In this year’s Union Budget, Finance Minister Nirmala Sitharaman announced that she will constitute a committee to evaluate 15 years of gender budgeting. It entails looking at the budget through the gender lens. In this post, Ashok K. Lahiri discusses what is gender budgeting and why it is needed, its achievements and issues so far, and the way forward.

In her 2019 Union Budget speech, Finance Minister Nirmala Sitharaman described Naari (woman) as Narayani (goddess) and said that she will constitute a committee to evaluate 15 years of gender budgeting.

She reminded us what Swami Vivekananda said in the context of gender equality. Vivekananda said “It is not possible for a bird to fly on one wing”. Much later, Mao Zedong, the former Chairman of China, who was a poet and had his way with words, summed it up well when he said “Women hold up half the sky”. Women are as important as, if not more than, men.

Who did we or do we see coming back in the evening from the farm or work, prepare dinner, look after the children, make the beds, and then retire only after everybody else, whose needs have been looked after, have gone to sleep? Our mothers earlier, and later our wives. From whom did we learn our first alphabets, numbers, rhymes, and mythological stories? From our mothers. Researchers tell us that there is some evidence in favour of the ‘good mother hypothesis’ that asserts that consumption of child-specific goods and child well-being may be superior in families in which mothers have greater control over economic resources (see for example, Phipps and Burton 1998). A country, which does not do as much for women as for men, wastes its potential. A focus on women is necessary not only from the equity angle, but also from the efficiency point of view.

What is gender budgeting?

It is a look at the budget through the gender lens. Let me emphasise that it is not a separate budget for women, but an analysis of the budget to examine its gender-specific impact, and to translate gender commitments into budgetary operations. It is extremely important to remember that all budgetary operations and their benefits do not lend themselves to gender partitioning. Public goods are characterised by non-rivalry and non-exclusiveness. Defence, for example, is as important for you as for me, irrespective of whether you are a man or a woman. There is hardly anything to be achieved by trying to apportion the benefits from defence between men and women. But, there is likely to be little disagreement that the Mukhyamantri Kanya Utthan Yojana promising unmarried girls Rs. 10,000 for passing the 12th grade examination, and Rs. 25,000 for completing graduation benefits women more than men. Men, in their capacity as fathers, brothers, and sons are also benefitted, but women benefit more.

As some other examples, let us take drinking water and cooking fuel. Whenever available only at a distance, these are fetched mostly by our women. Thus, Nal se Jal or piped water supply scheme, 2019, and Ujjwala Yojana, 2016 are likely to benefit women more than men.1 Groups of women in colourful ethnic clothing carrying headloads of stacked water pitchers or fuel wood may appear elegant and even be good for attracting foreign tourists. But, these cannot be pleasing vocations for those engaged in the enterprise. Cooking is done almost exclusively by our women and not by us men. Indoor air pollution due to unclean fuel kills millions of women from heart disease, stroke, chronic obstructive pulmonary disease, and lung cancer. According to experts, having an open fire in the kitchen is like burning 400 cigarettes an hour. Similarly, Swachh Bharat Abhiyan (SBA) provides another example. Women are more sensitive, and hence more restrained in committing nuisance in public spaces. Thus, this nation-wide campaign through the construction of household-owned and community-owned toilets will benefit them more than men.

Let us look at the genesis of gender budgeting not only in India but across countries in brief. Economists, in general, had looked at the ‘family’ or ‘household’ as the basic unit of analysis. The decisions of the family were that of a single homogenous unit taken collectively for the collective good. It could be analogous to one taken by a benevolent dictator. An increase in household income meant everyone in the household would be better off. A decrease in inter-household inequality was better for the society – implicitly, it was supposed to mean a less unequal distribution of income across individuals. In the 18th and 19th centuries, social scientists or economists such as Malthus, Marx, or Engels did point out the importance of economic factors in determining family characteristics such as the age for marriage, at what age to have children or how many children to have.

But, the need to carefully focus on the determinants of family decisions in the allocation of resources among members of the household came to be emphasised in the last two decades of the 20th century, most notably by the Nobel Laureate Gary Becker in his path-breaking book, A Treatise on the Family, published in 1981. Becker’s approach, for example, helped us understand that poor married couples might have more children partly because to them, children are ‘cheaper’ in terms of the value of time spent and income foregone.

Awareness about the complex decision-making process of allocating resources within the family gave rise to studies of intra-household inequalities. The inequality between men and women was easy to detect. In 1990, in the New York Review of Books, Amartya Sen wrote about ‘missing women’. He pointed out that women tend to outnumber men in Europe and North America. But, in developing countries that is not true. He pointed out that though about 5% more boys are born relative to girls, the women are hardier than men and survive better at all ages. In developing countries, millions of missing women relative to how many there should have been there indicated the neglect of female health and nutrition. The sex ratio – that is number of women per 1,000 men – declined almost steadily from 946 in 1951 Census to 933 in the 2001 Census before increasing to 943 in 2011 Census.2 The effective literacy ratio for females in 1951 at 8.9% was 18.3 percentage points below 27.2% for males. It increased to 29.8% in 1981, but relative to 56.4% for males it lagged behind by an even larger 26.6 percentage points. It is only after 1981 that we find that the gap between males and females in terms of literacy rates started declining.3

The United Nations Convention on the Elimination of All Forms of Discrimination against Women (CEDAW) was adopted by the UN General Assembly in 1979. CEDAW emphasised the importance of gender equality to strengthen prosperity and as a matter of basic human rights. Gender equality has been defined by the UN as “the equal rights, responsibilities and opportunities of women and men and girls and boys.” From 1990, recognising the importance of human development in terms of life expectancy, education and income per capita, the United Nations Development Programme (UNDP) was already publishing the Human Development Index (HDI) along with the Human Development Report (HDR) every year, except for 2012 and 2017. From 1995, along with the HDI, the Gender Development Index (GDI) and Gender Empowerment Measure (GEM) were calculated and presented. GDI measures gender gaps in human development achievements by accounting for disparities between women and men in three basic dimensions of human development – health, knowledge, and living standards using the same component indicators as in the HDI. Also, the Fourth World Conference on Women in Beijing in 1995 laid out a vision of achieving gender equality in the Beijing Declaration and Platform for Action.

In September 2000, building upon a decade of major United Nations conferences and summits, world leaders came together at the UN Headquarters in New York to adopt the UN Millennium Declaration. One hundred and eighty-nine (189) nations made a promise to free people from extreme poverty and multiple deprivations. This pledge became the eight Millennium Development Goals (MDGs) to be achieved by 2015. The 3rd goal was to ‘promote gender equality and empower women’ and the fifth was to ‘improve maternal health.’ The other goals were: (i) eradication of extreme poverty and hunger, (ii) universal primary education, (iv) reducing child mortality, (vi) combating HIV/AIDS, malaria and other diseases, (vii) ensuring environmental sustainability, and (viii) developing a global partnership for development. In September 2010, the world recommitted itself to accelerate progress towards these goals.

The Gender Inequality Index (GII) was introduced in the 2010 HDR. GII measures gender inequalities in three important aspects of human development – reproductive health, measured by maternal mortality ratio and adolescent birth rates; empowerment, measured by proportion of parliamentary seats occupied by females, and proportion of adult females and males aged 25 years and older with at least some secondary education; and economic status, expressed as labour market participation, and measured by labour force participation rate of female and male populations aged 15 years and older.

In 2015, the MDGs were substituted by Sustainable Development Goals (SDGs). It followed the resolution by 193 UN General Assembly member countries on 25 September 2015. The 17 SDGs are to be achieved by 2030, and include promoting gender equality and empowering women as the fifth goal.

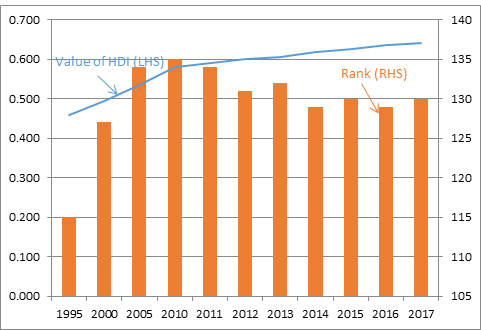

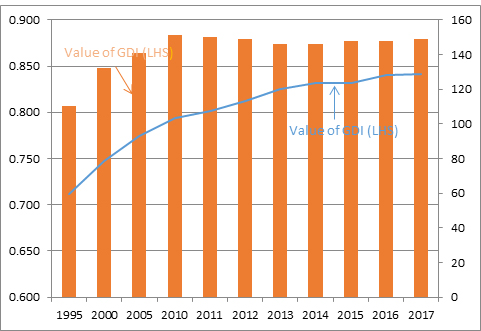

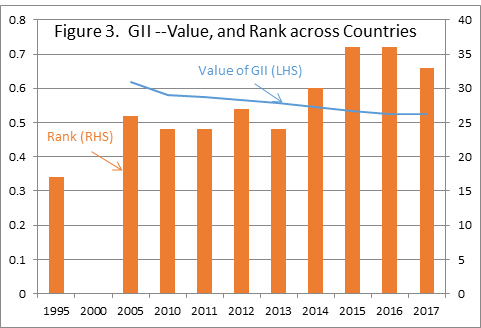

So, how have we done in terms of HDI, GDI, and GII? Figures 1-3 give the value of the index as well as India’s rank among the countries studied by the UNDP. It is important to remember though that the methodology of calculating these indices has undergone some changes since 1995. Also, the number of countries for which the HDI, GDI, and GII is calculated are not identical. Thus, the numbers and rankings over time are not strictly comparable, and provide only broad-brush pictures.

The value of HDI has increased (the blue line) indicating an improvement in absolute terms (Figure 1). Relative to the rest of the world, after a very poor performance during 1995-2010, we have done only moderately well since 2010. Our rank has improved from 135 (out of 188 countries) to 130 (out of 189 countries). Similarly, GDI has increased (the blue line) indicating an improvement in absolute terms (Figure 2). But, relative to the rest of the world, after slipping from 110 (out of 117) in 1995 to 151 (out of 158) in 2010, we have hardly moved! Our ranking barely changed to 149 (out of 164) in 2017.

Figure 1. HDI – value and rank across countries

Figure 2. GDI – value and rank across countries

Figure 3. GII – value and rank across countries

Our performance seems to have been particularly worrying in GII (Figure 3). Remember that a decline in GII indicates a decline in inequality and hence an improvement, and a higher ranking among countries with a higher value of GII suggests a deterioration. Just as a reference, in 2017, there were 21 countries with GII less than 0.1.4 The value of India’s GII declined from 0.687 in 1995 to 0.524 in 2017, and we improved our ranking from 17 (out of 121) in 1995 to 36 (out of 156) in 2015. But, in 2017, we slipped with our rank moving to 33 (out of 157). In a nutshell, in 2017, India ranked 130th in terms of HDI and was a medium HDI country, but with a value of 0.841 for GDI, it ranked 149, which is more or less the same level of GDI as some low HDI countries such as Cote d’Ivoire, Ethiopia, and Liberia. This dissonance between HDI and GDI is consistent with our poor performance in GII. We need to pay a lot more attention to gender issues, and gender budgeting is one of the instruments. I am sure some of you are waiting to ask “How do we compare with China?” In 2017, China, with a value of 0.752, ranked 86th in terms of HDI; with a value of 0.955, ranked 89th in terms of GDI; and with a value of 0.152, ranked 122nd in terms of GII (Table 1). So, we are lagging behind in gender development and bridging the gender inequality. We need to remove these deficiencies, and gender budgeting can help in this regard.

|

Table 1. China and India in terms of HDI, GDI and GII, 2017 |

|||

|

China |

India |

||

|

Human Development Index |

|||

|

Value |

0.752 |

0.640 |

|

|

Rank |

86 |

130 |

|

|

Gender Development Index |

|||

|

Value |

0.955 |

0.841 |

|

|

Rank |

89 |

149 |

|

|

Gender Inequality Index |

|||

|

Value |

0.152 |

0.524 |

|

|

Rank |

122 |

33 |

|

A common definition of gender budgeting is “integrating a clear gender perspective within the overall context of the budgetary process through special processes and analytical tools, with a view to promoting gender-responsive policies” (Organization for Economic Cooperation and Development (OECD), 2016), Gender budgeting now has got significant history across countries, especially in the developed ones. In 1984, Australia was the pioneer in introducing a gender-sensitive budget.5 Over time, all the G-7 countries have introduced gender budgeting in some form or the other.6 For example, in Germany, from 2000, gender equality has been a guiding principle in the Joint Rules of Procedure of the Federal Ministries. Outside the G-7, Austria, Belgium, and Spain have become relatively strong performers in the field of gender budgeting.7 South Korea has a substantive gender budgeting initiative, which applies to all levels of government.8 Canada since 1995 is committed to conducting gender-based analysis of legislation, policies, and programmes.9 South Africa started it in the mid-1990s. In South America, various countries, starting with Brazil at the sub-national level in 1997, have introduced gender budgeting.10 Though gender budgeting is still in its nascent stages – more in the form of an art rather than a science – a lot can be learnt from a careful study of the inter-country experiences. For now, let me turn directly to gender budgeting in India.

Early on, the erstwhile Planning Commission, in the Ninth Plan (1997-2002), adopted a ‘Women’s Component Plan’ as one of the major strategies to achieve gender equality. One of the initiatives was, in 1997, to earmark 30% of developmental funds for women in all sectors. However, evidence on the Women’s Component Plan revealed that earmarking of Plan funds for gender development is only a second-best principle for integrating gender in macroeconomic policymaking, as the 30% was not spent effectively on women. Subsequently, India moved away from ‘component plans’ for women to macro-level gender budgeting in 2000, encompassing the entire budget.

Gender budgeting efforts in India have encompassed four sequential phases: (i) knowledge building and networking, (ii) institutionalising the process, (iii) capacity building, and (iv) enhancing accountability. Table 2 summarises these four phases to provide snapshot of the history of gender budgeting in India.

Table 2. Phases of gender budgeting in India

|

|

Phases |

Actors |

Outcome |

|

2000-03 |

Knowledge building and networking |

National Institute of Public Finance and Policy (NIPFP), a think tank of the Ministry of Finance; Ministry of Women and Child Development (MWCD); United Nations Development Fund for Women (UNIFEM); Ministry of Finance |

Ex-post analysis of budget through a gender lens with objective “budgeting for gender equity”; Included a chapter in India’s Economic Survey; Highlighted the need to integrate unpaid care economy into budgetary policies; Linked public expenditure and gender development. |

|

2004-05 |

Institutionalising within government |

Ministry of Finance; NIPFP |

Expert committee on “Classification of Budgetary Transactions” with gender budgeting in the terms of reference; Budget Announcement on India’s commitment to gender budgeting; Analytical matrices to do gender budgeting were designed by the Ministry of Finance and NIPFP; Gender Budget Statements included in Expenditure Budgets, from 2005-06 onwards; Gender Budgeting Cells (GBC) were instituted in ministries. |

|

2005-present |

Capacity building |

Two phases: Phase I – NIPFP, MWCD and Ministry of Finance (till 2006), Phase II – MWCD, UN Women (2006-present) |

GBC officials, Ministries’ and state officers’ training; Charter on gender budgeting specifying the responsibilities of GRB cells. |

|

2012-present |

Enhancing accountability |

Erstwhile Planning Commission (Eleventh Five Year Plan) incorporated a Committee on ‘Accountability’, and NIPFP has been part of this process with Planning Commission. Comptroller and Auditor General (CAG) has initiated accountability/auditing of gender budgeting at the state level. |

Comptroller and Auditor General of India (CAG) has been publishing a Report on Gender Budgeting in the State Finance Accounts, since 2010. The accountability mechanism is yet to be followed effectively. This report covers money ‘actually spent’ on women. |

Source: Chakraborty (2016).

In 2000, the Government of India commissioned the NIPFP to undertake a comprehensive study on gender budgeting (Lahiri et al. 2000). This study, with which both Prof. Lekha Chakraborty and I had the privilege of being associated with, analysed the ‘Demand for Grants’ submitted by all the ministries and departments of central government. It is an extensive process to identify the programmes and schemes that existed, if any, for women and analyse the fiscal marksmanship of these spending programmes (that is, to assess the forecast errors or the deviation of budget estimates and revised estimates from actual results, which are released sequentially). This analysis was not selective, but covered all sectors.

Analysis of fiscal marksmanship indicated that there was a significant deviation of budgeted from actual expenditure, and the NIPFP coordinated with the Comptroller and Auditor General to understand the reasons for the deviation. One of the findings of the study was higher allocations per se had not ensured higher actual expenditure on gender-sensitive human development, and these findings led the researchers to conduct expenditure tracking analysis and benefit incidence analysis to understand the gender inequality effects of fiscal policies. Let me add though that poor marksmanship as manifested in significant departures of not only actuals from the budgeted, but even the revised and the budgeted, and the revised and the actual characterise not only expenditure on items related to women, but others as well. Such departures, when persistent over the years, raise serious issues about the integrity of the budget process.

The NIPFP study attempted an assessment of the benefit incidence of budget allocations and fiscal marksmanship, and traced the link between fiscal policy and gender development.11 Based on inputs from the NIPFP study and the recommendations of the Expert Committee on Classification of Budgetary Transactions of the Government of India, The Minister of Finance announced in the Union Budget speech for 2005-06 that gender budgeting would be institutionalised from the 2006-07 Union Budget.12 As per the recommendations of the Expert Group, a Gender Budgeting Secretariat was placed in the Ministry of Finance, and Gender Budgeting Cells were constituted in the sectoral ministries.

So, how has gender budgeting progressed in India in the last 15 years? The answer to this is mixed – well and not so well. There is satisfaction to be derived from the fact that gender budgeting has been sustained for the last 15 years. Not only has it been sustained but it has even spread to subnational governments including states and union territories. Simultaneously, however, there is a need to make a lot more progress in several areas including data integrity, better fiscal marksmanship, reporting on a consistent basis, emphasis on outcomes rather than expenditure, and more analysis of gender budgeting both ex ante and ex post.

Gender budgeting – not only sustained but implemented in states and union territories

It is not only the union government, but also many of the states that have adopted gender budgeting. As per the Gender Budget Handbook (October 2015), of the Ministry of Women and Child Development (MWCD), by January 2013, as many as 16 states had adopted gender budgeting (Table 3). Not only states, but even two union territories (UTs) – Andaman and Nicobar Islands, and Dadra and Nagar Haveli – had adopted gender budgeting by the end of 2012.

Table 3. Gender budgeting in the states (year of adoption)

|

Early adopters |

Subsequent adopters |

Recent adopters |

|

Odisha (2004-05) |

Madhya Pradesh (2007-08) |

Andaman and Nicobar Islands |

|

Tripura (2005-06) |

Jammu & Kashmir (2007-08) |

Rajasthan (August 2011) |

|

Uttar Pradesh (2005) |

Arunachal Pradesh (2007-08) |

Maharashtra (January 2013) |

|

Karnataka (2006-07) |

Chhattisgarh (2007-08) |

Dadra and Nagar Haveli |

|

Gujarat (2006) |

Uttarakhand (2007-08) |

|

|

Himachal Pradesh (2008) |

||

|

Bihar (2008-09) |

||

|

Kerala (2008-09) |

||

|

Nagaland (2009) |

Note: Andaman and Nicobar Islands, and Dadra and Nagar Haveli are union territories and not states.

Source: Gender Budget Handbook, Ministry of Women and Child Development, Government of India, October 2015.

Data integrity

Data integrity is essential for rigorous analysis of policies. Such integrity involves timely reporting of accurate data. But, such reporting doesn’t seem to be happening in the case of gender budgeting. Take a simple question such as the number of states that have adopted gender budgeting in India. While the Gender Budget Handbook (2015) reports 16 states doing gender budgeting, the MWCD website, accessed recently, yielded only the names of 13 states – Assam, Bihar, Chhattisgarh, Gujarat, Karnataka, Kerala, Madhya Pradesh, Nagaland, Odisha, Rajasthan, Tripura, Uttarakhand, and Uttar Pradesh. Unless, MWCD was being extra frugal with words to mention only 13 out of a larger universe, or if I may say, lazy, we may take 13 as the number of states having adopted gender budgeting. Then, at least one must be wrong if not both. It is sad to see that this has happened at the ministry in charge of women and child development, which I am sure, has some of the best and the brightest in the land at its helm. I cannot believe for a moment that they have a cavalier attitude towards data. I hope MWCD will make the necessary correction at the earliest. The gravest problem with such misreporting is that while one mistake or inconsistency in the data may be a one-off mistake, it still raises troubling questions in the minds of the researchers.

Fiscal marksmanship in gender budgeting

The NIPFP had conducted the gender-analysis of the budget for 2000-2005 (Lahiri et al. 2000, 2001, 2002). From 2005-06, on similar lines as the NIPFP’s, came the ‘Gender Budget Statement’ in the Expenditure Budget, Volume 1 of the Union Budget documents. The problems with the Gender Budget Statement in Expenditure Budget are three.

First, the Gender Budget Statement gives the budget estimate for the coming year, and both the budget estimate as well as revised estimate for the year that is coming to a close. But it is silent about the actuals for the year before, for which, beyond the budget and revised estimates, actual figures are available. For example, Expenditure Budget Vol. 1 for 2013-14 would give the budget estimates for 2013-14 along with the budget and revised estimates for 2012-13. It does not present the actuals for the relevant categories for 2011-12, making it very difficult to comment on the fiscal marksmanship in gender budgeting. Fortunately, from the current year (2019-20), the Union Government’s Expenditure Budget has started reporting the actuals for the last but one preceding year (2017-18). For example, in 2017-18, relative to the budgeted Rs. 1,133.11 billion and revised estimate of Rs. 1,172.21 billion, the actual for 2017-18 reported in 2019-20 Budget is Rs. 928.84 billion, indicating a shortfall of 18% relative to the budget estimate and an even higher 20.8% shortfall relative to the revised estimate. Not very good marksmanship! What is surprising is that when even the budget estimates could not be achieved, why the figures were moved upward in the revised estimates! Furthermore, the line items included under a particular demand for grant in the Gender Budget change from year to year. Thus, for example, Demand for Grant No. 28 “Ministry of External Affairs” had 13 items in the Budget and Revised Estimates for 2017-18 included in the Gender Budget Statement in 2018-19, but the same demand for the Ministry of External Affairs (with number changed to 26) under actual for 2017-18 had 36 line items! With these changes, it is not very clear that the figures are strictly comparable.

Second, there are many budget line items included under Part A, which are 100% women-specific programmes and under Part B, which are 30% women-specific programmes. How and why many budget line items have been included under Part A or Part B is not at all obvious. For example, why expenditure on Central Council for Research in Unani Medicine, or rural housing under Indira Awas Yojana should be included as 100% women-specific expenditure under Part A is not at all obvious. What is intriguing is that while expenditure on Central Council for Research in Unani Medicine is under Part A, expenditure under Central Council for Research in Ayurvedic Sciences is under Part B.

Third, the Budget documents are not very user-friendly. Sometimes, they try to test the arithmetic skills as well as commitment and patience of the user by not presenting the totals for the budget estimates and revised estimates for Parts A and B, like in Statement 20, Volume 1 of Expenditure Budget in Budget 2015-16. (I must confess that I failed the test and did not try and sum the numbers up to derive the relevant totals.)

So, how has the gender budget allocation according to the Union Government’s Gender Budget Statement moved over time? The allocation seems to have fluctuated quite a bit around a broadly upward trend. I do not need to elaborate on the problems associated with classification of budget items for the gender budget statement. In Das and Mishra (2006), authors have pointed out these classification problems. For example, they had pointed out that the entire allocation in 2006-07 for Safdarjung Hospital, Vardaman Mahavir Medical College, and All India Institute of Medical Sciences (AIIMS) – all in the capital city of Delhi – had been included under Part A, that is as 100% women-specific allocations. A sense of unease comes from the lack of details as to how and why some items have been included in Part A or Part B of the Gender Budget Statement.

Furthermore, as already mentioned, changes in allocations from one year to another in the Gender Budget Statement need to be interpreted carefully because of changes in how much of what Demand for Grants have been included in the Gender Budget Statement. The figures are not comparable across time points. For instance, in 2005, the analysis included only 33 Demand for Grants, which increased to more than 50 in 2014-15. Similarly, the declining trend in recent years is due to the realignment of intergovernmental transfers from tied to untied with lower discretionary transfers, as recommended by the Fourteenth Finance Commission.

Emphasis on inputs and not on outcome

The emphasis in gender budgeting continues to be on expenditure rather than outcomes. This, however, is a problem which is not restricted to gender budgeting alone but afflicts all spheres of public finance. There needs to be much more focus on the best public finance management (PFM) practices spanning the entire budget cycle from preparation, allocation, prioritisation, execution, monitoring, and evaluation. How much do we know about the impact of say the expenditure on Central Council for Research in Unani Medicine, which is included as a 100% women-specific scheme, on women? I must add though that while a part of the responsibility for such benefit-incidence analysis lies with the government, the academics and researchers also need to be pro-active in shedding more light on these issues.

Lack of both ex ante and ex post analysis of schemes

Careful analysis needs to be done both before launching a scheme or including it under gender budgeting as well as after its implementation. We may call these two ex-ante and ex-post analysis. Mostly, we launch schemes without adequate preparation and analysis – on the basis of guesses – perhaps ‘informed’ guesses. Furthermore, we often do not follow up with the evaluation of a scheme after it has been implemented. In the absence of such analyses, we may not only spend our scarce resources on items that do not deliver the desired results, but also be unaware of this reality and persist with the mistake for longer than necessary. Let us not forget that a gender budget statement is usually described as a gender-specific accountability document produced to show what the government’s programmes and budgets are achieving with respect to gender equality, not how much the government is spending on the belief that such spending must be helping women. Perhaps, time is opportune for launching a gender audit of Sarva Siksha Abhiyan, Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA), and Ayushman Bharat.

Conclusion

Before concluding let me point out that I have not touched upon two issues relating to the taxation and revenue side of gender budgeting and gender empowerment. It is because I do not think they are on top of the priority list for achieving gender equality. Our taxation system is still cluttered with a lot of exemption and concessional treatments for specific goods and assesses. I do not think giving, for instance, a well-off woman, an exemption from or a concessional rate of property tax on the house that she owns, in preference over her poorer second cousin who happens to be a male, will help the cause of gender development.

On gender empowerment, I am a strong believer in increasing the participation of women in participatory democracy and in the executive branch. At the same time, I also believe that such empowerment has to deal with the tough issue of bringing up the bottom end of the distribution even among our women, not the creamy layer. On this, which I know is a controversial topic, let me end with a story from Pakistan.

Benazir Bhutto became the Prime Minister of Pakistan in 1988, but that did not reflect the true state of women’s participation in elections in Pakistan. Women’s turnout in Pakistan was one of the lowest in the world. In some villages, like Dhurnal in Punjab of Pakistan, no woman had ever voted until the general elections of 2018. Pakistan had to promulgate a law in 2017 to announce that a constituency’s vote count would be nullified if the female voter turnout did not reach 10%.

Notes:

- Under Ujjwala Yojana, LPG (liquefied petroleum gas) stove and refill were available on credit, with the loan repaid by the oil marketing company deducting the subsidy on LPG cylinder as equated monthly instalments. The other associated scheme Pratyaksh Hanstantarit Scheme or PAHAL simplified the availability of LPG cylinders through a direct benefit transfer (DBT) of subsidy scheme.

- The ratio was 941 in 1961, 930 in 1971, 934 in 1981, 927 in 1991, 933 in 2001, and 943 in 2011.

- The male literacy rates were 27.2 in 1951, 40.4 in 1961, 46.0 in 1971, 56.4 in 1981, 64.1 in 1991, 75.3 in 2001, and 82.1 in 2011. The corresponding rates for females were 8.9, 15.4, 22.0, 29.8, 39.3, 53.7, and 65.5.

- The countries were Switzerland, Denmark, the Netherlands, Sweden, Belgium, Norway, Slovenia, Finland, Iceland, South Korea, Luxembourg, Singapore, Austria, Germany, Spain, France, Cyprus, Italy, Portugal, Canada, and Israel.

- “This practice of producing the Women’s Budget Statement abruptly ceased in 2014, though the reasons why are unclear” – Budlender (2015), quoted in Chakraborty (2016).

- IMF (2017) provides an overview.

- In 2009, changes to Austria’s Constitution required gender budgeting at all levels of government.

- The National Finance Act, legislated in 2006, requires submission of gender budgets and gender balance reports from the 2010 fiscal year onward.

- Since 2010, the annual Budget Law has an annex on equality between women and men in fiscal policies and gender-disaggregated amounts allocated in the budget.

- The Municipality of Santo Andre in 1997-2000 began to develop a budget using racial and gender analysis (UNIFEM (2008), quoted in Fragoso and Enríquez (2016)).

- The NIPFP diagnoses the existing degree of gender inequality in India through sex disaggregation of relevant macro data, quantification of existing non-Systems of National Accounts unpaid care economy work of women, econometric investigation of the link between public expenditures and gender development, assessment of budgetary policies through a gender lens, and identification of policy alternatives to build in a gender-sensitive national budgeting process (Lahiri et al. 2002).

- See United Nations Development Programme (2010) (p. 108). Again I had the good fortune of being associated with this Expert Committee on Classification of Budgetary Transactions.

Further Reading

- Budlender, D (2015), ‘Budget Call Circulars and Gender Budget Statements: A Review’, UN Women, New Delhi.

- Chakraborty, L (2016), ‘Asia: A Survey of Gender Budgeting Efforts’, IMF Working Paper, WP/16/150.

- Das, Subrat and Yamini Mishra (2006), “Gender Budget Statement”, Economic and Political Weekly, 29 July 2006.

- Fragoso LP and CR Enríquez (2016), 'Western Hemisphere: A Survey of Gender Budgeting Efforts', IMF Working Paper, WP/16/153, July 2016.

- International Monetary Fund (2017), ‘Gender Budgeting in G7 Countries’, Policy Papers.

- Lahiri, A, L Chakraborty and PN Bhattacharyya (2000), ‘India: Gender Budgeting’, NIPFP, New Delhi.

- Lahiri, A, L Chakraborty and PN Bhattacharyya (2001), ‘Gender Diagnosis and Budgeting in India’, NIPFP, New Delhi.

- Lahiri, A, L Chakraborty and PN Bhattacharyya, “Gender Budgeting in India,” Follow the Money Series, UNIFEM, New York, 2002.

- OECD (2017), “Gender budgeting in OECD countries”, OECD Journal on Budgeting, Volume 2016/3.

- Phipps, Shelley A and Peter S Burton (1998), “What's Mine Is Yours? The Influence of Male and Female Incomes on Patterns of Household Expenditure”, Economica, 65(260):599-613.

- United Nations Development Programme (2010), 'Asia Pacific Human Development Report 2010: Power, Voice and Rights. A Turning Point for Gender Equality in Asia and the Pacific', Mcmillan India.

- UNIFEM (2008), 'Aportes a los Presupuestos Sensibles al Género. Experiencias de Argentina, Brasil, Chile y Uruguay (Contributions to Gender Responsive Budgets Experiences of Argentina, Brazil, Chile, and Uruguay)', Cuadernos de Diálogos, Brazil, p. 50.

29 October, 2019

29 October, 2019

Comments will be held for moderation. Your contact information will not be made public.