Rural Indian households report lack of affordability as the main reason for not having a toilet. This article investigates – through an experiment in rural Maharashtra – whether microcredit labelled for sanitation can increase sanitation investments. It finds that targeted households demand the sanitation loans, and toilet uptake increases by 9 percentage points; however, roughly half of the loans were not used for sanitation.

Eliminating open defecation is an important goal for the current Indian government, as evidenced by its flagship sanitation programme, Swachh Bharat Mission (SBM). This programme was warranted, since at its introduction in late 2014, over 40% (over 57% in rural areas) of the Indian population practised open defecation.

Sanitation – recognised as an indispensable element of disease prevention and primary healthcare programmes (for example, the Declaration of Alma-Ata, 1978) – has the potential to reduce disease exposure, such as worms and diarrhoea (Pickering et al. 2015), which in turn is known to affect human capital in the short- (Nokes et al. 1992a, 1992b) and long-term (Almond and Currie 2011, Bozzoli et al. 2009).

Improving access to safe sanitation is essential to eliminate open defecation. In rural areas, efforts by the Government of India to increase safe sanitation coverage have concentrated on encouraging households to construct household toilets. Nonetheless, despite policy interventions, safe sanitation coverage remained low at just over 30% in rural India in 2015.

The main reason for not having a toilet, reported by households themselves, is affordability and lack of funding. This is unsurprising since even low-cost toilets account for a significant proportion of rural households’ budgets: in rural Maharashtra, the low-cost toilet recommended by SBM would account for around 20% of the median household’s annual income.

Microcredit labelled for sanitation

Microcredit – the provision of small, often collateral-free loans that are repaid in regular, frequent, and fixed instalments – is considered to be a promising tool to relax the funding constraints. Existing studies have found that bundling preventive health investments with microfinance loans make households more likely to invest in these goods (for example, Tarrozzi et al. (2014) for mosquito nets, Devoto et al. (2012) for water connections, Guiteras et al. (2016) and BenYishay et al. (2016) for sanitation). By contrast, randomised controlled trials (RCTs) of microfinance programmes – typically for income-generating activities, either do not study effects on preventive health investments, or find no effects (Banerjee et al. 2015). Thus, it is unclear whether microcredit labelled for sanitation can be effective.

In a new study, we designed an RCT to investigate whether microcredit labelled for sanitation can increase sanitation investments in rural Maharashtra (Augsburg et al. 2019). In the experiment, conducted in collaboration with a leading microfinance institution (MFI) between February 2015 and September 2017, microfinance clients in 40 out of 81 randomly selected Gram Panchayats (GPs) in Latur and Nanded districts of Maharashtra were offered micro-loans for sanitation. The MFI provides collateral-free microcredit loans to poor women through joint-liability lending groups. Clients of the partner MFI account for around 7% of households on average, although many more households are members of other MFIs.1

The loans, offered at a lower interest rate and longer repayment period than other loans (for example, business loans), were to be used for either financing a new toilet, or to upgrade or repair an existing toilet. However, the loan was not bundled with a specific toilet, nor was its use enforced, meaning that it was simply labelled for sanitation.

Theoretical framework

Ex-ante, it is unclear whether such a labelled loan programme could be effective in increasing toilet coverage. On the one hand, it could encourage sanitation investments by relaxing credit constraints, or by making sanitation investments more attractive through the preferential loan conditions, or by virtue of the ‘sanitation’ loan label. The latter could influence households’ borrowing and investment decisions through two channels: first, it could induce households to mentally associate the loan to be spent on sanitation only, an instance of ‘mental accounting’ proposed by Nobel Laureate Richard Thaler. Alternatively, clients may (incorrectly) believe that loan use will either be enforced, or that responsible loan use could help them build a good reputation with the lender, and consequently be offered larger loans at better terms in the future.

On the other hand, the lower interest rate would make the loan attractive to households wanting to borrow for other, non-sanitation purposes. Offering these households cheaper credit will not increase sanitation investments, even if they take the sanitation loan. Moreover, given that monetary returns to sanitation investments take a relatively long time to be realised, households may struggle to repay the loan, and thus use it for other purposes.

Using a theoretical model, our research first shows that loan labels can influence sanitation loan take-up and use. The theory suggests that if loan labels do not matter, the lower interest rate on the sanitation loan should induce households to take it, irrespective of how they intend to use it. Other more expensive loans will be taken once the limit on the sanitation loan is reached. This observation allows us to construct an empirical test for whether or not households are sensitive to the loan label.

The theory further shows that when households are sensitive to loan labels, the introduction of the sanitation loan will result in an increase in sanitation investments, in particular. The loan also relaxes overall credit constraints faced by households, and makes all investments cheaper through the lower interest rate. When labels are irrelevant, these two features would predict an increase in all investments, not just sanitation investments, and increases in overall borrowing.

Empirical findings

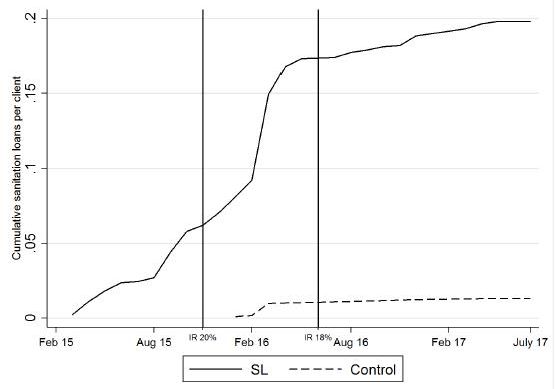

Our empirical findings demonstrate, first, that there is interest in the new sanitation loan. Around 18.1% of eligible households took the loan, as shown in Figure 1, which plots cumulative uptake of sanitation loans in the study area.

Figure 1. Sanitation loan uptake over time, by treatment arm

Note: The vertical lines mark reduction in interest rates, which occurred in November 2015 and June 2016.

Source: Administrative data from our implementation partner.

Further, data on other loans taken from the MFI reveals little evidence of substitution away from more expensive business loans to the cheaper sanitation loan, or of clients taking the business loan only after taking the sanitation loan: 62% of eligible clients took a business loan when they could have taken the sanitation loan; 31% of clients, who could have taken both loans chose to take a business loan only. Thus, a large proportion of households’ decisions are influenced by the loan label.

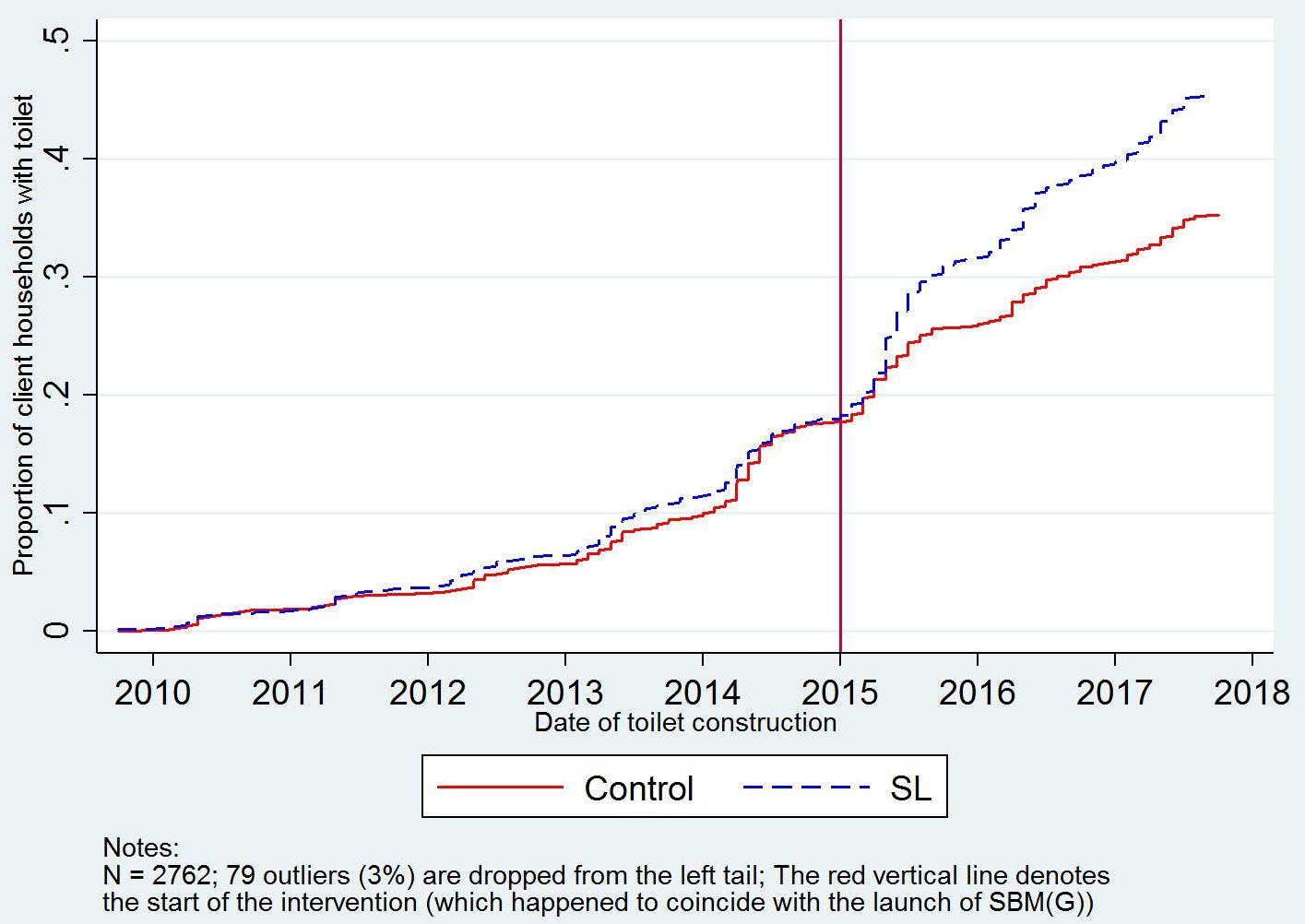

As explained earlier, loan uptake on its own is insufficient evidence to indicate that sanitation investments increased. We thus analyse the intervention impacts on toilet ownership, and on the repair and upgrade of existing toilets. We find that, overall, the sanitation microcredit intervention increased toilet uptake by around 9 percentage points, as can be seen in Figure 2. Interestingly, the figure also shows a rapid increase in toilet uptake in the control GPs (where the intervention was not undertaken), particularly from mid-2014, possibly due to the SBM programme which was launched on 2 October 2014. The impacts found in treated GPs (where the intervention was undertaken) are over and above this increase.

Figure 2. Toilet uptake over time, by treatment arm

We find little evidence that the sanitation loans were used to repair or upgrade existing toilets, or that the loans replaced other sources of funding for toilets that would have been built anyways. Thus, close to half of the sanitation loans have been spent on some non-sanitation investment purpose.

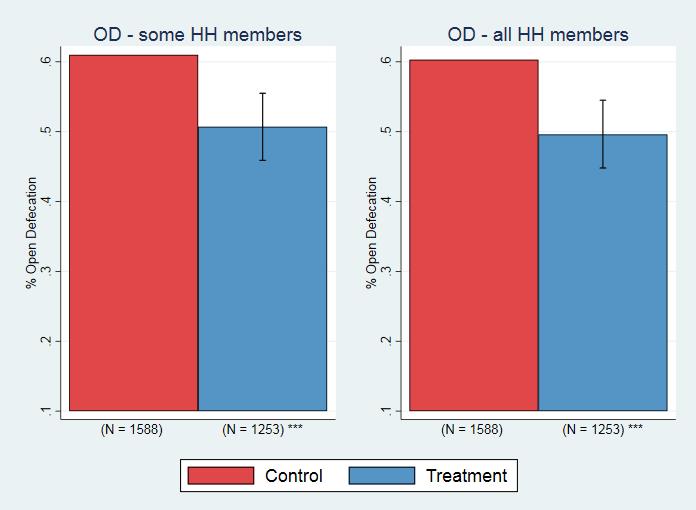

An important question is whether the new toilets are actually used, and consequently reduce open defecation. We find that open defecation by household members falls by just over 10 percentage points as a result of the intervention, indicating that the toilets constructed as a result of the sanitation loans are effectively being used.

Figure 3. Impacts on open defecation

Our study also finds no evidence of the sanitation microfinance programme worsening households’ financial health. We find no statistically significant increase in overall household borrowing on average, indicating that the loan programme did not lead to an increase in the average household’s debt. Moreover, we find little evidence of households experiencing repayment difficulties: 1.12% of clients taking sanitation micro-loans reported difficulties in repaying the loan, which is less than the 5.75% of clients reporting difficulties in repaying business loans.

The finding of no increase in overall borrowing for the average household also indicates that the sanitation micro-loan programme did not encourage sanitation investments through either relaxing overall credit constraints, or through the lower interest rate. If either of these explanations were relevant, we would have seen an increase in overall borrowing or a shift away from more expensive loans, neither of which we observe in the data.

Finally, analysing the cost of this programme, we estimate the MFI’s costs (operational and capital) of providing the sanitation loans to be around Rs. 3,000 (US$45) per loan disbursed. Assuming no default, the break-even interest rate is 20%, which is the average interest rate charged by the MFI over the intervention period.2

Effective but not sufficient

Overall, we conclude that loans labelled for sanitation can be effective in increasing sanitation investments, and that the label plays a role in households’ borrowing and investment decisions. However, the fact that roughly half of the loans were not used for sanitation also shows that the label, on its own, is not sufficient to ensure that loans are used for the stated purpose. Thinking about innovative ways in which loan use for particular purposes can be incentivised in a cost-effective way is an important avenue for future research.

Notes:

- Microfinance groups have a vast membership across India. The National Bank for Agriculture and Rural Development alone reported linking over 11 million families to credit through their microfinance programme in 2018.

- This is an upper bound, since MFIs can on-lend repaid loans, which our calculation ignores.

Further Reading

- Almond, D and J Currie (2011), ‘Human capital development before age five’, In D Card and O Ashenfelter (eds.), Handbook of Labor Economics’, Vol. 4, Part B, pp. 1315-1486.

- Augsburg, B, B Caeyers, S Guinti, B Malde, and S Smets (2019), ‘Labelled loans, credit constraints and sanitation investments’, Working Paper, Institute for Fiscal Studies.

- Bozzoli, Carlos, Angus Deaton and Climent Quintana-Domeque (2009), “Adult height and Childhood Disease”, Demography, 46(4): 647-669.

- Devoto, Florencia, Esther Duflo, Pascaline Dupas, William Parienté and Vincent Pons (2012), “Happiness of Tap: Piped Water Adoption in Urban Morocco”, American Economic Journal: Economic Policy, 4(4):68-99. Available here.

- Guiteras, R, D Levine, T Polley and B Quistorff (2016), ‘Credit constraints, discounting and investment in health: Evidence from micropayments for clean water in Dhaka’, Mimeo, North Carolina State University. Available here.

- Nokes, C, SM Grantham-McGregor, AW Sawyer, ES Cooper, DAP Bundy (1992a), “Parasitic helminth infection and cognitive function in school children”, Proceedings of the Royal Society London B, 247(1319):77-81.

- Nokes, C, SM Grantham-McGregor, AW Sawyer, ES Cooper, DAP Bundy (1992b), “Moderate to heavy infections of Trichuris trichiura affect cognitive function in Jamaican school children”, Parasitology, 104:539-47.

- Pickering, Amy Habiba Djebbari, Carolina Lopez, Massa Coulibaly and Maria Laura Alzua (2015), “Effect of a community-led sanitation intervention on child diarrhoea and child growth in rural Mali: A cluster-randomised controlled trial”, Lancet Global Health, 3(11):701-711.

- Tarozzi, Alessandro, Aprajit Mahajan, Brian Blackburn, Dan Kopf, Lakshmi Krishnan and Joanne Yoong (2014), “Micro-loans, Insecticide-Treated Bednets and Malaria: Evidence from a Randomized Controlled Trial in Orissa (India)”, American Economic Review, 104(7):1909-1941. Available here.

- Yishay, Ben Ariel, Andrew Fraker, Raymond Guiteras, Giordano Palloni, Neil Buddy Shah, Stuart Shirrel and Paul Wang (2016), “Microcredit and willingness to pay for environmental quality: Evidence from a randomized-controlled trial of finance for sanitation in rural Cambodia”, Journal of Environmental Economics and Management, 86, November 2016.

15 May, 2019

15 May, 2019

Comments will be held for moderation. Your contact information will not be made public.