transition away from a political system characterised by a high degree of State control, authoritarian rule, and corruption makes growth deceleration very likely. We believe that India´s story is different in this regard. The country has already gone through various difficult stages of learning to operate a democracy and has reached a level of political maturity. The major problem of transition that they believe China faces at this point which can constrain growth is not a risk for India. While so far, the political process has not managed to achieve support for all the required reforms, the institutional capability to do so certainly exists.

The second reason for believing that trend growth can be strong is that the long-run supply of factors of production – namely labour, human capital, infrastructure and non-infrastructure capital appears to be robust; and total factor productivity which measures efficiency of inputs has a potentially strong growth path as well. However, compared to the past few decades, in recent years there was a decline in investment as discussed and also there exist several frictions in factor markets which hinder growth. Hence, to understand the overall picture of the drivers of growth, we assess patterns in the supply of the factors, below.

Patterns in the supply of factors of production

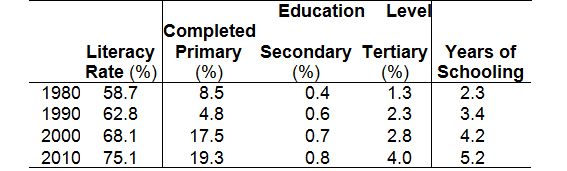

(a) Quality-adjusted labour supply: Labour supply has two components – the number of workers, and the quality of labour or human capital. Long-term labour supply in terms of number of workers and the hours of work is determined mainly by demographics, while human capital is determined largely by education and development of skills. The supply of quality labour does not appear to be declining given that: according to population forecasts (United Nations (UN), 2012), the working age-age group will increase to constitute 69% of the population by 2040; there is scope for increasing the labour force participation rate (55.5% in 2012); and education and skill levels are low, but improving (Table 1). Though abundant labour and human capital are available, they have to be properly absorbed into the production process to meaningfully contribute to output growth. Reforms in laws and regulations governing the labour market are required to reduce frictions and inflexibilities. While the absence of reforms in the labour market could negatively affect the trend growth of output, we can expect that initiation of reforms can reverse the effect, since there is sufficient labour capacity available to meet the demands of a growing economy.

Table 1. Educational attainment

Note: Literacy rate is weighted by population.

Note: Literacy rate is weighted by population.Sources: World Bank, World Development Indicators online database; Barro and Lee (2012).

(b) Capital: The supply of physical capital, a key driver of output growth in the economy, appears robust when we take a long-term view. Total investment, measured as gross fixed capital formation (at constant prices) increased from 17.9% of GDP (gross domestic product) in 1980 to 32.9% in 2008. Although the amount of investment declined since 2008 from its peak value, the rate of investment is still high at 30% (in 2013). Similarly, non-residential investment remains over 20% of GDP in the same year. A comparison across a small sample of emerging and advanced countries shows that the growth rate of capital stock is highest in India.

Figure 2. Investment

Sources: National Account Statistics; World Bank, World Development Indicators online database; Authors’ calculations.

Sources: National Account Statistics; World Bank, World Development Indicators online database; Authors’ calculations.

In the recent decline in investment, on the one hand, cyclical factors appear to be at play. A decrease in global demand during the crisis and fall in exports dragged down domestic investment. A number of new projects were initiated from 2005–2008, when credit conditions were easier, but they became unviable with the onset of the crisis. The fall in activity can be seen as a correction of the over-investment that took place during the boom years, but we can expect investment rates to return to at least the long-run level as many of these issues get resolved. As global recovery strengthens, domestic investment activity will pick up, since there is available capacity. But besides external and domestic cyclical factors, uncertainty from the policy framework may have been a negative shock to trend growth and reforms have to be stepped up to render its effect temporary.

(c) Infrastructure: The story of infrastructure capital is similar — while accumulation over the past decades appears strong, the recent decline in investment raises concerns for growth. Projects were shelved or stalled as they became unviable after the crisis and also because of the messy policy environment such as delays in issuing licenses, sudden decisions like the coal mining ban in some states, and policy paralysis in the face of bottlenecks. But with the right policy environment, can we expect investment to improve?

If we look at additions to actual infrastructure, we get a sense of the kind of growth that is possible. Based on projects completed, we see that over a period of 12 years (2002–2014), 207 kilometers (kms) of metro lines and 18,334 kms of national highway were constructed, which averages 17.3 kms and 1,527 kms per year, respectively. In Figure 3, after 2013 the lines are plotted based on the expected date of completion for projects under implementation and it shows continued additions in the future.

The problem is not the lack of capacity as much as frictions and impediments that prevent the optimal use of resources. In a conducive environment, stalled projects may be restarted and new projects initiated.

3a. National highway

3b. Metro line

Note: Kms = kilometers

Note: Kms = kilometers Source: CMIE CaPex database

(d) Total factor productivity (TFP): The strong output growth in the past three decades was not only due to additions to labour and capital, but also because of improvements in productivity. TFP dragged down growth in the 1980s, but has been increasing since then to become a main contributor to GDP growth. The literature shows that TFP growth is driven by spillovers from infrastructure development, improvements in human capital, spread of information and communications technology, and globalisation of firms that promotes learning, among other reasons (Baltabaev 2013, Dasgupta 2012). These factors were conducive for TFP growth in India in the past and potentially remain strong in the future, given the right policy environment.

Concluding remarks

To summarise, a cyclical slowdown in investment can be reversed with domestic fiscal and monetary stimulus policies and supported by the global recovery. In addition, given sufficient resources and the institutional capacity for reforms, if negative shocks can be rendered temporary through policy action, then trend growth of output can also remain strong.

The views expressed in this article are those of the authors and do not necessarily reflect the views and policies of the Asian Development Bank (ADB) or its Board of Governors or the governments they represent.

Further Reading

- Baltabaev, B (2013), ‘Foreign Direct Investment and Total Factor Productivity Growth: New Macro-evidence’, Discussion Paper No. 27/13, Monash University.

- Barro, Robert J and Jong-Wha Lee, “A New Data Set of Educational Attainment in the World, 1950-2010,” Journal of Development Economics No. 104(C) (2010), pp. 184-198.

- Dasgupta, Kunal (2012), “Learning and Knowledge Diffusion in a Global Economy”, Journal of International Economics, No. 87 (2), pp. 323–336.

- Patnaik, I and M Pundit, (2014), ‘Is India’s long-term trend growth declining?’, ADB Economics Working Paper Series No. 424, December.

- Pritchett, L and LH Summers (2014), ‘Asia-Phoria Meet Regression to the Mean’, NBER Working Paper No. 20573 (2014), pp. 1–35.

- United Nations (UN) (2012), ‘World Population Prospects: The 2012 Revision No. 23’.

25 May, 2015

25 May, 2015

Comments will be held for moderation. Your contact information will not be made public.