The idea of poverty traps being important for microenterprises is captured in the adage “it takes money to make money”. This article reports on a study following households in India exposed to different levels of microfinance. The findings reveal that microfinance has potentially transformative impacts for some entrepreneurs – especially those who without it were stuck in a poverty trap. However, for other households the effect is very small, suggesting that microlenders should consider more screening of households in order to provide some larger loans.

The persistence of poverty has long been a central issue in the study of economic development. One theory is that households are poor because they are caught in a poverty trap – a situation in which it is very hard to grow one’s income when starting from a very low level. However, if one were to start with more wealth, the scope for rapid growth would expand dramatically. In the presence of a poverty trap, two households with the same ‘fundamentals’ (skills, geographic location, etc.) could find themselves in very different situations, solely because of small differences in initial wealth. One implication of poverty traps is that a short-term infusion of investment or aid, sometimes referred to as a ‘Big Push’, might be able to move households out of poverty, after which the new, higher income would be self-sustaining. This, in turn, means that it is important to determine whether poverty traps do in fact exist, or whether poverty persists for other reasons, which would require different solutions.

That households may be ‘trapped’ in poverty has a long intellectual history (for example, Aghion and Bolton 1997, Lloyd-Ellis and Bernhardt 2000), although clear-cut empirical evidence has been lacking (for example, Kaboski and Townsend 2011, Masset et al. 2019).1 One reason is the challenge of distinguishing correlation from causation. If we observe that people who have low income levels also have low income growth rates, it could be because they are in a poverty trap, but it could also be because of a third factor that is causing both the level and the growth rate to be low, such as differences in skills.

The importance of poverty traps for microenterprises in the context of microfinance

This idea of poverty traps being important for microenterprises is captured in the adage “it takes money to make money”. Consider an aspiring entrepreneur who wants to make clothes. If she starts with enough money, she can buy a sewing machine, allowing her to earn higher profits and grow faster. On the other hand, if she starts with very little money, she can only sew by hand. Because her productivity is limited, she is never able to save enough to buy a sewing machine, and she stays poor.

Our research investigates the possibility of poverty traps in the context of microloans for the poor (Banerjee et al. 2019). One narrative about microfinance is that, by allowing poor households to borrow – more than they could otherwise borrow, possibly at lower interest rates – it might allow them to escape from a poverty trap. And if all (or many) households are stuck in such a poverty trap, then microfinance might have transformative effects. However, a significant body of work,2 including some of our own past work, has shown that in the short to medium run, on average, microfinance does not lead to dramatic reductions in poverty, or dramatic increases in income or consumption.

Why identifying poverty traps is challenging

In this project, we identify a reason why the search for poverty traps has been challenging. Namely, there might be a poverty trap for some people, but not others. Some entrepreneurs simply may not have the skills to transition their businesses to larger, more efficient ones; others might not have the desire; yet others might not want a business at all (for example, Meager 2019). Moreover, more abundant credit might facilitate the entry of new, low-productivity businesses. If we look for evidence of a poverty trap on average, the fact that the population is a mix of those who are ‘gung-ho’ about entrepreneurship, with those who are not, means that we might not detect the poverty trap, although it is present.

Tracking randomly varied exposure to microfinance: ‘Gung-ho’ entrepreneurs do best

To shed light on this question, we follow a group of households who were randomised to have different amounts of exposure to microfinance. These households had been studied before, and when we observed them 1.5 and four years after first getting (or not getting) microfinance access, we found modest, but not transformational, effects: more business creation and spending on business assets, but little effect on bottom-line outcomes like consumption (Banerjee et al. 2015b). We followed them again, six years after the initial experiment, during a period when microfinance was no longer available.3 This could be important because it could take time for the effects of microfinance to be fully apparent.

Six years post-treatment, average outcomes are better for the ‘treatment’ than the ‘control’ group across a number of dimensions including total entrepreneurship rates, profits, business scale, expenses, revenues, and employment. However, almost all of these positive impacts are driven by a particular experimental sub-group: households that had a business before microfinance arrived, who we call ‘gung-ho’ entrepreneurs (GEs). Within the ‘gung-ho’ entrepreneurs, self-employment hours increased almost 20% as a result of treatment, business assets increased by almost 25%, business spending increased by 80%, and revenues more than doubled. We also found positive and significant effects for ‘gung-ho’ entrepreneurs on profits, and business and non-business durables spending.

The distributional impacts of microfinance

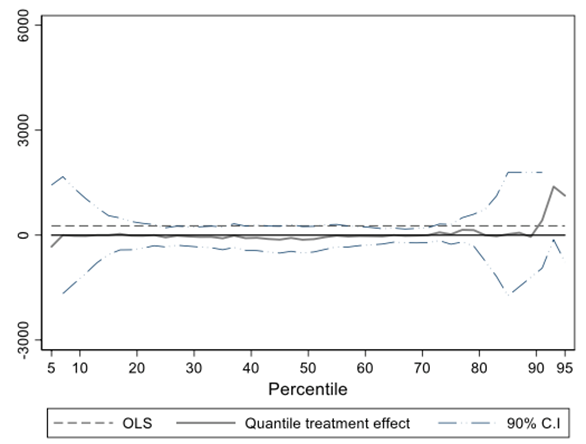

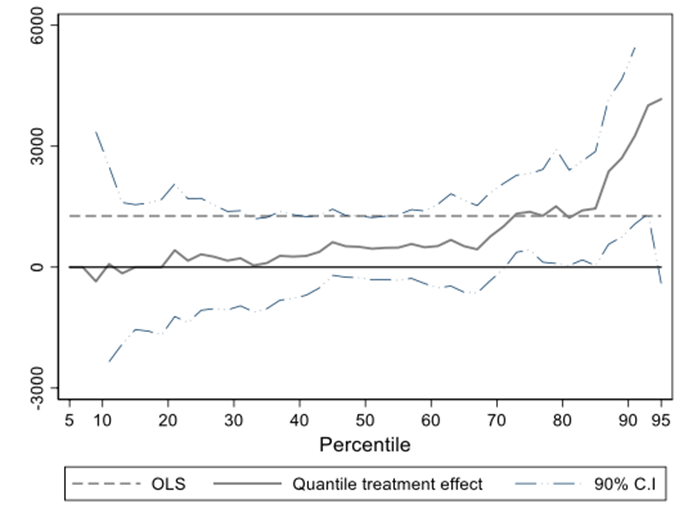

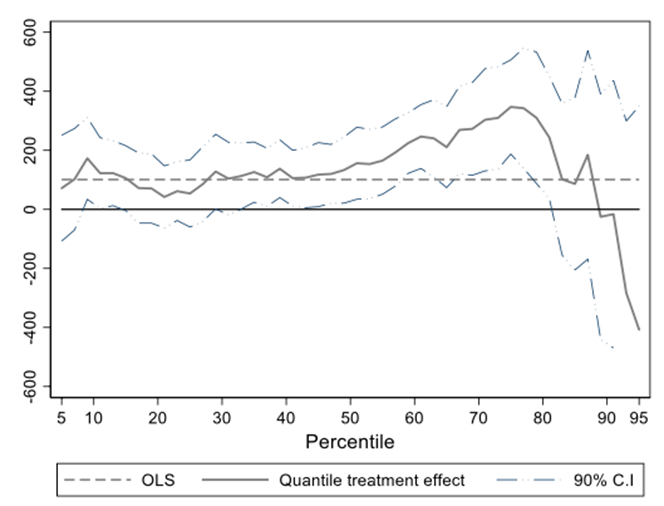

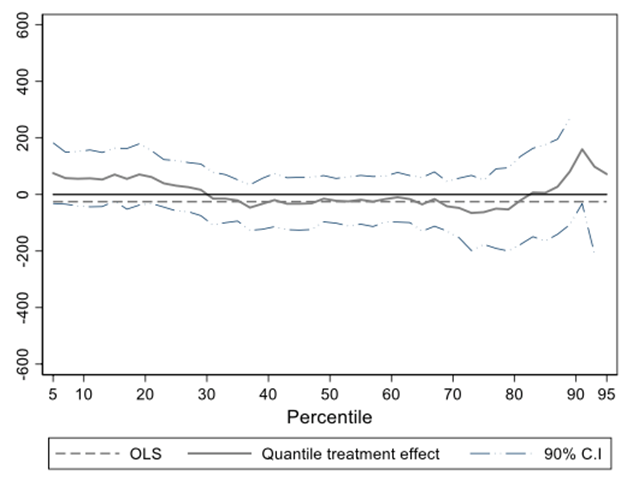

One important implication of a poverty trap is that, even among the ‘gung-ho’ entrepreneurs, the effects of microcredit will not be the same for everyone. Some households may already be out of the poverty trap, while others may be so poor that microcredit is not enough to help them escape. To explore this, we look for impacts of microfinance at different parts of the distribution. For instance, we compare the median (the 50th percentile) household in the treatment vs. control groups. Figures with these distributional comparisons are shown below. They reveal that for those who are not ‘gung-ho’ entrepreneurs, there are essentially no impacts (positive or negative) on profits or consumption anywhere in the distribution. For the ‘gung-ho’ entrepreneurs, the effects on profits are concentrated in the top third of the distribution. Turning to consumption, while we do not detect an impact on average non-durable consumption, we see positive impacts for the 30th to 80th percentiles (see Figure 2).

Figure 1. The distributional impacts of microfinance on business profits

Panel A: ‘Gung-ho’ entrepreneurs

Panel B: Other households

Notes: OLS refers to Ordinary Least Squares estimation method. A 90% confidence interval (CI) is a range of values; there is a 90% probability that this range of values contains the true mean of the population.

Figure 2. The distributional impacts of microfinance on per capita monthly consumption

Panel A: ‘Gung-ho’ entrepreneurs

Panel B: Other households

We also find evidence that the businesses created because of microfinance are of worse quality than the incumbent businesses. We calculate that the new businesses are worse than young incumbent businesses along an index of business outcomes by a large margin (two thirds of a standard deviation4). Our results imply that microfinance has two important offsetting impacts on businesses:

- It causes existing businesses to grow and become more profitable

- It also encourages entry by businesses with lower potential profitability

Evidence from a dynamic model of household consumption

The persistent impacts of microfinance are consistent with poverty trap dynamics. But it could also be the case that there is no poverty trap, and that microfinance only accelerates a process that was happening already – the ‘gung-ho’ entrepreneurs would have eventually got there on their own. Or, there could be a poverty trap, but one so small as to be unimportant. A quantitative model of firm growth under credit constraints is needed in order to assess the importance of poverty trap dynamics.

We use the first wave of data to show that, indeed, our data are consistent with the presence of a fixed cost, below which one cannot operate the more productive technology. We estimate a significant up-front cost, and moreover, when we nest this production function into a dynamic model of household consumption, savings, and investment decisions, we find that some entrepreneurs are indeed stuck in a poverty trap. Without access to microfinance, talented but low-wealth households are unable to invest in a new, more productive technology and therefore remain stuck operating a traditional, less efficient technology instead. Think again of the poor tailor who cannot afford to buy a sewing machine. Using the dynamic model, we find that microfinance pushes some of them out of the poverty trap. In fact, our model-based estimates suggest that two-thirds of the overall effect of microfinance is explained by this.

The other third of the treatment effect can be explained by households with enough wealth to purchase the new technology even without microfinance, but who still use microfinance to grow. For instance, a tailor who could already afford the sewing machine could use a microfinance loan to purchase better fabric, hire an assistant, or put a better sign outside her shop. The key difference is that in this case, the entrepreneur would have eventually been able to do these things even without microfinance; the loan accelerates their progress but does not change where the entrepreneur ultimately ends up. In sum, the model shows that households escaping from the poverty trap are an important driver of our observed effects.

Implications for microlenders

Microfinance has meaningful, potentially transformative impacts for some entrepreneurs – especially those who, without microfinance, were stuck in a poverty trap. For other households, the effect is very small. In addition, microcredit induces some less-productive businesses to enter. This suggests that microlenders should consider more screening of households in order to provide some larger loans. While limiting screening helps microlenders to reduce costs, it has a major downside: not channelling credit to where the effects would be largest. Given that new sources of data are now becoming available for lenders – for example, data from digital transactions, peers, and remote sensing – the ability to engage in more screening is increasing. Our results suggest it may be valuable to find ways to channel the right amounts of credit to those, like our ‘gung-ho’ entrepreneurs, who can make the best use of it.

This article first appeared on VoxEU and VoxDev.

Notes:

- One exception is Balboni et al. (2019), which presents evidence for a different kind of poverty trap among the poorest villagers in Bangladesh.

- For a summary, see Banerjee et al. (2015a).

- The departure of microfinance was due to a government policy that de facto ended the ability for lenders to operate in the study areas (for example: https://www.bbc.com/news/world-south-asia-12035909).

- Standard deviation is a measure that is used to quantify the amount of variation or dispersion of a set of values from the mean value (average) of that set.

Further Reading

- Aghion, Philippe and Patrick Bolton (1997), “A theory of trickle-down growth and development”, The Review of Economic Studies, 64(2):151-172.

- Balboni, C, O Bandiera, R Burgess, M Ghatak and A Heil (2019), ‘Why do People Stay Poor?’, Working Paper.

- Banerjee, Abhijit, Dean Karlan and Jonathan Zinman (2015a), “Six randomized evaluations of microcredit: Introduction and further steps”, American Economic Journal: Applied Economics, 7(1):1-21.

- Banerjee, Abhijit, Esther Duflo, Rachel Glennerster and Cynthia Kinnan (2015b), “The miracle of microfinance? Evidence from a randomized evaluation”, American Economic Journal: Applied Economics,7(1):22-53.

- Banerjee, A, E Breza, E Duflo and C Kinnan (2019), ‘Can Microfinance Unlock a Poverty Trap for Some Entrepreneurs?’, NBER Working Paper No. w26346.

- Kaboski, Joseph P and Robert M Townsend (2011), “A structural evaluation of a large‐scale quasi‐experimental microfinance initiative”, Econometrica,79(5):1357-1406.

- Lloyd-Ellis, Huw and Dan Bernhardt (2000), “Enterprise, inequality and economic development”,The Review of Economic Studies, 67(1):147-168.

- Masset, Edoardo, Jorge García Hombrados and Arnab Acharya (2019), “Aiming high and falling low: The SADA-Northern Ghana Millennium Village Project”, Journal of Development Economics,143:102427.

- Meager, Rachael (2019), “Understanding the average impact of microcredit expansions: A Bayesian hierarchical analysis of seven randomized experiments”, American Economic Journal: Applied Economics,11(1):57-91.

15 May, 2020

15 May, 2020

By: sundaresan T P 15 May, 2020

Only the best way to do something for the poor people to get the loan from the bank and also provide the assistance to start the self employment projects