In India, where microenterprises form a crucial foundation for livelihoods and employment, the effects of the Covid-19 lockdown can potentially be significant. Based on the first wave of a dynamic, multidimensional survey of 1,461 microenterprises across the country, Buteau and Chandrasekar show that, while most business owners surveyed have displayed remarkable levels of confidence in the possibility of business recovery after Covid-19, more than half of them do not have a strategy to chart their recovery plan and are dipping into their savings to stay afloat.

Covid-19 and the preventive measures implemented to tackle the spread, such as lockdowns in multiple countries, have affected the global economy. In India, where microbusinesses form a crucial foundation for livelihoods and employment, the effects of the lockdown can potentially be significant in the immediate term, and irreversible in the long term. Little is known about the dynamic aspects of microenterprises, their ability to weather shocks and adapt, and the mechanisms by which this occurs.

A new collaborative study by the Global Alliance for Mass Entrepreneurship (GAME) and Leveraging Evidence for Access and Development (LEAD) at Krea University, aims to understand the various stages and dynamics of the impact of Covid-19 crisis on microenterprises in India. The dynamic, multidimensional, rapid survey of microenterprises across the country will capture systematic and granular insights over a period of six months. Our ‘stratified, convenience random’ sample of 1,461 microenterprises, was drawn to represent microenterprises from various sub-industries in manufacturing, services, and trade. The sample is derived from lists provided by partner organisations. In terms of region, the sample has been drawn from across North, South, and West India1. A first-round telephonic survey was conducted between 29 May and 10 June. The bulk of the microenterprises are situated in tier-3 cities or rural areas.

Figure 1. Snapshot of enterprises surveyed

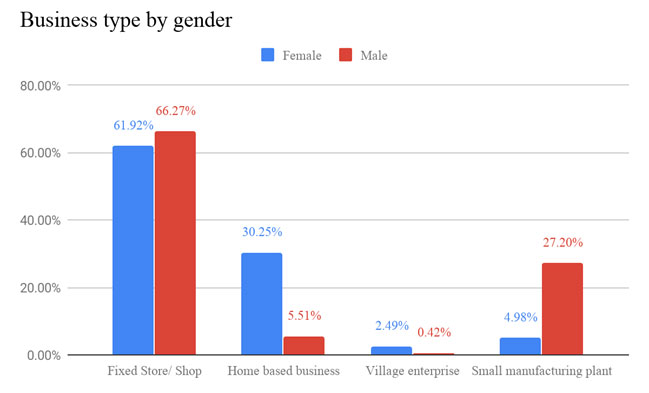

The median age of businesses in our sample is 12 years, with a median of 2 employees; 67% of the enterprises employ 1-4 people, 24% employ 5-15 people, while the remaining 9% have more than 15 employees. Women-led enterprises comprise 19% of the microenterprises surveyed. Fixed establishment-type shops (wholesale or retail) comprise over 60% of the sample for both men and women-led microenterprises; while 27.2% of men-led enterprises are small manufacturing plants, and 30.5% of women-led enterprises are home-based businesses.

Prior to the lockdown, the sluggish economy was already detrimental to these microenterprises, with 39% mentioning they were doing worse than expected in the pre-lockdown scenario, and only 24% doing better than expected.

Our preliminary findings present a complex scenario, highlighting distress and, at the same time, optimism and resilience among microenterprises, and differential impacts across sectors as well as gender.

Operational challenges

Overall, the majority of microenterprises were closed, with only 17% partially or fully operational during the lockdown. It is notable that the survey was conducted in midst of the national lockdown. In our survey, 52% of the essential businesses remained shut, as they were not aware of government classification. In terms of non-essential businesses, 92% of the surveyed respondents remained completely shut.

Among those who are fully or partly operational, 72% of the surveyed businesses have reported a significant decline in profits compared to the pre-Covid scenario. The decline is more pronounced in manufacturing and service sectors, where profits suffered a hit of 78% and 81%, respectively. The impact was less pronounced for the trading sector, with 62% businesses reporting a decrease in profits. This is primarily because most essential businesses, such as provision stores, vegetable shops, etc., fall under this category.

Furthermore, looking at the microenterprises that were operational during the lockdown, the revenue only 28% of regular pre-lockdown revenues, on average.

Business recovery sentiment

Looking at initial sentiments during the lockdown, 81% of the respondents suggested that they are fully or somewhat confident of business recovery in a post-Covid scenario. However, a similar percentage believe that it would take four months or more to get their business back to pre-Covid levels. Such responses are similar to that in other surveys, such as the one by Bankable Frontier Associates (BFA) on 26 March, and another by the Chinese Academy of Financial Inclusion, conducted within a month of the lockdown in China.

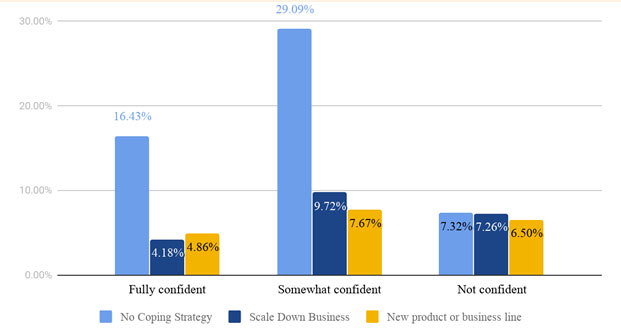

Despite that strong recovery sentiment though, 46% of the respondents suggested that they do not have any coping strategy in place, even though they are confident of business recovery (Figure 2). Similarly, 14% of the respondents are confident of business recovery, and plan to scale down their business significantly in order to cope with Covid-19 related losses.

Figure 2. Business recovery confidence and coping strategies

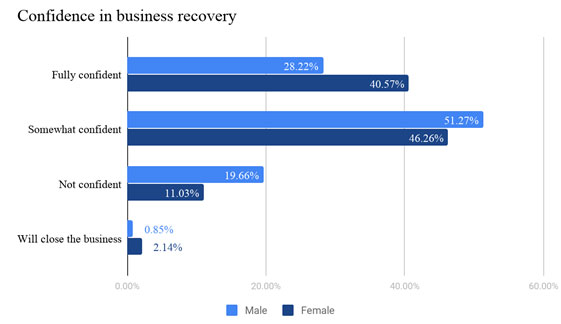

While the overall sentiment points towards confidence among most microenterprises, there were differences observed between male and female entrepreneurs (Figure 3). When asked if they were fully confident of business recovery, female entrepreneurs were more confident than their male counterparts.

Figure 3. Business recovery confidence: Women seem more confident than men about recovery

Financial scenario

The financial scenario portrays a somewhat gloomy picture, and is a strong reminder of the formal credit gap and the precarious financial situation in which most microenterprises were operating even prior to the Covid crisis.

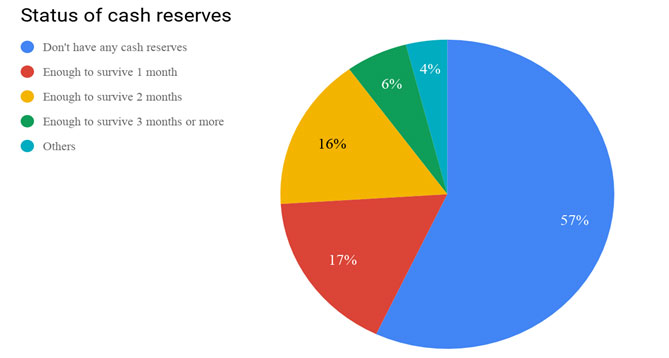

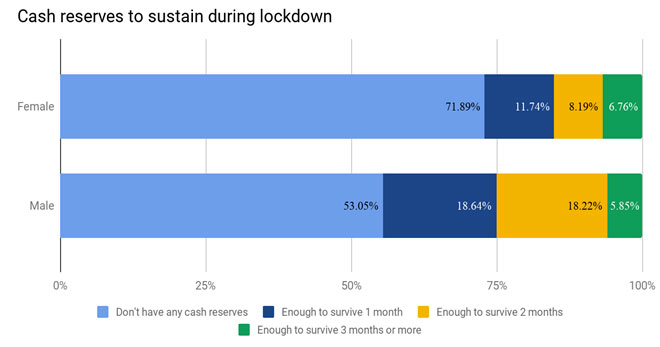

During the lockdown, 57% of businesses reported that they do not have any cash reserves to survive. Businesses also dipped into savings to meet expenses, with the median value of Rs. 30,000 wiped out from savings. Female-led microenterprises seem more vulnerable than male-led businesses. While 53% of male business owners suggested lack of any sort of cash reserves, the figure shot up to 72% for female-led businesses.

Figure 4. Status of cash reserves

Figure 5. How long business can sustain with current cash reserves

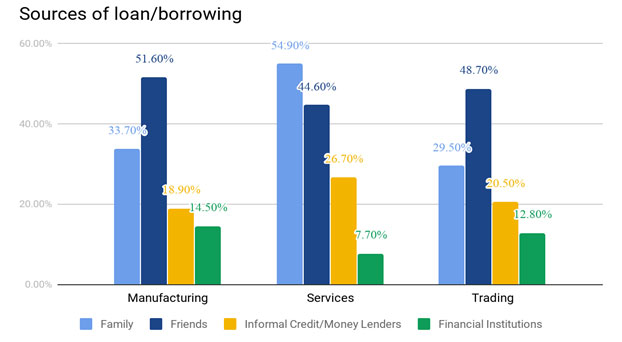

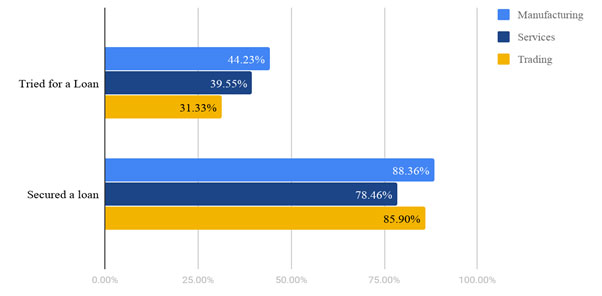

If we look at credit, 40% of the respondents tried to take a loan, and 85% of those who tried, were successful in securing the same. There were some variations across sectors (Figure 6). However, most of the loans secured by business owners were through informal sources – 58% of all respondents who secured loans, received it from friends, while 34% received it from family members. Only 14% of the overall borrowing was from formal sources – predominantly microfinance institutions.

Figure 6. Variation in sources of borrowing across sectors

Figure 7. Percent of respondents across sectors who tried for loans vs. those who secured loans

There are practical challenges for business owners in furnishing documentation for formal credit applications. As an example, one of the challenges that an entrepreneur mentioned was when they apply for loans, they need to have rental agreements for their business spaces, and if they are either due to be renewed or yet to be made, the landlords are often not willing to sign them or provide their reference.

Digital payments did not convert new users, as 58% of respondents do not use any form of digital payment solution. Among those who do, 82% have been using these for over a year, signalling no significant increase in digital-payment adoption during lockdown.

Employment status

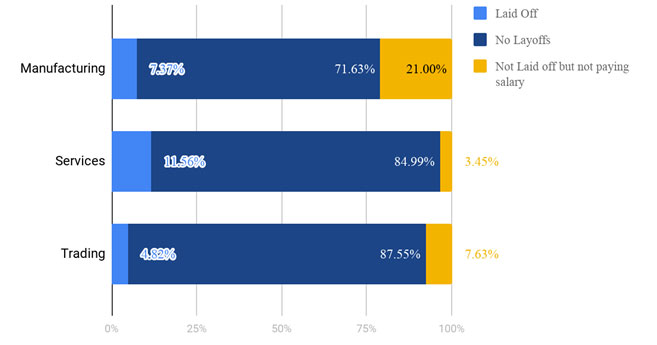

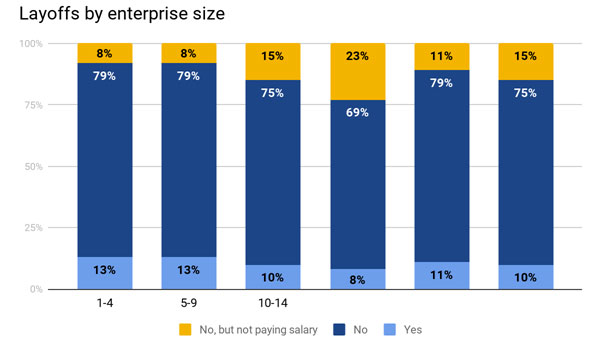

One of the anticipated cascading effects of the lockdown was the impact on employee layoffs. While layoffs remain common across the economy, 75% surveyed businesses that had workers said they have not laid off any of their workers; however, 14% said that they were unable to pay their workers. While most businesses were closed during lockdown, the ones who reopened have issues in getting back their full labour force either due to unavailability of transport or insufficient work orders to keep the workers engaged.

A fabrication unit owner in Thiruvallur, near Chennai, told us, “I paid my employees, with the income from minimal orders, what would be sufficient for them to run their family expenses on a weekly basis”. This is the case for businesses who have been employing labourers more than five years. The business owner claims that the relationship of trust will bring employees back who are from surrounding villages, once the situation normalises.

If we look at how employment is affected across sectors and firm size (Figures 8 and 9), it is evident that micro and small businesses with employee size less than 4 and 10, respectively, have not laid off most of their employees. However, as the size of the firm increases, especially among those between 15 to 19 employees, we find that they are unable to pay salaries even though they have not technically laid off employees.

Figure 8. Status of layoffs, by sector

Figure 9. Status of layoffs, by firm size

Challenges in the household

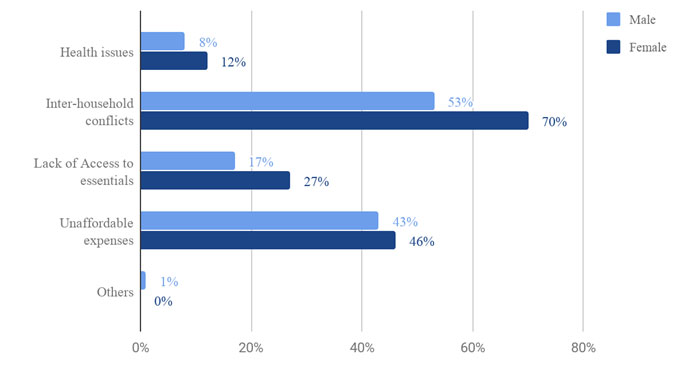

With lockdown in place and the business owners confined within their homes, reports have suggested that there are increased instances of intra-household conflicts and differences. Our survey echoed that sentiment. However, what is interesting is the difference between the views of male and female respondents. Over 70% female respondents suggested that they are facing increased household conflicts, compared with 53% of male respondents. Similarly, more female business owners seem to be facing problems around household expenses (Figure 10).

Figure 10. Major household challenges during lockdown, by gender

Figure 11. Priority tasks during lockdown, by gender

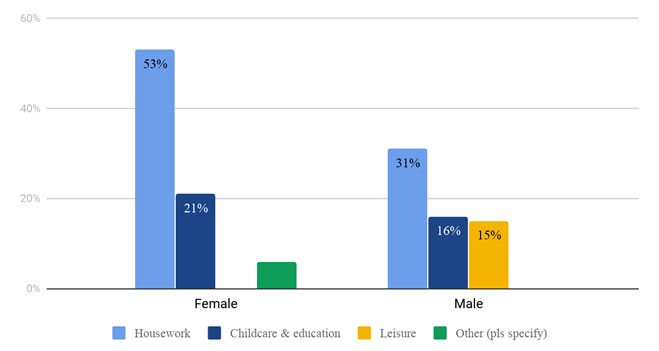

There are also major differences when it comes to household tasks that male and female members of the household performed during lockdown (Figure 11). While 53% of female respondents suggested that household chores were a priority for them during lockdown, only 31% male respondents reported so. At the same time, 15% males listed leisure activities as one of the priority tasks during lockdown, while none of the female respondents suggested the same for themselves.

Conclusion

Based on our first round of survey conducted during the lockdown period, a key finding is that microenterprises require adequate interventions to help them devise a sustainable coping strategy to get their businesses back on track. While most business owners have displayed remarkable levels of confidence in the possibility of recovery after Covid-19, more than half of them do not have a strategy to chart their recovery plan.

In addition, Covid clearly seems to have caused women to become more vulnerable when it comes to their businesses. Most women have been pushed to doing basic household work, which may make it difficult for them to get back to their businesses in the post-Covid world. On the contrary, a lot of men seem to have taken to leisure and other non-critical household activities, making their return to business much easier.

As mentioned, this is a dynamic six-month study, where we go back to these respondents every month to understand their current status. The idea is to chart a six-month journey, based on the responses of the owners of microenterprises, and to provide critical data to help stakeholders take relevant policy decisions to help these businesses. Granular insights on microenterprises and their challenges are already very scarce, making it even more crucial to understand their ability to weather shocks and adapt, and the mechanisms by which this occurs. A dynamic dashboard has also been created for this purpose, and can be accessed here.2

Notes:

- States covered include Delhi, Haryana, Maharashtra, Punjab, Rajasthan, Tamil Nadu, and Uttar Pradesh.

- Since our endeavour is to keep this study collaborative, the entire dataset has been open-sourced (can be downloaded via our dashboard) in order to let other researchers draw unique inferences from our collected data.

31 July, 2020

31 July, 2020

Comments will be held for moderation. Your contact information will not be made public.