Since the launch of the Unified Payment Interface (UPI), the volume of digital transactions in India has increased exponentially over the last few years. Shamim Ara highlights the trends in the expansion of UPI to make payments both in India, and in other countries through partnerships with local payment networks. She discusses the advantages for both consumers, and banks and financial institutions in utilising the cashless payment system with no transaction costs and anytime access.

The Unified Payment Interface (UPI) of National Payment Corporation of India (NPCI)1 has revolutionised the digital payment ecosystem in India. Since the launch of UPI in 2016, the number of digital transactions in India have increased phenomenally, making India the global leader in instant payments. In 2021, India alone accounted for 40% of the total digital transactions globally. The introduction of UPI has democratised and ensured universal access to financial services to anyone having a mobile phone and a mobile number linked to their bank account, through features such as its instant single click app-based transfer, Quick Response (QR) code scanning, bank interoperability, 24x7x365 utility features and robust customer protection through two-factor authentication system.

The NPCI further launched UPI 2.0 in 2018, with several new features to increase penetration of UPI in rural areas having poor internet connectivity and lower smart phone ownership. This enabled users without a smart phone to make payments without using apps or internet by giving a missed call on the UPI number, link overdraft accounts and credit cards with UPI, and automatically pay recurring bills like utility bills, EMIs, mutual fund premiums etc. through UPI Auto Pay features. Besides these, a round-the-clock support service – ‘Digi Sathi’ – was also introduced to address users’ queries and to provide them with information about various digital payment products and services. With the introduction of these new and enhanced security features, there has been a significant jump in digital transactions in India, which is evident from the exponential growth in the volume and frequency of transaction through UPI in the last six years.

Growth of UPI transactions

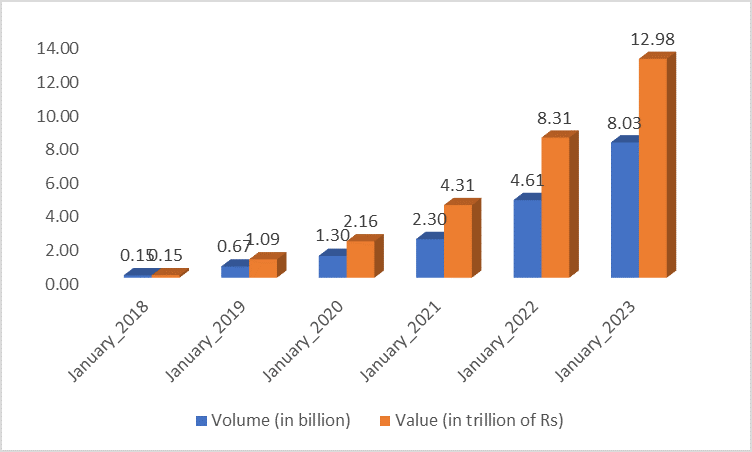

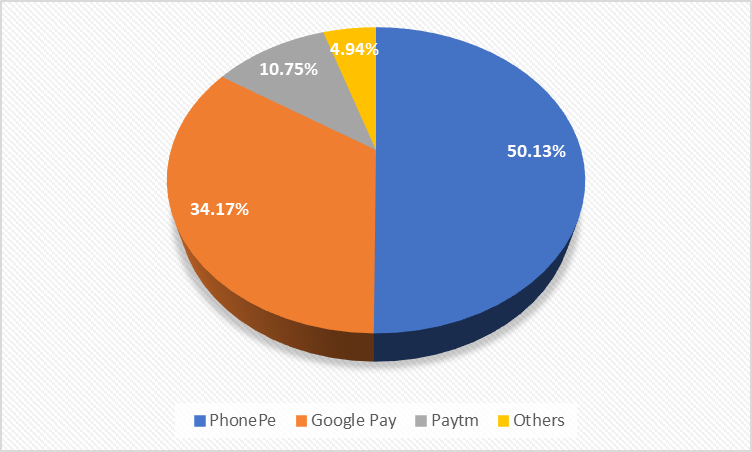

As per the NPCI database, the total number of banks that became part of UPI systems increased by almost 11 times, from 35 in January 2017 to 385 in January 2023 (Figure 1). During the same period, transaction volumes on UPI grew 1802 times, from 4.46 million in January 2017 to 8.03 billion in January 2023, while total transaction value rose 766 times, from Rs. 16.90 billion to 12.98 trillion (Figure 2).

Figure 1. Number of banks live on UPI in India

Figure 2. Growth in UPI transactions in India

Source: Data from NPCI

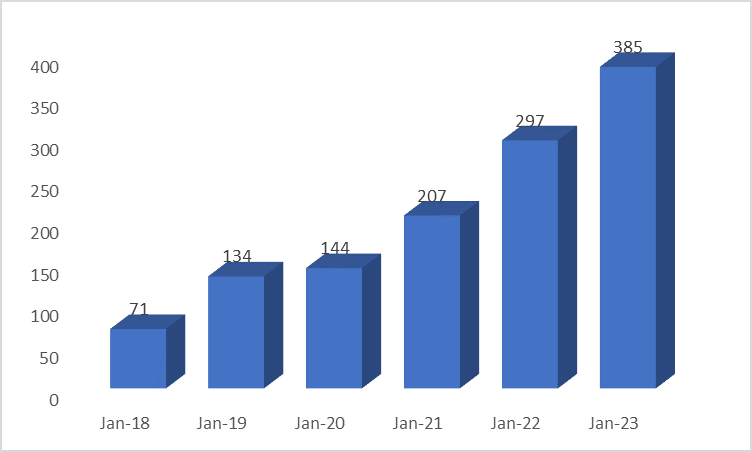

The volume of transaction through UPI was highest in January 2023, at around 20% of the Indian GDP. As per the Economic Survey of Government of India, 2022-23, UPI accounted for 52% of the total 88.4 billion financial digital transactions in FY2022-23. Interestingly, around 77% of such digital transaction (in terms of value) in January 2023 were Peer-to-Peer (P2P) payments, and more than 95% of such transaction were done through just three digital payment platforms – PhonePe (50.13%), Google Pay (34.17%) and Paytm (10.8%) (see Figure 3).

Figure 3. Share of UPI transactions

Source: Data from NPCI

Clearly, UPI has altered users’ spending behaviour, as one can pay and collect payment instantly via their unique UPI ID or by scanning a QR code. As a result of this ease of transaction, UPI has been widely adopted by all segments of society, from vegetable sellers to auto rickshaw drivers, small grocery shops to large retail chains. This is definitely a transformational change towards financial inclusion. The volume of such transactions was further accelerated by the onset of the Covid-19 pandemic, mainly due to social distancing protocols, increased availability of internet, increase in smart phone ownership, cashback and other offers by payment platforms, and changes in the mindset of users. The Government of India’s initiatives towards a cashless society such as mass opening of bank account under the Pradhan Mantri Jan Dhan Yojana (PMJDY), linking of bank account with Aadhar and mobile number under the JAM trinity2, and removal of charges and fees on UPI transaction has also contributed to this increase. Recently, Union Cabinet of India approved a Rs. 26 billion scheme under which financial incentives will be given to banks for promoting transactions using UPI and RuPay in the current financial year.

Global collaborations with UPI

Given the wide adoption of UPI in India, it has also received considerable attention globally, and around 30 countries have expressed their interest to collaborate with UPI. In this regard, NPCI launched its subsidiary – NPCI International Payment Ltd (NIPL) – in 2020 to roll out RuPay Card Scheme and UPI in international markets. NIPL collaborated with the Royal Monetary Authority of Bhutan in July 2021 for the adoption of UPI QR based transactions, and Nepal’s Gateway Payment Services and Manan Infotech network to enable UPI in Nepal in 2022. These two countries became the first to deploy India’s UPI QR code and UPI in their countries respectively. NIPL also partnered with the Monetary Authority of Singapore in September 2021 to link its PayNow and Network for Electronic Transfer (NETS) with UPI, and with UAE’s NEOPAY and Lulu Financial Holdings in 2022. India’s Prime Minister Narendra Modi and his Singapore counterpart Hsien Loong formally launched linkages between India’s UPI and Singapore’s PayNow on 17 February, 2023. NIPL also entered into a partnership with the payment networks of several other countries (Table 1). Collaborations with the payment networks of these countries are currently in various stages of discussion.

Table 1. UPI’s global partnerships

|

Date of announcement |

Partner country |

Entity partnering with UPI |

|

July 2021 |

Bhutan |

The Royal Monetary Authority of Bhutan |

|

August 2021 |

Malaysia |

Merchantrade Asia |

|

September 2021 |

Singapore |

Monetary Authority of Singapore to link with PayNow, Network for Electronic Transfers (NETS) |

|

September 2021 |

North Asia and Southeast Asia (10 markets of Singapore, Malaysia, Thailand, Philippines, Vietnam, Cambodia, Hong Kong, Taiwan, South Korea, and Japan) |

Liquid Group |

|

January 2022 |

Europe (Netherlands, Belgium, Luxembourg, Switzerland, and France) |

Worldline, TerraPay (for QR-based payments) |

|

February 2022 |

Nepal |

Gateway Payment Services and Manam Infotech |

|

April & August 2022 |

UAE |

NEOPAY (Mashreq Bank) & Lulu Financial holdings (respectively) |

|

June 2022 |

France |

Lyra |

|

August 2022 |

UK |

Payxpert, Terrapay |

|

October 2022 |

Oman |

Central Bank of Oman |

On 10 January, 2023, NPCI announced that Non-Resident Indians having Non-Resident Ordinary (NRO) and Non-Resident External (NRE) accounts linked with international mobile numbers would also be able to use UPI soon. This facility is expected to start in May 2023, and will be limited to NRIs from 10 countries to begin with (Australia, Canada, Hong Kong, Oman, Qatar, Saudi Arabia, Singapore, UAE, UK and USA). However, such remitters and their beneficiary banks will have to ensure compliance to rule and regulations of the Foreign Exchange Management Act (FEMA), RBI and anti-money laundering regulations. On 22 February, 2023, RBI announced that all travellers to India will also get access to UPI for their merchant payments while they are in India. To start with, this facility was to be given to the G20 delegation at three airports (New Delhi, Bengaluru and Mumbai). Going forward, it will be extended to all travellers to India, at all airports.

Successful integration with the payment network of these countries and linking of NRE/NRO accounts with UPI will enable Indian travellers, migrants, and students to make payment in the partnering countries using UPI or RuPay Card. Besides these, it would also facilitate transfer of cross border remittances in real time and without paying exorbitant remittance fees. Adoption of UPI is also expected to bring down the cost of printing and managing currency, and boost commerce across hospitality, tourism and retail sectors in partnering countries. The successful spread of UPI across the world is also expected to provide an alternative to global giants such as VISA, Mastercard and SWIFT3 since UPI transactions are free, while merchant discount rate (MDR charges) of 2-5% is levied on transactions done using existing systems.

Economic benefits of digital transactions

The phenomenal change in payment systems towards more efficient digital transactions has the potential to contribute significantly to economic growth through multiple channels – it’s possible that the option to link UPI with credit cards and the availability of pre-sanctioned credit lines might increase consumption, saving and investment, encourage business expansion and boost trade, financial innovation, financial market expansion, and increase government revenue through tax compliance etc. The option to transfer money instantly, anywhere, and anytime through single click app-based transfer or QR code scanning should boost consumer confidence and further promote consumption. Further, as households can receive remittances instantly, it may induce further consumption, savings, and human development investments in health, education etc. Similarly, if businesses can receive payments directly through UPI without paying transaction charges, it would save time, improve efficiency and increase savings which can be used for further business expansion. The convenience of transacting through UPI might also incentivise individuals to maintain sufficient balances in their bank accounts – this amounts will enable banks to expand their business by providing loans and other financial services to individual and businessmen. Digital payments will also help banks to save merchant onboarding cost by encouraging the use of low-cost UPI as an alternative to cash. Digital payments ensure accountability, as data for all transactions are recorded in a digital payment system which can be tracked, monitored, and verified easily. Banks and financial institutions can use such data to understand spending and saving patterns, which they may use to serve consumers in a better way. As transaction data are recorded and can be tracked easily, merchants and individuals will be bound to pay taxes, thereby boosting the number of taxpayers in the country and the increasing government revenue. Wide adoption of digital payment is also expected to reduce petty corruption, and the prevalence of a black market and informal sector– which are both cash-based segments and very difficult to track and monitor. Further, such transaction data can be helpful to the government should they wish to track economic activities in order to formulate policy and budgets. It can also be utilised to transfer subsidies to intended beneficiaries directly and within seconds.

Conclusion

As discussed above, it is evident that initiatives of NPCI have brought remarkable change in the payment ecosystem in India, as well as globally, and can significantly contribute to global economic growth. However, there are certain challenges hindering penetration of UPI, especially in rural areas, including poor internet connectivity, lack of knowledge about functioning of UPI, increasing failure rate in UPI payments due to technical glitches, rising incidence of online fraud, risk of cyber-attacks and data privacy issues etc.

To achieve the goal of financial inclusion and digitisation in the economy, emphasis should be given to imparting financial and digital literacy, creating awareness about new products, upgrading technical infrastructure to manage increasing traffic on UPI platforms, and adopting secure technology with adequate safeguards and consumer protection measures.

Views expressed by the author are personal.

Notes:

- NPCI is an umbrella organisation for operating retail payments and settlement systems in India. It was introduced by the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) to create a robust Payment and Settlement Infrastructure in India. UPI and RuPay were developed by NPCI in 2016.

- The JAM Trinity is the government mechanism to provide benefits and cash transfers directly to the bank accounts of beneficiaries using three tools - Jan Dhan, Aadhar, and Mobile.

- SWIFT (Society for Worldwide Interbank Financial Telecommunication) is a financial system used for seamless and speedy transmission of money across borders.

22 May, 2023

22 May, 2023

Comments will be held for moderation. Your contact information will not be made public.